Ford Invests to Promote Online Auto Loans -- WSJ

January 24 2017 - 3:02AM

Dow Jones News

By Peter Rudegeair

The lending arm of Ford Motor Co. has tapped a San Francisco

startup to make it easier for its customers to buy and finance a

car without going into a showroom.

Ford Motor Credit Co. said Monday that it would use software

developed by AutoFi Inc. to let car buyers shop for a Ford or

Lincoln car and secure a loan online through its dealers'

websites.

As part of the new deal, Ford Motor Credit also announced an

equity investment in AutoFi. It didn't disclose the amount.

AutoFi doesn't make any credit decisions or loans itself. The

company operates a marketplace where dealers can select which

banks, credit unions or other lenders can pitch loans to car

buyers. Customers can choose among competing offers. AutoFi gets

paid a fee by both the dealer and the lender if its service is used

in a purchase.

"Our approach from the beginning was not to be, 'We're a Silicon

Valley disrupter that's come to take out the manufacturers and the

dealers,'" said AutoFi Chief Executive Kevin Singerman in an

interview.

While this new service promises to help streamline the buying

process, laws in many states require customers to visit a showroom

to complete the paperwork on a new-car purchase, which often must

be signed in person.

The auto-loan market expanded rapidly after the financial

crisis, surpassing $1 trillion in outstanding balances for the

first time in 2015, according to the Federal Reserve Bank of New

York. During the third quarter, lenders extended $150 billion in

auto loans in the U.S., tying a record, according to the Federal

Reserve Bank of New York.

Other fintech companies are also eyeing the auto-finance

market.

In August, car-buying firm TrueCar Inc. announced a deal with

J.P. Morgan Chase & Co. to simplify the process of finding a

vehicle and getting an auto loan online.

In October, online lender LendingClub Corp. announced it would

start refinancing outstanding auto loans for borrowers.

Mr. Singerman co-founded AutoFi in 2015 after a stint as a

corporate-development executive at LendingClub. "There was a lot of

innovation that was being brought for most other consumer finance

products, but auto was really lacking," he said.

The deal with AutoFi comes a few months after Ford Motor Credit

warned analysts that 2017 profit before taxes would be $300 million

lower than previously forecast due in part to falling values on

used cars. The Dearborn, Mich., auto maker has also been

maneuvering to position itself more like a tech company, committing

to big investments in projects like fully autonomous vehicles.

Christina Rogers contributed to this article.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

January 24, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

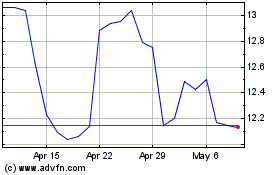

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

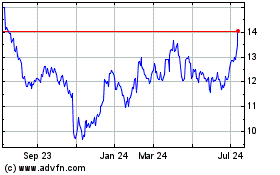

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024