- Fourth quarter 2016 Revenue:

$1.72 billion; up 6%

- Fourth quarter 2016 Operating

Income: $194.4 million; up 1%

- Fourth quarter 2016 EPS:

$1.05 vs. $1.01; up 4%

- Full Year 2016 Revenue: $6.6

billion; up 6%

- Full Year 2016 Operating Income:

$721 million; up 1%

- Full Year 2016 EPS: $3.81 vs.

$3.66; up 4%

J.B. Hunt Transport Services, Inc., (NASDAQ:JBHT) announced

fourth quarter 2016 net earnings of $117.6 million, or diluted

earnings per share of $1.05 vs. fourth quarter 2015 net earnings of

$116.7 million, or $1.01 per diluted share. Fourth quarter 2016 net

earnings included a one-time after tax benefit of $9.5 million or

$0.08 per diluted share for a change in the company’s paid time off

policy.

Total operating revenue for the current quarter was $1.72

billion, compared with $1.62 billion for the fourth quarter 2015.

Load growth of 5% in Intermodal (JBI) was the primary reason for a

3% increase in segment revenue. Dedicated Contract Services (DCS)

segment revenue increased by 8%, primarily from the addition of new

customer accounts, rate increases implemented in the current and

earlier periods and improved asset utilization. Integrated Capacity

Solutions (ICS) segment revenue increased by 22% primarily from a

38% increase in load growth. Truck (JBT) segment revenue decreased

3% primarily from customer rate per mile decreases. Current quarter

total operating revenue, excluding fuel surcharges, increased 6%

vs. the comparable quarter 2015.

Operating income for the current quarter increased to $194.4

million vs. $192.9 million for the fourth quarter 2015. The

increase primarily reflects higher revenue in JBI, DCS and ICS

business segments and a $15.2 million pre-tax, one-time benefit

recorded to reflect a change in employee paid time off policy. The

one-time benefit was partially offset with corporate charges

totaling approximately $5 million pre-tax that included charitable

contributions, employment tax audit settlements and increases to

reserves for uncollectable accounts. Continuing operational cost

increases in rail purchased transportation, wages paid to drivers,

driver and independent contractor recruiting, equipment ownership,

increased technology spending and lower gross profit margins in the

brokerage business also offset the benefits from increases in

revenue and the change in paid time off policy.

Net earnings increased to $117.6 million in the current quarter

from $116.7 million in 2015, due to the increased revenue, the paid

time off policy change benefit and a lower effective income tax

rate. The fourth quarter effective tax rates for 2016 and 2015 were

37.63% and 38.10%, respectively. The annual effective tax rates for

2016 and 2015 were 37.89% and 38.10%, respectively.

Segment Information:

Intermodal (JBI)

- Fourth quarter 2016 Segment

Revenue: $998 million; up 3%

- Fourth quarter 2016 Operating

Income: $124 million; down 3%

JBI total volumes grew 5% over the same period in 2015. Eastern

network loads were flat and transcontinental loads increased 9%

compared to the fourth quarter 2015. Revenue increased 3%,

reflecting volume growth of 5% and a 2% decrease in revenue per

load which is the combination of freight mix, customer rate

increases and fuel surcharges. Revenue per load excluding fuel

surcharges decreased approximately 2% compared to a year ago.

Operating income decreased 3% from the prior year. Benefits from

increased revenue, improved utilization and approximately $5.7

million from the change in paid time off policy were more than

offset with increases in rail purchased transportation costs,

insurance and claims costs, equipment ownership costs and driver

recruiting and retention costs. The current period ended with

approximately 84,600 units of trailing capacity and approximately

5,280 power units in the dray fleet.

