UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material under Rule 14a-12

|

KLR ENERGY

ACQUISITION CORP.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Rosehill Resources Investor

Presentation January 2017

THE INFORMATION CONTAINED HEREIN IS

PROVIDED FOR INFORMATIONAL AND DISCUSSION PURPOSES ONLY AND IS NOT, AND MAY NOT BE RELIED ON IN ANY MANNER AS, LEGAL, TAX OR INVESTMENT ADVICE OR AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY SECURITIES. THE INFORMATION CONTAINED HEREIN

IS DERIVED FROM VARIOUS INTERNAL AND EXTERNAL SOURCES. NO REPRESENTATION IS MADE AS TO THE REASONABLENESS OF THE ASSUMPTIONS MADE WITHIN OR THE ACCURACY OR COMPLETENESS OF ANY PROJECTIONS OR MODELING OR ANY OTHER INFORMATION CONTAINED HEREIN. ANY

INFORMATION ON PAST PERFORMANCE OR MODELING CONTAINED HEREIN IS NOT AN INDICATION AS TO FUTURE PERFORMANCE. THE INFORMATION CONTAINED HEREIN IS NOT, AND SHOULD NOT BE ASSUMED TO BE, COMPLETE. THIS DOCUMENT IS BEING PROVIDED TO ASSIST PARTIES IN

MAKING THEIR OWN EVALUATION WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION OF KLR ENERGY ACQUISITION CORP. (“KLRE”) AND A WHOLLY OWNED SUBSIDIARY OF TEMA OIL AND GAS COMPANY (“TEMA”) AND FOR NO OTHER PURPOSE. The proposed

business combination remains subject to the approval from the Rosemore, Inc. BOARD OF DIRECTORS, Tema BOARD OF DIRECTORS, kLRE Board of Directors, AND THE KLRE PUBLIC SHAREHOLDERS. EXCEPT WHERE OTHERWISE INDICATED HEREIN, THE INFORMATION PROVIDED

HEREIN IS BASED ON MATTERS AS THEY EXIST AS OF THE DATE OF THIS PRESENTATION AND NOT AS OF ANY FUTURE DATE. EXCEPT AS OTHERWISE REQUIRED BY APPLICABLE LAW, WE DISCLAIM ANY DUTY TO UPDATE OR OTHERWISE REVISE THIS PRESENTATION TO REFLECT INFORMATION

THAT SUBSEQUENTLY BECOMES AVAILABLE, OR CIRCUMSTANCES THAT EXIST OR CHANGES THAT OCCUR AFTER THE DATE HEREOF. THIS PRESENTATION INCLUDES FINANCIAL AND OPERATIONAL FORECASTS, PROJECTIONS AND OTHER FORWARD-LOOKING STATEMENTS REGARDING ROSEHILL

RESOURCES (“ROSEHILL” OR “THE COMPANY”), ITS BUSINESS AND PROSPECTS THAT, UNLESS OTHERWISE INDICATED, WERE PROVIDED BY ROSEHILL’S PREDECESSORS TO KLRE AND ARE WITHIN THE MEANING OF THE “SAFE HARBOR”

PROVISIONS OF THE UNITED STATES PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY THE USE OF TERMINOLOGY SUCH AS “MAY,” “WILL,” “SHOULD,” “EXPECT,”

“ANTICIPATE,” “PROJECT,” “ESTIMATE,” “INTEND,” “CONTINUE” OR “BELIEVE,” OR THE NEGATIVES THEREOF OR OTHER VARIATIONS THEREON OR COMPARABLE TERMINOLOGY OR PROSPECTIVE FINANCIAL

DATA. FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS REGARDING: FUTURE FINANCIAL AND OPERATING RESULTS; STRATEGIES, OUTLOOK AND GROWTH PROSPECTS; FUTURE PLANS; POTENTIAL FOR FUTURE GROWTH; LIQUIDITY AND CAPITAL RESOURCES; AND ECONOMIC OUTLOOK AND

INDUSTRY TRENDS. SUCH FORWARD-LOOKING STATEMENTS ARE BASED ON CURRENT EXPECTATIONS THAT ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT MAY CAUSE ACTUAL RESULTS AND PERFORMANCE TO DIFFER MATERIALLY. THESE RISKS INCLUDE, BUT ARE NOT LIMITED TO, COMMODITY

PRICE VOLATILITY, INFLATION, LACK OF AVAILABILITY OF DRILLING AND PRODUCTION EQUIPMENT AND SERVICES, ENVIRONMENTAL RISKS, DRILLING AND OTHER OPERATING RISKS, REGULATORY CHANGES, THE UNCERTAINTY INHERENT IN ESTIMATING RESERVES AND IN PROJECTING

FUTURE RATES OF PRODUCTION, CASH FLOW AND ACCESS TO CAPITAL, THE TIMING OF DEVELOPMENT EXPENDITURES, AND RISKS ASSOCIATED WITH THE COMPLETION OF THE PROPOSED BUSINESS COMBINATION. Without limiting the foregoing, the inclusion of the financial

projections in this presentation should not be regarded as an indication that the company considered, or now considers, them to be a reliable prediction of future results. The financial projections were not prepared with a view towards public

disclosure or with a view to complying with the published guidelines of the SECURITIES AND EXCHANGE COMMISSION (“SEC”). the guidelines established by the American Institute of Certified Public Accountants with respect to prospective

financial information, or with U.S. generally accepted accounting principles. Neither the company’s independent auditors, nor any other independent accountants, have compiled, examined or performed any procedures with respect to the financial

projections, nor have they expressed any opinion or any other form of assurance on such information or its achievability. Although the financial projections were prepared based on assumptions and estimates that the company’s management

believes are reasonable, the company provides no assurance that the assumptions made in preparing the financial projections will prove accurate or that actual results will be consistent with these financial projections. Projections of this type

involve significant risks and uncertainties and should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. None of the historical financial

statements of Tema included herein have been audited or reviewed by independent auditors. Tema is currently conducting an audit of the nine months ended September 30, 2016 and as such, actual results may vary from those described herein. NON-GAAP

