Halliburton Winds Down Discounts for Oil Producers -- WSJ

January 24 2017 - 3:02AM

Dow Jones News

By Christopher M. Matthews and Austen Hufford

Halliburton Co. is taking a tough new line with its customers in

the oil patch: pay us more or we will take our equipment

elsewhere.

Chief Executive Dave Lesar on Monday said the oil-field-services

company has begun negotiating prices with customers after offering

them steep discounts during a two-year oil downturn.

"If a customer agreed to better pricing, we continued to work

for them," Mr. Lesar said during the company's fourth-quarter

earnings call. "If not, we took that equipment and used it to fill

the incremental demand with a customer that shared our view on how

to work together and make better wells."

Those conversations "were sometimes hard, but they needed to

happen," he added.

The tough talk came as Halliburton posted a fourth-quarter loss

of $149 million, or 17 cents a share, compared with a year-earlier

loss of $28 million, or 3 cents a share. While revenue also fell,

the company said the market in North America was on the

upswing.

Echoing remarks Friday by Paal Kibsgaard , the chief executive

of rival Schlumberger Ltd., Mr. Lesar said the energy market was in

a "tale of two cycles". North America was largely positive, he

said, but in the rest of the world, he doesn't expect to see

improvements until the second half of 2017.

U.S. oil producers, particularly shale drillers, have increased

budgets for 2017 by an average of 60%, according to preliminary

capital-spending plans released by more than a dozen U.S. shale

drillers

"The North America market appears to have rounded the corner,

but the international downward cycle is still playing out," he

said.

In the North America region, the company's largest, revenue

increased from the third quarter, and the company swung to an

operating profit as better pricing and utilization combined with

cost management boosted results.

Mr. Lesar said customers should count on Halliburton's service

prices increasing by more than the 10% rise some analysts have

predicted over the next year. "I would be using something higher...

I don't see how there is going to be the ability for the customers

to hold prices down," he said.

Still, total revenue fell 21% to $4.02 billion. During the

latest quarter, Halliburton took a $53 million loss on the

devaluation of the Egyptian pound and a separate $54 million charge

to settle a 14-year-old securities fraud class action lawsuit that

had gone to the U.S. Supreme Court.

On an adjusted basis, which excludes the lawsuit and currency

fluctuations, the company posted a 4 cent profit per share.

Analysts polled by Thomson Reuters had projected a loss of 2

cents a share on $4.09 billion in revenue.

Shares in the company, which have risen 17% in the past three

months, fell 2.7% to $54.91 in recent trading.

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 24, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

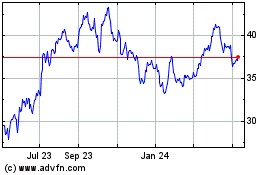

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

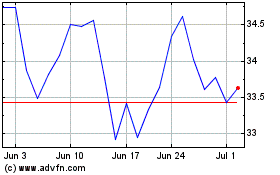

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024