Fourth Quarter 2016 Results

- Sales were $796 million, up 3%

compared to Q3 2016

- Business segment operating profit

improved to $53 million, or 6.7% of sales

- High Performance Materials &

Components segment operating profit improved to $54 million, or 11%

of sales

- Increase of almost 15% compared to

Q3 2016

- Flat Rolled Products segment nearly

break-even, at $1 million operating loss

- Net income attributable to ATI was

$10 million, or $0.09 per share

- Results include $29 million pretax,

or $(0.17) per share, of restructuring charges across HPMC titanium

operations and the FRP segment

- $32 million income tax benefit above

a normal 35% tax rate, or $0.30 per share, primarily related to

income tax valuation allowance changes

- Excluding the restructuring costs

and the above-normal income tax benefit, Q4 2016 net loss was $4

million, or $(0.04) per share

Full Year 2016 Results

- Sales were $3.1 billion, with over

50% of sales to the aerospace and defense market

- Net loss attributable to ATI was

$641 million, or $(5.97) per share

- Results include $544 million after

tax, or $(5.06) per share, of restructuring and other non-recurring

charges, and income tax valuation allowances

- Completed significant HPMC

restructuring actions across titanium operations, including

indefinitely idling the Rowley, UT facility

- Ongoing FRP restructuring to focus

on value, not volume, including permanent idling of Midland and

Bagdad, PA facilities

Allegheny Technologies Incorporated (NYSE: ATI) reported fourth

quarter 2016 sales of $796 million and net income attributable to

ATI of $10 million, or $0.09 per share. Fourth quarter 2016 results

include $29 million of pre-tax restructuring charges, including $13

million for additional High Performance Materials & Components

(HPMC) segment closure-related actions at the Rowley, UT,

Frackville, PA and Albany, OR titanium operations, and $16 million

for Flat Rolled Products (FRP) segment closure-related costs at the

Midland and Bagdad, PA facilities, and for additional FRP severance

charges. Excluding these restructuring costs and an above-normal

income tax benefit, the net loss attributable to ATI was $4

million, or $(0.04) per share.

For the full year 2016, ATI reported a net loss attributable to

ATI of $641 million, or $(5.97) per share, on $3.1 billion in

sales. Adjusted results were a net loss of $97 million, or $(0.91)

per share, excluding $(5.06) per share for the following items, net

of tax: $355 million of restructuring charges primarily relating to

asset impairment charges following the idling of the Rowley

facility, $48 million of work stoppage, return-to-work, and Rowley

excess production costs which will not re-occur, and $141 million

of income tax valuation allowances, primarily related to ATI’s U.S.

federal deferred tax assets.

“Our fourth quarter 2016 results represent a positive ending to

a difficult year. Growth was strong for our next-generation

aerospace products, and ATI benefited from significant

restructuring actions across the Company,” said Rich Harshman,

Chairman, President and Chief Executive Officer. “High Performance

Materials & Components operating profit reached 11% of sales.

The Flat Rolled Products segment results were close to break-even,

after four years of operating losses.

“The full year 2016 has been a period of transition for ATI as

we made hard decisions and took significant actions to improve our

cost structure and lay the groundwork for future long-term

profitable growth. Sales to the aerospace and defense market were

over 50% of sales. Our next-generation, differentiated jet engine

product mix continued to grow, and our airframe titanium product

shipments remained strong. Our Flat Rolled Products segment made

progress to achieve sustainable profitability primarily as a result

of cost reduction and restructuring actions.”

- ATI’s sales to the key global markets

of aerospace and defense, oil & gas, electrical energy,

automotive and medical represented 80% of ATI sales for 2016:

- Sales to the aerospace and defense

markets were $1.59 billion and represented 51% of ATI sales: 28%

jet engine, 15% airframe, 8% government aero/defense. ATI’s sales

to the commercial aerospace market increased $106 million, or 9%,

in 2016 compared to 2015.

- Sales to the oil and gas market were

$281 million and represented 9% of ATI sales. ATI’s sales to this

market decreased 48% in 2016 compared to 2015 and decreased 63%

from 2014, when sales were $752 million.

- Sales to the electrical energy market

were $233 million and represented 7% of ATI sales. ATI’s sales to

this market decreased 37% in 2016 compared to 2015, including the

effects of exiting the grain-oriented electrical steel (GOES)

market in early 2016.

- Sales to the automotive market were

$233 million and represented 7% of ATI sales.

- Sales to the medical market were $196

million and represented 6% of ATI sales.

- Direct international sales were $1.3

billion and represented 41% of ATI’s 2016 sales.