FINANCIAL MEASURES THIS PRESENTATION INCLUDES FINANCIAL MEASURES THAT ARE NOT CALCULATED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN THE U.S. (“GAAP”). WHILE MANAGEMENT BELIEVES SUCH MEASURES ARE USEFUL FOR INVESTORS,

THEY SHOULD NOT BE USED AS A REPLACEMENT FOR FINANCIAL MEASURES CALCULATED IN ACCORDANCE WITH GAAP. PLEASE SEE ADJUSTED EBITDAX RECONCILIATION ON PAGE 36 FOR A RECONCILIATION OF ADJUSTED EBITDAX TO THE NEAREST GAAP MEASURE. CAUTIONARY STATEMENT

REGARDING HYDROCARBON QUANTITIES WE HAVE PROVIDED IN THIS PRESENTATION ESTIMATES OF ROSEHILL’S MANAGEMENT FOR PROVED RESERVES AND AGGREGATED PROVED, PROBABLE AND POSSIBLE RESERVES (“3P RESERVES”) AS OF JUNE 30, 2016, WITH EACH

CATEGORY OF RESERVES ESTIMATED USING SEC GUIDELINES. AS USED IN THIS PRESENTATION. THE SEC PROHIBITS COMPANIES FROM AGGREGATING PROVED, PROBABLE AND POSSIBLE RESERVES ESTIMATED USING DETERMINISTIC ESTIMATION METHODS IN FILINGS WITH THE SEC DUE TO

THE DIFFERENT LEVELS OF UNCERTAINTY ASSOCIATED WITH EACH RESERVE CATEGORY. ACTUAL QUANTITIES THAT MAY BE ULTIMATELY RECOVERED MAY DIFFER SUBSTANTIALLY FROM THE ESTIMATES IN THIS PRESENTATION. FACTORS AFFECTING ULTIMATE RECOVERY INCLUDE THE SCOPE OF

OUR ONGOING DRILLING PROGRAM, WHICH WILL BE DIRECTLY AFFECTED BY COMMODITY PRICES, THE AVAILABILITY OF CAPITAL, REGULATORY APPROVALS, DRILLING AND PRODUCTION COSTS, AVAILABILITY OF DRILLING SERVICES AND EQUIPMENT, DRILLING RESULTS, LEASE

EXPIRATIONS, TRANSPORTATION CONSTRAINTS AND OTHER FACTORS; ACTUAL DRILLING RESULTS, WHICH MAY BE AFFECTED BY GEOLOGICAL, MECHANICAL AND OTHER FACTORS THAT DETERMINE RECOVERY RATES; AND BUDGETS BASED UPON OUR FUTURE EVALUATION OF RISK, RETURNS AND

THE AVAILABILITY OF CAPITAL. THE TERM “EUR” (OR ESTIMATED ULTIMATE RECOVERY) IS USED IN THIS PRESENTATION TO DESCRIBE ESTIMATES OF POTENTIALLY RECOVERABLE HYDROCARBONS REMAINING IN THE APPLICABLE RESERVOIR. THESE RESOURCES ARE NOT PROVED

RESERVES IN ACCORDANCE WITH SEC REGULATIONS AND SEC GUIDELINES RESTRICT US FROM INCLUDING THESE MEASURES IN FILINGS WITH THE SEC. THESE HAVE BEEN ESTIMATED BY ROSEHILL WITHOUT REVIEW BY INDEPENDENT ENGINEERS. ACTUAL RECOVERY OF THESE POTENTIAL

RESOURCE VOLUMES IS INHERENTLY MORE SPECULATIVE THAN RECOVERY OF ESTIMATED RESERVES AND ANY SUCH RECOVERY WILL BE DEPENDENT UPON FUTURE DESIGN AND IMPLEMENTATION OF A SUCCESSFUL DEVELOPMENT PLAN AND THE ACTUAL GEOLOGIC CHARACTERISTICS OF THE

RESERVOIRS. ULTIMATE RECOVERIES WILL BE DEPENDENT UPON NUMEROUS FACTORS INCLUDING THOSE NOTED ABOVE. References to Rosehill herein shall mean the business after the consummation of the transactions which are currently contemplated between Tema,

KLRE, and Rosemore according to a non-binding letter of intent. Rosehill is not a currently operating entity and may not include all assets of the current Tema operating company. DISCLAIMER

Introduction Rosehill Overview

Financial Overview Benchmarking Analysis Appendix AGENDA

4,771 net acres in the core of the

Delaware Basin (>80% HBP as of September 2016) Ten stacked benches, with >85% of locations economic(1) at current strip pricing and ~50% of locations with IRRs > 50% Current net production of 5,000 Boepd as of 15 January 2017 ~200 undrilled

gross locations on current leasehold as of 30 June 2016 9 years of inventory (using a 2-rig program) with significant upside through downspacing program (>11 years of inventory) Scalable Assets in the Core of the Delaware Basin Economic defined

as > 10% IRR at NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019), $55.22 (2020), and escalating to $58.30 (2025+); average

annual NYMEX HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI. ROSEHILL HIGHLIGHTS: DRIVEN TO SUCCEED Team members have

extensive experience in Energy: Gary Hanna (Rosehill Chairman) – 35 years leading multiple public energy companies Rosehill executives – average 30+ years E&P operating experience with proven horizontal drilling success

Rosehill’s predecessors have been operating in the Permian Basin since the 1940s Amoco’s founding family has over a century of Oil & Gas experience (1920 – present) Planned Equity incentives ensure management is aligned with

shareholder interests Aligned Veteran Leadership Rosemore has a long history of “accretive dilution” and own an approximately 61% economic interest in Rosehill Operating on an as converted basis Rosehill’s predecessor grew to 4,050

