UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

Catalyst

Biosciences, Inc.

(Name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which the transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of the transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Catalyst Biosciences, Inc.

260 Littlefield Ave.

South San

Francisco, California 94080

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON February 2, 2017

To the Stockholders of Catalyst Biosciences, Inc.:

You are cordially invited to attend a Special Meeting of the Stockholders (the “Special Meeting”) of Catalyst Biosciences, Inc. (the

“Company”) that will be held at the Company’s offices located at 260 Littlefield Ave, South San Francisco, California 94080, on February 2, 2017, at 9:00 a.m. Pacific Time for the following purposes:

|

|

1.

|

To authorize the board of directors of the Company, in its discretion at any time prior to June 30, 2017, to file an amendment to our Fourth Amended and Restated Certificate of Incorporation, as amended (the

“Certificate of Incorporation”), to effect a reverse stock split of our outstanding common stock at a ratio of at least

one-for-five

and up to

one-for-fifteen.

|

|

|

2.

|

To transact any other business that may properly come before the Special Meeting or any adjournments or postponements thereof.

|

At the Special Meeting, our stockholders will be afforded the opportunity to discuss Company affairs with members of our management. Only

stockholders of record of the Company’s common stock as of the close of business on January 6, 2017 are entitled to receive notice of and to vote at the special meeting of stockholders and any adjournments or postponements thereof.

On behalf of the board of directors, we thank you for your continued support and interest in the Company.

By order of the board of directors,

Nassim Usman, Ph.D.

President and Chief Executive Officer

South San Francisco, California

January 12, 2017

*IMPORTANT*

Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of

a quorum at the Special Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so,

as your proxy is revocable at your option. YOUR VOTE IS IMPORTANT SO PLEASE ACT TODAY!

TABLE OF CONTENTS

(i)

Catalyst Biosciences, Inc.

260 Littlefield Ave.

South San Francisco, California 94080

PROXY

STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS TO

BE HELD ON February 2, 2017

The board of

directors of Catalyst Biosciences, Inc. (the “Board”) is soliciting your proxy to vote at the Special Meeting of Stockholders (the “Special Meeting”) to be held at our offices, located at 260 Littlefield Ave., South San

Francisco, California 94080, on February 2, 2017, at 9:00 a.m. Pacific Time, including at any adjournments or postponements of the Special Meeting. You are invited to attend the Special Meeting to vote on the proposals described in this proxy

statement. We made copies of this proxy statement available to stockholders beginning on or about January

12, 2017.

QUESTIONS AND ANSWERS

Why have I received these materials?

The Board is soliciting proxies for use at the Special Meeting to be held on February 2, 2017 at

9:00 a.m. Pacific Time to authorize the Board, in its discretion at any time prior to June 30, 2017, to file an amendment to our Fourth Amended and Restated Certificate of Incorporation, as amended (the “Certificate of

Incorporation”), to effect a reverse stock split of our outstanding common stock at a ratio of at least

one-for-five

and up to

one-for-fifteen

and to transact any other business that may properly come before the meeting.

Why is the

Company seeking to effect a reverse stock split of the outstanding common stock?

The Company believes that the decrease in the number of shares of our outstanding common stock as a consequence of the Reverse Stock Split, and the

anticipated increase in the price per share resulting from the Reverse Stock Split, will (i) facilitate our ability to continue to satisfy the requirements for listing on The Nasdaq Capital Market (“Nasdaq”), and (ii) encourage

greater interest in our common stock by the financial community and the investing public which will in turn facilitate future financing transactions of the Company, and help us attract and retain employees and other service providers. See

“Proposal One – To authorize the Board, in its discretion, to file an amendment to the Certificate of Incorporation, to effect a reverse stock split of our outstanding common stock at a ratio of at least

one-for-five

and up to

one-for-fifteen.”

Who may vote?

You are entitled to vote if our records show that you held one or more shares of the Company’s common stock at the close

of business on January 6, 2017, which we refer to as the record date. At that time, there were 12,026,344 shares of common stock outstanding and entitled to vote, and approximately 127 holders of record. Each share entitles you to one

vote at the Special Meeting. For ten days prior to the Special Meeting, during normal business hours, a complete list of all stockholders on the record date will be available for examination by any stockholder at the Company’s offices at 260

Littlefield Ave., California 94080. The list of stockholders will also be available at the Special Meeting.

What is the difference between holding

shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, a

“stockholder of record.” If you are a stockholder of record, these proxy materials are being mailed to you directly starting on or about January 12, 2017.

1

If your shares are held in a stock brokerage account or by a bank or other stockholder of

record, you are considered a “beneficial owner” of shares held in “street name.” If you are a beneficial owner, we have requested that a Notice of Special Meeting (the “Notice”) be forwarded to you by the bank, broker

or other stockholder of record starting on or about January 12, 2017. The Notice provides instructions for how to request a paper or email copy of this document. As a beneficial owner, the bank, broker or other holder of record is entitled to

vote at the Special Meeting and, as a beneficial owner of the shares, you have the right to direct the bank, broker or other stockholder of record on how to vote the shares. However, because a beneficial owner is not the stockholder of record, you

may not vote the shares in person at the meeting unless you obtain a broker’s proxy card from the bank, broker, or other stockholder of record. The broker’s proxy card will give you the right to vote the shares at the Special Meeting.

How do I vote if I am a stockholder of record?

If you were a holder of record of our common stock on January 6, 2017, the record

date for the Special Meeting, you may use the following methods to vote your shares at the Special Meeting:

|

•

|

|

By Mail

. You may vote by completing, signing, dating and returning your paper proxy in the accompanying postage prepaid envelope. Please allow sufficient time for us to receive your proxy card if you decide to

vote by mail.

|

|

•

|

|

Via the Internet.

You can vote your shares via the Internet by following the instructions in the enclosed proxy card. The Internet voting procedures are designed to authenticate your identity and to allow you to

vote your shares and confirm your voting instructions have been properly recorded. If you vote via the Internet, you do not need to mail a proxy card.

|

|

•

|

|

In person at the Special Meeting.

If you attend the meeting, be sure to bring a form of government issued picture identification with you. You may deliver your completed proxy card in person or you may vote by

completing a paper proxy card or a ballot, which will be available at the meeting.

|

How do I vote if I hold my shares in street

name?

If on the record date of January 6, 2017, your shares are held in a stock brokerage account or by a bank or other stockholder of record, you may use the following methods to vote your shares at the Special Meeting:

|

•

|

|

By Mail or via the Internet.

You should receive instructions from your bank, broker or other nominee explaining how to vote your shares by mail or via the Internet. If you wish to vote your shares by mail or via

the Internet, you should follow those instructions.

|

|

•

|

|

In person at the meeting.

