Today's Top Supply Chain and Logistics News From WSJ

January 20 2017 - 7:38AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The CSX Corp. board is offering its support for the current

management team and growth strategy even as investors show lots of

confidence in a bid by Hunter Harrison to take control of the

freight railroad. Shares in the carrier surged to all-time highs on

news that the rail industry veteran was teaming up with an activist

investor in a new run at CSX, the WSJ's Paul Ziobro reports, a move

that's will revive talk of consolidation in the industry. Mr.

Harrison walked away from an exit package worth $89 million at

Canadian Pacific Railway Ltd. to make the new effort. CSX investors

are anxious to see if Mr. Harrison can bring the railroad the sort

of efficiency gains he wrung from CP, which just reported its

best-ever annual operating ratio. CSX remains broadly profitable,

but its operating earnings have barely budged this decade and last

year were the lowest since 2010. Mr. Harrison sees room for

improvement, and investors appear to agree -- whether that means

gains for CSX on its own or as part of an even bigger railroad.

Union Pacific Corp. isn't willing to say whether the commodities

slump has hit bottom even though figures at North America's biggest

freight railroad suggest the long-lagging business is getting

better. Union Pacific reported a profit of $1.14 billion in the

fourth quarter, up slightly from $1.11 billion, the WSJ's Ezequiel

Minaya reports, even as revenue slipped slightly to $5.17 billion.

The improvement came mostly because the railroad is continuing to

pare back its operations in line with diminishing demand: Union

Pacific cut its locomotive fleet by 5% in the quarter from the same

quarter the year before, and the railroad is delaying the

acquisition of 40 of the 100 new locomotives it planned to add this

year. But grain volumes jumped, the slide in coal volume and

revenue was more modest and intermodal business was flat. Union

Pacific is looking for volume gains this year, and with capacity

reductions still in place that would mean the carrier would be on a

fast track toward higher pricing.

J.B. Hunt Transport Services Inc. is finding its strongest

returns outside the daily freight market . The transport giant

improved its net profit slightly in the fourth quarter, the WSJ's

Anne Steele reports, but the returns across its various lines

highlight the ongoing struggle that companies face in adjusting

capacity to a volatile and highly competitive market. Weak pricing

in J.B. Hunt's intermodal, freight brokerage and trucking units

held down earnings in those areas even as business jumped at the

dedicated contract services operation that manages fleets for

customers. The company says basic truckload prices fell 1.4% in the

quarter from a year ago and revenue, operating income and revenue

per load in the logistics operation all fell at a double-digit

pace. The strength in dedicated services proves the value the

diversified strategy has for the company, but the results in other

lines suggest that J.B. Hunt and other U.S. freight operators are

still looking for prices to push higher.

TRANSPORTATION

With larger vessels, shifting trade patterns and population

growth all changing the landscape for shipping, industry expert

Olaf Merk says it's time for public policies involving ports to

catch up. The administrator for ports and shipping at the

International Transport Forum writes in a Guest Voices commentary

for WSJ Logistics Report that a new wave of port reform is needed

to meet new demands in modern trade. Mr. Merk writes that many

ports operating strictly as landlords for global cargo terminal

operators are ill-equipped to meet the needs of both ship operators

and the big cities that are growing around seaports. The ports, he

writes, must be "able to bridge the demands of a range of parties

beyond the port while providing innovative transport solutions to

local firms." Questions over port management are becoming more

important as bigger ships strain dockside operations and terminal

operators gaining their own scale through acquisition and

expansion.

QUOTABLE

IN OTHER NEWS

U.S. housing starts rose 11.3% in December and reached their

highest level in nine years in 2016. (WSJ)

The number of Americans newly applying for unemployment benefits

fell sharply and remained near a four-decade low. (WSJ)

The decline in sales at physical stores is hitting small-town

malls in the U.S. especially hard as big chains close anchor sites.

(WSJ)

Big leaps in artificial intelligence are raising tensions among

businesses and policy makers over the impact of the technology on

middle-income jobs. (WSJ)

Beer maker Asahi Group Holdings Ltd. is reviewing its

investments in China, including its minority stake in Tsingtao

Brewery Co. (WSJ)

Shares in DryShips Inc. fell more than 28% after the bulk

carrier announced a one-for-eight reverse stock split.

(MarketWatch)

Alphabet Inc. unit Google is facing inventory shortages of its

Pixel and Pixel XL smartphones. (The Verge)

A measure of U.S. domestic road and rail shipments rose 3.5% in

December, the fastest growth pace in two years. (Logistics

Management)

Malaysia's Port Klang says its container throughput expanded

10.8% last year. (Port Technology)

Freight exports from Hong Kong International Airport jumped

12.8% year-over-year in December. (Air Cargo World)

One of two Hanjin Shipping Co. vessels stranded with crew off

Canada's Pacific Coast for six months is sailing back to Asia after

the ship was sold. (Victoria Times Colonist)

Hapag-Lloyd AG increased the size of its new bond offering to

$266 million, citing strong demand. (American Shipper)

Scorpio Tankers Inc. won a $172 million loan commitment to

finance its purchase of eight tankers under construction. (Shipping

Watch)

The price of U.S. First-Class postage stamps will rise by two

cents on Sunday. (Detroit Free-Press)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 20, 2017 07:23 ET (12:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

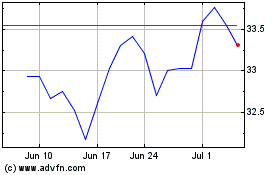

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024