Ahead of the Tape: Insurer Is Set to Pass Its Exam -- WSJ

January 17 2017 - 3:03AM

Dow Jones News

By Charley Grant

At a moment of uncertainty for health insurers, there appear to

be few risks to UnitedHealth Group Inc.'s strong long-term

performance.

The country's largest publicly traded health insurer by market

value will report fourth-quarter results on Tuesday. Analyst

consensus calls for sales of $47.4 billion and adjusted earnings

per share of $2.07, according to FactSet. There shouldn't be too

much drama in the headline numbers. UnitedHealth has lagged behind

the earnings consensus just one time since the fourth quarter of

2011.

What UnitedHealth will say about its business prospects, and

those of the industry, is far less certain. The report will come

less than a week after the Senate took the first step toward a

repeal of the Affordable Care Act. It is anyone's guess at this

point just what would replace President Barack Obama's signature

law should it eventually be scrapped.

Meanwhile, the industry is waiting to see whether two planned

megamergers will close. The Justice Department has sued to block

Aetna Inc.'s planned tie-up with Humana Inc., as well as Anthem

Inc.'s proposed deal with Cigna Corp.

The good news for UnitedHealth investors is those issues

shouldn't have much of a direct impact on the company's financial

performance.

At last count, more than two-thirds of UnitedHealth's members

came from employer groups, rather than through government programs

such as Medicare and Medicaid. UnitedHealth has the smallest public

exchange business of any major publicly traded insurer and has been

scaling back its presence in that market since 2015. Meanwhile, the

company hasn't eschewed acquisitions altogether; it recently

announced a $2.3 billion purchase of Surgical Care Affiliates Inc.,

an outpatient surgery center company.

But that proposed transaction won't trigger the antitrust

concerns or thorny integration issues that its rivals face.

Perhaps the biggest investment risk is the stock's long run of

success. Its shares have more than tripled over the past five years

and now trade at 17 times forward earnings. That is close to a

10-year high.

UnitedHealth's lofty valuation eventually could pose a problem

for shareholders if years of robust business growth begins to

stall. But that risk is, for now, a hypothetical one. Sales rose

more than 11% in the third quarter from a year earlier.

Given that backdrop, the prospect of Tuesday's checkup shouldn't

raise investors' blood pressure.

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

January 17, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

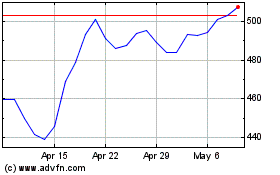

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024