Boepd in September 2016 by drilling within cash flow and credit facility availability During Gary Hanna’s 5-year tenure at EPL Energy, EPL spent ~$2 billion on acquisitions and development while generating positive free cash flow and

maintaining Debt/EBITDA <1.6x Proven Record of Disciplined Capital Allocation Larger fracs resulting in higher EURs are driving premier returns Most recent 2016 completions outperforming type curve by 11% to 35% Ready to execute drilling and

completion program with refined completion technique approach Offset operators achieving superior results across multiple benches Superior Well Results Preeminent Delaware Basin focused small-cap with outstanding growth potential Projected net

production of ~6,000 Boepd by the end of January 2017 Projected production growth of 40% and 36% / projected EBITDAX growth of 112% and 70% in 2017 and 2018 respectively Poised for bolt-on acquisitions for further growth in core areas Dedicated to

Strong, Profitable Growth

High Growth Assets Supported by

Low-Decline, Non-Core Barnett Asset Cash Flow Note: Reserves and location information as of 30 June 2016. 30 June 2016 reserves audited by Ryder Scott. Projected production based on two rig program and existing type curves. Economic defined as >

10% IRR at NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019), $55.22 (2020), and escalating to $58.30 (2025+); average annual

NYMEX HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI. June 30, 2016 long range planning pricing for reserves: WTI

– $48.18 (Q2-Q4 2016), $50.17 (2017), $53.78 (2018), $59.30 (2019), $65.13 (2020), and $71.25 thereafter; HHUB – $2.40 (Q2-Q4 2016), $2.96 (2017), $3.33 (2018), $3.59 (2019), $3.58 (2020), and $3.62 thereafter; NGL at 27.5% of WTI.

Rosehill OVERVIEW DRILLING: DEVELOPMENT TARGETING THE DELAWARE BASIN CORE Core Location in Emerging Delaware Basin Delaware Hyper-Core 4,771 net acres in the hyper-core of the Delaware Basin >80% HBP across all productive benches Attractive

leasehold NRI of ~80% across operated acreage Ten stacked benches, with >85% of locations economic and ~50% of locations with IRRs >50% at NYMEX strip pricing(1) Current net production of 5,000 Boepd as of 15 January 2017, growing to a

projected net production of ~6,000 Boepd by the end of January 2017 ~200 gross undrilled locations on current leasehold Nine years of drilling inventory with two-rig program June 30, 2016 3P reserves of 70,100 MBoe (Ryder Scott)(2) Additional ~50

locations and 3P growth potential with downspacing based on company estimates Rosehill Acreage Rosehill Acreage TX NM Delaware Properties Solid Production Growth With A Delaware Focus (Boepd) Barnett Properties

Note: Figures based on company draft

financial statements as of 30 September, 2016. EBITDAX projections based on NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019),

$55.22 (2020), and escalating to $58.30 (2025+); average annual NYMEX HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI.

1. Rosehill’s credit facility had a $45 million balance as of 30 September 2016; an additional $10 million has been drawn as of 9 December 2016. 2. Assumes no redemptions by KLRE shareholders. 3. For a reconciliation of EBITDAX to the nearest

GAAP measure, see slide 36. 4. Fully diluted shares outstanding calculated according to the Treasury Stock Method assuming a strike price of $11.50, at $12.00 per share. 5. Valued on an as converted basis assuming a preferred share conversion ratio

of ~87 common shares per preferred share. FINANCIAL OVERVIEW KLR Energy (“KLRE”) is led by Gary Hanna, a 35-year industry veteran who previously built and sold EPL Oil & Gas (NYSE:EPL) for an 8.5x equity return within 5 years KLRE is

acquiring a 39% as converted interest in Rosehill Operating Company, LLC (“Rosehill Operating”), an entity formed by Tema Oil & Gas Company (“Tema”) and into which Tema will contribute the contributed assets for $35 MM in

cash, shares of Class B common stock, 4 MM warrants, and the assumption of $55 MM in debt, which implies an enterprise value of $400 MM(1) Tema is a private Delaware Basin operator wholly owned by Rosemore Inc. (“Rosemore”), the founding

family of the American Oil Company (“Amoco”) and Crown Central Petroleum Corporation KLRE shareholders and Rosehill’s owners are strongly aligned due to Tema retaining a 61% interest in Rosehill Operating on an as converted basis

Rosehill’s operations focus on the core of the Delaware Basin in Loving County, with drilling locations across ten distinct benches $85 MM(2) of cash from the KLRE Trust Account will be contributed with $75 MM of proceeds of a private

placement of Series A Cumulative Convertible Preferred Stock and warrants $117 MM of pro forma liquidity to fully fund projected development through 2018 and pursue strategic acquisitions Targeted close of the transaction in Q1 2017 December 2016:

Executed definitive business combination agreement, announce transaction, and announce Preferred Stock and Warrants offering February/March 2017: Shareholder vote March 2017: File Shelf Registration Statement Small-Cap E&P Poised to Exploit the

Delaware Basin Pro Forma Capitalization TRANSACTION SUMMARY Actual Pro Forma ($MM unless otherwise noted) 9/30/2016 Adjustments 9/30/2016 Cash and Cash Equivalents $0.4 $116.9 $117.2 Cash Held in Trust Account $85.3 ($85.3) -- Long-Term Debt Notes

Payable $0.3 ($0.3) -- Revolving Credit Facility -- $55.0 $55.0 Total Debt $0.3 $55.0 Preferred Equity -- $75.0 $75.0 Shareholder's Equity $5.0 $470.3 $475.3 Total Capitalization $5.3 $605.3 % Debt / Capitalization 5.2% 9.1% Operating Metrics (3)

2016E EBITDAX $21 2017E EBITDAX $45 2018E EBITDAX $77 November 2016 Average Production 3,907 Boepd June 30, 2016 Proved Reserves 12.1 MMBoe % PDP 52.0% Liquidity Cash (including cash held in trust) $85.6 $31.6 $117.2 Borrowing Base Availability --

Total Liquidity $85.6 $117.2 Estimated Shares Outstanding (MM) (2)(4) $10.40 $12.00 % Preferred Stock As Converted 6.5 6.5 13.4% / 13.1% Common Shares KLRE Shareholders 8.2 8.5 16.8% / 17.1% KLRE Sponsors 3.5 3.9 7.2% / 7.8% Preferred Stock