Dedicated Contract Services (DCS)

- Fourth quarter 2016 Segment Revenue:

$398 million; up 8%

- Fourth quarter 2016 Operating

Income: $57.5 million; up 37%

DCS revenue increased 8% during the current quarter over the

same period 2015. Productivity (revenue per truck per week)

increased approximately 5% vs. 2015. Productivity excluding fuel

surcharge revenue increased approximately 3% from a year ago

primarily from improved integration of assets between customer

accounts, fewer unseated trucks, increased customer supply chain

fluidity and customer rate increases. A year over year net

additional 193 revenue producing trucks, 29 net additions compared

to third quarter 2016, were in the fleet by the end of the quarter.

Approximately 82% of these additions represent private fleet

conversions versus traditional dedicated capacity fleets and

primarily reflect new contract implementations in this and prior

periods. Customer retention rates remain above 98%.

Operating income increased by 37% from a year ago. The increase

in revenue, improved asset utilization and approximately $7.3

million from the change in paid time off policy were partially

offset with higher driver wages, higher driver recruiting costs and

higher equipment ownership costs compared to the same period in

2015.

Integrated Capacity Solutions (ICS)

- Fourth Quarter 2016 Segment

Revenue: $232 million; up 22%

- Fourth Quarter 2016 Operating

Income: $6.1 million; down 52%

ICS revenue increased 22% in the current quarter vs. the fourth

quarter 2015 mostly due to a 38% increase in volume offset by a 12%

decrease in revenue per load and freight mix changes driven by

customer demand. Contractual volumes represent approximately 75% of

the total load volume and 62% of the total revenue in the current

quarter compared to 73% and 62%, respectively, in fourth quarter

2015.

Operating income decreased 52% over the same period in 2015

primarily due to a lower gross profit margin, increased claim

costs, higher technology costs and increased personnel costs

partially offset with approximately $1.0 million from the change in

paid time off policy. Gross profit margin decreased to 12.9% in the

current period from 16.0% last year primarily from new customer

rates implemented during the quarter and lower spot rates compared

to the fourth quarter 2015. Total branches at the end of the period

grew to 42 from 34 at the end of the same period in 2015. ICS’s

carrier base increased 11% and the employee count increased 23%

from a year ago.

Truck (JBT)

- Fourth quarter 2016 Segment Revenue:

$ 96 million; down 3%

- Fourth quarter 2016 Operating

Income: $ 6.8 million; down 35%

JBT revenue for the current quarter decreased 3% from the same

period in 2015. Revenue excluding fuel surcharges also decreased 3%

primarily from a 3% decrease in rate per mile due to core customer

rate decreases of approximately 1.4% and freight mix changes

compared to fourth quarter 2015. At the end of the period, JBT

operated 2,128 tractors compared to 2,149 a year ago.

Operating income decreased 35% from fourth quarter 2015 levels.

Favorable changes from increased load count, fewer empty miles and

approximately $1.2 million from the change in paid time off policy

were more than offset by lower customer rates per mile, increased

equipment maintenance costs and higher safety and insurance costs

compared to fourth quarter 2015.

Cash Flow and Capitalization:

At December 31, 2016, we had total debt outstanding of $986

million on various debt instruments compared to $998 million at

December 31, 2015 and $944 million at September 30, 2016.

Our net capital expenditures for 2016 approximated $485 million

vs. $556 million in 2015. At December 31, 2016, we had cash and

cash equivalents of $6.4 million.

In the fourth quarter 2016, we purchased 880,000 shares of our

common stock for approximately $75 million. At December 31, 2016,

we had approximately $201 million remaining under our share

repurchase authorization. Actual shares outstanding at December 31,

2016 approximated 111.3 million.

This press release may contain forward-looking statements, which

are based on information currently available. Actual results may

differ materially from those currently anticipated due to a number

of factors, including, but not limited to, those discussed in Item

1A of our Annual Report filed on Form 10-K for the year ended

December 31, 2015. We assume no obligation to update any

forward-looking statement to the extent we become aware that it

will not be achieved for any reason. This press release and

additional information will be available immediately to interested

parties on our web site, www.jbhunt.com.

