Oil-Patch Deal Pays Off Big -- WSJ

January 19 2017 - 3:02AM

Dow Jones News

Investment firm made more than $1 billion in under a year by

aiding Clayton Williams

By Ryan Dezember

Last year, during the depths of the oil-price slump, Los Angeles

investment firm Ares Management LP threw a lifeline to a struggling

Texas crude producer.

Now that Noble Energy Inc. has agreed to pay $2.7 billion for

that company, Clayton Williams Energy Inc., Ares is in line to

triple its money and reap more than $1 billion in profit.

Ares's huge gain is the sort of prize private-equity investors

envisioned when oil prices collapsed in late 2014 and pressured the

U.S. shale drillers that had been financed with $100-a-barrel oil

in mind.

But opportunities have been rare to buy into companies strong

enough to survive but too strained to tap other financing sources,

such as the stock market, that are cheaper and have fewer strings

attached than what firms such as Ares usually offer.

Clayton Williams, named for its octogenarian chairman and chief

executive, was an alluring target. The Midland, Texas, company held

a swath of land in what has emerged as the hottest drilling area in

the U.S. but not much money to develop it, and Clayton Williams was

in danger of tripping debt-to-earnings limits set by its

creditors.

Last March, about a month after oil prices slid to about $26 a

barrel, Ares lent Clayton Williams $350 million, charging 12.5%

with an option to defer interest payments and add more debt for two

years. Ares, which got a pair of board seats in the deal, also

bought warrants to buy more than two million shares.

The cash allowed Clayton Williams to pay down its bank debt and

renegotiate credit agreements to give it breathing room. The timing

was fortuitous, as oil's February low turned out to be the bottom,

and oil prices rose to roughly $50 a barrel, where they have

hovered in recent months. Ares padded its bet by snapping up

another million shares on the open market as the stock languished

at its lowest levels in more than a decade.

In late July, Ares agreed to buy about five million shares from

Clayton Williams for $150 million, gaining another board seat. The

company used the cash to keep drilling in the Delaware Basin, a

part of West Texas' Permian Basin, where prolific wells sparked a

land grab among oil producers and big Wall Street firms.

The firm's enthusiasm for Clayton Williams wasn't shared by many

investors. In mid-July, more than half of the company's publicly

traded shares were held short, in bets that the stock would lose

value, according to SunTrust Robinson Humphrey. Sentiment would

soon shift, however.

The week before Clayton Williams and Ares agreed to the big

stock sale, a blank-check company run by former EOG Resources Inc.

CEO Mark Papa agreed to buy Centennial Resource Development Inc., a

closely held company, in a deal that valued its 42,500 Delaware

Basin acres at about $1.74 billion.

Clayton Williams's 65,000 acres were basically next door. The

move by Mr. Papa, a major figure in the shale business who built

EOG into the largest oil producer in the lower 48 states,

"certainly gave people much more faith in that acreage," says

SunTrust analyst Neal Dingmann.

Clayton Williams's stock rose sharply as oil prices moved higher

and Delaware Basin properties started fetching record highs. By

Monday, when Noble said it would buy the company with a combination

of cash and stock, Clayton Williams's shares had risen to more than

three times the price Ares paid for most of its stake. Noble agreed

to pay a large premium, and a 7.1% pop in its own shares on Tuesday

boosted the return for Ares, which is also due a big prepayment

penalty on the loan.

In all, the roughly $516.6 million Ares invested in Clayton

Williams is currently worth more than $1.7 billion under terms of

the Noble deal, according to securities filings and people familiar

with the matter. About half of that will be paid in cash, while the

rest is represented by what will be a roughly 5% stake in

Houston-based Noble, one of the largest U.S. exploration and

production companies.

"That's what happens in the oil business," Mr. Dingmann said.

"Had the Delaware acreage been a county or two counties over, they

might have gotten half to a quarter of that."

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

January 19, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

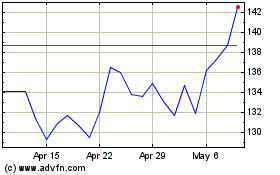

Ares Management (NYSE:ARES)

Historical Stock Chart

From Mar 2024 to Apr 2024

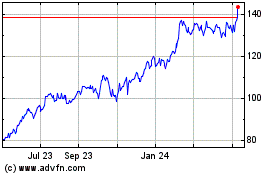

Ares Management (NYSE:ARES)

Historical Stock Chart

From Apr 2023 to Apr 2024