By Justin Baer

Bank of New York Mellon Corp. posted a higher fourth-quarter

profit, helped in part by a long-running cost-cutting push hatched

in 2014 amid pressure from an activist investor.

The profit increase came despite a hit to earnings from a

stronger U.S. dollar and disappointing results from its

money-management arm.

The trust bank's shares fell $1.39, or 3%, to $44.84, Thursday,

as per-share profit matched analysts' average estimate and revenue

was just under Wall Street's forecasts.

"The results were decidedly goldilocks -- not too hot, not too

cold," UBS analyst Brennan Hawken said. "There was a

foreign-exchange factor, which came into play and is going to

subdue revenue."

BNY Mellon's shares have climbed 11% since Dec. 2, 2014, when

the bank added Trian Fund Management LP's Edward Garden to its

board. Trian, the activist investor, had taken a stake in the

company that June and sought cost cuts. In October 2014, BNY Mellon

executives unveiled plans to shed $500 million in expenses through

2017.

Trian's influence has been positive, Mr. Hawken said. "Investors

used to love to deride BNY, calling them '50 cents,' " he said.

"Earnings every quarter was 50 cents. Since then, we've seen steady

growth in earnings per share."

BNY Mellon's revenue growth has outpaced increases in expenses,

leading to better margins and operating leverage for three

consecutive years, Mr. Hawken said. "They have definitely delivered

on the promises they made several years ago," he said.

For the fourth quarter, BNY Mellon reported profit of $870

million, up from $693 million the year before. Per-share earnings

rose to 77 cents from 57 cents. Total revenue rose 1.7%, to $3.79

billion. Analysts polled by Thomson Reuters predicted profit of 77

cents a share on $3.85 billion in revenue.

The bank's assets under management fell during the period due to

outflows, unfavorable exchange rates and market performance. Assets

under management fell to $1.65 trillion at the end of the quarter,

from $1.72 trillion at the end of the prior quarter. The company

reported $11 billion in net long-term outflows during the quarter,

primarily from actively managed strategies.

More broadly, actively managed funds -- or those run by human

stock pickers -- had net withdrawals of $340.1 billion last year,

topping the $230.5 billion investors pulled from those funds in

2015, according to Morningstar. Investors have pulled money out of

actively managed U.S. stock funds for 33 consecutive months, and

U.S. equity funds run by human stock pickers haven't seen a full

calendar year of inflows since 2005, according to Morningstar.

The company was also hurt by a mix of businesses outside the

U.S., where the stronger dollar crimped results, and by a large

client's decision to pull money from BNY Mellon to manage its

liability-driven investments internally, finance chief Thomas

Gibbons said. Some of the firm's money managers also missed out on

the rally in riskier assets following the U.S. presidential

election, leaving them short of the returns needed to pull in

performance fees, Mr. Gibbons said.

As a custody bank, BNY Mellon derives much of its business from

serving trillions of dollars in assets for money managers and other

clients, in addition to managing clients' investments. While the

shares of many financial firms have rallied for much of the past

few months, helped by expectations of higher interest rates from

the Federal Reserve, BNY Mellon has been relatively flat. Its

results are aided by higher rates, and the pickup in trading

activity that often accompanies changing expectations for economic

growth, but BNY Mellon's set of steadier businesses aren't expected

to see the same surge as investment banks'.

Expenses fell 2%, to $2.56 billion, as BNY Mellon continued to

chip away at its cost-cutting initiatives.

Mr. Gibbons said Thursday that BNY Mellon had stopped sharing

its targets for additional cost cuts. But, he added, "we've well

exceeded anything we've targeted."

BNY Mellon, the nation's oldest bank, benefited this past year

from its plans to automate certain tasks, moving to more digital

platforms, and by shrinking the amount of rented real estate, Mr.

Gibbons said. He said the bank's asset-management arm is poised to

generate more performance fees this year and expects revenue growth

to outpace expenses again in 2017.

He also said he enjoyed working with Mr. Garden and the Trian

team, calling them "fact-based" and "engaged." "Management is

managing the business, and we certainly share ideas with Ed and the

other directors," he said.

Fee revenue, which makes up nearly 80% of the bank's total

revenue, grew 0.1% in the fourth quarter from a year before as

investment-services fees increased on higher money-market fees.

Investment-management and performance fees decreased due to the

stronger dollar and lower performance fees.

Net interest revenue grew 8.9% on the increase in interest rates

and interest-rate hedging.

In December, the Federal Reserve approved its second rate

increase in a decade and signaled that interest rates would rise at

a faster pace than previously projected.

The bank's net interest margin, a key measure of lending

profitability, rose to 1.17%, from 1.06% in the third quarter and

0.99% in the prior year.

Late last year, the bank was unable to process client-payment

instructions sent over the Swift network for several hours in a

rare outage that caused some payments to fail.

--Austen Hufford contributed to this article.

Corrections & Amplifications: Edward Garden is a founding

partner of Trian Fund Management. An earlier version of this

article misspelled his last name as Garten. (Jan. 19, 2016)

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

January 20, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

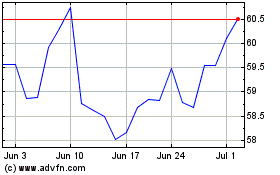

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024