By Suzanne Vranica, Maureen Farrell and Steven Perlberg

As Snap Inc. woos Wall Street ahead of its initial public

offering, the parent of the popular messaging app is also spending

plenty of time courting another constituency: advertisers on

Madison Avenue.

The Venice, Calif. company is in talks with the media-buying

arms of several big advertising companies, including WPP PLC,

Omnicom Group Inc., Publicis Groupe SA, and Interpublic Group of

Cos., and is seeking ad-spending commitments of $100 million to

$200 million for 2017 from each firm, according to people familiar

with the discussions.

That would be roughly double or triple the amounts the ad

companies spent last year. Snap is looking for yearlong and in some

cases multiyear deals, the people say.

Such agreements typically are only a promise to spend a certain

amount and aren't binding contracts, ad executives said. Still,

securing the deals would give the five-year-old company a welcome

boost as it pitches itself to public investors and tries to live up

to a valuation that could be as much as $25 billion.

Wall Street will be looking for assurances that Snapchat's

legion of young devotees -- it counts more than 150 million daily

users -- will translate into a giant ad business. Snapchat sells

vertical video ads that run in between content from media outlets

such as Cosmopolitan, Vice, CNN and The Wall Street Journal, and

specialized ads that brands use such as sponsored lenses and

geo-filters. eMarketer estimates the company generated $367 million

in ad revenue last year. This compares with Google's ad revenue of

$63 billion and Twitter's $2.26 billion, according to

eMarketer.

Snap's chief strategy officer, Imran Khan, has been the

company's lead in its IPO process, given his background as a former

head of internet banking at Credit Suisse Group AG. But in recent

months he also has invested significant time in wooing ad

executives, people familiar with the situation say.

His key lieutenant in that endeavor has been Jeff Lucas, a

former executive at media giant Viacom Inc., owner of cable

channels such as MTV and Comedy Central. Snap lured him last summer

and made him global head of sales.

A well-liked executive with ties on Madison Avenue dating back

decades, Mr. Lucas has relationships that could help the company

attract the big prize it is seeking -- a piece of the roughly $70

billion that gets spent on U.S. television ads annually.

"Jeff is old school, he connects with our old-school ad guys and

they control billions in TV ad spend," said one top ad

executive.

The Snapchat executives took their ad pitch to the CES trade

show in Las Vegas last month. Mr. Khan pitched a room full of

Publicis executives and its clients, making the case for TV ad

dollars by pointing to its huge base of users 18 to 34 years old, a

coveted demographic in TV, people who attended the meeting say. He

also had an intimate dinner at Aureole restaurant, with top

executives from Publicis and Bank of America Corp., according to

people familiar with the dinner.

Also at CES, Messrs. Khan and Lucas hosted a swanky dinner party

at the Wynn Resorts' Fairway Villa to schmooze with senior

executives from companies such as PepsiCo. Inc., Nestlé SA,

Omnicom, BuzzFeed and Refinery29. Trevor Noah, host of Comedy

Central's "The Daily Show," performed at the gathering.

To entice ad commitments, Mr. Lucas has promised discounts on ad

prices, first looks at new products; and help with producing ad

content tailored for its platform, some of the people familiar with

the discussions said.

There is no guarantee Snap will line up the ad commitments it is

seeking -- some ad executives say the asks are too high. One ad

buyer said that his clients tend to think of Snapchat as a good way

to promote a new movie release or product to hard-to-reach young

audiences, but not a destination for year-round media buys like

Facebook Inc., Alphabet Inc.'s Google or TV.

Some ad buyers say they hope Snapchat will continue improving

its usage metrics. Sarah Hofstetter, CEO of digital agency 360i,

said marketers want to know, "Did it work to build my brand? Did it

work to sell my cookies?"

Snap has been ramping up its use of such metrics, recently

signing a deal with Oracle Data Cloud to help marketers use data

from offline purchases to target consumers with ads and measure the

effectiveness of these campaigns.

Despite reservations, many ad firms expect to back the platform

partly as a defensive move against Facebook and Google's dominance

of digital advertising. WPP said it spent about $90 million on

Snapchat last year, making it one of the platform's biggest

customers. Other ad companies spent well under that amount, with

one firm spending roughly $30 million, according to people familiar

with the matter.

Mr. Lucas, who was hired last summer, spent the first few months

of his tenure putting together his team, making hires from the TV

world, agency business, and digital powerhouses Facebook and

Google.

Before his arrival, Snap had some trouble on Madison Avenue.

Initially, its strategy was to directly engage with big brands, a

person familiar with the company's plans said. The company didn't

build ties with ad agencies that control big media-buying budgets,

leaving some agency executives feeling sidelined, some industry

executives said.

Mr. Lucas knows how crucial it is to maintain cozy relationships

with ad companies and marketers. During the Cannes Lions Ad

festival in June, for example, when he was still working for

Viacom, he helped secure a performance by rapper Flo Rida at a

beach party hosted by ad-buying giant Omnicom Media Group.

Write to Suzanne Vranica at suzanne.vranica@wsj.com, Maureen

Farrell at maureen.farrell@wsj.com and Steven Perlberg at

steven.perlberg@wsj.com

(END) Dow Jones Newswires

January 25, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

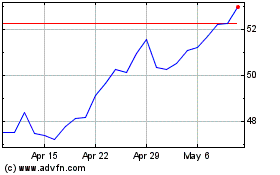

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024