Investors 0.7 0.9 1.5% / 1.9% Tema Equity Retained 29.8 30.0 61.1% / 60.2% Total Common Shares 42.2 43.3 86.6% / 86.9% Total As Converted Shares 48.8 49.8 100.0% / 100.0% Implied Enterprise Value Assumed Share Price $10.40 x Common Shares

Outstanding (MM) (4) 42.2 Common Equity Value $439 Plus: Net Debt ($62.2) Plus: Preferred Equity (5) $67.8 Enterprise Value $445 Implied Valuation Metrics (3) Enterprise Value/ Rosehill Metric 2017E EBITDAX $45 MM 9.8x 2018E EBITDAX $77 MM 5.8x

November 2016 Average Production 3,907 Boepd $113,866 / Boepd June 30, 2016 Proved Reserves 12.1 MMBoe $36.75 / Boe

Rosehill OVERVIEW ROSEHILL OVERVIEW

Section 1 Rosehill Overview Section 2 Financial Overview Section 3 Benchmarking Analysis Appendix

Rosehill OVERVIEW Lea Co. Eddy Co.

Correlative to the Midland Basin but deeper, thicker, and with higher pressure Rosehill’s core acreage is in the thickest part of the Delaware Basin with multiple high-quality source rocks 10 distinct, productive benches over a vertical

distance of 4,000 feet Rosehill will focus its near-term drilling efforts in the Wolfcamp A and 3rd Bone Spring Sand reservoirs Central Delaware Basin Reservoir Thickness Thickest and Richest Part of the Basin Superior Reservoir Quality Wolfcamp A

Porosity (PhiH) The Wolfcamp A has proven to be the most prolific reservoir in the Delaware Basin and is the dominant current drilling target in the area The Wolfcamp A and the 3rd Bone Spring Sand are overpressured, which significantly enhances

recovery and economics Porosity is a key factor contributing to high EURs, as well as brittleness, organic content, maturity and overall thickness Porosity-Feet (PhiH) WHAT SEPARATES THE DELAWARE CORE FROM OTHER PLAYS?

Wolfcamp A Brittleness Brittle Source

and Reservoir Rocks Strong EURs Across Multiple Benches Offset Wolfcamp & Avalon EUR’s Rosehill OVERVIEW Brittleness of the rock is a major factor that contributes to completion effectiveness and high EURs The Wolfcamp A (the X,Y Sands and

the Lower Wolfcamp A Shale) is interbedded reservoir and source rocks with a low clay content and high overall brittleness Natural fractures are abundant and increase drainage efficiency Offset operators have drilled many >1,000 MBoe EUR wells in

the Wolfcamp and Avalon zones All 10 benches are productive within a short distance of Rosehill’s Loving County core Ample running room for future growth Offset operators are testing various spacing patterns and optimizing frac sizes Rosehill

Acreage Feet of Wolfcamp A with Brittleness Coefficient >.65 WHAT SEPARATES THE DELAWARE CORE FROM OTHER PLAYS? (CONT’D) Rosehill Acreage Loving Co. EUR MBoe > 1,000 > 800 > 600 > 400 > 200 > 0 Permits

Endurance Yates 16 State #1H 227 MBoe

6 Months Brushy Canyon Source: IHS, Drilling Info Note: Peak Rate represents average daily production for peak production month; Boe calculated on a 6:1 ratio. Rosehill OVERVIEW Chevron Moose's Tooth #1H Peak Rate: 592 Boepd 2nd Bone Spring Shale

Anadarko Thresher #9HN Peak Rate: 1,129 Boepd Upper Avalon EOG State Magellan #13H Peak Rate: 1,352 Boepd 3rd Bone Spring Sand EOG State Pathfinder #2H Peak Rate: 898 Boepd 1st Bone Spring Sand Devon Rattlesnake 13-12 #1H Peak Rate: 818 Boepd Brushy

Canyon EOG Excelsior 7 #8H Peak Rate: 999 Boepd Wolfcamp B EOG State Galileo #6H Peak Rate: 2178 Boepd 2nd Bone Spring Sand Tema/Rosehill Kyle 24 #G1 Peak Rate: 1,318 Boepd Lower Wolfcamp A Anadarko Thresher #5HN Peak Rate: 822 Boepd Lower Avalon

Anadarko Hammerhead #1H Peak Rate: 1,198 Boepd Lower Wolfcamp A Anadarko Bullhead State #4H Peak Rate: 1,189 Boepd Lower Wolfcamp A Shell Bonnethead #1H Peak Rate: 1,450 Boepd Lower Wolfcamp A Apache Falcon State #S224H Peak Rate: 954 Boepd 3rd Bone

Spring Shale Anadarko Big Bucks #2H Peak Rate: 1,385 Boepd Lower Wolfcamp A Anadarko Corsair #1H Peak Rate: 1,323 Boepd Lower Wolfcamp A Producing Formation Brushy Canyon Upper Avalon Shale Lower/Middle Avalon 1st Bone Spring Sand 2nd Bone Spring

Shale 2nd Bone Spring Sand 3rd Bone Spring Shale 3rd Bone Spring Sand Wolfcamp A (X/Y Sands) Wolfcamp A Lower Wolfcamp B Rosehill Acreage Loving Co. Lea Co. Rosehill has benefited from drilling efficiencies and enhanced completion techniques

performed by its offset operators Rosehill’s well results have improved dramatically across its footprint Oil peak IPs on its Gen-2 wells 113% higher than its Gen-1 wells Gen-2 wells are exceeding the 747 Gross MBoe type curve by 23% on

average IRRs on 6 of the 10 benches are now above 50% Locations have high liquid content Highly repeatable drilling due to close proximity to offset activity and similar geologic features Compelling Area Results Offset operators have derisked

Rosehill’s core acreage BENCH STRENGTH: PROVEN SUPERIOR ACREAGE Tema/Rosehill Kyle 26 #E4 Peak Rate: 687 Boepd Wolfcamp A (X,Y Sands)