If you attend the meeting, you will need to contact the bank, broker or other nominee that is the stockholder of record for your shares to obtain a broker’s proxy card and then

bring the proxy card, an account statement, or a letter from the stockholder of record indicating that you beneficially owned the shares as of the record date, and a form of government issued picture identification to the meeting. If you have each

of (1) the broker’s proxy card, (2) an account statement or letter indicating beneficial ownership as of the record date and (3) a government issued picture identification, you may vote by completing a paper proxy card or a

ballot, which will be available at the meeting. If you do not have these items, you will not be able to vote at the meeting.

|

The Notice is

not

a proxy card or ballot and cannot be used to vote your shares. If you do not provide instructions with your proxy,

your bank, broker, or other nominee may deliver a proxy card expressly indicating that it is NOT voting your shares; this indication that a bank, broker, or nominee is not voting your shares is referred to as a “broker

non-vote.”

Since the proposal to be voted upon at the Special Meeting is a

non-discretionary

matter, brokers who do not receive instructions on how to vote will not be

considered present and entitled to vote at the Special Meeting. Therefore, broker

non-votes

will not be counted for the purpose of determining the existence of a quorum. Your bank, broker, or other nominee can

vote your shares only if you provide instructions on how to vote. You should instruct your broker to vote your shares in accordance with directions you provide.

2

Is my vote confidential?

Yes, your vote is confidential. Only the following persons have access to

your vote: the inspector of elections, individuals who help with processing and counting your votes, and persons who need access for legal reasons. Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to

the Company’s management and the Board.

What are the voting procedures?

You may vote “FOR” “AGAINST” or

“ABSTAIN” with respect to the proposal described in this proxy statement. If voting by proxy, you should specify your choice on the accompanying proxy card or your vote instruction card.

What is an Abstention

?

An abstention is a stockholder’s affirmative choice to decline to vote on the proposal. Abstentions are

counted as present and entitled to vote for purposes of determining a quorum and are included in the tabulation of the voting results of the proposal. Abstentions will have the same effect as a vote against the proposal.

How will the Company representatives vote for me?

The Company representatives, Nassim Usman and Fletcher Payne or anyone else that they

choose as their substitutes, have been chosen to vote in your place as your proxies at the Special Meeting. The Company representatives will vote your shares as you instruct them. If you sign, date and return the enclosed proxy card and do not

indicate how you want your shares voted, the Company representatives will vote as our Board recommends. If there is an interruption or adjournment of the Special Meeting before the agenda is completed, the Company representatives may still vote your

shares when the meeting resumes. If a broker, bank or other nominee holds your common stock, they will ask you for instructions and instruct the Company representatives to vote the shares held by them in accordance with your instructions.

What are the votes required for approval?

Provided that a quorum is present, approval of the proposal described in this proxy statement

will require the affirmative vote of a majority of the shares of our common stock outstanding on the record date. As a result, abstentions and broker non-votes will have the same effect as a vote against the proposal.

Can I change my vote after I have returned my proxy card?

Yes. After you have submitted a proxy, you may change your vote at any time

before the proxy is exercised by submitting a notice of revocation or a proxy bearing a later date. Accordingly, you may change your vote either by submitting a proxy card prior to or at the Special Meeting or by voting

in-person

at the Special Meeting. The later submitted vote will be recorded and the earlier vote revoked. You also may revoke your proxy by sending a notice of revocation to our Chief Financial Officer, Fletcher

Payne, which must be received prior to the Special Meeting.

What constitutes a quorum for purposes of the Special Meeting?

To

carry on business at the Special Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the record date, are represented in person or by proxy. As of the record date for the Special Meeting,

6,013,173 shares of our common stock must be represented in person or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other

nominee) or if you vote in person at the Special Meeting. Abstentions will be counted towards the quorum requirement and broker

non-votes

will not be counted towards the quorum. Shares owned by the Company are

not considered outstanding or considered to be present at the Special Meeting. If there is not a quorum at the Special Meeting, our stockholders may adjourn the meeting.

Who pays for this solicitation?

The expense of preparing, printing and mailing this proxy statement and the accompanying material will be

borne by the Company. Solicitation of individual stockholders may be made by mail, personal interviews, telephone, facsimile, electronic delivery or other telecommunications by directors, officers and regular employees of the company who will

receive no additional compensation for those activities. We will reimburse brokers and other nominees for their expenses in forwarding solicitation material to beneficial owners.

3

What happens when two stockholders share the same address?

We may satisfy SEC rules regarding

delivery of proxy statements by delivering a single proxy statement to an address shared by two or more of our stockholders. This delivery method can result in meaningful cost savings for us. To take advantage of this opportunity, we may deliver

only one proxy statement to multiple stockholders who share an address, unless contrary instructions are received prior to the mailing date. Similarly, if you share an address with another stockholder and have received multiple copies of our proxy

materials, you may write us at the address above or call us at (650)

871-0761

to request delivery of a single copy of these materials in the future. We undertake to deliver promptly upon written or oral

request a separate copy of the proxy statement to a stockholder at a shared address to which a single copy of these documents was delivered. If you hold stock as a record stockholder and prefer to receive separate copies of a proxy statement either

now or in the future, please contact us.

What happens if other business not discussed in this proxy statement comes before the

meeting?

The Company does not know of any business to be presented at the Special Meeting other than the proposals discussed in this proxy statement. If other business comes before the meeting and is proper under Delaware law, the

Company representatives will use their discretion in casting all of the votes that they are entitled to cast.

Do I have Dissenters’ Rights of

Appraisal?

Catalyst stockholders do not have appraisal rights under Delaware law or under the governing documents of Catalyst with respect to the matter to be voted upon at the Special Meeting.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. Final

voting results will be published in a Current Report on Form

8-K,

which we will file within four business days of the meeting.

Whom can I contact for further information?

If you would like additional copies, without charge, of this proxy statement or

if you have questions about the Special Meeting, the proposals, or the procedures for voting your shares, you should contact our Chief Financial Officer, Fletcher Payne, at (650)

871-0761.

4

PROPOSAL ONE — TO AUTHORIZE THE BOARD, IN ITS DISCRETION,

TO FILE AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION, TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING COMMON STOCK AT A RATIO OF AT LEAST

ONE-FOR-FIVE

AND UP TO

ONE-FOR-FIFTEEN

We believe it is advisable and in the best

interests of the Company and its stockholders to authorize our Board, in its discretion at any time prior to June 30, 2017, to effect a reverse stock split of the Company’s outstanding common stock at a ratio of at least

one-for-five

and up to

one-for-fifteen,

by filing an amendment to our Certificate of

Incorporation effective the same, with the timing of such amendment, if it is to be implemented at all, and the specific reverse split exchange ratio to be effected being determined in the sole discretion of our Board (the “Reverse Stock

Split”).

Although we are asking our stockholders to vote on a range of proposed reverse split ratios, only one, if any, of such

ratios will be effected within the range approved by our stockholders. Our Board believes that stockholder approval of an amendment within the proposed reverse split ratio ranges granting it the discretion to approve the specific ratio to be

effected, rather than approval of only one exchange ratio at this time, provides our Board with sufficient flexibility to react to then-current market conditions and, therefore, is in our best interests and those of our stockholders.

