Steve Madden Announces Fourth Quarter and Fiscal Year 2016 Sales Results

January 09 2017 - 4:05PM

Business Wire

Updates Fiscal Year 2016 EPS

Guidance

Steve Madden (Nasdaq:SHOO), a leading designer and marketer of

fashion footwear and accessories for women, men and children, today

announced preliminary sales results for the fourth quarter and

fiscal year ended December 31, 2016, and updated its fiscal year

2016 EPS guidance.

For the fourth quarter, net sales were $336.4 million, down 2.3%

compared to the same period of 2015. Net sales for the wholesale

division decreased 5.1% to $251.5 million. Retail net sales

increased 7.1% to $84.9 million. Retail comparable store sales for

the fourth quarter of 2016 increased 1.1%.

For fiscal year 2016, net sales were $1.4 billion, a 0.4%

decrease compared to fiscal year 2015. Wholesale net sales

decreased 2.4% to $1.1 billion. Retail net sales increased 9.3% to

$262.8 million. Retail comparable store sales for fiscal year 2016

increased 4.0%.

Diluted EPS for fiscal year 2016 is now expected to be at the

high end of the Company’s previously provided guidance range of

$1.98 to $2.03.

Edward Rosenfeld, Chairman and Chief Executive Officer,

commented, “We are pleased with our fourth quarter performance,

with earnings per share expected to be at the high end of our

guidance range despite the challenging retail environment. Sales

were lower than anticipated, due largely to softness in cold

weather accessories as well as our decision to wind down our

relationship with our distributor in Asia as we plan to transition

to a new business model in the region in 2017. However, the sales

shortfall was offset by better-than-anticipated gross margin, with

both our wholesale footwear and wholesale accessories segments

expected to show strong gross margin improvement compared to last

year’s fourth quarter. We also expect our tax rate to be lower than

forecast due to the income tax benefit from stock option activity

during the quarter.”

Reported results are preliminary and remain subject to

adjustment until the filing of the Company's Annual Report on Form

10-K with the SEC.

The Company will be presenting at the 19th Annual ICR Conference

held at the JW Marriott Orlando Grande Lakes in Orlando, FL, on

Wednesday, January 11, 2017, at 9:30 am Eastern Time. The audio

portion of the presentation will be webcast live over the internet

and can be accessed through the Investor Relations section at

http://www.stevemadden.com/. An online archive will be available

for a period of 90 days following the presentation.

About Steve Madden

Steve Madden designs, sources and markets fashion-forward

footwear and accessories for women, men and children. In addition

to marketing products under its own brands including Steve Madden®,

Dolce Vita®, Betsey Johnson®, Report®, Big Buddha®, Brian Atwood®,

Cejon®, Blondo® and Mad Love®, Steve Madden is the licensee of

various brands, including Superga® for footwear in North America.

Steve Madden also designs and sources products under private label

brand names for various retailers. Steve Madden's wholesale

distribution includes department stores, specialty stores, luxury

retailers, national chains and mass merchants. Steve Madden also

operates 189 retail stores (including Steve Madden's four Internet

stores). Steve Madden licenses certain of its brands to third

parties for the marketing and sale of certain products, including

for ready-to-wear, outerwear, intimate apparel, hosiery, jewelry,

luggage and bedding and bath products. For local store information

and the latest Steve Madden booties, pumps, men’s and women’s

boots, dress shoes, sandals and more, visit

http://www.stevemadden.com/.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170109006165/en/

ICR, Inc.Investor RelationsJean Fontana/Megan

Crudele203-682-8200www.icrinc.com

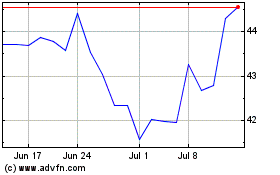

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

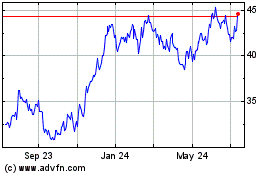

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2023 to Apr 2024