Represents a blended Wolfcamp A

(X,Y) and Lower Wolfcamp A type curve. Rosehill OVERVIEW Gen-2 Lower Wolfcamp A 747 Gross MBoe Type Curve Gen-1Wolfcamp A 710 Gross MBoe Type Curve(1) Gen-1 Completions Gen-2 Completions Enhanced completion techniques have significantly improved

well performance Increased Choke Size Increased Choke Size WOLFCAMP PERFORMANCE EXCEEDING TYPE CURVE

Rosehill OVERVIEW Gen-1 Completions

Gen-2 Completions Completion techniques have been refined based on experience gained and offset operator completion results Early designs, ramping up learning curve Lower Lower Lower Testing sliding sleeve vs. plug & perf Smaller diameter

Conservative choke management – wells were choked back during unloading and throughout early well life Leveraging service company knowledge to improve designs; greater focus on perf cluster spacing, stage spacing, carrier fluid designs Higher

Higher Higher Employ only plug & perf Larger diameter More aggressive choke management during and after flowback Completion Designs Sand Volumes Frac Fluid Volumes Pump Rates Fracing Technique Production Tubing Choke Management EVOLUTION OF

COMPLETION TECHNIQUES

Source: Company filings Note:

Locations as of 30 June 2016. Rosehill OVERVIEW Brushy Canyon Upper Avalon Lower Avalon/1st Bone Spring 2nd B. Spring Shale 2nd Bone Spring Sand 3rd B. Spring Shale 3rd Bone Spring Sand Wolfcamp A X,Y Lower Wolfcamp A Wolfcamp B Base Case Spacing

Pattern Down-Spaced Pattern = 40 Wells per Square Mile (~200 total locations) = 50+ Wells per Square Mile (250+ total locations) 4,000’ 1,320’ 880’ Contiguous Reservoir Gross Drilling Inventory by County Ten Benches of Stacked Pay

with Downspacing Potential Stacked pay with multiple horizontal targets across core acreage Delaware Operators Testing Downspacing Initial Development Offset operators are utilizing multiple techniques, including stacked / staggered well patterns,

to test downspacing in the Delaware Basin UNDEVELOPED LOCATION INVENTORY 9 Years of Operated Inventory with 2 Rigs

Gas pricing held flat at

$3.00/MMBtu. Based on internal company type curves. NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019), $55.22 (2020), and

escalating to $58.30 (2025+); average annual NYMEX HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI. Rosehill OVERVIEW

Target Type Curve Economics(2) Commentary Rosehill will have three wells coming online in Q4 2016 One Wolfcamp A well has already been drilled and is in the process of being completed Beginning in 2017, Rosehill expects to run 1 rig full-time and

another rig alternating for a majority of the year The drilling plan calls for a focus on the following benches: 3rd Bone Spring Sand Wolfcamp A (X,Y) Lower Wolfcamp A Target Type Curve WTI Price Sensitivities(1) Rosehill’s development program

will target the highly economic 3rd Bone Spring Sand and Wolfcamp A benches WELL ECONOMICS & HORIZONTAL DEVELOPMENT PLAN Shifting to Pad Development with 2 Rig Plan

Rosehill OVERVIEW Loving County

Acreage Midstream Overview Oil and Gas Marketing Summary Gathering infrastructure wholly owned by Gateway Gathering & Marketing Company, a wholly owned subsidiary of Rosemore, Inc. Majority of Loving County acreage serviced by Gateway Five year

tenure on Gateway services agreement Outrigger Midstream contracted for one outlying acreage block Gathering line to be completed in late 2016 coinciding with completion of new Wolfcamp A well Arms-length fair market pricing established between

Rosehill and Gateway Gateway is positioned to continue to support Rosehill’s growth Midstream infrastructure buildout developed in conjunction with Rosehill development plan Oil delivered onto Plains All American system via the Raven Oil

Pipeline Average oil transportation costs consist of $0.63/Bbl fee to Raven Oil Pipeline and $1.92/Bbl fee on Plains All American Pipeline for a total negative differential to Midland pricing of $2.55/Bbl High end negative differentials for

easternmost acreage block of $3.32 due to trucking costs Gas delivered onto ETC Field Services Pipeline via the LCGS and HP Gas pipelines Average gas gathering fee of $0.40 per Mcf Gas and NGLs sold as percentage of proceeds in addition to Waha Hub

differential TEXAS Tank Battery 20 East Tank Battery 32 West Tank Battery 32 East Tank Battery 42 East Tank Battery 26 West Tank Battery 26 East Compression Station Separator Raven Truck Station #1 LCGS Raven Oil HP Gas I/C Plains I/C ETC Field

Services Interconnection Points Rosehill Acreage Raven Oil LCGS Tank Batteries HP Gas Truck Station Compression Station Separator 0 1,000 2,000 3,000 6,000 ft Existing infrastructure fully supports current drilling program at fair market pricing

MIDSTREAM INFRASTRUCTURE

Source: IHS Herolds; Drilling Info

Based on company internal estimates (internal type curves and geological data). Assuming 4 locations per sq. mile per productive zone and an average ~790 MBoe EUR per location. Operators by Basin Delaware E&P Deals Active pipeline of bolt-on

opportunities >250 private operators in the Delaware Basin Twice that of the Williston Basin Numerous small, private companies are overlooked as potential acquisition targets Only ~ 3% of the recoverable reserves have been exploited in the

Delaware basin(1) Transactions in the Delaware Basin announced in the last 8 quarters average $2 Billion per quarter (6 deals per quarter) Delaware activity has outpaced all other basins Since July 2016, the Delaware Basin has seen 5 transformative

acquisitions over $1 billion Sellers willing to take significant equity consideration in order to retain upside exposure Numerous M&A Targets Strong Deal Flow = Willing Sellers ACCRETIVE M&A PIPELINE

FINANCIAL OVERVIEW SECTION 2:

FINANCIAL OVERVIEW Section 1 Rosehill Overview Section 2 Financial Overview Section 3 Benchmarking Analysis Appendix

Note: Adjusted EBITDAX projections

based on NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019), $55.22 (2020), and escalating to $58.30 (2025+); average annual NYMEX

HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI. Liquidity defined as cash plus borrowing base availability. Borrowing

base assumes growth with production and is estimated at ~$10,000 per Boepd increase. Forecast assumes no redemptions by KLRE shareholders, $75 million in proceeds from private placement, and that revolver debt is repaid during 2017. 2017 and 2018

forecast based on Rosehill’s expected one full-time rig program with a second rig alternating for a majority of the year at an average well cost of ~$6 million per well. FINANCIAL OVERVIEW D&C Capital ($MM)(2) Average Daily Production

(Boepd) Adjusted EBITDAX ($MM) Debt / LTM Adj. EBITDAX and Liquidity(1) FINANCIAL FORECAST

FINANCIAL OVERVIEW Capital Spending

Overview ($MM) Commentary 2017E - 2018E Capital Budget Development plans for 2017 and 2018 focus on the Wolfcamp Shale, both A & B benches, as well as the 3rd Bone Spring Sand Development plans for 2017 and 2018 assume four laterals per bench

per 640-acre spacing unit Wells will be drilled and completed in “clusters” to maximize productivity and minimize downtime Management team has experience with the scope of projected capital expenditure plan for 2017 CAPITAL BUDGET

OVERVIEW

Note: Average realized price based

on NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88 (2019), $55.22 (2020), and escalating to $58.30 (2025+); average annual NYMEX HHUB

strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5% of WTI. FINANCIAL OVERVIEW % Oil Volume Hedged Rosehill intends to have a flexible

approach with regards to its hedging strategy With no pro forma net leverage, Rosehill can be opportunistic about when to hedge based on its drilling program and the forward pricing market Current 2017 hedges in place: Oil: ~15% of expected

production hedged at an average price of $48.91/Bbl Gas: ~60% of expected production hedged at an average price of $3.19/Mcf Commentary HEDGING OVERVIEW % Gas Volume Hedged

DELAWARE TRANSACTIONS OVERVIEW

SECTION 3: BENCHMARKING ANALYSIS Section 1 Rosehill Overview Section 2 Financial Overview Section 3 Benchmarking Analysis Appendix

Source: 1Derrick, Company filings

Note: Includes Delaware Basin transactions announced through 18 January 2017 over $100 in transaction value and for which net locations could be estimated from publicly disclosed data. Averages exclude Rosehill. Net of current production disclosed

as part of the acquisition valued at $35k per flowing equivalent barrel. Based on Rosehill base case 40 wells per section spacing assumption. DELAWARE TRANSACTIONS OVERVIEW Notable Recent Delaware Transactions Adjusted Net Locations($MM/location)(1)

Current Production ($/Boepd) Proved Reserves ($/Boe) RECENT DELAWARE BASIN TRANSACTIONS Select Transaction Metrics Silver Run (2)

Source: Company filings, FactSet

Consensus Estimates Note: Averages exclude Rosehill. Comparable company forward estimates derived from analyst consensus estimates via FactSet Consensus Estimates as of 18 January 2017. Pro forma for all transaction announced as of 18 January 2017.

1. Production expenses include lease operating expenses, ad valorem/severance taxes, and transportation/gathering expenses. DELAWARE TRANSACTIONS OVERVIEW 2018E YoY Production Growth COMPARABLE COMPANY ANALYSIS Performance Metrics 2016E –

2018E EBITDAX CAGR YTD 2016 Production Expenses ($/Boe)(1) Net DEBT / LTM EBITDAX 2016E – 2018E Production CAGR

Source: Company filings, FactSet

Consensus Estimates Note: Averages exclude Rosehill. Comparable company forward estimates derived from analyst consensus estimates via FactSet Consensus Estimates as of 18 January 2017. Pro forma for all transaction announced as of 18 January 2017.

DELAWARE TRANSACTIONS OVERVIEW EV / 2017E EBITDAX EV / 2018E EBITDAX EV / Proved reserves ($/Boe) COMPARABLE COMPANY ANALYSIS (CONT’D) Valuation Metrics EV / 2017E Production ($/Boepd) EV / 2018E Production ($/Boepd)

APPENDIX APPENDIX Section 1

Rosehill Overview Section 2 Financial Overview Section 3 Benchmarking Analysis Appendix

Note: Figures based on company

draft financial statements as of 30 September, 2016. EBITDAX projections based on NYMEX strip pricing as of 9 December 2016. Average annual NYMEX WTI strip pricing as of 9 December 2016 is $47.64 (Q4 2016), $54.19 (2017), $54.94 (2018), $54.88

(2019), $55.22 (2020), and escalating to $58.30 (2025+); average annual NYMEX HHUB strip pricing as of 9 December 2016 is $2.92 (Q4 2016), $3.52 (2017), $3.08 (2018), $2.89 (2019), $2.90 (2020), and escalating to $3.36 (2025+). NGLs priced at 27.5%

of WTI. 1. Rosehill’s credit facility had a $45 million balance as of 30 September 2016; an additional $10 million has been drawn as of 9 December 2016. 2. Assumes no redemptions by KLRE shareholders. 3. For a reconciliation of EBITDAX to the

nearest GAAP measure, see slide 36. 4. Fully diluted shares outstanding calculated according to the Treasury Stock Method assuming a strike price of $11.50, at $12.00 per share. 5. Valued on an as converted basis assuming a preferred share

conversion ratio of ~87 common shares per preferred share. FINANCIAL OVERVIEW In October 2016, Rosemore’s subsidiary, Tema Oil & Gas Company, executed a Letter of Intent with KLRE to contribute its Delaware and Barnett assets into a newly

formed subsidiary of Tema, Rosehill Operating, and sell 39% of the equity interests on an as converted basis in such entity to KLRE for a total implied enterprise value of Rosehill Operating of $400 MM: equity in Rosehill Operating retained by Tema

valued at $310M, $35 MM in cash consideration to Tema, and the assumption of $55 MM in debt by KLRE(1) Tema will retain a meaningful equity stake in the new company, Rosehill (61% economic interest on an as converted basis) 85 MM(2) of cash from the