If our stockholders approve the amendment, no further action by our stockholders will be required either to implement or to abandon the

Reverse Stock Split, and our Board (or a committee designated by the Board) will have the sole discretion to elect, as it determines to be in our best interests and the best interests of our stockholders, whether and when to effect the Reverse Stock

Split, and to determine the reverse split ratio of at least

one-for-five

and up to

one-for-fifteen,

at any time before June 30, 2017. In determining a reverse split ratio, our Board or its committee may consider, among other things, factors such

as (i) the historical trading price and trading volume of our common stock; (ii) the number of shares of common stock outstanding; (iii) the then-prevailing trading price and trading volume of our common stock and the anticipated

impact of the Reverse Stock Split on the trading market for our common stock; and (iv) prevailing general market and economic conditions. If our Board or its committee were to effect the Reverse Stock Split, we would notify our stockholders of

the effectiveness of the split by issuing a press release.

The full text of the form of proposed amendment of our Certificate of

Incorporation is attached to this Proxy Statement as Appendix A. If approved by our stockholders and following such approval our Board determines that effecting the Reverse Stock Split is in our best interests and those of our stockholders, the

Reverse Stock Split will become effective as of 5:00 p.m., Eastern Time on the date of filing of such amendment with the Secretary of State of the State of Delaware. The amendment filed will indicate the reverse split ratio approved by our

stockholders and selected by our Board. Only one such amendment will be filed, if at all.

Although we presently intend to effect the

Reverse Stock Split, our Board reserves the right, notwithstanding our stockholders’ approval of the proposed amendment at the Special Meeting, to abandon it at any time without further action by our stockholders before the amendment is filed

with the Secretary of State of the State of Delaware. Our Board may consider a variety of factors in determining whether or not to proceed with the proposed amendment, including overall trends in the stock market, recent changes and anticipated

trends in the per share market price of our common stock, business developments, and our actual and projected financial performance. As discussed more fully below, our Board may decide to abandon the filing of the proposed amendment. If our Board

fails to implement the Reverse Stock Split prior to June 30, 2017, stockholder approval again would be required prior to implementing any future reverse stock split.

Purpose and Background of the Reverse Stock Split

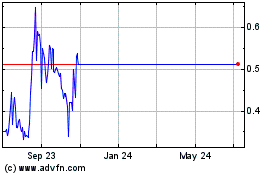

On November 29, 2016, the Company received a letter from Nasdaq stating that the minimum bid price of the Company’s common stock has

been below $1.00 per share for 30 consecutive business days and that the Company therefore is not in compliance with the minimum bid price requirement for continued listing set forth

5

in Nasdaq Marketplace Rule 5550(a)(2). The Company has been provided 180 calendar days to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of

the Company’s common stock must meet or exceed $1.00 per share for at least ten consecutive business days during this

180-day

grace period. We expect that the Reverse Stock Split will increase the price

per share of our common stock above the $1.00 per share minimum market price and facilitate compliance with the requirements for continued listing on Nasdaq. However, there can be no assurance that the Reverse Stock Split will have that effect,

initially or in the future, or that it will enable us to maintain our listing of our common stock on Nasdaq.

We believe that

effecting the Reverse Stock Split may make our common stock more attractive to certain types of investors, including institutional investors and institutional funds, which could improve the Company’s overall liquidity. On January 9, 2017, the

closing price of our common stock, which is currently traded on Nasdaq, was $0.65. A number of institutional investors, investment funds and other members of the investing public may be reluctant to invest, and in some cases may be prohibited from

investing, in lower-priced stocks, and brokerage firms may be reluctant to recommend lower-priced stocks, which some view as unduly speculative in nature, to their clients. By effecting the Reverse Stock Split, we believe that the per share price of

our common stock may increase to a level that would be viewed more favorably by these classes of potential investors. Further, investors may be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the

total transaction, tend to be higher for such stocks. The potential for a higher stock price after the Reverse Stock Split is effected may help to reduce this concern. The Reverse Stock Split could also help increase analyst and broker interest in

our common stock as such parties’ internal policies and practices can discourage or prohibit them from following or recommending companies with lower stock prices. The combination of increased interest from certain types of investors, lower

transaction costs and additional analyst and broker interest could have the effect of improving the trading liquidity of our common stock, which would benefit our stockholders. However, the possibility also exists that liquidity may be adversely

affected by the reduced number of shares which would be outstanding if the Reverse Stock Split is effected, particularly if the price per share of our common stock declines after the Reverse Stock Split is effected.

Additionally, the Reverse Stock Split would reduce the number of shares of our common stock issued and outstanding without reducing the total

number of authorized shares of common stock. As a result, the Company would have a larger number of authorized but unissued shares from which to issue additional shares of common stock, or securities convertible or exercisable into shares of common

stock, in the future. In light of the number of currently outstanding shares of common stock, we believe that increasing the number of authorized and unissued shares is in the best interests of the Company and its stockholders in order to allow the

Company to meet its current and future capital and other needs which may include, without limitation, the issuance of additional equity or convertible debt securities (i) to raise additional capital, (ii) to acquire another company or its

assets, (iii) to establish strategic relationships with corporate partners, or (iv) to pursue other capital-raising or strategic transactions. We do not currently have any plans, proposals or arrangements to issue for any purpose,

including future acquisitions or financings, any of the newly available authorized shares of common stock resulting from a change in the authorized shares.

We further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some

potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization. If the Reverse Stock Split successfully increases the per share price of our

common stock, we believe this increase will enhance our ability to attract and retain employees and service providers. We hope that the decrease in the number of shares of our outstanding common stock as a consequence of the Reverse Stock Split, and

the anticipated increase in the price per share, will encourage greater interest in our common stock by the financial community and the investing public, help us attract and retain employees and other service providers, and possibly promote greater

liquidity for our stockholders with respect to those shares presently held by them.

There can be no assurance that the Reverse Stock

Split will achieve any of the desired results initially or in the future. There also can be no assurance that the price per share of our common stock immediately after the

6

Reverse Stock Split will increase proportionately with the Reverse Stock Split, or that any increase will be sustained for any period of time. The price per share of our common stock is a

function of our business performance and other factors, some of which may be unrelated to the number of shares outstanding.

The proposed

Reverse Stock Split is not intended to be an anti-takeover device or a “going private” transaction.

The Reverse Stock Split May Not Result

in an Increase in the Per Share Price of Our Common Stock; There Are Other Risks Associated with the Reverse Stock Split

We cannot

predict whether the Reverse Stock Split will increase the market price for our common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

|

|

•

|

|

the market price per share of our common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares outstanding before the Reverse Stock Split;

|

|

|

•

|

|

the Reverse Stock Split will result in a per share price that will attract certain types of investors;

|

|

|

•

|

|

the Reverse Stock Split will result in a per share price that will permit us to continue to meet the listing requirements of Nasdaq;

|

|

|

•

|

|

the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks;

|

|

|

•

|

|

the Reverse Stock Split will result in a per share price that satisfies the investing guidelines of institutional investors or investment funds;

|

|

|

•

|

|

the Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers; or

|

|

|

•

|

|

the stockholders owning “odd lots” of less than 100 shares of our common stock on a post-split basis will be able to sell their shares and will be able to do so without incurring greater transaction costs per

share to sell than shares in “round lots” of even multiples of 100 shares.

|

The market price of our common stock

will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our common stock declines, the percentage decline as an absolute

number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Additionally, the liquidity of our common stock could be adversely affected by the reduced number of shares

that would be outstanding after the implementation of the Reverse Stock Split.