“Fourth quarter 2016 HPMC segment operating profit improved for

the sixth consecutive quarter and almost 15% sequentially. Segment

operating profit was $54 million, or 11% of sales,” Harshman

continued. “Segment sales were $477 million, a 3% increase compared

to the third quarter 2016. Sales to the aerospace and defense

market represented 76% of fourth quarter segment sales: 44% jet

engine, 19% airframe and 13% government aero/defense. Our HPMC

results continue to benefit from the transition to next-generation

aircraft and engines. Challenging business conditions continued in

other key HPMC end markets such as oil & gas and electrical

energy.

“We completed our titanium operations restructuring activities

in the HPMC segment. The indefinite idling of the Rowley, UT

premium titanium sponge production facility was completed in the

fourth quarter 2016, as was the closure of the Frackville, PA

titanium wire production facility, and the idling of certain

titanium manufacturing operations in Albany, OR. We recorded $13

million in restructuring charges for these actions in the fourth

quarter 2016, which are excluded from HPMC segment results.

“Our FRP segment achieved near-breakeven results in the fourth

quarter 2016 on sales of $319 million, which increased 3% compared

to the third quarter 2016. Weakness continued in the oil & gas

market, which is the segment’s largest end market. FRP segment

results are showing the benefits of our significant efforts on cost

reductions and operating improvements, including benefits from the

HRPF. In October 2016, we announced the permanent idling of FRP’s

Midland, PA standard/commodity stainless melt shop and finishing

operations, and of FRP’s Bagdad, PA GOES facility. We recorded $16

million of fourth quarter 2016 restructuring charges associated

with these actions and other workforce reduction costs, which are

excluded from FRP segment results.

“Capital expenditures were $202 million in 2016, including $27

million in the fourth quarter 2016. Approximately $85 million of

2016 capital expenditures related to scheduled HRPF payments. At

December 31, 2016, cash on hand was $230 million, and available

liquidity under our Asset Based Lending facility was approximately

$310 million. Cash provided by operations in the fourth quarter

2016 was $68 million, as we improved our managed working capital

position.”

Strategy and 2017

Outlook

“Our HPMC segment is very well-positioned for profitable growth,

especially in the next-generation jet engine platforms,” Harshman

continued. “In 2017, we expect HPMC segment sales growth of

approximately 10%, and operating profit as a percentage of sales to

improve to the low-teens. Our HPMC segment is expected to continue

sustained profitable growth, supported by long-term agreements that

provide significant growth and share gains for ATI on

next-generation airplanes and the jet engines that power them. We

expect our cost structure to continue to improve throughout the

year as a result of our 2016 titanium operations restructuring

actions, including achieving a better balance of titanium raw

material cost inputs following the idling of our Rowley titanium

sponge production facility. Additionally, our isothermal and

hot-die forge press utilization continues to improve to meet

aerospace demand growth, including new market share gains. We have

sufficient available capacity for the forecasted growth in demand

over the next several years.

“The FRP segment made tremendous progress throughout 2016 toward

returning to profitability, but our work is not done. As we

continue to reposition this business to a higher value product mix,

we expect shipments of our specialty coil and plate products to

improve in 2017 and benefit from the HRPF capabilities,

particularly for our 48”-wide nickel-based alloy sheet. In 2017, we

expect the FRP segment to achieve sequential sales growth through

the first two quarters of 2017, however, our visibility in the

second half of 2017 remains cautious, and market conditions remain

challenging in certain key end markets. We expect the FRP segment

to reach a low-single digit operating profit level, as a percentage

of sales.

“We expect 2017 to be another step in our continuing journey

toward our goals of long-term profitable growth and consistently

earning a premium to our cost of capital. Cash generation from

operations will remain a key focus throughout 2017. We do not

expect to pay any U.S. federal taxes in 2017 due to net operating

loss carryforwards, and we intend to carefully balance our working

capital and other cash needs with the pace of our capital

expenditure requirements, pension funding requirements, and debt

obligations. We expect 2017 capital expenditures to be

approximately $125 million, including 2016 carryover and

approximately $40 million for the expansion at our 60% owned

Chinese joint venture, STAL. Beyond 2017, we continue to expect

capital expenditures to average no more than $100 million annually

for the next several years.

“We currently expect 2017 pre-tax retirement benefit expense to

be about $71 million, or approximately $23 million lower than 2016,

due primarily to the increase in pension assets, and liability

management actions. We expect to make a $135 million cash

contribution to the U.S. qualified pension plan in 2017.”

Quarterly

Results

Three Months Ended Dec. 31 Sept.

