CSX Investors Cheered by Former Rail Rival's Sudden Switch

January 19 2017 - 11:48AM

Dow Jones News

By Paul Ziobro

Railroad veteran Hunter Harrison tried twice to take over rival

CSX Corp. and failed. But investors cheered Thursday the idea of

letting him run CSX himself.

Mr. Harrison on Wednesday quit his post as CEO of Canadian

Pacific Railway Ltd. and walked away from an exit package worth $89

million so he would be free to join a rival. He is teaming up with

an activist investor to press CSX's board to hire him to a senior

leadership job, people familiar with the matter said.

Shares of CSX surged to all-time highs Thursday morning on the

news. The stock recently added $6.43, or 17%, to $43.31, giving CSX

a market value of nearly $40 billion.

Unlike his unsuccessful merger attempts, Mr. Harrison may find a

more receptive ear at CSX if his plan is to work at the company,

investors and analysts say. Such a move wouldn't raise the

antitrust concerns of a takeover. Plus, CSX has a chief executive

near retirement age. CSX has declined to comment.

One institutional investor said CSX shareholders would welcome

Mr. Harrison as its next chief executive given his track record. At

Canadian Pacific, "he took the worst performing railroad ... and

turned it around in a relatively short period of time," this

investor said.

One problem? Mr. Harrison is 72 years old, or seven years older

than CSX's current chief, Michael Ward. "You generally look for

someone who will be there for a decade," the CSX shareholder

said.

Bringing in Mr. Harrison would provide a succession plan for Mr.

Ward, who took over as CEO in 2003 and has spent nearly four

decades with CSX. Mr. Ward's retirement was delayed two years ago

when the company lost its No. 2 executive, Oscar Munoz, to the top

job at United Continental Holdings Inc.

Citi analyst Christian Wetherbee wrote in a research note

Thursday that the situation is a "win/win/win" for Mr. Harrison,

CSX management and shareholders. "CSX management may be more

receptive than people think," he wrote.

Mr. Harrison began his career more than 50 years ago squirting

oil under railcars. The blunt, demanding executive has attracted a

loyal investor following for his detailed attention to cost-cutting

and improved traffic times.

Word of Mr. Harrison's plan comes as the railroad industry sees

brighter days ahead. Railroad operators last year suffered

significant volume losses from fewer coal shipments, forcing

employee furloughs and other cost reductions.

But operators are optimistic about the year ahead, including the

potential for easing regulation and beneficial tax reform from

Washington, as well as prospects for an improving economy.

CSX, which operates one of two major rail networks east of the

Mississippi, on Tuesday reported a slight dip in fourth-quarter

profit but projected higher profit for the coming year despite a

stronger U.S. dollar and low commodity prices.

--Joann S. Lublin contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 19, 2017 11:33 ET (16:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

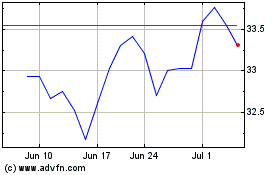

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024