Principal Effects of the Reverse Stock Split on the Market for our

Common Stock

On January 9, 2017, the closing price for our common stock on Nasdaq was $0.65 per share. By decreasing the number of

shares of common stock outstanding without altering the aggregate economic interest represented by the shares, we believe the market price will be increased. The greater the market price rises above $1.00 per shares, the less risk there will be that

we will fail to satisfy the requirements for continuing to list our common stock on Nasdaq. However, there can be no assurance that the market price of the common stock will rise to or maintain any particular level or that we will at all times be

able to meet the requirements for maintaining the listing of our common stock on Nasdaq.

Principal Effects of the Reverse Stock Split on Common

Stock; No Fractional Shares

If approved by our stockholders and implemented by the Board or applicable committee, the principal effect

of the Reverse Stock Split will be to reduce the number of issued and outstanding shares of our common stock in accordance with an exchange ratio in the range approved by our stockholders and determined by our Board as set

7

forth in this Proposal. The actual effects of the Reverse Stock Split will vary depending on the timing of the Reverse Stock Split and the exchange ratio determined by the Board.

The total number of shares of common stock each stockholder holds will be reclassified automatically into the number of shares of common stock

equal to the number of shares of common stock each stockholder held immediately before the Reverse Stock Split divided by the ratio approved by our stockholders and determined by our Board as set forth in this Proposal. If the number of shares of

common stock a stockholder holds is not evenly divisible by such ratio, such holder will not receive a fractional share but instead will receive, upon surrender of stock certificates representing such shares of common stock, cash in an amount equal

to the fraction of a share that stockholder otherwise would have been entitled to receive multiplied by the last sale price (as adjusted to reflect the Reverse Stock Split) of the Common Stock as last reported on Nasdaq on the trading day before the

Reverse Stock Split takes effect. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment therefor as described herein. Stockholders should be aware that, under the

escheat laws of the various jurisdictions where stockholders reside, where we are domiciled and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to

the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any such holder’s percentage ownership

interests, except to the extent that the Reverse Stock Split results in any such holder owning a fractional share. As described above, stockholders holding fractional shares will be entitled to cash payments in lieu of such fractional shares. Such

cash payments will reduce the number of post-split stockholders to the extent there are stockholders presently holding fewer than five to fifteen shares, depending on the exchange ratio selected by our Board. This, however, is not the purpose for

which we are proposing to effect the Reverse Stock Split. Common stock issued pursuant to the Reverse Stock Split will remain fully paid and

non-assessable.

The par value of our common stock would remain

unchanged at $0.001 per share.

Upon effectiveness of the Reverse Stock Split, the number of authorized shares of common stock that are

not issued or outstanding will increase substantially because the proposed amendment will not reduce the number of authorized shares while it will reduce the number of outstanding shares by

one-fifth

to

one-fifteenth,

depending on the exchange ratio selected by our Board. Authorized but unissued shares will be available for issuance, and we may issue such shares in financings or otherwise. The Company currently

plans to seek additional financing in order to fund operations. If we issue additional shares, the ownership interest of holders of our common stock may also be diluted. Our future capital needs will be highly dependent on our product development

and other business activities and our ability to raise capital through strategic transactions, grants or other means. Thus, any projections of future cash needs and cash flows are subject to substantial uncertainty. If our available funds and cash

generated from operations are insufficient to satisfy our liquidity requirements, we may seek to sell additional equity or debt securities, obtain a line of credit or curtail our existing operations. In addition, from time to time we may evaluate

other methods of financing to meet our capital needs on terms that we believe are attractive.

Principal Effects of the Reverse Stock Split on

Outstanding Options, Notes and Warrants

As of the record date for the Special Meeting, we had outstanding: (i) $19,401,466 in

aggregate principal amount of

non-interest

bearing redeemable convertible notes (the “Notes”), convertible at the option of each noteholder, into cash or into shares of our common stock at a rate of

$9.19 per share; (ii) warrants to purchase 180,954 shares of our common stock at a weighted average exercise price of $9.71 per share (the “Warrants”); and (iii) options to purchase 2,114,849 shares of our common

stock at a weighted average exercise price of $8.51 per share (the “Options”).

Under the terms of the Notes, Options

and Warrants, when the Reverse Stock Split becomes effective, the number of shares covered by each of them will be automatically reduced by

one-fifth

to

one-fifteenth

of

the

8

number currently covered and the exercise price per share will increase by

one-fifth

to

one-fifteenth,

resulting in

the same aggregate price being required to be paid therefor upon exercise thereof as was required immediately preceding the Reverse Stock Split. The number of shares reserved for issuance and the award limitations under our 2015 Stock Incentive

Plan, as amended and restated effective June 9, 2016, will decrease by

one-fifth

to

one-fifteenth

of the number of shares currently included in such plans.

Principal Effects of the Reverse Stock Split on Legal Ability to Pay Dividends

Our Board does not currently have any plans to declare in the foreseeable future any distributions of cash, dividends or other property, and we

are not in arrears on any dividends. Therefore, we do not believe that the Reverse Stock Split will have any effect with respect to future distributions, if any, to our stockholders.

Accounting Matters

The Reverse Stock

Split will not affect the par value of our common stock. As a result, on the effective date of the Reverse Stock Split, the stated capital on our balance sheet attributable to our common stock will be reduced by

one-fifth

to

one-fifteenth,

and the additional

paid-in

capital account will be credited with the amount by which the stated

capital is reduced. The per share net income or loss and net book value of our common stock will be increased because there will be fewer shares of Common Stock outstanding.

Potential Anti-Takeover Effect

The

increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change

in the composition of our Board or contemplating a tender offer or other transaction for our combination with another company). However, the Reverse Stock Split proposal is not being proposed in response to any effort of which we are aware to

accumulate shares of our Common Stock or obtain control of our Company, nor is it part of a plan by management to recommend a series of similar amendments to our Board and stockholders.

Procedure for Effecting the Reverse Stock Split; Exchange of Stock Certificates; Effect on Registered and Beneficial Holders and Registered

“Book-Entry” Holders of Common Stock; Payment for Fractional Shares

If our stockholders approve granting our Board the

authority to exercise its discretion to effectuate the Reverse Stock Split and if our Board determines that the Reverse Stock Split is in the best interests of the Company, we will file the proposed amendment to the Certificate of Incorporation with

the Secretary of State of the State of Delaware. The Reverse Stock Split will become effective at 5:00 p.m., Eastern Time on the date of filing of such amendment which we refer to as the “effective time.” Beginning at the effective time,

each certificate representing outstanding

pre-reverse

stock split shares of common stock will be deemed for all corporate purposes to evidence ownership of post-reverse stock split shares of common stock.

