WEX Inc. Announces New Collaboration with Enterprise Fleet Management in Canada

January 11 2017 - 6:30AM

Business Wire

WEX Inc., a leading global provider of corporate payment

solutions, today announced that it has signed a new agreement with

Enterprise Fleet Management in Canada. The partnership supports

Enterprise’s growth in the Canadian market through WEX’s Canadian

fleet capabilities.

WEX and Enterprise Fleet Management have been working together

since 1993 in the United States. Leveraging the Canadian fueling

locations now available through WEX’s acquisition of EFS, the

expanded partnership will deliver WEX products to Enterprise Fleet

Management customers throughout Canada as well.

“WEX is a global company servicing markets throughout the world.

We are looking forward to this new chapter in our partnership with

Enterprise and the opportunity for us to expand our presence in

Canada,” said Melissa Smith, president and CEO of WEX, Inc. “WEX

and Enterprise have a long, successful history together, and we’re

certain that working in tandem to bring our offering to Canada will

prove beneficial to everyone involved.”

“We’re thrilled to extend our 24-year partnership with WEX into

the Canadian market,” said Brice Adamson, Senior Vice President of

Enterprise Fleet Management. “We have a great history of working

collaboratively with WEX, and we are confident we will see

continued success through this expanded agreement.”

Forward-Looking StatementsThis news release contains

forward-looking statements, including statements regarding: the

impact of WEX’s entry into a commercial relationship with

Enterprise Fleet Management to help expand in the Canadian Market

and the impact of that relationship WEX’s and Enterprise’s

commercial growth; and, the benefits of the same to WEX and

Enterprise customers. Any statements that are not statements of

historical facts may be deemed to be forward-looking statements.

When used in this new release, the words "may," "could,"

"anticipate," "plan," "continue," "project," "intend," "estimate,"

"believe," "expect,” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain such words. These

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially,

including: the effects of general economic conditions on fueling

patterns as well as payment and transaction processing activity;

the impact of foreign currency exchange rates on the Company’s

operations, revenue and income; changes in interest rates; the

impact of fluctuations in fuel prices; the effects of the Company’s

business expansion and acquisition efforts; potential adverse

reactions or changes to business or employee relationships,

including those resulting from the completion of an acquisition;

competitive responses to any acquisitions; uncertainty of the

expected financial performance of the combined operations following

completion of an acquisition; the ability to successfully integrate

the Company's acquisitions, specifically, the Electronic Funds

Source LLC's operations and employees; the ability to realize

anticipated synergies and cost savings; unexpected costs, charges

or expenses resulting from an acquisition; the Company's failure to

successfully operate and expand commercial fuel card programs for

its various customers, including Enterprise; the failure of

corporate investments to result in anticipated strategic value; the

impact and size of credit losses; the impact of changes to the

Company's credit standards; breaches of the Company’s technology

systems and any resulting negative impact on our reputation,

liabilities or relationships with customers or merchants; the

Company’s failure to maintain or renew key agreements; failure to

expand the Company’s technological capabilities and service

offerings as rapidly as the Company’s competitors; the actions of

regulatory bodies, including banking and securities regulators, or

possible changes in banking or financial regulations impacting the

Company’s industrial bank, the Company as the corporate parent or

other subsidiaries or affiliates; the impact of the Company’s

outstanding notes on its operations; the impact of increased

leverage on the Company's operations, results or capacity

generally, and as a result of potential acquisitions specifically;

financial loss if the Company determines it necessary to unwind any

derivative instrument positions prior to the expiration of a

contract; the incurrence of impairment charges if our assessment of

the fair value of certain of our reporting units changes; the

uncertainties of litigation; as well as other risks and

uncertainties identified in Item 1A of our annual report on Form

10-K for the year ended December 31, 2015, filed on February 26,

2016, and Item 1.A. of Part II of the quarterly report on Form 10-Q

filed on April 28, 2016, both with the Securities and Exchange

Commission. The Company's forward-looking statements do not reflect

the potential future impact of any alliance, merger, acquisition,

disposition or stock repurchases, other than the acquisition. The

forward-looking statements speak only as of the date of this news

release and undue reliance should not be placed on these

statements. The Company disclaims any obligation to update any

forward-looking statements as a result of new information, future

events or otherwise.

About WEX Inc.WEX Inc. (NYSE: WEX) is a leading provider

of corporate payment solutions. From its roots in fleet card

payments beginning in 1983, WEX has expanded the scope of its

business into a multi-channel provider of corporate payment

solutions representing approximately 10 million vehicles and

offering exceptional payment security and control across a wide

spectrum of business sectors. WEX serves a global set of customers

and partners through its operations around the world, with offices

in the United States, Australia, New Zealand, Brazil, the United

Kingdom, Italy, France, Germany, Norway and Singapore. WEX and its

subsidiaries employ more than 2,500 associates. The company has

been publicly traded since 2005, and is listed on the New York

Stock Exchange under the ticker symbol “WEX.” For more information,

visit www.wexinc.com and follow WEX on Twitter at @WEXIncNews.

About WEX Subsidiary EFSWEX acquired the EFS fleet

business in July of 2016.

About Enterprise Fleet ManagementOwned by the Taylor

family of St. Louis, Enterprise Fleet Management supplies most

makes and models of cars, light- and medium-duty trucks and service

vehicles across North America. The business provides full-service

management for companies, government agencies and organizations

operating medium-sized fleets of 20 or more vehicles, as well as

those seeking an alternative to employee reimbursement programs.

Enterprise Fleet Management operates a network of more than 50

fully-staffed offices, which manages more than 430,000 vehicles in

the U.S. and Canada. The company also has been recognized with the

Automotive Service Excellence “Blue Seal of Excellence” award for

20 consecutive years, an industry record.

Enterprise Fleet Management and its affiliate, Enterprise

Holdings, together offer a total transportation solution. Through

an integrated global network of independent regional subsidiaries

and franchises, Enterprise Holdings operates more than 9,600 fully

staffed neighborhood and airport branch offices worldwide.

Combined, these businesses, which include car rental and

car-sharing services, truck rental, corporate fleet management and

retail car sales, accounted for more than $20.9 billion in revenue

and operated nearly 1.9 million vehicles throughout the world in

fiscal year 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170111005146/en/

Media contact:WEXRob Gould,

207-523-7429robert.gould@wexinc.com

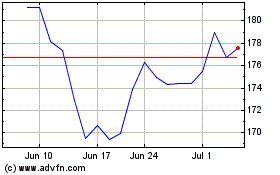

WEX (NYSE:WEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

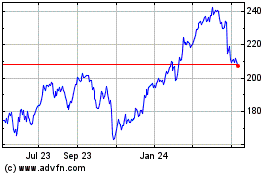

WEX (NYSE:WEX)

Historical Stock Chart

From Apr 2023 to Apr 2024