KLRE Trust Account will be contributed with $75 MM of proceeds of a private placement of Series A Cumulative Convertible Preferred Stock and warrants Pro forma adjustments assume no redemption by current shareholders of KLRE $117 MM of projected

liquidity to fully fund projected development through 2018 and pursue strategic acquisitions Capitalization Estimated Sources & Uses of Cash (US$MM) TRANSACTION DETAIL

Convertible Preferred Stock

Termsheet KLR Energy Acquisition Corp. (Rosehill Resources) Issuer Name KLR Energy Acquisition Corp. (NASDAQ: KLRE) Principal Amount $75 million Liquidation Preference $1,000 per preferred share Ranking Preferred Stock Cumulative Dividend 8.000%

Cash or PIK Conversion Price $11.50 (11% conversion premium to $10.40 per share in Trust) Shares Underlying 6.52 million shares of Class A common stock Maturity Perpetual Mandatory Conversion Option Conversion at the option of the Issuer after 2

years if the price of Issuer’s Class A common stock exceeds 120% of the Conversion Price for 20 of 30 consecutive trading days However, in any calendar month, Issuer may not mandatorily convert a number of shares of preferred stock in excess

of the number of shares of preferred stock which would convert into 15% of the number of shares of Class A common stock traded on NASDAQ in the preceding calendar month Warrants Holders will receive a total of 5 million American Style Warrants with

a $11.50 Strike Price and an Expiration Date that is 5 years from the closing date on the offering Sponsor Promote Contribution Sponsors will contribute an aggregate of 734,704 (33% of 2,203,670 anti-dilution shares) shares of Class A common stock

to Preferred Stock and Warrants investors De-SPAC Redemption Backstop KLR and Rosemore backstop to take effect if greater than 30% redemption by current KLRE public shareholders in which case KLR and Rosemore have agreed to purchase Class A common

stock or Convertible Preferred stock of up to $20 million

Note: June 30, 2016 reserves

audited by Ryder Scott. June 30, 2016 long range planning pricing for reserves: WTI – $48.18 (Q2-Q4 2016), $50.17 (2017), $53.78 (2018), $59.30 (2019), $65.13 (2020), and $71.25 thereafter; HHUB – $2.40 (Q2-Q4 2016), $2.96 (2017), $3.33

(2018), $3.59 (2019), $3.58 (2020), and $3.62 thereafter; NGL at 27.5% of WTI. APPENDIX June 30, 2016 Reserves Reserves by Category Reserves by Commodity +4% Reserves by Area RESERVE PROFILE PV-10 by Category(1)

APPENDIX TARGETED TRANSACTION

TIMELINE Date: Event: Week of 12/12 Execute definitive business combination agreement, announce transaction, and announce private placement January Preliminary Proxy Materials filed with SEC for review Late January / Early February Roadshow to

market transaction to existing SPAC IPO investors and new fundamental investors February Set Record Date and Meeting Date for Stockholder Vote and notify Proxy Solicitor, Transfer Agent, and NASDAQ Late February / Early March File Definitive Proxy;

Shareholder Vote (notices of redemption due two days prior to shareholder vote) March Hold Special Meeting; after meeting and vote simultaneous close of acquisition and Preferred Stock and Warrants; file “Super 8-K” four days after

closing business combination March File Shelf Registration Statement Note: The proxy statement relating to the business combination transaction will be subject to SEC review. Actual timing may vary depending on the duration of any such

review.”

Long history of successful energy

investing Early mover into the Delaware Basin 10+ year track record of drilling horizontal shale wells History of strong shareholder support Deep technical knowledge of basin Continue optimization of operations Tailor completion designs and

production practices to geologic sections Preeminent Delaware Basin small-cap E&P company Strong balance sheet with ability to self-fund growth plans Technical and operations focused team Experienced and knowledgeable management team Focus on

shareholder returns Strong track record of value creation Focused on long-term growth Conservative financial outlook Superior knowledge of the basin and a pipeline of accretive acquisition opportunities to help grow core acreage Active M&A

Pipeline Drilling & Completion Efficiencies Core Delaware Acreage Production, Reserves, & Value Growth Drilling & Completion Efficiencies Active M&A Pipeline An acquisition growth strategy combined with excellence in execution makes

Rosehill the ideal growth-oriented Delaware Basin small-cap investment ROSEHILL COMBINES TWO COMPANIES WITH COMPLIMENTARY VISIONS Core Delaware Acreage

Based on 30 June 2016 reserve

report audited by Ryder Scott. Z&T 42 #F4WH Wolfcamp A (X/Y) Z&T 20 #G001 Lower Wolfcamp A Kyle 24 #G001 Lower Wolfcamp A Z&T 20 #C4WH Wolfcamp A (X/Y) Kyle 26 #E4WH Wolfcamp A (X/Y) Gen-1 Well Comp. Date Stages Lateral Length (Ft.)

Flowing Tubing Pressure (PSI) Technical Commentary Projected EUR(1) June 2014 16 4,515 1,122 687 4,200 12 Early plug & perf completion mid-2014 (Gen-1 style) Limited to 16 stage completion Relatively small sand and liquid volumes pumped (5 MMLbs

sand, 152 MBbls fluid) Injection rate average 60-70 BPM 717 MBoe (585 MBo) Dec. 2014 43 4,024 1,265 625 4,060 12 Early sliding sleeve completion technique late 2014 (alternate Gen-1 style) Small sand and liquid volumes to Kyle 26 E4 (5.1 MMLbs sand,

108 MBbls fluid) Low injection rates due to placement technique 20-25 BPM 869 MBoe (647 MBo) June 2015 46 4,455 1,874 712 3,100 18 Sliding sleeve completion early 2015 (alternate Gen-2 style) Ramped up sand and liquid volumes to (8.3 MMLbs sand, 183