30 Dec. 31 2016 2016 2015

In Millions Sales $ 796.1 $ 770.5 $ 738.9 Net income

(loss) attributable to ATI $ 9.9 $ (530.8 ) $ (226.9 )

Restructuring and other charges, net of tax (18.6 ) (329.1 ) (167.3

) Rowley excess operating costs, net of tax — (6.1 ) (6.7 ) Income

tax items including valuation allowances 32.4

(173.1 ) — Loss attributable to ATI

before special items $ (3.9 ) $ (22.5 ) $ (52.9 )

Per

Diluted Share Net income (loss) attributable to ATI $ 0.09 $

(4.95 ) $ (2.12 ) Restructuring and other charges, net of tax (0.17

) (3.07 ) (1.56 ) Rowley excess operating costs, net of tax — (0.06

) (0.06 ) Income tax items including valuation allowances

0.30 (1.61 ) — Loss

attributable to ATI before special items $ (0.04 ) $ (0.21 ) $

(0.50 )

The accompanying financial tables include a reconciliation and

additional explanations of financial information prepared in

accordance with U.S. generally accepted accounting principles

(GAAP) and non-GAAP financial measures.

Percentage of Total ATI Sales

Three Months Ended

Dec. 31 Sept. 30 Dec. 31

High-Value Products (excluding GOES) 2016

2016 2015 Nickel-based alloys and specialty

alloys 26% 26% 27% Titanium and titanium alloys 18% 19% 18%

Precision forgings, castings and components 18% 17% 16% Precision

and engineered strip 14% 15% 14% Zirconium and related alloys 8%

7% 9%

Total High-Value Products 84%

84% 84%

Fourth Quarter and Full Year 2016 Financial Results

- Sales for the fourth quarter

2016 were $796.1 million, a 3% increase compared to the third

quarter 2016, with both HPMC and FRP segment sales increasing 3%.

HPMC sales reflect stronger demand for nickel-based and specialty

alloys mill products, and forged and cast components. FRP sales

increased primarily due to stronger demand for standard stainless

sheet products.

- Sales for the full year 2016

decreased 16% to $3.13 billion, compared to $3.72 billion for 2015.

Compared to the full year 2015, sales decreased 3% in the HPMC

segment and 31% in the FRP segment. The FRP sales decrease is

primarily due to a 25% decline in standard stainless shipments

following the idling of the Midland, PA standard stainless steel

operations, and ATI’s exit from the GOES business, in 2016.

- Net income (loss) attributable to

ATI for the fourth quarter 2016 was $9.9 million, or $0.09 per

share, compared to a loss of $530.8 million, or $(4.95) per share,

for the third quarter 2016. Results in both periods include

restructuring charges and impacts from income taxes which differ

from a standard 35% tax rate, primarily related to income tax

valuation allowance changes. Excluding these charges and

non-standard income tax effects from both 2016 periods, the net

loss attributable to ATI was $3.9 million, or $(0.04) per share, in

the fourth quarter 2016 compared to $22.5 million, or $(0.21) per

share, in the third quarter 2016.

- Full year 2016 net loss attributable

to ATI was $640.9 million, or $(5.97) per share, including all

charges, compared to the full year 2015 loss of $377.9 million, or

$(3.53) per share.

- Cash on hand at the end of 2016

was $229.6 million, a $79.8 million increase from year-end 2015.

Cash used in operations was $43.7 million, and included a $115.0

million contribution to ATI’s U.S. defined benefit pension plan,

and a benefit of $91.7 million from lower managed working capital

balances. Cash used in investing activities was $200.0 million,

entirely related to capital expenditures. Cash provided by

financing activities was $323.5 million, with $387.5 million of

borrowings of long-term debt, partially offset by $25.8 million of

dividends paid to ATI shareholders, and $16.0 million paid to the

40% noncontrolling interest in our STAL joint venture.

High Performance Materials & Components Segment

Market Conditions

- Sales to the commercial jet engine

market in the fourth quarter 2016 remained solid, and increased

slightly compared to the third quarter 2016. Government aerospace

and defense sales were also higher sequentially, while sales to the

commercial airframe market were flat. Sales to the electrical

energy market improved by 25%, and sales to the oil & gas

market increased 9%, both off low levels. Sales of our nickel-based

and specialty alloys were 7% higher, and sales of precision

forgings and castings increased 10%, both compared to the third

quarter 2016. Sales of titanium and titanium alloys were 4% lower.

Direct international sales represented over 46% of total segment

sales for fourth quarter 2016.

Fourth quarter 2016 compared to fourth quarter 2015

- Sales were $477.2 million, a 4%

increase compared to the fourth quarter 2015, primarily as a result

of higher sales of nickel-based and specialty stainless alloys, and

forged and cast components. Sales to the commercial aerospace

market, which represented 63% of fourth quarter 2016 sales, were

19% higher than the fourth quarter 2015, with equal growth in both

the commercial jet engine and airframe markets. Sales to the oil

& gas market decreased 32% compared to the fourth quarter 2015

due to the ongoing effects of significant supply chain rebalancing.

Sales to the electrical energy and medical markets were also

weaker.

