Procter & Gamble Earnings: What to Watch

January 19 2017 - 12:29PM

Dow Jones News

By Sharon Terlep

Procter & Gamble Co., the world's largest maker of household

and personal-care products, is scheduled to release earnings for

the quarter ended Dec. 31 before the market opens Friday. Here's

what you need to know:

EARNINGS FORECAST: Analysts polled by Thomson Reuters expect

P&G to report $1.06 a share in "core" earnings, which excludes

items such as restructuring costs, compared with core earnings of

$1.04 a share a year earlier.

SALES FORECAST: Analysts expect net sales of $16.79 billion for

the quarter, a small drop from $16.92 billion a year earlier.

WHAT TO WATCH:

ORGANIC SALES: P&G has shown it is able to cut costs but has

yet to deliver on a promise to meaningfully increase revenue.

Investors will look for P&G to post improved organic-sales

growth, a measure that strips out currency moves, acquisitions and

divestments. Last quarter, the company posted an unexpected jump in

profit and its biggest increase in organic sales -- 3% -- in more

than a year. But the company said not to expect another dramatic

increase right away, and falling short of the cautious forecast

would likely deal a further blow to P&G's stock price, which is

down nearly 3% since the company's last earnings announcement.

BEAUTY BUSINESS: This will be P&G's first quarterly results

since the company unloaded the bulk of its beauty business to Coty

Inc. P&G's beauty brands, including CoverGirl makeup and

Clairol hair dye, were sucking resources while returning little in

the way of profit or growth for the company. The $11.4 billion deal

closed last fall, shrinking P&G by more than 10,000 employees

and 40 brands. Investors will get their first look at how P&G

fares without those ailing brands, and will gain insight into the

performance of the remaining beauty names, such as Olay facial

moisturizers and Pantene shampoo.

CURRENCY: Currency volatility hasn't let up, much to the

detriment of the world's big multinational corporations. P&G

and its rivals for many quarters have felt the effect of the strong

dollar on financial results. In a report earlier this month,

Bernstein analysts said 37 of the 40 currencies the firm regularly

tracks have weakened in value since Oct. 15. Wall Street will look

to what P&G has to say on overseas currency woes, particularly

since about two-thirds of the company's sales are outside the

U.S.

INDUSTRY HEALTH: P&G is the first of among its

consumer-products peers, which include Unilever NV,

Colgate-Palmolive Co. and Kimberly Clark Corp., to announce results

this earnings season. Wall Street will look for an indication of

how the overall industry is expected to fare in 2017 based on

P&G's take on consumer sentiment, pricing of products and other

economic factors. P&G is rarely the first of the major

consumer-products companies to report results but opted to release

its earnings figures a week earlier than usual for the most recent

quarter.

(END) Dow Jones Newswires

January 19, 2017 12:14 ET (17:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

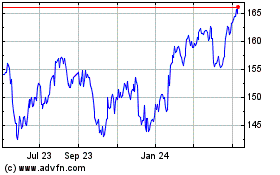

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

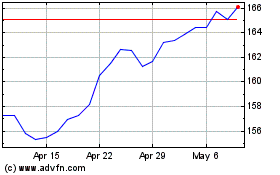

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024