We will appoint American Stock Transfer & Trust Company, LLC as exchange agent for our stockholders in connection with the Reverse

Stock Split (the “Transfer Agent”). We will deposit with the Transfer Agent, as soon as practicable after the effective time, cash in an amount equal to the value of the estimated aggregate number of fractional shares that will result from

the Reverse Stock Split. The funds required to purchase the fractional share interests are available and will be paid from our current cash reserves. Our stockholder list shows that some of the outstanding shares of common stock are registered in

the names of clearing agencies and broker nominees. Because we do not know the numbers of shares held by each beneficial owner for whom the clearing agencies and broker nominees are record holders, we cannot predict with certainty the number of

fractional shares that will result from the Reverse Stock Split or the total amount we will be required to pay for fractional share interests. However, we do not expect that amount will be material.

As of the record date for the Special Meeting, we had approximately 127 stockholders of record (although we had significantly more

beneficial holders). We do not expect the Reverse Stock Split and the payment of cash in lieu of fractional shares to result in a significant reduction in the number of record holders.

9

As soon as practicable after the effective time, we will mail a letter of transmittal to each

stockholder. Each stockholder will be able to obtain a certificate evidencing its post-Reverse Stock Split shares and, if applicable, cash in lieu of a fractional share only by sending the Transfer Agent its old stock certificate(s), together with

the properly executed and completed letter of transmittal and such evidence of ownership of the shares as we may require. Stockholders will not receive certificates for post-Reverse Stock Split shares unless and until their old certificates are

surrendered to the Transfer Agent together with the properly completed and executed letter of transmittal and such evidence of ownership of the shares as we may require.

Stockholders should not destroy any stock certificates and should not

forward their certificates to the Transfer Agent until they receive the letter of transmittal, and they should only send in their certificates with the letter of transmittal.

The Transfer Agent will send each stockholder’s new stock

certificate and payment in lieu of any fractional share promptly after receipt of that stockholder’s properly completed letter of transmittal and old stock certificate(s). Stockholders will not have to pay any service charges in connection with

the exchange of their certificates or the payment of cash in lieu of fractional shares.

Upon the effectiveness of the Reverse Stock

Split, shares of common stock held by stockholders that hold their shares through a broker or other nominee will be treated in the same manner as shares held by registered stockholders that hold their shares in their names. Brokers and other

nominees that hold shares of common stock will be instructed to effect the Reverse Stock Split for the beneficial owners of such shares. However, those brokers or other nominees may implement different procedures than those to be followed by

registered stockholders for processing the Reverse Stock Split. Stockholders whose shares of common stock are held in the name of a broker or other nominee are encouraged to contact their broker or other nominee with any questions regarding the

procedure of implementing the Reverse Stock Split with respect to their shares.

Registered holders of shares of common stock may hold

some or all of their shares electronically in book-entry form under the direct registration system for the securities. Those stockholders will not have stock certificates evidencing their ownership of common stock, but generally have a statement

reflecting the number of shares registered in their accounts. Stockholders that hold registered shares of Common Stock in book-entry form do not need to take any action to receive new post-Reverse Stock Split shares of common stock (or a cash

payment in lieu of any fractional share interest, if applicable). Any such stockholder that is entitled to new post-Reverse Stock Split shares of common stock will automatically receive, at the stockholder’s address of record, a transaction

statement indicating the number of shares of common stock held following the implementation of the Reverse Stock Split. If any such stockholder is entitled to a payment in lieu of any fractional share interest, a check will be mailed to the

stockholder’s address of record as soon as practicable after the Reverse Stock Split is implemented.

Even if our stockholders

approve the Reverse Stock Split, our Board reserves the right to not effect the Reverse Stock Split if in our Board’s opinion it would not be in our best interests or those of our stockholders to effect such Reverse Stock Split.

No Appraisal Rights

Under the Delaware

General Corporation Law, stockholders are not entitled to dissenters’ rights of appraisal with respect to the proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split, and we will not independently provide our

stockholders with any such right.

Federal Income Tax Consequences of the Reverse Stock Split; Rule 144

The following is a summary of certain of the material anticipated federal income tax consequences under current law relating to the Reverse

Stock Split. The following discussion does not purport to deal with all aspects of federal income taxation that may be applicable to specific stockholders.

The following description of federal income tax consequences is based on the current provisions of the Internal Revenue Code of 1986, as

amended (the “Code”), current and proposed applicable Treasury regulations promulgated thereunder, judicial authority and current administrative rulings and practices as in effect on the date

10

of this Proxy Statement. This summary does not take into account possible changes in such laws or interpretations, including amendments to the Code, applicable statutes, regulations and proposed

regulations or changes in judicial or administrative rulings, some of which may have retroactive effect. This discussion should not be considered tax or investment advice, and the tax consequences may not be the same for all stockholders. In

addition, this discussion does not address the tax treatment of special classes of stockholders, such as banks, insurance companies,

tax-exempt

organizations, financial institutions, broker-dealers, persons

holding common stock as part of a hedge, straddle or other risk reduction, constructive sale or conversion transaction, U.S. expatriates, persons subject to the alternative minimum tax, foreign corporations, foreign estates or trusts and persons who

are not citizens or residents of the United States for U.S. tax purposes. This discussion also may not apply to stockholders who acquired their common stock as compensation.

Each stockholder is urged to consult his, her or its own tax advisors to determine particular federal tax consequences to such stockholders

of the Reverse Stock Split, as well as the applicability and effect of state, local, foreign and other laws.

The following

discussion is limited to certain tax consequences resulting to stockholders of the Company as part of the Reverse Stock Split. Accordingly, holders of options, notes and warrants to purchase the capital stock of the Company should consult their own

tax advisors with respect to the tax consequences associated with the Reverse Stock Split.

We believe that, for federal income tax

purposes, the Reverse Stock Split will constitute a

tax-free

recapitalization. Accordingly, we believe that the Reverse Stock Split will not be a taxable transaction to the stockholders or the Company. Each

stockholder’s tax basis in his or her shares of the Company’s common stock received in the Reverse Stock Split will be equal to such stockholder’s tax basis in the shares of the Company’s common stock held immediately prior to

the effectiveness of the Reverse Stock Split, and his or her holding period of such shares of the Company’s common stock for federal income tax purposes will include the holding period of such shares of the Company’s common stock that were

surrendered in connection with the Reverse Stock Split, provided such shares were held as a capital asset at the time of the effectiveness of the Reverse Stock Split.

A stockholder who receives cash in lieu of fractional shares in the Reverse Stock Split should recognize capital gain or loss equal to the

difference between the amount of the cash received in lieu of fractional shares and the portion of the stockholder’s adjusted tax basis allocable to the fractional shares unless the distribution of cash is treated as having the effect of a

distribution of dividend, in which case the gain will be treated as dividend income to the extent of our current accumulated earnings and profits as calculated for U.S. federal income tax purposes. Stockholders are urged to consult their own tax

advisors to determine whether a stockholder’s receipt of cash has the effect of a distribution of a dividend.