- Segment operating profit was $53.8

million, or 11.3% of sales, compared to $21.0 million, or 4.6% of

sales for the fourth quarter 2015. HPMC segment operating profit

has increased for six consecutive quarters, reflecting improving

utilization on increasing aerospace and defense sales and the

benefits of the 2016 titanium operations restructuring activities,

including the Rowley, UT titanium sponge operations idling.

Flat Rolled Products Segment

Market Conditions

- Market conditions improved in the

fourth quarter 2016, particularly for commodity standard stainless

products. Sales of standard grade stainless sheet products were 25%

higher and overall standard grade sales volume increased 10%,

compared to the third quarter 2016. Sales of high-value products

were slightly lower on 3% higher shipment volume, reflecting a

weaker product mix, compared to the third quarter of 2016. Flat

Rolled Products segment shipment information is presented in the

attached Selected Financial Data – Mill Products table. Direct

international sales represented 34% of total segment sales for

fourth quarter 2016.

Fourth quarter 2016 compared to fourth quarter 2015

- Sales were $318.9 million, a 13.2%

increase compared to the prior year period, due to a recovery from

exceptionally weak market conditions in the fourth quarter 2015.

Sales in the fourth quarter 2015 also included GOES and certain

standard stainless sheet products, for which production was idled

in early 2016. Shipments of high-value products increased 16%,

excluding GOES volume in 2015 for comparison. Shipments of standard

stainless products increased 25% compared to the fourth quarter

2015. Average selling prices were 12% higher for high-value

products and 18% higher for standard stainless products.

- Segment operating results were a loss

of $0.8 million, compared to a 2015 segment operating loss of

$120.1 million. Segment operating results in the fourth quarter

2016 reflect slowly improving selling prices, and the benefits of

cost reductions and improving operating performance following the

end of the work stoppage in March 2016. Results for the fourth

quarter 2015 include the effects of weak market conditions, very

low base-selling prices and raw material surcharges, and the

effects of lower operating levels following the mid-August 2015

work stoppage.

Restructuring and Other Charges

- The fourth quarter 2016 includes $28.6

million of restructuring charges, including $13.0 million for

additional HPMC segment titanium operations closure-related actions

at the Rowley, UT, Frackville, PA and Albany, OR titanium

operations, and $15.6 million for FRP closure-related costs at the

Midland and Bagdad, PA facilities and for additional FRP severance

charges for salaried workforce reductions. These restructuring

charges, which are excluded from business segment results, include

contractual obligations, closure costs, severance and supplemental

unemployment benefits. FRP restructuring costs also include $3.4

million of special termination benefits for pension and other

postretirement benefit plans.

Closed Operations and Other Expenses

- Closed operations and other expenses in

the fourth quarter 2016 decreased $5.4 million compared to the

third quarter 2016, to $10.0 million, primarily due to lower Rowley

costs as indefinite idling and shutdown activities were completed

in the quarter. Closed operations costs in the fourth quarter 2016

also include certain costs of the Midland and Bagdad facilities,

which were announced as being permanently idled in October 2016.

Other closed operations costs including environmental, insurance

and retirement benefits expenses were comparable with prior

periods.

Income Taxes

- The fourth quarter 2016 benefit for

income taxes was $42.5 million, or 148% of the pretax loss,

primarily due to adjustments to the income tax valuation allowance

on ATI’s U.S. federal deferred tax assets. For fiscal year 2016,

ATI’s tax rate benefit was 14.6%, including the effects of income

tax valuation allowance charges due to cumulative losses from U.S.

operations. For fiscal year 2017, ATI expects to report results

using approximately a 10% effective tax rate, primarily due to the

ongoing effects of the income tax valuation allowance.

Allegheny Technologies will conduct a conference call with

investors and analysts on Tuesday, January 24, 2017, at 8:30 a.m.

ET to discuss the financial results. The conference call will be

broadcast, and accompanying presentation slides will be available,

at ATImetals.com. To access the broadcast, click on “Conference

Call”. Replay of the conference call will be available on the

Allegheny Technologies website.

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Certain statements in this news release relate to future

events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements include those containing

such words as “anticipates,” “believes,” “estimates,” “expects,”

“would,” “should,” “will,” “will likely result,” “forecast,”

“outlook,” “projects,” and similar expressions. Forward-looking

statements are based on management’s current expectations and

include known and unknown risks, uncertainties and other factors,

many of which we are unable to predict or control, that may cause

our actual results, performance or achievements to differ

materially from those expressed or implied in the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include: (a) material adverse changes in economic or industry

conditions generally, including global supply and demand conditions

and prices for our specialty metals; (b) material adverse changes

in the markets we serve, including the aerospace and defense,

electrical energy, oil and gas/chemical and hydrocarbon processing

industry, medical, automotive, construction and mining, and other

markets; (c) our inability to achieve the level of cost savings,

productivity improvements, synergies, growth or other benefits

anticipated by management from strategic investments and the

integration of acquired businesses, whether due to significant

increases in energy, raw materials or employee benefits costs,

project cost overruns or unanticipated costs and expenses, or other

factors; (d) continued decline in, or volatility of, prices,

and availability of supply, of the raw materials that are critical

to the manufacture of our products; (e) declines in the value of

our defined benefit pension plan assets or unfavorable changes in

laws or regulations that govern pension plan funding;

(f) significant legal proceedings or investigations adverse to

us; (g) labor disputes or work stoppages; and (h) other risk

factors summarized in our Annual Report on Form 10-K for the year

ended December 31, 2015, and in other reports filed with the

Securities and Exchange Commission. We assume no duty to update our

forward-looking statements.

