BNY Mellon Assets Fall, Hurt by Outflows and Strong Dollar

January 19 2017 - 8:09AM

Dow Jones News

By Austen Hufford

Bank of New York Mellon Corp. said outflows and exchange rates

pushed down assets under management during its latest quarter on a

sequential basis, even as higher interest rates helped bolster

year-over-year profit.

As a custody bank, BNY Mellon derives much of its business from

serving trillions in assets for money managers and other clients,

in addition to managing clients' investments.

The bank saw assets under management fall during the period due

to outflows, unfavorable exchange rates and market performance.

Assets under management stood at $1.65 trillion at the end of the

quarter compared with $1.72 trillion at the end of the prior

quarter, but up from $1.63 trillion last year.

The stronger U.S. dollar, primarily compared with the British

pound, hurt results.

The company reported $11 billion in net long-term outflows

during the quarter, primarily from actively managed strategies.

Expenses fell 2.3% as the stronger U.S. dollar also helped

decrease staff and severance expenses.

Fee revenue, which makes up nearly 80% of the bank's total

revenue, grew 0.1% from a year prior as investment services fees

increased on higher money market fees. Investment management and

performance fees decreased due to the stronger dollar and lower

performance fees.

Net interest revenue grew 8.9% on the increase in interest rates

and interest-rate hedging.

In December the Federal Reserve approved its second rate

increase in a decade and signaled that interest rates would rise at

a faster pace than previously projected.

The bank's net interest margin, a key measure of lending

profitability, grew to 1.17% from 1.06% in the third quarter and

0.99% in the prior year.

For the quarter, BNY Mellon reported a profit of $870 million,

up from $693 million a year prior. Per-share earnings rose to 77

cents from 57 cents.

Total revenue increased 1.7% to $3.79 billion. Analysts polled

by Thomson Reuters predicted 77 cents in adjusted earnings per

share on $3.85 billion in revenue.

Late last year, the bank was unable to process client payment

instructions sent over the Swift network for several hours in a

rare outage that caused some payments to fail.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 19, 2017 07:54 ET (12:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

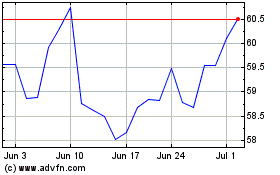

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024