J.B. HUNT TRANSPORT SERVICES, INC. Condensed

Consolidated Statements of Earnings (in thousands, except per

share data) (unaudited)

Three Months Ended December 31 2016

2015 % Of % Of Amount

Revenue Amount Revenue

Operating revenues, excluding fuel surcharge revenues $ 1,558,638 $

1,472,291 Fuel surcharge revenues 162,424 148,724

Total operating revenues 1,721,062 100.0 % 1,621,015 100.0 %

Operating expenses Rents and purchased transportation 874,144 50.8

% 799,903 49.3 % Salaries, wages and employee benefits 360,190 20.9

% 363,801 22.4 % Fuel and fuel taxes 78,355 4.6 % 69,575 4.3 %

Depreciation and amortization 91,794 5.3 % 88,374 5.5 % Operating

supplies and expenses 60,001 3.5 % 56,100 3.5 % Insurance and

claims 20,026 1.2 % 17,975 1.1 % General and administrative

expenses, net of asset dispositions 25,483 1.4 % 16,051 1.0 %

Operating taxes and licenses 11,798 0.7 % 11,579 0.7 %

Communication and utilities 4,910 0.3 % 4,764 0.3 %

Total operating expenses 1,526,701 88.7 % 1,428,122

88.1 % Operating income 194,361 11.3 % 192,893 11.9 % Net interest

expense 5,876 0.3 % 4,290 0.3 % Earnings before

income taxes 188,485 11.0 % 188,603 11.6 % Income taxes

70,929 4.2 % 71,857 4.4 % Net earnings $ 117,556 6.8 % $

116,746 7.2 % Average diluted shares outstanding 112,327

115,048 Diluted earnings per share $ 1.05 $ 1.01

J.B. HUNT TRANSPORT SERVICES, INC. Condensed

Consolidated Statements of Earnings (in thousands, except per

share data) (unaudited)

Twelve Months Ended December

31 2016 2015 % Of % Of

Amount Revenue Amount

Revenue Operating revenues, excluding fuel

surcharge revenues $ 6,007,347 $ 5,516,282 Fuel surcharge revenues

548,112 671,364 Total operating revenues 6,555,459

100.0 % 6,187,646 100.0 % Operating expenses Rents and

purchased transportation 3,255,692 49.7 % 2,994,586 48.4 %

Salaries, wages and employee benefits 1,469,187 22.4 % 1,394,239

22.5 % Fuel and fuel taxes 283,437 4.3 % 313,034 5.1 % Depreciation

and amortization 361,510 5.5 % 339,613 5.5 % Operating supplies and

expenses 233,223 3.6 % 220,597 3.6 % Insurance and claims 78,410

1.2 % 73,689 1.2 % General and administrative expenses, net of

asset dispositions 87,053 1.3 % 72,522 1.1 % Operating taxes and

licenses 45,954 0.7 % 43,084 0.7 % Communication and utilities

19,973 0.3 % 20,588 0.3 % Total operating expenses

5,834,439 89.0 % 5,471,952 88.4 % Operating income

721,020 11.0 % 715,694 11.6 % Net interest expense 25,223

0.4 % 25,491 0.4 % Earnings before income taxes 695,797 10.6

% 690,203 11.2 % Income taxes 263,707 4.0 % 262,968

4.3 % Net earnings $ 432,090 6.6 % $ 427,235 6.9 % Average diluted

shares outstanding 113,361 116,728 Diluted earnings

per share $ 3.81 $ 3.66

Financial Information By Segment (in

thousands) (unaudited)

Three Months Ended December 31 2016

2015 % Of % Of Amount

Total Amount Total

Revenue

Intermodal $ 997,967 58 % $ 967,133 59 % Dedicated 398,325

23 % 368,992 23 % Integrated Capacity Solutions 231,594 13 %

189,540 12 % Truck 96,296 6 % 99,292 6

% Subtotal 1,724,182 100 % 1,624,957 100 % Intersegment

eliminations (3,120 ) (0 %) (3,942 ) (0 %)