Creating Value Thru Relentless Innovation™

ATI is a global manufacturer of technically advanced specialty

materials and complex components. With 2016 revenue of $3.1

billion, our largest market (over 50% of sales) is aerospace &

defense, particularly jet engines, and we have a strong presence in

the oil & gas, electrical energy, medical, automotive, and

other industrial markets. ATI is a market leader in manufacturing

differentiated specialty alloys and forgings that require our

unique manufacturing and precision machining capabilities and our

innovative new product development competence. ATI produces

nickel-based alloys and superalloys, titanium alloys, specialty

alloys, stainless steels, and zirconium and other related alloys in

many mill product forms. We also are a leader in producing

nickel-based alloy and titanium-based alloy powders for use in

next-generation jet engine forgings and 3D-printed products.

ATIMetals.com

Allegheny Technologies Incorporated and

Subsidiaries

Consolidated Statements of Operations (Unaudited, dollars in

millions, except per share amounts)

Three Months Ended Fiscal Year

Ended December 31 September 30 December 31

December 31 December 31 2016 2016

2015 2016 2015 Sales $

796.1 $ 770.5 $ 738.9 $

3,134.6 $ 3,719.6 Cost of sales

698.8 720.3 836.4 2,972.1

3,659.3 Gross profit (loss) 97.3 50.2 (97.5 )

162.5 60.3 Selling and administrative expenses 65.3 60.5

40.8 247.7 238.8 Restructuring charges 28.6 488.6 64.3 527.2 64.3

Impairment of goodwill - - 126.6

- 126.6 Operating income (loss)

3.4 (498.9 ) (329.2 ) (612.4 ) (369.4 ) Interest expense, net (32.8

) (32.6 ) (29.2 ) (124.0 ) (110.2 ) Other income (expense), net

0.6 - (0.7 ) 2.4

1.6 Loss before income taxes (28.8 ) (531.5 ) (359.1

) (734.0 ) (478.0 ) Income tax benefit (42.5 ) (4.3 )

(135.8 ) (106.9 ) (112.1 )

Net income

(loss) $ 13.7 $ (527.2 )

$ (223.3 ) $ (627.1 )

$ (365.9 ) Less: Net income attributable to

noncontrolling interests 3.8 3.6

3.6 13.8 12.0

Net income

(loss) attributable to ATI $ 9.9 $

(530.8 ) $ (226.9 ) $

(640.9 ) $ (377.9 )

Per common share: Basic net income (loss) attributable to

ATI $ 0.09 $ (4.95 )

$ (2.12 ) $ (5.97 )

$ (3.53 ) Diluted net income (loss)

attributable to ATI $ 0.09 $

(4.95 ) $ (2.12 ) $

(5.97 ) $ (3.53 )

Weighted average common shares outstanding

-- basic (millions)

107.3 107.3 107.3 107.3 107.3

Weighted average common shares outstanding

-- diluted (millions)

108.7 107.3 107.3 107.3 107.3

Actual common shares outstanding -- end of

period (millions)

108.9 108.9 109.2 108.9 109.2

Allegheny Technologies

Incorporated and Subsidiaries Sales and Operating Profit by

Business Segment (Unaudited, dollars in millions)

Three Months Ended Fiscal Year

Ended December 31 September 30 December 31

December 31 December 31 2016 2016

2015 2016 2015 Sales: High Performance

Materials & Components $ 477.2 $ 461.8 $ 457.3 $ 1,930.4 $

1,985.9 Flat Rolled Products 318.9 308.7

281.6 1,204.2 1,733.7

Total External Sales $ 796.1

$ 770.5 $ 738.9

$ 3,134.6 $ 3,719.6

Operating Profit (Loss): High Performance Materials

& Components $ 53.8 $ 47.0 $ 21.0 $ 168.7 $ 157.1 % of Sales

11.3 % 10.2 % 4.6 % 8.7 % 7.9 % Flat Rolled Products (0.8 )

