3M Earnings: What to Watch

January 23 2017 - 3:07PM

Dow Jones News

By Andrew Tangel

3M Co., the St. Paul, Minn.-based maker of consumer and

industrial products, is scheduled to report fourth-quarter earnings

before the stock market opens on Tuesday. Here's what you need to

know:

EARNINGS FORECAST: Wall Street analysts' consensus estimate for

fourth-quarter earnings per share is $1.87, up from the $1.66 prior

year, according to Thomson Reuters. In October, 3M said it expects

to earn between $8.15 and $8.20 a share for 2016, up from $7.58 a

share for 2015. Analysts are expecting the company to earn $8.16 a

share for the year.

REVENUE FORECAST: Analysts expect sales of $7.3 billion for the

quarter, essentially flat from the prior year. For all of 2016,

analysts are forecasting revenue of $30.1 billion, down slightly

from $30.3 billion in 2015. The company in October said it expects

full-year organic sales will be approximately flat compared to the

previous year.

WHAT TO WATCH:

DOLLAR: 3M signaled in December that growing revenue in 2017

would be difficult given the strengthening of the U.S. dollar. The

U.S. currency gained in the wake of Donald Trump's election as

president and the U.S. Federal Reserve's decision to raise interest

rates. A strong dollar makes it harder for exporters like 3M to

sell products overseas as they become more expensive. Foreign sales

also become less valuable when they are translated into U.S.

currency. 3M has said it expects local-currency organic sales to

increase between 1% and 3% in 2017, but a currency-translation

headwind could drag down revenue by as much as 2%.

ELECTRONICS: A focus for analysts is likely to be 3M's

struggling electronics and energy business, which makes components

for everything from smart-phone screens to wind and solar power

generation. Third-quarter sales for the unit declined 7.5% to $1.3

billion, while operating income of $312 million was down 9.1% from

the previous year as the company cited difficulties in the

consumer-electronics market. 3M expects organic sales in the

segment to decline as much as 3% or grow as much as 1% in 2017.

Still, the segment had a third-quarter operating margin of 24.2%,

and Chairman and Chief Executive Inge Thulin said in December the

business was "much more profitable than it was four, five years

ago."

TRUMP EFFECT: 3M's stock is up about 4% since Mr. Trump's

election, while the Dow Jones industrial average has risen about

8%. In December, 3M signaled it stood to benefit from Mr. Trump's

plans to boost spending on infrastructure and rejuvenate U.S.

manufacturing. 3M's myriad products include coatings for rebar used

in construction as well as personal protective gear for factory

workers. "When people think about who will benefit short-term

there, we will be ahead of that, because we are the suppliers to

those businesses," Mr. Thulin said in December, without commenting

on Mr. Trump or his policy plans specifically.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

January 23, 2017 14:52 ET (19:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

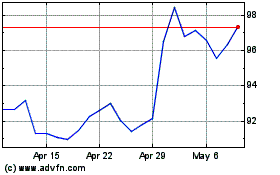

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

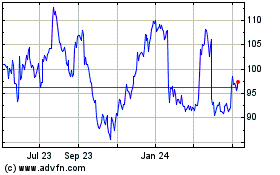

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024