Current Report Filing (8-k)

January 17 2017 - 8:01AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

8-K

Current Report Pursuant to Section 13 or

15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January

13, 2017

MEDICINE MAN TECHNOLOGIES, INC.

(Exact name of small business issuer as

specified in its charter)

|

Nevada

|

000-55450

|

46-5289499

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer ID No.)

|

4880 Havana Street

Suite 102 South

Denver, Colorado 80239

(Address of principal executive offices)

(303) 371-0387

(Issuer’s Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On or about July 29, 2016 we filed a Form

8-K advising that on July 26, 2016, we executed a non-binding Term Sheet whereby we had reached an agreement to acquire Capital

G Ltd, an Ohio limited liability company and its three wholly owned subsidiary companies, Funk Sac LLC, Commodogy LLC, and OdorNo

LLC, in consideration for the issuance of an aggregate of 1.3 million shares of our Common Stock. Effective January 13, 2017, Medicine

Man Technologies and Capital G mutually agreed not to proceed with this transaction. Our respective managements have decided that it would be in the best interests of both

companies not to continue to move forward with this planned acquisition. We are currently in discussions with management of Capital

G as to the convertible promissory note we hold in Capital G and are optimistic that mutually agreeable arrangements for satisfaction

of that note will be reached. It is possible both parties may attempt to explore this potential acquisition opportunity again in

the future.

Our other pending acquisition of Pono Publications

Ltd. and Success Nutrients, Inc. is in the final stages of due diligence and while no assurances can be provided, we remain optimistic

that we will successfully close these transactions during the initial calendar quarter of 2017. It should also be noted that we

entered into an ‘Interim Agreement’ with both companies on or about October 20, 2016, as disclosed in an 8K filing

on that date that provided for the interaction between the companies pending closing of the acquisition, including various renewals

that were not dependent upon the successful completion of this acquisition but substantially benefit all parties.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MEDICINE MAN TECHNOLOGIES, INC.

|

|

|

(Registrant)

|

|

|

|

|

Dated: January 17, 2017

|

By:

|

/s/ Brett Roper

|

|

|

|

Brett Roper,

Chief Operating Officer

|

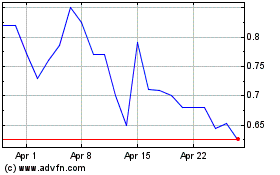

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Apr 2023 to Apr 2024