(20.8 ) (120.1 ) (163.0 ) (241.9 ) % of Sales -0.3 %

-6.7 % -42.6 % -13.5 % -14.0 %

Operating Profit (Loss) 53.0 26.2 (99.1

) 5.7 (84.8 ) % of Sales 6.7 % 3.4 %

-13.4 % 0.2 % -2.3 % LIFO and net realizable value

reserves 0.4 - 0.1 0.8 0.1 Corporate expenses (10.8 ) (9.8 )

(11.1 ) (43.4 ) (44.7 ) Closed operations and other expenses

(10.0 ) (15.4 ) (3.5 ) (34.6 ) (22.1 ) Restructuring and

other charges (28.6 ) (499.9 ) (89.7 ) (538.5 ) (89.7 )

Impairment of goodwill - - (126.6 ) - (126.6 ) Interest

expense, net (32.8 ) (32.6 ) (29.2 )

(124.0 ) (110.2 )

Loss before income

taxes $ (28.8 ) $ (531.5

) $ (359.1 ) $ (734.0

) $ (478.0 ) Allegheny

Technologies Incorporated and Subsidiaries Condensed

Consolidated Balance Sheets (Unaudited, dollars in millions)

December 31 December 31

2016 2015 ASSETS Current Assets:

Cash and cash equivalents $ 229.6 $ 149.8

Accounts receivable, net of allowances for

doubtful accounts

452.1 400.3 Inventories, net 1,037.0 1,271.6 Prepaid expenses and

other current assets 47.8 45.9

Total Current

Assets 1,766.5 1,867.6 Property, plant and

equipment, net 2,498.9 2,928.2 Goodwill 641.9 651.4 Other assets

262.7 304.5

Total Assets $

5,170.0 $ 5,751.7 LIABILITIES AND

EQUITY Current Liabilities: Accounts payable $

294.3 $ 380.8 Accrued liabilities 309.3 301.8

Short term debt and current portion of

long-term debt

105.1 3.9

Total Current Liabilities

708.7 686.5 Long-term debt 1,771.9 1,491.8

Accrued postretirement benefits 317.7 359.2 Pension liabilities

827.9 833.8 Deferred income taxes 15.6 75.6 Other long-term

liabilities 83.4 108.3

Total Liabilities

3,725.2 3,555.2 Redeemable

noncontrolling interest - 12.1 Total ATI

stockholders' equity 1,355.2 2,082.8 Noncontrolling interests

89.6 101.6

Total Equity 1,444.8

2,184.4 Total Liabilities and Equity

$ 5,170.0 $ 5,751.7

Allegheny Technologies Incorporated and

Subsidiaries

Condensed Consolidated Statements of

Cash Flows

(Unaudited, dollars in millions)

Fiscal Year Ended December 31

2016 2015 Operating Activities:

Net loss $ (627.1 ) $ (365.9 ) Depreciation and

amortization 170.3 189.9 Non-cash restructuring and other charges

471.3 54.5 Impairment of goodwill - 126.6 Deferred taxes (119.8 )

(118.0 ) Change in managed working capital 91.7 229.0 Change in

retirement benefits (a) (80.0 ) 14.3 Accrued liabilities and other

49.9 1.0

Cash provided by (used in)

operating activities (43.7 )

131.4 Investing Activities: Purchases of property,

plant and equipment (202.2 ) (144.5 ) Purchases of businesses, net

of cash acquired - (0.5 ) Asset disposals and other 2.2

(0.1 )

Cash used in investing activities

(200.0 ) (145.1 )

Financing Activities: Borrowings on long-term debt 387.5 - Payments

on long-term debt and capital leases (2.7 ) (23.6 ) Net borrowings

under credit facilities 3.1 1.5 Debt issuance costs (10.4 ) -

Dividends paid to shareholders (25.8 ) (66.5 ) Dividends paid to

noncontrolling interests (16.0 ) (16.0 ) Acquisition of

noncontrolling interests (12.2 ) - Taxes on share-based

compensation and other - (1.4 )

Cash

provided by (used in) financing activities 323.5

(106.0 ) Increase (decrease) in cash

and cash equivalents 79.8 (119.7 ) Cash

and cash equivalents at beginning of period 149.8

269.5

Cash and cash equivalents at end of

period $ 229.6 $ 149.8

(a)

Includes $(115) million contribution to

the U.S. defined benefit pension plan in 2016.

Allegheny Technologies Incorporated and Subsidiaries

Selected Financial Data - Mill Products (Unaudited)

Three Months Ended Fiscal

Year Ended December 31 September 30 December

31 December 31 December 31 2016

2016 2015 2016 2015 Shipment

Volume: Flat Rolled Products (000's lbs.) High value

75,708 73,481 65,030 293,589 317,054 Standard 112,164

102,252 89,397 385,010 514,035 Flat Rolled

Products total 187,872 175,733 154,427 678,599 831,089

Average Selling Prices: Flat Rolled Products

(per lb.) High value $ 2.54 $ 2.64 $ 2.26 $ 2.59 $ 2.50 Standard $

1.11 $ 1.10 $ 0.94 $ 1.06 $ 1.16 Flat Rolled Products combined

average $ 1.68 $ 1.75 $ 1.50 $ 1.72 $ 1.67 Note: High value

products exclude GOES for all periods presented.

