By Jacquie McNish in Toronto and Paul Ziobro and David Benoit in New York

Hunter Harrison has spent several years trying to assemble a

transcontinental railroad empire. This week the 72-year-old

maverick set aside that pursuit but not his desire to run one of

America's biggest railroads.

Mr. Harrison abruptly left his job Wednesday as chief executive

of Canadian Pacific Railway Ltd., leaving behind $89 million in

compensation, to team up with activist investor Paul Hilal to shake

up management at U.S. rival CSX Corp., according to people familiar

with the matter.

Investors cheered the notion, sending shares of CSX up 23%

Thursday to an all-time high of $45.51, giving the company a market

value of nearly $41 billion. The stock has doubled over the past

year.

While he was running CP, Mr. Harrison twice tried to acquire CSX

and failed. He also launched a hostile bid for rival Norfolk

Southern Corp. that ended in defeat last year. Each time the

message was similar: Mr. Harrison has proved himself able to cut

costs and improve operations and is a better executive than your

current team.

Mr. Harrison and his backers are expected to use activist

tactics to press CSX to install him in a senior leadership role at

the Jacksonville, Fla., company, but they don't currently have

plans to push for another industry merger, the people said.

Thursday's stock-price jump reflects the loyal following Mr.

Harrison has earned from investors for his so-called precision

railroad management strategy, which combines aggressive

cost-cutting with tightly controlled train schedules.

The strategy was first honed at Illinois Central after Mr.

Harrison was hired by a private-equity firm in 1989 to revive a

railroad plagued with financial and operating problems. He applied

the same techniques to Canadian National Railway Co. and, later,

CP.

Mr. Harrison has such reverence for his operating strategy that

the Memphis-born son of a former traveling preacher organized

"Hunter Camps, " daylong brainstorming sessions at CN and CP to

spread the gospel with staff about running a more efficient

railway.

Unlike his takeover attempts, Mr. Harrison may find a more

receptive ear at CSX if his plan is to work at the company,

investors and analysts say. Such a move wouldn't raise the

antitrust concerns of a takeover. Plus, CSX has a chief executive

near retirement age.

CSX said its board of directors will "actively evaluate" the

views of Mr. Hilal's fund, Mantle Ridge LP, and looks forward to

discussing the company's strategy with shareholders. The railroad

also said its board and management team remain supportive of the

company's current strategy.

The campaign for CSX will closely resemble when Pershing Square

Capital Management LP , Mr. Hilal's former firm, ran a successful

proxy battle in 2012 to replace a majority of CP's directors and

install Mr. Harrison as the CEO.

Mr. Hilal, who was a partner at Pershing Square, helped steer

the CP proxy battle. The team will also include Mark Wallace, a

longtime lieutenant to Mr. Harrison and a CP executive who is

expected to resign from the railway, according to people familiar

with the matter.

Mr. Harrison will likely face questions about his health. He is

six years older than CSX's current chief executive, Michael Ward,

and had health issues in 2015. After a bout of pneumonia and other

complications, Mr. Harrison took sick leave for several weeks,

after which his doctors recommended he limit long-distance

traveling.

One person close to Mr. Harrison said his doctors have cleared

him to continue working. Travel will be more limited if he moves to

CSX as its Jacksonville headquarters is about 300 miles north of

the Harrison family horse farm near West Palm Beach, Fla.

Anthony Hatch, a New York-based railway consultant who has known

Mr. Harrison for years, said the executive doesn't "feel like going

out to pasture."

One institutional investor welcomed the notion of Mr. Harrison

as the next CSX leader. At Canadian Pacific, "he took the worst

performing railroad ... and turned it around in a relatively short

period of time," this investor said. But the investor acknowledged

that age was a concern, adding "you generally look for someone who

will be there for a decade."

Bringing in Mr. Harrison could help with the succession plan for

Mr. Ward, who took over as CEO in 2003 and has spent nearly four

decades with CSX. Mr. Ward's retirement was delayed two years ago

when the company lost its No. 2 executive, Oscar Munoz, to the top

job at United Continental Holdings Inc.

"CSX management may be more receptive than people think," wrote

Citi analyst Christian Wetherbee.

Word of Mr. Harrison's plan comes as the railroad industry sees

brighter days ahead, with moderating losses in coal revenue and

rising consumer and business confidence.

"There's reason to be optimistic that we'll really start seeing

some uptick in volume," Union Pacific Corp. CEO Lance Fritz said in

an interview.

CSX, which operates one of two major rail networks east of the

Mississippi, on Tuesday reported a slight dip in fourth-quarter

profit but projected higher profit for the coming year despite a

stronger U.S. dollar and low commodity prices.

One area where the company has room to improve is profitability.

CSX has for years aimed to reach an operating ratio -- a measure of

costs as a percentage of revenue -- in the mid-60s. In its last

fiscal year, its ratio was just under 70%.

--Joann S. Lublin and David George-Cosh contributed to this

article.

Write to Jacquie McNish at Jacquie.McNish@wsj.com, Paul Ziobro

at Paul.Ziobro@wsj.com and David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

January 19, 2017 19:22 ET (00:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

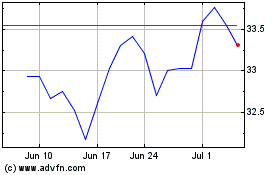

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024