Although we believe

that the U.S. federal income tax consequences to the Reverse Stock Split will be as described above, the Internal Revenue Service (the “IRS”) is not precluded from taking a contrary position that could have an adverse tax consequence on

holders of the Company’s common stock. There can be no assurance that the U.S. federal income tax consequences described above will not be challenged by the IRS or, if challenged, will be decided favorably to the holders of the Company’s

common stock.

Under Rule 144 under the Securities Act of 1933, the holding period for the common stock received in connection with the

Reverse Stock Split will include the period during which the

pre-split

common stock was held prior to its surrender.

Required Approval

The consent required

to authorize the Company to effect the Reverse Stock Split is the affirmative vote of a majority of the shares of our common stock outstanding on the record date.

THE BOARD RECOMMENDS A VOTE FOR AUTHORIZATION OF THE REVERSE STOCK SPLIT AT A RATIO OF AT LEAST

ONE-FOR-FIVE

AND UP TO

ONE-FOR-FIFTEEN.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of January 6,

2017, for:

|

|

•

|

|

each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock;

|

|

|

•

|

|

each of our named executive officers;

|

|

|

•

|

|

each of our directors; and

|

|

|

•

|

|

all current executive officers and directors as a group.

|

Applicable percentage ownership

is based on 12,026,344 shares of common stock outstanding at January 6, 2017. We have determined beneficial ownership in accordance with SEC rules. The information does not necessarily indicate beneficial ownership for any other purpose.

Under these rules, the number of shares of common stock deemed outstanding includes shares issuable upon exercise of options or warrants, or the conversion of convertible notes, held by the respective person or group that may be exercised or

converted within 60 days after January 6, 2017. For purposes of calculating each person’s or group’s percentage ownership, stock options and warrants exercisable, and notes convertible, within 60 days after January 6, 2017 are

included for that person or group, but not the stock options of any other person or group.

Unless otherwise indicated and subject to

applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed. Unless otherwise noted below, the address of each person listed in the table is

c/o Catalyst Biosciences, Inc., 260 Littlefield Ave, South San Francisco, CA 94080.

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Number of Shares

Owned and Nature of

Beneficial Ownership

|

|

|

Percent

of Class

|

|

|

5% or Greater Stockholders

|

|

|

|

|

|

|

|

|

|

Funds affiliated with Essex Woodlands Health Ventures

|

|

|

1,226,519

|

(1)

|

|

|

10.2%

|

|

|

335 Bryant Street, 3

rd

Floor

|

|

|

|

|

|

|

|

|

|

Palo Alto, CA 94301

|

|

|

|

|

|

|

|

|

|

New Enterprise 10, Limited Partnership and affiliates

|

|

|

1,188,242

|

(2)

|

|

|

9.5%

|

|

|

Greenspring Drive, Suite 600

|

|

|

|

|

|

|

|

|

|

Timonium, Maryland 21093

|

|

|

|

|

|

|

|

|

|

BVF Inc. and affiliates

|

|

|

1,161,234

|

(3)

|

|

|

9.5%

|

|

|

900 North Michigan Avenue, Suite 1100

|

|

|

|

|

|

|

|

|

|

Chicago, Illinois 60611

|

|

|

|

|

|

|

|

|

|

HealthCare Ventures VIII, L.P.

|

|

|

1,068,717

|

(4)

|

|

|

8.9%

|

|

|

47 Thorndike Street, Suite

B1-11954

|

|

|

|

|

|

|

|

|

|

Cambridge, MA 02141

|

|

|

|

|

|

|

|

|

|

Johnson & Johnson Innovation – JJDC, Inc.

|

|

|

1,029,144

|

(5)

|

|

|

8.5%

|

|

|

410 George Street

|

|

|

|

|

|

|

|

|

|

New Brunswick, NJ 08901

|

|

|

|

|

|

|

|

|

|

Morgenthaler Partners VIII, L.P.

|

|

|

905,558

|

(6)

|

|

|

7.5%

|

|

|

2710 Sand Hill Road, Suite 100

|

|

|

|

|

|

|

|

|

|

Menlo Park, CA 94025

|

|

|

|

|

|

|

|

|

|

Rosetta Capital V LP

|

|

|

772,784

|

(7)

|

|

|

6.4%

|

|

|

c/o The Accounts Bureau Limited

|

|

|

|

|

|

|

|

|

|

83 Victoria Street

|

|

|

|

|

|

|

|

|

|

London, SW1H OHW

|

|

|

|

|

|

|

|

|

|

United Kingdom

|

|

|

|

|

|

|

|

|

12

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Number of Shares

Owned and Nature of

Beneficial Ownership

|

|

|

Percent

of Class

|

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

|

|

Nassim Usman, Ph.D.

|

|

|

255,189

|

(8)

|

|

|

2.1%

|

|

|

Edwin L. Madison, Ph.D.

|

|

|

146,919

|

(9)

|

|

|

1.2%

|

|

|

Fletcher Payne

|

|

|

77,662

|

(10)

|

|

|

*

|

|

|

Howard Levy, M.B.B. Ch., Ph.D., M.M.M

|

|

|

—

|

(11)

|

|

|

—

|

|

|

Harold E. Selick, Ph.D.

|

|

|

32,364

|

(12)

|

|

|

*

|

|

|

Stephen A. Hill, M.D.

|

|

|

343,213

|

(13)

|

|

|

2.8%

|

|

|

Augustine Lawlor

|

|

|

1,081,214

|

(14)

|

|

|

9.0%

|

|

|

Jeff Himawan, Ph.D.

|

|

|

1,226,519

|

(1)

|

|

|

10.2%

|

|

|

John P. Richard

|

|

|

65,334

|

(15)

|

|

|

*

|

|

|

Errol B. De Souza

|

|

|

65,877

|

(16)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

All Directors and Executive Officers as a Group (9 persons)

|

|

|

3,147,372

|

(17)

|

|

|

26.0%

|

|

|

*

|

Indicates less than 1% of class.

|

|

|

(1)

|

The information reported is based on a Schedule 13D filed with the SEC on August 31, 2015 which reports that, as of August 20, 2015, (i) Essex Woodlands Health Ventures Fund VIII, L.P. (“Essex VIII”)

directly holds 1,111,538 shares, which include 42,748 shares issuable upon the exercise of warrants within 60 days, (ii) Essex Woodlands Health Ventures Fund

VIII-A,

L.P. (“Essex

VIII-A”)

directly holds 80,139 shares which include 3,080 shares issuable upon the exercise of warrants within 60 days), and (iii) Essex Woodlands Health Ventures Fund

VIII-A,

L.P. (“Essex

VIII-B”)

directly holds 34,842 shares, which include 1,339 shares issuable upon the exercise of warrants within 60 days. Essex Woodlands

Health Ventures VIII, L.P. (the “GP Partnership”) is the general partner of Essex VIII, Essex

VIII-A,

and Essex

VIII-B.

