Ahead of the Tape: EBay Is Volatile, But Shares Are Still a Good Bet -- WSJ

January 25 2017 - 3:03AM

Dow Jones News

By Steven Russolillo

For eBay Inc., striking out on its own has created a surprising

development: more volatility.

Some 18 months after the e-commerce titan carved off its

payments subsidiary -- what is now PayPal Holdings Inc. -- eBay's

share price has gotten noticeably choppier. The stock has had

double-digit percentage swings after four of its previous five

earnings reports, rallying twice and plunging twice. Before that,

eBay went 13 straight quarters without such a move.

Much of this is due to the ebb and flow of eBay's ongoing

transformation into more of an online marketplace and less of a

traditional auction platform. With success also comes steep

competition from other e-commerce platforms, notably Amazon.com

Inc. Fourth-quarter earnings for the key holiday season, out

Wednesday, should soothe jittery investors.

Analysts polled by FactSet expect earnings of 53 cents per

share, up from 50 cents in the year-earlier period. But this isn't

necessarily the best metric to gauge how shares will react. Over

the past five years, eBay has exceeded quarterly earnings estimates

all but once, yet the stock has risen on the day after earnings

just 60% of the time. Revenue is expected to have increased by 3.5%

to $2.4 billion, which would be a fourth straight quarter of sales

gains.

A better indicator is gross merchandise volume -- the value of

items sold on eBay's site. After a sluggish few years, growth

picked up again at the end of 2015 and continued last year. When

eBay's shares jumped 11% following its earnings report in July --

one of its biggest gains over the past five years -- gross

merchandise volume growth had its best quarter since 2014.

When the stock dropped 11% in October after eBay reported a

disappointing outlook, growth also slowed and fell short of

analysts' views. Expectations are more reasonable for the fourth

quarter, with analysts anticipating 2.7% growth from a year

ago.

Whether growth can keep improving is based largely on eBay's

efforts to reorganize its marketplace. It is focusing on so-called

structured data, with a goal of improving its search functionality

and boosting its standing in Google results. Active buyers on

eBay's site are expected to increase for a third straight quarter

thanks to these efforts.

EBay also is counting on strong growth from its lucrative

StubHub marketplace. And with its new ad campaign, eBay is aiming

for a younger audience by trying to capture millennial consumers

who spend more time shopping on their phones.

With plenty of cash on hand and an ardent buyer of its own

stock, eBay shares are attractive. Any further volatility offers a

reason to bid more.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

January 25, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

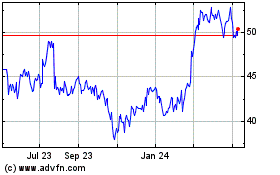

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

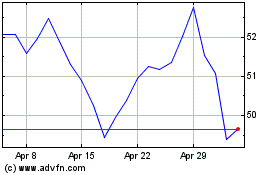

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024