Consolidated revenue

$ 1,721,062 100 % $ 1,621,015 100 %

Operating

income

Intermodal $ 124,143 64 % $ 127,730 66 % Dedicated 57,539 30

% 42,000 22 % Integrated Capacity Solutions 6,074 3 % 12,754 7 %

Truck 6,750 3 % 10,416 5 % Other (1) (145 ) (0 %) (7

) (0 %) Operating income $ 194,361 100 % $ 192,893

100 %

Twelve Months Ended December 31

2016 2015 % Of % Of Amount

Total Amount Total

Revenue

Intermodal $ 3,796,251 58 % $ 3,664,670 59 % Dedicated

1,533,186 23 % 1,451,256 24 % Integrated Capacity Solutions 851,550

13 % 699,525 11 % Truck 387,764 6 % 385,510

6 % Subtotal 6,568,751 100 % 6,200,961 100 % Intersegment

eliminations (13,292 ) (0 %) (13,315 ) (0 %)

Consolidated revenue $ 6,555,459 100 % $ 6,187,646

100 %

Operating

income

Intermodal $ 449,768 62 % $ 476,685 67 % Dedicated 205,240

29 % 163,511 23 % Integrated Capacity Solutions 36,260 5 % 35,729 5

% Truck 29,862 4 % 39,864 5 % Other (1) (110 ) (0 %)

(95 ) (0 %) Operating income $ 721,020 100 % $ 715,694

100 % (1) Includes corporate support activity

Operating Statistics by Segment (unaudited)

Three Months Ended December 31

2016 2015

Intermodal

Loads 491,570 467,461 Average length of haul 1,685 1,664

Revenue per load $ 2,030 $ 2,069 Average tractors during the period

* 5,274 5,088 Tractors (end of period) Company-owned 4,581

4,276 Independent contractor 695 805

Total tractors 5,276 5,081 Net change in trailing equipment

during the period 1,773 1,020 Trailing equipment (end of period)

84,594 78,957 Average effective trailing equipment usage 81,654

76,305

Dedicated

Loads 606,900 578,692 Average length of haul 181 175 Revenue

per truck per week** $ 4,247 $ 4,048 Average trucks during the

period*** 7,390 7,177 Trucks (end of period) Company-owned

6,976 6,762 Independent contractor 15 10 Customer-owned (Dedicated

operated) 410 436 Total trucks 7,401

7,208 Trailing equipment (end of period) 22,688 21,672

Average effective trailing equipment usage 23,334 22,594

Integrated

Capacity Solutions

Loads 237,845 171,887 Revenue per load $ 974 $ 1,103 Gross

profit margin 12.9 % 16.0 % Employee count (end of period) 824 670

Approximate number of third-party carriers (end of period) 50,900

45,700

Truck

Loads 96,906 95,190 Average length of haul 439 454 Loaded

miles (000) 42,476 42,749 Total miles (000) 50,472 51,437 Average

nonpaid empty miles per load 82.6 91.3 Revenue per tractor per

week** $ 3,540 $ 3,663 Average tractors during the period * 2,158

2,157 Tractors (end of period) Company-owned 1,376 1,462

Independent contractor 752 687 Total

tractors 2,128 2,149 Trailers (end of period) 7,642 7,604

Average effective trailing equipment usage 7,287 6,814 *

Includes company-owned and independent contractor tractors ** Using

weighted workdays *** Includes company-owned, independent

contractor, and customer-owned trucks

Operating Statistics by Segment (unaudited)