MBbls fluid) Low injection rates 20-25 BPM 861 MBoe (640 MBo) Feb. 2016 16 3,999 2,073 1,277 4,400 24 Plug & Perf large frac design (Gen-2 style) Modified 6x1’ perf. clusters with 34’ carrier spacing, 265’ stage spacing 16

stages with injection rates 80-103 BPM High volume frac: (8.2 MMLbs sand, 221 MBls fluid) 873 MBoe (638 MBo) May 2016 21 4,186 2,418 1,371 4,275 20 Plug & Perf large frac design (Gen-2 style) Modified 6x1’ perf. clusters with 25’

carrier spacing, 217’ stage spacing 21 stages with injection rates 80-102 BPM High volume frac: (10.1 MMLbs sand, 276 MBls fluid) 1,067 MBoe (814 MBo) Lbs. Sand / Ft. IP (Boepd) Choke Gen-2 TECHNICAL ENHANCEMENTS HAVE SIGNIFICANTLY INCREASED

EURs

1. Assumes no redemptions by KLRE

shareholders. FINANCIAL OVERVIEW Aggressively manage D&C, LOE and G&A Benchmark against peers Intention to hedge to protect capital program Evergreen program De-risk funding of capital budget Return driven investment decisions Flex capital

plans to market conditions Grow leasehold position Flexibility through the cycle No pro forma net leverage(1) Debt target of < 2.5x Debt/EBITDAX Strong Liquidity & Low Leverage Prudent Capital Allocation Maintain Low Cost Structure Hedge

Program to Protect Cash Flow DISCIPLINED FINANCIAL MANAGEMENT

APPENDIX J. A. (Alan) Townsend

– President & CEO Over 40 years of industry experience – with Tema since 2001 Former President of Equitable Resources and CEO of Camelot Oil and Gas BS and Masters in Petroleum Engineering – Colorado School of Mines T.J. Thom

– Interim CFO (CFO of KLRE) Over 20 years of financial and operational experience in the energy industry Former CFO of EPL and board member of Yates Petroleum; currently on the board of Patterson-UTI Energy Undergraduate degree from the

University of Illinois and an MBA from Tulane University Brian K. Ayers – Vice President of Geology Over 35 years of industry experience – with Rosehill since 2012 Former CEO of Centurion Exploration and VP of Domestic Exploration at

Coastal Oil & Gas BA Geophysical Science from University of Chicago – MBA (Finance) from Millsaps College R. Colby Williford – Vice President of Land Over 28 years of petroleum land management experience – with Rosehill since

2014 Former VP of Land at Momentum Oil & Gas, America Capital Energy and Centurion Exploration BBA in International Business from University of Houston - Downtown Paul Larson – Reservoir Engineering Manager Over 25 years of petroleum

engineering experience – with Rosehill since 2015 Former Asset Manager at SM-Energy and Sinochem, Project Manager/Team Lead at Unocal 76 BS and MS in Petroleum Engineering from Tulsa University – BS in Mechanical Engineering from

University of New York Bryan Freeman – Drilling and Operations Manager Over 20 years of petroleum engineering experience – with Rosehill since 2016 Former Production and Operations Manager at SM-Energy and Engineer at Chevron BS of

Engineering from University of Texas at Tyler – MS in Engineering from University of Texas Johnnye Yearwood – Controller Over 24 years of oil and gas accounting experience – with Rosehill since 2016 Former Controller at Gulf Coast

Energy Resources and Harvest Natural resources BBA in Accounting from California State University - Bakersfield MANAGEMENT BIOS NTD: Do not move table down any further; resizes when printing to PDF

APPENDIX Gary Hanna –

Chairman Over 30 years of industry experience Former CEO and chairman of EPL Oil & Gas, Inc. prior to sale to Energy XXI in 2014 Currently a member of the board of Aspire Holdings Corp. Ed Kovalik – Director Over 18 years of financial in

the financial services industry, primarily in the energy space Former head of Rodman & Renshaw’s Energy Investment Banking team Currently a director on the boards of River Bend Oil and Gas as well as Marathon Patent Group SELECT BOARD OF

DIRECTOR BIOS

Rosehill OVERVIEW 1930: BRT

acquires Crown Central Petroleum Corporation 1910: Amoco Founding (as American Oil Company) by Blaustein/Rosenberg/Thalhiemer family (“BRT”) 1925: Standard of Indiana acquires 50% of Amoco 1944: Atapco Oil and Gas Division (later Tema)

founded by BRT 1954: Standard of Indiana acquires remaining Amoco interest, including brand naming rights 1998: Amoco sells to BP for stock; BRT splits with Rosenbergs obtaining Tema & Crown Central Petroleum Corporation 2004/2005: Rosenbergs

sell most of Crown Central Petroleum Corporation 2009: Rosenbergs sell majority BP stock pre-Macondo 2004: Tema drills its first Horizontal Barnett Shale well in Wise County, TX Nearly 100 Years of History in the Oil & Gas Space ROSEHILL

HISTORICAL GROWTH TIMELINE 2013: Tema drills its first Avalon Shale Horizontal well in Loving County, TX 2014: Tema drills its first Wolfcamp Shale Horizontal well in Loving County, TX Q1 2017: KLRE to combine with/acquire Tema Oil & Gas and

form Rosehill Resources 1920 1930 1990 1940 1950 1960 1970 1980 2000 2010 1910

Rosehill OVERVIEW Historical

Average Daily Production (Boepd) Commentary In 2012, Tema strategically moved to higher growth and higher oil percentage by focusing on the Delaware Basin vs. Barnett Rosehill has demonstrated consistent growth in production since 2012 with a

dramatic shift to oil and NGLs in the Delaware Basin Rosehill’s legacy Barnett Shale assets in Wise County, Texas provide modest support to near-term cash flow Product Mix Evolution (Boepd) Shift in Focus to Delaware Basin (Boepd) Delaware

Growth Liquids-Weighted SHIFT TO A LIQUIDS-WEIGHTED DELAWARE BASIN COMPANY

Note: Figures based on company

draft financial statements as of 30 September, 2016. Rosehill OVERVIEW EBITDAX RECONCILIATION

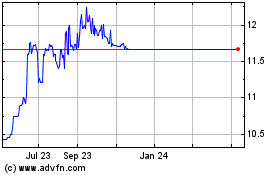

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Apr 2023 to Apr 2024