Amended Statement of Beneficial Ownership (sc 13d/a)

January 23 2017 - 6:09AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment No. 1)*

ZONED

PROPERTIES, INC.

(Name

of Issuer)

COMMON

STOCK

(Title

of Class of Securities)

98978X

208

(CUSIP

Number)

GREG

JOHNSTON

c/o

Zoned Properties, Inc.

14300

N. Northsight Blvd., #208,

Scottsdale,

AZ 85260

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August

3, 2016

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note

:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP

No. 98978X 208

|

13D

|

Page

2 of 5 Pages

|

|

1.

|

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

GREG

JOHNSTON

|

|

2

.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

|

|

(a) ☐

(b) ☐

|

|

3

.

|

SEC

USE ONLY

|

|

|

|

4

.

|

SOURCE

OF FUNDS (see instructions)

|

|

OO

|

|

5

.

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

|

|

6

.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

|

|

UNITED

STATES

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7.

|

SOLE

VOTING POWER

|

|

1,262,500

|

|

8

.

|

SHARED

VOTING POWER

|

|

0

|

|

9

.

|

SOLE

DISPOSITIVE POWER

|

|

1,262,500

|

|

10

.

|

SHARED

DISPOSITIVE POWER

|

|

0

|

|

11.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

1,262,500

|

|

12

.

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

|

|

13

.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

7.3%

|

|

14

.

|

TYPE

OF REPORTING PERSON (see instructions)

|

|

IN

|

|

CUSIP

No. 98978X 208

|

13D

|

Page

3 of 5 Pages

|

Item

1. Security and Issuer.

This

statement relates to the common stock of Zoned Properties, Inc. The issuer’s principal executive offices are located at

14300 N. Northsight Blvd., #208, Scottsdale, AZ 85260.

Item

2. Identity and Background.

(a)

Greg Johnston

(b)

Business Address: 14300 N. Northsight Blvd., #208, Scottsdale, AZ 85260

(c)

The reporting person’s principal business is 915 Stitch Road, Lake Stevens, Washington 98258.

(d)

Criminal Proceedings: None

(e)

Civil Proceedings: None

(f)

Citizenship: United States

Item

3. Source or Amount of Funds or Other Consideration.

On

January 14, 2014, approximately 12,500 shares of common stock were purchased from the Issuer by Greg Johnston in exchange for

payment of $1,500,000. On July 28, 2014, 1,500,000 shares of common stock were purchased from the Issuer by Greg Johnston in exchange

for payment of $15,000. On August 22, 2014, 1,000,000 shares of common stock were purchased from the Issuer by Greg Johnston in

exchange for payment of $1,000,000.

Item

4. Purpose of Transaction.

The

reporting person intends to participate in and influence the affairs of the issuer only with respect to his voting rights associated

with his shares of common and preferred stock.

In

addition to the reporting person’s common stockholdings, the reporting person holds 1,000,000 shares of the issuer’s

non-convertible preferred stock. Each share of the issuer’s common stock is entitled to one vote per share on each matter

submitted to a vote of stockholders. Each share of the issuer’s non-convertible preferred stock is entitled to 50 votes

per share on each matter submitted to a vote of stockholders. Holders of preferred shares vote along with common stockholders

on each matter submitted to a vote of security holders. As a result of the multiple votes accorded to holders of the preferred

stock, the reporting person and another stockholder (Alex McLaren) have the ability to control the outcome of all matters submitted

to a vote of stockholders, including the election of directors. In addition, certain corporate action requires the affirmative

vote by holders of at least 51% of the outstanding preferred stock. On those matters that require the approval of at least 51%

of the preferred stock, both the reporting person and Mr. McLaren must provide their approval inasmuch as each of them owns 50%

of the outstanding preferred stock.

The

reporting person’s aggregate voting power, with his common and preferred stockholdings, is approximately 43.7%.

The

reporting person does not have any present plans or proposals that relate to or would result in the occurrence of any of the events

or matters described in Item 4(a)-(j) of Schedule 13D.

|

CUSIP

No. 98978X 208

|

13D

|

Page

4 of 5 Pages

|

Item

5. Interest in Securities of the Issuer.

|

|

(a)

|

The

reporting person beneficially owns 1,262,500 shares of common stock, representing approximately

7.3% of the outstanding shares of common stock.

|

In

addition to the reporting person’s common stockholdings, the reporting person holds 1,000,000 shares of the issuer’s

non-convertible preferred stock. Each share of the issuer’s common stock is entitled to one vote per share on each matter

submitted to a vote of stockholders. Each share of the issuer’s non-convertible preferred stock is entitled to 50 votes

per share on each matter submitted to a vote of stockholders. Holders of preferred shares vote along with common stockholders

on each matter submitted to a vote of security holders. As a result of the multiple votes accorded to holders of the preferred

stock, the reporting person and another stockholder (Alex McLaren) have the ability to control the outcome of all matters submitted

to a vote of stockholders, including the election of directors. In addition, certain corporate action requires the affirmative

vote by holders of at least 51% of the outstanding preferred stock. On those matters that require the approval of at least 51%

of the preferred stock, both the reporting person and Mr. McLaren must provide their approval inasmuch as each of them owns 50%

of the outstanding preferred stock.

|

|

(b)

|

The

information set forth in Item 5(a) of this Schedule 13D is incorporated herein by reference.

The reporting person has sole voting power and sole dispositive power over the shares

of common stock, and does not have shared voting power or shared dispositive power over

any shares of common stock.

|

|

|

(c)

|

The

reporting person did not effect any transactions in the issuer’s common stock in

the last 60 days. On August 3, 2016, the reporting person transferred 1,250,000 shares

of common stock pursuant to a separation agreement as part of a division of marital assets

in connection with the reporting person’s pending divorce.

|

|

|

|

|

|

|

(d)

|

Other

than the reporting person, no person is known to have the right to receive or the power

to direct the receipt of dividends from, or the proceeds from the sale of, the shares

that are the subject of this statement.

|

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The

information set forth under Items 3, 4 and 5 herein is incorporated herein by reference. The reporting person: (i) holds no options

to purchase shares of common stock, (ii) has no interest in any other securities of the issuer, except as set forth in Items 4

and 5(a) above, and (iii) is not a party to an agreement in which it shall receive additional securities of the issuer.

Item

7. Material to Be Filed as Exhibits.

None.

|

CUSIP

No. 98978X 208

|

13D

|

Page

5 of 5 Pages

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date:

January 20, 2017

|

|

/s/

Greg Johnston

|

|

|

Greg

Johnston

|

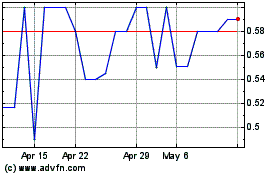

Zoned Properties (QB) (USOTC:ZDPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zoned Properties (QB) (USOTC:ZDPY)

Historical Stock Chart

From Apr 2023 to Apr 2024