By Brent Kendall and Anna Wilde Mathews

WASHINGTON -- A federal judge Monday blocked the proposed merger

of health insurers Aetna Inc. and Humana Inc. on antitrust grounds,

a potentially fatal blow to the $34 billion deal and a capstone

victory for Justice Department antitrust officials under former

President Barack Obama.

U.S. District Judge John D. Bates ruled the Justice Department

had proven its case that the merger would unlawfully threaten

competition. harming seniors who buy private Medicare coverage as

well as some consumers who purchase health plans through an

Affordable Care Act insurance exchange.

The government's challenge to the merger was among the last

major law-enforcement actions taken by Obama administration

antitrust officials. The administration also challenged Anthem

Inc.'s proposed acquisition of Cigna Corp ., and a ruling in that

case is expected any day. Together the deals could have transformed

an industry already facing uncertainty from Republican plans to

dismantle the Affordable Care Act and replace it with another

health-care plan.

The ruling by Judge Bates, a George W. Bush appointee, followed

a 13-day trial last month. The Justice Department filed a lawsuit

last year challenging the proposed merge, which Aetna and Humana

announced in July 2015. The two companies said the deal would allow

them to offer more cost-effective products by combining their

strengths and becoming more efficient.

For Judge Bates, the proposed transaction was particularly

problematic for the sale of Medicare Advantage plans, a

government-backed alternative to traditional Medicare that is

offered to seniors by private insurers.

Combining Aetna and Humana likely would lead to a substantial

lessening of competition for these plans in 364 counties, the judge

said. Humana is one of the biggest players in the market and Aetna

in recent years expanded its Medicare Advantage footprint

aggressively, putting it "on a collision course with Humana," Judge

Bates said.

"This head-to-head competition benefits seniors who shop for

Medicare Advantage plans in the form of broader networks and lower

costs," the judge wrote in the opinion.

He rejected the insurers' argument that the merged firm wouldn't

be dominant because government-run Medicare was part of the same

market. That holding sets an important precedent for the

managed-care industry. If the judge had reached the opposite

conclusion, companies likely would have perceived a green light for

more ambitious deal-making.

Judge Bates also said the merger would harm competition on

Affordable Care Act insurance exchanges in parts of Florida.

Aetna last year withdrew from selling plans on most state

exchanges, including in Florida, citing mounting financial losses.

The insurer said its move made the government's argument on this

point moot, but Judge Bates disagreed, saying Aetna withdrew from

certain locations "specifically to evade judicial scrutiny of the

merger."

A Humana spokesman said "Aetna and Humana are reviewing the

decision." Aetna signaled it may not be ready to give up its fight

for the deal. "We're reviewing the opinion now and giving serious

consideration to an appeal after putting forward a compelling

case," Aetna spokesman T.J. Crawford said.

Merging parties don't often appeal adverse court rulings because

of the time, money and uncertainty involved in trying to keep a

deal together during prolonged litigation.

Aetna potentially could seek to start new discussions with

incoming Trump administration antitrust enforcers about a way to

salvage the deal, but it could be weeks or months before a new

Justice Department antitrust team is fully in place. Even if such

talks did unfold, Aetna and Humana are now facing a court ruling

that says unequivocally the deal violates federal antitrust

law.

In trading Monday, shares of Humana rose 2.2%, and shares of

Aetna fell 2.7%.

The companies' merger agreement is set to expire Feb. 15, after

which either insurer could walk away from the deal.

The Justice Department said the court's decision would save

customers and taxpayers up to $500 million a year. "Aetna attempted

to buy a formidable rival, Humana, instead of competing

independently to win customers," said Deputy Assistant Attorney

General Brent Snyder, a career official temporarily heading the

antitrust division.

Humana is the second-largest Medicare insurer, with around 3.3

million beneficiaries, or about 16.9% of the Medicare Advantage

market, according to Credit Suisse. Aetna is fourth, with about 1.4

million beneficiaries and 7.2% of the Medicare Advantage market.

Combined, they would surpass the enrollment of Medicare Advantage

leader UnitedHealth Group Inc.

The government's antitrust concerns focused more on particular

geographies, not national market share, because Medicare Advantage

plans are sold on a local basis. Aetna and Humana had argued they

could alleviate the concerns by divesting -- or selling off --

assets representing about 290,000 enrollees in 21 states to Molina

Healthcare Inc., a managed care company focused primarily on

Medicaid.

Judge Bates ruled, however, that the proposed divestiture "would

not ameliorate the anticompetitive effects of the merger."

Molina said it was disappointed in the ruling but remained

committed to growing its Medicare business.

After Monday's ruling, Aetna and Humana now face the prospect of

going it alone, without the added cost-squeezing scale and clout

they had hoped to gain in their combination.

Without the deal, Humana maintains a narrow focus on Medicare

Advantage, a rapidly growing business but one that can be

operationally difficult. The changeover to Republican control in

Washington is generally seen as a positive for private Medicare

plans. Humana has already pulled back from its ACA marketplace

business, which had run losses, and thus reduced its risk from

upheaval if the health law is repealed.

Humana is also poised to emerge with a $1 billion breakup fee

from Aetna if the deal doesn't close. The company has previously

said money from the breakup fee would be allocated according to its

earlier capital plans, which include possible spending on

acquisitions, share buybacks and dividends.

If the deal dies, Aetna Chief Executive Mark T. Bertolini would

lose the chance to rapidly build a diversified insurance powerhouse

with government business balanced against traditional commercial

coverage. Aetna remains far smaller than UnitedHealth and Humana in

the important Medicare market. It will have to find other engines

for growth, either organically or through smaller-scale deals.

Aetna has already sharply scaled back its position in the ACA

marketplaces this year after deepening losses. Its footprint has

fallen to four states, down from 15 in 2016.

Hospitals and doctors have watched insurance industry

consolidation warily, amid concern that larger insurance firms

would push to impose lower reimbursement rates on health-care

providers. Both the American Medical Association and American

Hospital Association cheered the judge's ruling.

Write to Brent Kendall at brent.kendall@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

January 24, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

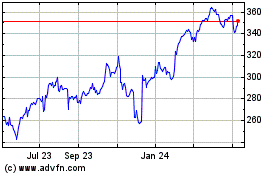

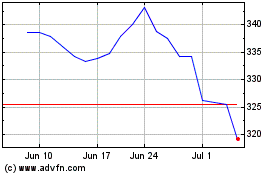

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024