Allegheny Technologies Incorporated and Subsidiaries

Computation of Basic and Diluted Earnings Per Share Attributable

to ATI (Unaudited, in millions, except per share amounts)

Three Months Ended

Fiscal Year Ended December 31 September 30

December 31 December 31 December 31

2016 2016 2015 2016 2015

Numerator for Basic net income (loss) per common share - Net income

(loss) attributable to ATI $ 9.9 $ (530.8 ) $ (226.9 ) $ (640.9 ) $

(377.9 ) Redeemable noncontrolling interest - - - - (0.3 ) Effect

of dilutive securities: 4.75% Convertible Senior Notes due 2022

- - - - -

Numerator for Dilutive net income (loss) per common share -

Net income (loss) attributable to ATI after assumed conversions $

9.9 $ (530.8 ) $ (226.9 ) $ (640.9 ) $ (378.2 ) Denominator

for Basic net income (loss) per common share - Weighted average

shares outstanding 107.3 107.3 107.3 107.3 107.3 Effect of dilutive

securities: Share-based compensation 1.4 - - - - 4.75% Convertible

Senior Notes due 2022 - - -

- - Denominator for Diluted net income

(loss) per common share - Adjusted weighted average assuming

conversions 108.7 107.3 107.3

107.3 107.3 Basic net income

(loss) attributable to ATI per common share

$ 0.09

$ (4.95 ) $ (2.12 )

$ (5.97 ) $ (3.53 )

Diluted net income (loss) attributable to ATI per common

share

$ 0.09 $ (4.95 ) $

(2.12 ) $ (5.97 ) $

(3.53 ) Allegheny Technologies Incorporated

and Subsidiaries Other Financial Information Managed

Working Capital (Unaudited, dollars in millions)

December 31 December 31 2016 2015

Accounts receivable $ 452.1 $ 400.3 Inventory 1,037.0

1,271.6 Accounts payable (294.3 ) (380.8 ) Subtotal

1,194.8 1,291.1 Allowance for doubtful accounts 7.3 4.5 LIFO

reserve (97.3 ) (136.4 ) Inventory reserves 169.0

206.3 Managed working capital $ 1,273.8 $

1,365.5

Annualized prior 3 months sales

$ 3,184.2 $ 2,955.5

Managed working capital as a % of

annualized sales

40.0 % 46.2 %

December 31, 2016 change in managed

working capital

$ (91.7 )

As part of managing the liquidity in our

business, we focus on controlling managed working capital, which is

defined as gross accounts receivable and gross inventories, less

accounts payable. In measuring performance in controlling this

managed working capital, we exclude the effects of LIFO and other

inventory valuation reserves and reserves for uncollectible

accounts receivable which, due to their nature, are managed

separately.

Allegheny Technologies Incorporated and Subsidiaries

Other Financial Information Debt to Capital

(Unaudited, dollars in millions)

December 31

December 31 2016 2015 Total debt (a) $

1,894.1 $ 1,505.2 Less: Cash (229.6 ) (149.8 ) Net

debt $ 1,664.5 $ 1,355.4 Net debt $ 1,664.5 $ 1,355.4 Total

ATI stockholders' equity 1,355.2 2,082.8

Net ATI capital $ 3,019.7 $ 3,438.2

Net debt to

ATI capital 55.1 % 39.4

% Total debt (a) $ 1,894.1 $ 1,505.2 Total ATI

stockholders' equity 1,355.2 2,082.8

Total ATI capital $ 3,249.3 $ 3,588.0

Total debt to total

ATI capital 58.3 % 42.0

% (a) Excludes debt issuance costs.

In managing the overall capital structure

of the Company, some of the measures that we focus on are net debt

to net capitalization, which is the percentage of debt, net of cash

that may be available to reduce borrowings, to the total invested

and borrowed capital of ATI (excluding noncontrolling interest),

and total debt to total ATI capitalization, which excludes cash

balances.