Essex Woodlands Health Ventures VIII,

LLC (“Essex VIII LLC”) is the general partner of the GP Partnership. Essex VIII LLC, as the general partner of the GP Partnership, may be deemed to have sole voting investment power with respect to 1,226,519 shares comprising of

(i) 1,179,352 shares and (ii) 47,167 shares that may be purchased upon the exercise of warrants within 60 days. Essex VIII LLC disclaims beneficial ownership to 1,226,519 shares comprising of (i) 1,179,352 shares and (ii) 47,167 shares

that may be purchased upon the exercise of warrants within 60 days, except to the extent of its pecuniary interest. Dr. Jeff Himawan, Marty Sutter, Immanuel Thangaraj, Petri Vainio, Ron Eastman, Steve Wiggins and Guido Neels (the

“Managers”) may also be deemed to have shared dispositive power and voting power with respect to 1,226,519 shares comprising of (i) 1,179,352 shares and (ii) 47,167 shares that may be purchased upon the exercise of warrants within 60

days. The GP Partnership disclaims beneficial ownership of the shares except to the extent of its pecuniary interest therein.

|

|

|

(2)

|

The information reported is based on a Schedule 13D/A filed with the SEC on February 11, 2016, which reports that, as of August 20, 2015, New Enterprise Associates 10, Limited Partnership (“NEA 10”),

is the record owner of 651,930 shares of our common stock (the “NEA 10 Shares”). As the sole general partner of NEA 10, NEA Partners 10, Limited Partnership (“NEA Partners 10”) may be deemed to own beneficially the NEA 10 Shares.

As the individual general partners of NEA Partners 10, each of Michael James Barrett, Peter J. Barris and Scott D. Sandell also may be deemed to own beneficially the NEA 10 Shares. Also includes 536,312 shares issuable upon the conversion of

$4,928,707.28 in aggregate principal amount of redeemable convertible notes issued by the Company on August 19, 2015 in respect of the shares reported as held by NEA 10 and convertible within 60 days.

|

|

|

(3)

|

The information reported is based on a Schedule 13G, filed with the SEC on February 16, 2016, which reported

certain beneficial ownership information and figures as of the close of business on December 31, 2015 based upon 11,427,983 shares outstanding as of October 30, 2015. Such beneficial ownership information and figures are adjusted to

reflect a basis of 11,427,983 shares outstanding as of October 30, 2015 as follow: (i) BVF beneficially owns 624,985 shares, including 190,286 shares

|

13

|

|

issuable upon the exercise of the conversion of the BVF Convertible Notes (as defined below) and excluding 156,676 shares issuable upon the exercise of the BVF Convertible Notes, (ii) BVF2

beneficially owned 250,172 shares, excluding 201,416 shares issuable upon the exercise of the BVF Convertible Notes and (iii) Trading Fund OS beneficially owned 0 shares, excluding 66,826 shares issuable upon the exercise of the BVF Convertible

Notes. Pursuant to the terms of the convertible notes exercisable within 60 days for an aggregate of 850,752 shares (the “BVF Convertible Notes”), the stockholders may not acquire shares upon exercise of the BVF Convertible Notes to the

extent that, upon exercise, the number of shares beneficially owned by them would exceed 9.99% of our issued and outstanding shares. Therefore, certain shares issuable upon the exercise of the BVF Convertible Notes are excluded. Partners OS, as the

general partner of Trading Fund OS may be deemed to beneficially own the 0 shares beneficially owned by Trading Fund OS. Partners, as the general partner of BVF and BVF2, the investment manager of Trading Fund OS and the sole member of Partners OS,

may be deemed to beneficially own the 1,161,234 shares beneficially owned in the aggregate by BVF, BVF2, Trading Fund OS, and certain Partners management accounts (the “Partners Management Accounts”), including 286,077 shares held in the

Partners Management Account, excluding 232,548 shares issuable upon the exercise of the BVF Convertible Notes held within the Partners Management Accounts. BVF Inc., as the general partner of Partners, may be deemed to beneficially own the 1,161,234

shares beneficially owned by Partners. Mark N. Lampert, as a director and officer of BVF Inc., may be deemed to beneficially own the 1,161,234 shares beneficially owned by BVF Inc. Partners, BVF Inc. and Mr. Lampert share voting and dispositive

power over the shares beneficially owned by BVF, BVF2, Trading Fund OS and the Partners Management Fund OS. Each of Partners, BVF Inc. and Mr. Lampert disclaims beneficial ownership of the shares beneficially owned by BVF, BVF2,Trading Fund OS

and the Partners Management Accounts.

|

|

|

(4)

|

The information reported is based on a Schedule 13D filed with the SEC on August 31, 2015 which reports that, as of August 20, 2015, Healthcare Ventures VIII, L.P. (“HCVVIII”) directly beneficially

owns 1,068,717 shares which include 27,693 shares that may be purchased upon the exercise of warrants within 60 days. Each of James H. Cavanaugh, Ph.D., Harold R. Werner, John W. Littlechild, Christopher Mirabelli, Ph.D., and Augustine Lawlor are

the managing directors of HealthCare Ventures VIII, LLC (“HCPVIIILLC”), the general partner of HealthCare Partners VIII, L.P. (“HCPVIII”), which is the general partner of HCVVIII. HCPVIIILLC and HCPVIII may be deemed to

indirectly beneficially own 1,068,717 shares, which include 27,693 shares that may be purchased upon the exercise of warrants within 60 days. Each of Drs. Cavanaugh and Mirabelli and Messrs. Werner, Littlechild and Lawlor may be deemed to indirectly

beneficially own 1,068,717 shares, which include 27,693 shares that may be purchased upon the exercise of warrants within 60 days. HCVVIII, HCPVIII, HCPVIIILLC. Drs. Cavanaugh and Mirabelli and Messrs. Werner, Littlechild and Lawlor share the power

to vote and direct the vote and to dispose of and direct the disposition of the shares beneficially owned by HCVVIII.

|

|

|

(5)

|

The information reported is based on a Schedule 13G filed with the SEC on August 28, 2015 which reports that as of August 20, 2015, Johnson & Johnson Innovation-JJDC, Inc. (“JJDC”) directly

beneficially owns 1,029,144 shares, which includes 24,875 shares issuable upon exercise of warrants within 60 days. JJDC is a wholly-owned subsidiary of Johnson & Johnson, a New Jersey corporation (“J&J”). J&J may be

deemed to indirectly beneficially own the securities that are directly beneficially owned by JJDC.

|

|

|

(6)

|

The information reported is based on a Schedule 13D filed with the SEC on August 31, 2015 which reports that

as of August 20, 2015, Morgenthaler Partners VIII, L.P. (“MP LP”) is the record holder of 886,885 shares and 18,673 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days. Morgenthaler

Management Partners VIII, LLC (“MMP LLC”) is the general partner of MP LP and may be deemed to beneficially own the 886,885 shares and 18,673 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days.