Twelve Months Ended December 31 2016

2015

Intermodal

Loads 1,916,303 1,772,808 Average length of haul 1,657 1,652

Revenue per load $ 1,981 $ 2,067 Average tractors during the period

* 5,222 4,949 Tractors (end of period) Company-owned 4,581

4,276 Independent contractor 695 805

Total tractors 5,276 5,081 Net change in trailing equipment

during the period 5,637 5,659 Trailing equipment (end of period)

84,594 78,957 Average effective trailing equipment usage 77,179

72,622

Dedicated

Loads 2,401,332 2,250,099 Average length of haul 177 175

Revenue per truck per week** $ 4,077 $ 4,028 Average trucks during

the period*** 7,307 7,012 Trucks (end of period)

Company-owned 6,976 6,762 Independent contractor 15 10

Customer-owned (Dedicated operated) 410 436

Total trucks 7,401 7,208 Trailing equipment (end of

period) 22,688 21,672 Average effective trailing equipment usage

22,827 22,391

Integrated

Capacity Solutions

Loads 852,179 542,947 Revenue per load $ 999 $ 1,288 Gross

profit margin 14.3 % 15.3 % Employee count (end of period) 824 670

Approximate number of third-party carriers (end of period) 50,900

45,700

Truck

Loads 385,298 366,297 Average length of haul 455 448 Loaded

miles (000) 175,038 163,115 Total miles (000) 207,998 193,856

Average nonpaid empty miles per load 85.6 83.9 Revenue per tractor

per week** $ 3,458 $ 3,698 Average tractors during the period*

2,191 2,051 Tractors (end of period) Company-owned 1,376

1,462 Independent contractor 752 687

Total tractors 2,128 2,149 Trailers (end of period) 7,642

7,604 Average effective trailing equipment usage 6,956 6,460

* Includes company-owned and independent contractor tractors **

Using weighted workdays *** Includes company-owned, independent

contractor, and customer-owned trucks

J.B. HUNT TRANSPORT SERVICES, INC. Condensed

Consolidated Balance Sheets (in thousands) (unaudited)

December 31, 2016

December 31, 2015 ASSETS Current assets: Cash and

cash equivalents $ 6,377 $ 5,566 Accounts Receivable 797,473

654,542 Prepaid expenses and other 141,831

197,817 Total current assets

945,681 857,925 Property and equipment

4,258,915 4,019,451 Less accumulated depreciation

1,440,124 1,318,122 Net property and

equipment 2,818,791

2,701,329 Other assets 64,516

70,290 $ 3,828,988 $

3,629,544

LIABILITIES & STOCKHOLDERS’

EQUITY

Current liabilities: Trade accounts payable $ 384,308 $ 340,332

Claims accruals 109,745 104,220 Accrued payroll 51,929 59,420 Other

accrued expenses 27,152

28,445 Total current liabilities 573,134

532,417 Long-term debt 986,278 998,003

Other long-term liabilities 64,881 58,552 Deferred income taxes

790,634 740,220

Stockholders’ equity

1,414,061 1,300,352

$ 3,828,988 $ 3,629,544

Supplemental Data (unaudited)

December

31, 2016 December 31, 2015 Actual

shares outstanding at end of period (000)

111,305 113,948 Book value per actual

share outstanding at end of period $ 12.70

$ 11.41

Twelve Months Ended December 31 2016

2015 Net cash provided by operating activities (000)

$ 854,143 $ 873,308 Net capital

expenditures (000) $ 485,256 $ 556,436

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170119005150/en/

J.B. Hunt Transport Services, Inc.David G. Mee,

479-820-8363Executive Vice President, Finance/Administration and

Chief Financial Officer

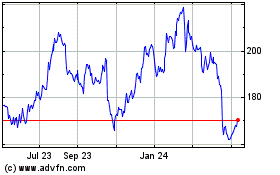

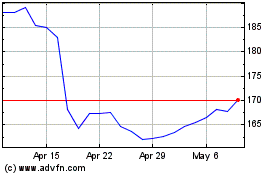

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Apr 2023 to Apr 2024