ABCO Energy, Inc. Announces FINRA Approval of 1-for-10 Reverse Stock Split

January 25 2017 - 9:40AM

Marketwired

ABCO Energy, Inc. Announces FINRA Approval of 1-for-10 Reverse

Stock Split

TUCSON, AZ-(Marketwired - Jan 25, 2017) - ABCO Energy, Inc.

(OTCQB: ABCED) announced the FINRA approval of the 1 for 10 reverse

split of its common stock. The effective date of the action was

January 13, 2017 and the company will trade under the symbol ABCED

for 20 business days or until February 8, 2017. The reverse split

has become necessary because of conversions of several promissory

notes totaling $246,711 into 198,737,390 shares during the last

half of 2016. The common shares outstanding at December 31, 2016

became 268,645,844 shares. The reverse was also necessary to allow

the Company to raise capital from the sale of its common stock

through the previously announced $5,000,000 financing with

Blackbridge Capital, LLC. In addition, OTC Markets required a stock

price in excess of $.01 per share in order to continue the

Company's OTCQB listing. These were the cause and effect and the

driving force for the reverse split decision.

In addition to the reduction in shares outstanding, the company

financial statement was improved by the elimination of $396,798 in

direct and derivative liability and a reduction of related

derivative interest and amortization expenses totaling $246,711 on

the income statement. The total effect to the ABCO balance sheet

for cancellation of the notes through conversion will be $643,509.

This reduction in debt will improve the company credit lines and

fund raising in the very near future. Due to the conversion of the

debt to common shares, the company experienced a very large volume

of trading and wide dispersion of it stock to many new investors

and traders. Our post reversal of shares has resulted in

approximately 26,871,761 shares being currently outstanding. This

will benefit the Company in the future and will create a more

reliable market for our stock.

"In the first day of trading under the new symbol, our stock

price reached $0.0235, which will allow the Company to proceed with

the Blackbridge financing and begin to satisfy the OTC share price

rules," says Charles O'Dowd, President of ABCO. "This will also

allow us to issue new shares with less dilution on an expedited

basis to raise capital necessary to expand our operations."

ABCO Energy, Inc. is an Arizona licensed contractor for sales

and installation of Photovoltaic Solar Systems, Solar Street

Lighting and installation of LED and energy conservation lighting

systems in their markets. ABCO provides products and services to

residential, commercial, government and non-profit entities in all

their markets.

Safe Harbor Statement Note: Certain statements in this news

release may contain "forward-looking" information within the

meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-5

under the Securities Act of 1934 and are subject to the safe harbor

created by those rules. All statements, other than the statements

of fact, included in this press release may include forward-looking

statements that involve risks and uncertainties. There can be no

assurance that such statements will be accurate and actual results

and future events could differ materially from those anticipated in

such statements. ABCO undertakes no obligation to update

forward-looking statements to reflect subsequently occurring events

or circumstances or to reflect unanticipated events or

developments.

INVESTOR RELATIONS CONTACT: Benchmark Advisory Partners, LLC

Timothy Connor President 2010 Jimmy Durante Blvd. Carlsbad, CA

92009 Phone: 866-703-4778 admin@bmarkadvisory.com

CORPORATE CONTACT INFORMATION: Charles O'Dowd President Email:

info@abcoenergy.com 2100 North Wilmot, Suite 211 Tucson, Arizona

85712 Phone: 520-777-0511 Fax: 520-620-5574 Website

www.abcosolar.com

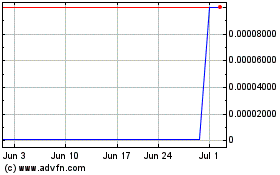

ABCO Energy (CE) (USOTC:ABCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

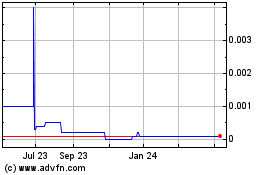

ABCO Energy (CE) (USOTC:ABCE)

Historical Stock Chart

From Apr 2023 to Apr 2024