Greenridge Global Issues Research Report with Buy Rating and $3 Price Target on Staffing 360 Solutions, Inc.

January 19 2017 - 8:00AM

Marketwired

Greenridge Global Issues Research Report with Buy Rating and $3

Price Target on Staffing 360 Solutions, Inc.

NEW YORK, NY-(Marketwired - January 19, 2017) - Staffing 360

Solutions, Inc. (NASDAQ: STAF), an international staffing services

provider, announced its fiscal second quarter numbers last week,

and after the company detailed double-digit growth in almost all

categories, Greenridge Global Equity Research updated its coverage

of the company. In its latest report, Greenridge Global maintained

its Buy rating for Staffing 360 Solutions and released a $3.00

price target.

The Greenridge Global report can be viewed at:

http://ow.ly/qUNR3088HQF

In Greenridge Global's recent coverage, analyst, William

Gregozeski, CFA, highlighted a number of key points, including the

latest revenue and gross profit figures, progress the Company has

made with its balance sheet and recent refinancing of over $2

million in debt.

"Staffing 360 Solutions posted another quarter of improving

operational results," stated William Gregozeski in his latest

research report on STAF. "With the terms of the amended debt and

the ongoing Series E offering, it looks like the Company should

have more capital and flexibility to make acquisitions and generate

more cash to pay down existing debt. With continued positive

developments we are reiterating our Buy rating and $3.00 target

price on Staffing 360 Solutions. Our target price is based on an

EV/aEBITDA multiple of roughly 6.0 times our forward twelve month

aEBITDA estimate of $6.3 million."

Greenridge Global's research report reflects Staffing 360's

various improvements in its most recent quarterly financials. A

summary of Staffing 360's financial results is presented below:

Summary of the Fiscal Second Quarter Ended November 30, 2016

- Revenue increased 14.0% to $47.1 million, compared to $41.4

million in the fiscal quarter ended November 30, 2015;

- Gross profit increased 8.4% to $8.1 million, compared to $7.5

million in the fiscal quarter ended November 30, 2015;

- Net loss attributable to common stock decreased 57.0% to $1.5

million*, compared to $3.4 million* in the fiscal quarter ended

November 30, 2015;

- Adjusted EBITDA increased 10.1% to $1.4 million*, compared to

Adjusted EBITDA of $1.3 million* in the fiscal quarter ended

November 30, 2015.

Read the latest Greenridge Global Report here:

http://ow.ly/qUNR3088HQF

To be added to Greenridge Global's distribution list, please

contact: research@greenridgeglobal.com

About Greenridge Global

Greenridge Global is a Chicago, Illinois-based equity research

firm that focuses on uncovering small cap companies with a deep

value base and outsized growth potential. Greenridge Global covers

companies listed in various exchanges around the world and provides

proprietary investment ideas, consulting services, due diligence

reports and company presentations. Greenridge does not, and will

not, engage in paid-for research. The firm distributes its research

directly to investors; through all major distribution channels,

including Bloomberg, Capital IQ, FactSet, Morningstar, Thomson

Reuters and Zack's; and through select third party research

distribution arrangements. To learn more, please visit:

www.greenridgeglobal.com

About Stock Market Media Group

Stock Market Media Group is a Content Development IR firm

offering a platform for corporate stories to unfold in the media

with research reports, corporate videos, CEO interviews and feature

news articles.

Stock Market Media Group may from time to time include our own

opinions about the companies, their business, markets and

opportunities in our articles. Any opinions we may offer about any

of the companies we write about are solely our own, and are made in

reliance upon our rights under the First Amendment to the U.S.

Constitution, and are provided solely for the general opinionated

discussion of our readers. Our opinions should not be considered to

be complete, precise, accurate, or current investment advice, or

construed or interpreted as research. Any investment decisions you

may make concerning any of the securities we write about are solely

your responsibility based on your own due diligence. Our

publications are provided only as an informational aid, and as a

starting point for doing additional independent research. We

encourage you to invest carefully and read the investor information

available at the web site of the U.S. Securities and Exchange

Commission at: www.sec.gov, where you can also find all the

company's filings and disclosures. We also recommend, as a general

rule, that before investing in any securities you consult with a

professional financial planner or advisor, and you should conduct a

complete and independent investigation before investing in any

security after prudent consideration of all pertinent risks.

We are not a registered broker, dealer, analyst, or adviser. We

hold no investment licenses and may not sell, offer to sell or

offer to buy any security. Our publications about any of the

companies we write about are not a recommendation to buy or sell a

security.

SEC RULE 17b

COMPENSATION DISCLOSURE

Section 17(b) of the 1933 Securities and Exchange Act requires

publishers who distribute information about publicly traded

securities for compensation, to disclose who paid them, the amount,

and the type of payment. In order to be in full compliance with the

Securities Act of 1933, Section 17(b), Stock Market Media Group is

disclosing that it was compensated $850 for content development

related to this news regarding Staffing 360 Solutions, Inc. and

Greenridge Global by a third party via a bank wire.

For more information: www.stockmarketmediagroup.com.

CONTACT INFORMATION

Contact: Stock Market Media Group

info@stockmarketmediagroup.com

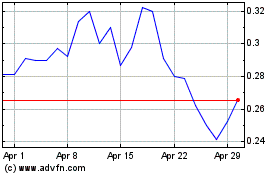

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024