UniCredit Hit by $8.6 Billion Bad-Loan Charge -- Update

January 12 2017 - 5:56AM

Dow Jones News

By Giovanni Legorano

ROME--Italian lender UniCredit SpA said Thursday it will book

EUR8.1 billion ($8.57 billion) in provisions for bad loans, as part

of a balance-sheet cleanup it unveiled in December.

The bank said last month it planned to launch a EUR13 billion

rights issue by the end of March--one of the largest Italy has

seen--as well as cutting thousands of jobs and selling a large

chunk of bad loans.

The move follows a tumultuous year for Italian banks, which have

been battered by investor anxiety about the solidity of a sector

that struggles with bad loans and low profitability. Italian

banking stocks have fallen more than 30% in the past year.

At the end of last year, the Italian government set up a fund to

prop up the banking sector, setting the stage for a bailout of

Europe's most troubled lender, Banca Monte dei Paschi di Siena

SpA.

In remarks issued before the start of a shareholders assembly

called to approve the plan, UniCredit said the measures weren't

requested by any supervisory authority. The bank will book the

provisions in its fourth-quarter earnings.

In December, the bank said it planned to shed EUR17.7 billion of

gross bad loans by bundling them into securities to be sold to

investors.

The bank also said last month it would cut an additional 6,500

jobs by 2019 on top of those already planned, bringing the total

reductions to 14,000, or 10% of its workforce.

The redundancies will require the booking of EUR1.7 billion in

costs for the last quarter of 2016, UniCredit said Thursday.

Shares in UniCredit were down 1.2% Thursday morning.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

January 12, 2017 05:41 ET (10:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

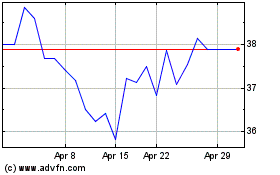

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Apr 2023 to Apr 2024