Allegheny Technologies Incorporated and Subsidiaries

Non-GAAP Financial Measures (Unaudited, dollars in millions,

except per share amounts) The Company reports its financial

results in accordance with accounting principles generally accepted

in the United States of America ("GAAP"). However, management

believes that certain non-GAAP financial measures, used in managing

the business, may provide users of this financial information with

additional meaningful comparisons between current results and

results in prior periods. Non-GAAP financial measures should be

viewed in addition to, and not as an alternative for, the Company's

reported results prepared in accordance with GAAP. The following

table provides the calculation of the non-GAAP financial measures

discussed in the Company's press release dated January 24, 2017:

Three Months Ended

Fiscal YearEnded

December 31 September 30 December 31

December 31 2016 2016 2015 2016

Income (loss) attributable to ATI $ 9.9 $ (530.8 ) $ (226.9

) $ (640.9 ) Adjustments: Restructuring and other charges, net of

tax (a) (18.6 ) (329.1 ) (167.3 ) (354.8 ) Rowley excess operating

costs, net of tax (b) - (6.1 ) (6.7 ) (19.3 ) Work stoppage and

return-to-work costs (c) - - - (28.1 ) Income tax items including

valuation allowances (d) 32.4 (173.1 )

- (141.3 ) Loss attributable to ATI excluding special

items $ (3.9 ) $ (22.5 ) $ (52.9 ) $ (97.4 )

Per Diluted

Share Income (loss) attributable to ATI $ 0.09 $ (4.95 ) $

(2.12 ) $ (5.97 ) Adjustments: Restructuring and other charges, net

of tax (a) (0.17 ) (3.07 ) (1.56 ) (3.30 ) Rowley excess operating

costs, net of tax (b) - (0.06 ) (0.06 ) (0.18 ) Work stoppage and

return-to-work costs (c) - - - (0.27 ) Income tax items including

valuation allowances (d) 0.30 (1.61 ) -

(1.31 ) Loss attributable to ATI excluding special

items $ (0.04 ) $ (0.21 ) $ (0.50 ) $ (0.91 ) (a)

Restructuring and other charges include the following: For

the three months ended December 31, 2016, $28.6 of pre-tax

restructuring charges ($18.6 after-tax at a standard 35% tax rate),

or $(0.17) per share, including $13.0 for additional HPMC segment

titanium operations closure-related actions at the Rowley, UT,

Frackville, PA and Albany, OR titanium operations, and $15.6 for

FRP closure-related costs at the Midland and Bagdad, PA facilities

and for additional FRP severance charges for salaried workforce

reductions. These restructuring charges, which are excluded from

business segment results, include contractual obligations, closure

costs, severance and supplemental unemployment benefits. FRP

restructuring costs also include $3.4 of special termination

benefits for pension and other postretirement benefit plans.

For the three months ended September 30, 2016, $471.3 of pre-tax

asset impairment charges ($310.3 after-tax), or $(2.89) per share,

and $28.6 of pre-tax shutdown, idling and employee benefit costs

($18.8 after-tax), or $(0.18) per share for the Rowley, UT

facility, which are excluded from HPMC segment results. For

the three months ended December 31, 2015, $216.3 of pre-tax

impairment and restructuring charges ($135.3 after-tax), or $(1.26)

per share including $126.6 FRP segment goodwill impairment, $54.5

for FRP asset impairments at Midland, PA and GOES operations, $25.4

for titanium inventory valuation, and $9.8 of severance and other

costs. Charges also include $51.2 of pre-tax Net Realizable Value

inventory valuation adjustments ($32.0 after-tax), or $(0.30) per

share. For the fiscal year ended December 31, 2016, amounts

include additional charges for severance actions. (b) During

the third quarter of 2016, the Company indefinitely idled its

titanium sponge production facility in Rowley, UT. These amounts

represent the above-market production costs and other operating

expenses for this facility for the periods indicated, net of

expected ongoing carrying costs, and have been adjusted out of the

Company's GAAP amounts to provide Company results that are more

representative of the fourth quarter 2016 and future periods, which

will exclude these costs.

(c) For the first six months of fiscal

year 2016, the Company incurred costs associated with the work

stoppage and return-to-work of USW-represented employees including

reduced operating efficiencies, out-of-phase raw material costs,

and provisions of the new labor agreements.

(d) Amounts for the three months ended December 31, 2016

include $32.4, or $0.30 per share, of above-normal income tax

benefits compared to those that would apply at a standard 35% tax

rate, primarily related to income tax valuation allowance changes.

Amounts for the three months ended September 30, 2016 include a

charge of $173.1, or $(1.61) per share primarily related to income

tax valuation allowances recorded on U.S. federal deferred tax

assets due to cumulative losses from U.S. operations. Amounts for

the fiscal year ended December 31, 2016 include $141.3 or $(1.31)

per share, of below-normal income tax benefits on the $734.0 pretax

loss due primarily to valuation allowances recorded on U.S. federal

deferred tax assets.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170124005731/en/

Allegheny Technologies IncorporatedDan L. Greenfield,

412-394-3004

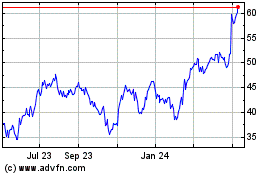

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

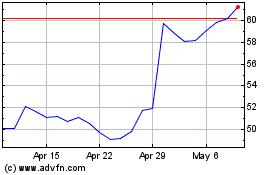

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024