MMP LLC shares voting control and investment power over the 886,885 shares and 18,673 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days with Ralph Christoffersen, Ph.D., Robert Bellas, John Lutsi, Gary

Morgenthaler, Robery Pavey and Gary Little (the “Members”),

|

14

|

|

each of whom disclaim beneficial ownership over the 885,885 shares and 18,673 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days. The Members are the

members of MMP LLC.

|

|

|

(7)

|

The information reported is based on a Schedule 13D filed with the SEC on August 28, 2015 which reports that as of August 20, 2015, Rosetta Capital V GP Limited (the “GPCo”) is the record holder of

758,529 shares and 14,255 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days on behalf of Rosetta Capital V LP (“Rosetta V”). Rosetta V, Rosetta Capital V GP LP (the “GP”), and Rosetta

Capital Limited (“Rosetta Capital”) are management vehicles within the Rosetta Capital group. Rosetta Capital has management control over all of the shares directly held by Rosetta V, and Rosetta Capital has management control over Rosetta

V. The GP, the GPCo and Rosetta Capital control Rosetta V through their respective direct and indirect interests in the Rosetta V partnership and pursuant to a management agreement, and may be deemed to share beneficial ownership of the 758,529

shares and 14,255 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days by virtue of their ability to collectively direct decision of Rosetta V. Rosetta Capital is the general partner of the GPCo and was

appointed the manager of Rosetta V and therefore, it may be deemed to beneficially own the 758,529 shares and 14,255 shares that may be purchased upon the exercise of warrants that are exercisable within 60 days.

|

|

|

(8)

|

Consists of (i) 60,847 shares and 29 shares issuable upon the exercise of warrants within 60 days held by the Usman Family Trust, of which Dr. Usman is a

co-trustee

with

Susan L. Usman, (ii) 17,528 shares and (iii) 176,785 shares issuable upon the exercise of options within 60 days.

|

|

|

(9)

|

Consists of (i) 31,008 shares and (ii) 115,882 shares issuable upon the exercise of options within 60 days.

|

|

|

(10)

|

Consists of (i) 25,032 shares held by Charles and Nancy Payne 2000 Trust, of which Mr. Payne is a trustee and (ii) 52,630 shares issuable upon the exercise of options within 60 days.

|

|

|

(11)

|

No shares were issuable upon the exercise of options within 60 days.

|

|

|

(12)

|

Consists of (i) 16,232 shares, (ii) 15,463 shares issuable upon the exercise of options within 60 days and (iii) 287 shares issuable upon the exercise of warrants within 60 days. Also includes 382 shares held directly

by Dr. Selick’s wife.

|

|

|

(13)

|

Consists of (i) 20,711 shares, (ii) 299,608 shares issuable upon the exercise of options within 60 days, and (iii) 22,894 shares issuable upon the conversion of $210,397 in aggregate principal amount of redeemable

convertible notes issued by the Company on August 19, 2015, as reported on a Form 4 filed on August 18, 2015, in respect of the shares, held by Dr. Hill and convertible within 60 days.

|

|

|

(14)

|

Consists of 12,497 shares issuable upon the exercise of options within 60 days.

|

|

|

(15)

|

Consists of (i) 3,261 shares, (ii) 59,393 shares issuable upon the exercise of options within 60 days and (iii) 2,680 shares issuable upon the conversion of $24,635 in aggregate principal amount of redeemable

convertible notes convertible within 60 days.

|

|

|

(16)

|

Consists of (i) 2,190 shares, (ii) 61,887 shares issuable upon the exercise of options within 60 days and (iii) 1,800 shares of common stock issuable upon the conversion of $16,543.00 in aggregate principal amount of

redeemable convertible notes convertible within 60 days.

|

|

|

(17)

|

Includes (i) 2,397,567 shares, (ii) 794,145 shares of subject to options exercisable within 60 days, 75,176 shares subject to warrants exercisable within 60 days, and 27,374 shares issuable upon the conversion of

redeemable convertible notes convertible within 60 days.

|

15

STOCKHOLDER PROPOSALS

Our stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of our bylaws and

the rules established by the SEC. Under these requirements, proposals from our stockholders that are intended to be presented by such stockholders at the 2017 annual stockholders meeting must be addressed to the Secretary of the Company and received

in writing at our executive offices no later than March 10, 2017, unless the date of the 2017 annual stockholders meeting is more than 30 days before or after June 9, 2017, in which case the deadline is a reasonable time before we begin to

print and send its proxy materials. If you wish to submit a proposal that is not to be included in the our proxy materials for next year’s annual meeting pursuant to the SEC’s shareholder proposal procedures or to nominate a director, you

must do so between February 8 and March 10, 2017; provided that if the date of that annual meeting is more than 30 days before, or more than 60 days after June 9, 2017, you must give notice not later than the close of business on the

90th day prior to the annual meeting date, or, if the first public disclosure of the date of such annual meeting is less than 100 days prior to such annual meeting, the close of business on the 10th day following the day on which public disclosure

of the annual meeting date is first made.

OTHER MATTERS

We have no knowledge of any other matters that may come before the Special Meeting and do not intend to present any other matters. However, if

any other matters shall properly come before the meeting or any adjournment, our representatives will have the discretion to vote as they see fit unless directed otherwise.

If you do not plan to attend the Special Meeting, in order that your shares may be represented and in order to assure the required quorum,

please sign, date and return your proxy promptly. In the event you are able to attend the Special Meeting, at your request, we will cancel your previously submitted proxy.

By order of the board of directors,

Nassim Usman

President

and Chief Executive Officer

January 12, 2017

16

Appendix A

SECOND CERTIFICATE OF AMENDMENT TO THE FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF THE COMPANY

A-1

SECOND CERTIFICATE OF AMENDMENT OF

THE FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

CATALYST BIOSCIENCES,

INC.

It is hereby certified that:

1. The name of the corporation (hereinafter called the “Company”) is Catalyst Biosciences, Inc. The date of the filing of its

Certificate of Incorporation with the Secretary of State of the State of Delaware was March 7, 1997.

2. The Fourth Amended and Restated

Certificate of Incorporation filed on April 18, 2006, as amended, is hereby further amended by striking out the second paragraph of Article IV in its entirety and by substituting in lieu of said paragraph the following paragraph:

“Upon the effectiveness of the Second Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation (the

“

Effective Time

”), to effect a plan of recapitalization of the Common Stock by effecting a

1-for-[●]

reverse stock split with respect to the

issued and outstanding shares of the Common Stock (the “Reverse Stock Split”), without any change in the powers, preferences and rights or qualifications, limitations or restrictions thereof, such that, without further action of any kind

on the part of the Company or its stockholders, every [●] shares of Common Stock outstanding or held by the Company in its treasury immediately prior to the Effective Time shall be changed and reclassified into one (1) share of Common

Stock, $0.001 par value per share, which shares shall be fully paid and nonassessable shares of Common Stock. There shall be no fractional shares issued. A holder of record of Common Stock on the Effective Time who would otherwise be entitled to a

fraction of a share shall, in lieu thereof, be entitled to receive a cash payment in an amount equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing trading price of the Common Stock on The Nasdaq

Capital Market on the date of the Effective Time.”