Current Report Filing (8-k)

January 10 2017 - 3:54PM

Edgar (US Regulatory)

United

States

Securities and Exchange Commission

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

December

31, 2016

Date

of Report

(Date

of Earliest Event Reported)

PCS

EDVENTURES!.COM, INC.

(Exact

name of Registrant as specified in its Charter)

|

IDAHO

|

|

000-49990

|

|

82-0475383

|

|

(State

or Other Jurisdiction of

Incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

345

Bobwhite Court, Suite 200

Boise,

Idaho 83706

(Address

of Principal Executive Offices)

(208)

343-3110

(Registrant’s

Telephone Number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions (see general instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

REFERENCES

References

in this Current Report to PCS Edventures!.com, Inc., refer to the Registrant and its subsidiaries, including the words “PCS”,

“PCSV”, “we”, “our”, “us” and words of similar import.

FORWARD-LOOKING

STATEMENTS

Except

for historical facts, all matters discussed in the Press Release attached to this Current Report, which are forward-looking, involve

a high degree of risk and uncertainty. Certain statements in this Press Release set forth management’s intentions, plans,

beliefs, expectations, or predictions of the future based on current facts and analyses. When we use the words “believe”,

“expect”, “anticipate”, “estimate”, “intend” or similar expressions, we intend

to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Actual results

may differ materially from those indicated in such statements, due to a variety of factors, risks and uncertainties. Potential

risks and uncertainties include, but are not limited to, competitive pressures from other companies within the Educational Industries,

economic conditions in the Company’s primary markets, exchange rate fluctuation, reduced product demand, increased competition,

inability to produce required capacity, unavailability of financing, government action, weather conditions and other uncertainties,

including those detailed in the Company’s SEC filings. The Company assumes no duty to update forward-looking statements

to reflect events or circumstances after the date of such statements.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On

June 8, 2016, the Company executed a Promissory Note in the amount of $340,000 with a lender who is the Company’s Chairman,

CEO and largest shareholder. The note was a combination of the renewal of other notes with the same lender. This Promissory Note

was due on December 31, 2016, is non-convertible, had an interest rate of 10% per annum and was secured by any and all current

and prospective assets of the Company.

On

November 3, 2016, the Company executed a Promissory Note in the amount of $60,000 with the same lender, which was due on December

30, 2016, and is non-convertible, had an interest rate of 10% per annum and was secured by the full faith and credit of the Company.

On

December 31, 2016, and January 1, 2017, these Promissory Notes went into default.

An

additional Promissory Note with the same lender totaling $1,292,679 has payment terms requiring consecutive monthly installments

in the sum of $50,000 per month commencing January 15, 2017. The Company anticipates that it will not be able to fund this principal

payment at that time. The Company is currently in negotiations with this lender regarding the referenced defaulted Promissory

Notes and the upcoming payment on this additional Promissory Note.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed

on its behalf by the undersigned hereunto duly authorized.

PCS

EDVENTURES!.COM, INC.

|

Dated:

|

January 10, 2017

|

|

By:

|

/s/

Michael J Bledsoe

|

|

|

|

|

Michael

J Bledsoe

|

|

|

|

|

Vice

President

|

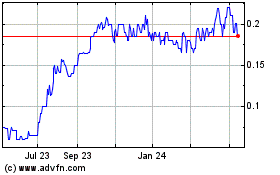

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

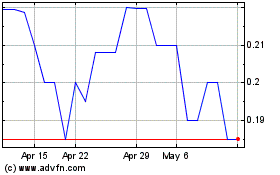

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Apr 2023 to Apr 2024