Consolidated net earnings up 23.1% on 12%

revenue increase

Simulations Plus, Inc. (NASDAQ: SLP), the premier provider of

simulation and modeling software and consulting services for all

stages of pharmaceutical discovery and development from the

earliest discovery through all phases of clinical trials, today

reported financial results for its first quarter of fiscal year

2017, the period ended November 30, 2016 (1QFY17).

1QFY17 highlights compared with 1QFY16:

- Net revenues increased 12.0%, or

$579,000, to a new first quarter record $5.42 million vs. $4.84

million

- Gross profit increased 8.7% to $4.08

million from $3.76 million

- SG&A was $1.86 million, an increase

of $187,000 or 11.2%, from $1.68 million

- SG&A as a percentage of revenues

decreased slightly from 34.6% to 34.4%

- Income before taxes increased $250,000

or 14.6%, to $1.97 million from $1.72 million

- Net income increased $255,000 or 23.1%,

to $1.36 million from $1.11 million

- Diluted earnings per share increased

22% or $0.014, to $0.078 from $0.064 per share

John Kneisel, chief financial officer of Simulations Plus, said:

“Fiscal year 2017 is starting out with good first quarter profits,

bolstered by strong consulting revenues. Our ability to effectively

leverage our operations is enabling us to grow our bottom line at

nearly twice the pace we are growing revenues, driving a 22%

improvement in earnings per share.”

Ted Grasela, Company president, added: “It is rewarding to see

the increase in business from both existing and new clients. This

represents recognition and appreciation for the quality and value

of our technology and consulting services. We are aggressively

looking to expand our staff to meet the growing demand for modeling

and simulation consulting support and are recruiting additional

software engineers to continue development of our PBPK modeling and

pharmacometrics communication platforms in order to streamline

model-based drug development activities and increase license

sales.

John DiBella, vice president for marketing and sales of

Simulations Plus, said: “The positive trend of solid software sales

and increasing requests for our consulting services continued in

1QFY17. Software license revenue increased 7.2%, driven by robust

renewal rates and 28 new organizations, or new departments at

existing organizations, now utilizing our technology. Revenue from

consulting services increased 21.1%, as we applied our technology

and expertise in a wide range of projects and engaged with 13 new

clients. Education remains a key focus for us in 2017, as we have

scheduled workshops for the U.S., Europe, and Asia to allow us to

train more scientists on the applications of our tools. This,

coupled with new releases of all major software products expected

in FY17, gives us confidence in our ability to continue expanding

our client base.”

Walt Woltosz, chairman and chief executive officer of

Simulations Plus, concluded: “Fiscal year 2017 is off to a very

good start with this record first quarter. Both divisions delivered

strong performance in this first quarter, and our Buffalo division

is now generating significant new revenues from our five-year,

nearly $5 million consulting contract with a major research

foundation in addition to our typical consulting work in that

division. Software sales continue to grow as the pharmaceutical

industry continues to adopt simulation and modeling technology to

improve productivity and reduce wasted R&D efforts on compounds

that would have failed. We expect this trend to continue in 2017,

and Simulations Plus is increasingly well-positioned to benefit

from this trend.”

Investor Conference Call

The Company has announced an investor conference call that will

be webcast live at 1:15 p.m. PST/4:15 p.m. EST on Monday, January

9, 2017. All interested parties may join the call by registering

here. On registering, you will receive a confirmation e-mail with

instructions for joining the call. Please dial in five to ten

minutes prior to the scheduled start time. For listen-only mode,

you may dial (415) 655-0052, and enter access code 187-204-517. A

replay will be available on the Simulations Plus website following

the call.

About Simulations Plus, Inc.

Simulations Plus, Inc., is a premier developer of drug discovery

and development software licensed to and used in the conduct of

drug research by major pharmaceutical and biotechnology companies

and regulatory agencies worldwide. The Company is also a leading

provider of both preclinical and clinical pharmacometric consulting

services for regulatory submissions and a global leader focused on

improving the ways scientists use knowledge and data to predict the

properties and outcomes of pharmaceutical and biotechnology agents.

Our innovations in integrating new and existing science in

medicinal chemistry, computational chemistry, pharmaceutical

science, biology, and physiology into our software have made us the

leading software provider for physiologically based pharmacokinetic

modeling and simulation. For more information, visit our website at

www.simulations-plus.com.

Follow Us on Twitter

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995 – With the exception of historical

information, the matters discussed in this press release are

forward-looking statements that involve a number of risks and

uncertainties. Words like “believe,” “expect” and “anticipate” mean

that these are our best estimates as of this writing, but that

there can be no assurances that expected or anticipated results or

events will actually take place, so our actual future results could

differ significantly from those statements. Factors that could

cause or contribute to such differences include, but are not

limited to: our ability to maintain our competitive advantages,

acceptance of new software and improved versions of our existing

software by our customers, the general economics of the

pharmaceutical industry, our ability to finance growth, our ability

to continue to attract and retain highly qualified technical staff,

our ability to identify and close acquisitions on terms favorable

to the Company, and a sustainable market. Further information on

our risk factors is contained in our quarterly and annual reports

as filed with the U.S. Securities and Exchange Commission.

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Audited) November 30, August

31, ASSETS

2016

2016

Current assets Cash and cash equivalents $ 8,844,664 $

8,030,284 Accounts receivable, net of allowance for doubtful

accounts of $0 3,417,479 3,009,517 Revenues in excess of billings

1,035,078 694,131 Prepaid income taxes - 555,486 Prepaid expenses

and other current assets

314,707

410,811 Total current assets

13,611,928 12,700,229 Long-term

assets

Capitalized computer software development

costs, net of accumulated amortization of $8,897,704 and

$8,613,487

3,963,739 4,013,127 Property and equipment, net 271,997 256,381

Intellectual property, net of accumulated amortization of

$1,560,625 and $1,408,750 4,514,375 4,666,250 Other intangible

assets net of accumulated amortization of $331,875 and $295,000

1,318,125 1,355,000 Goodwill 4,789,248 4,789,248 Other assets

34,082 34,082 Total

assets $ 28,503,494

$ 27,814,317

LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities Accounts payable $ 211,800 $ 108,111 Accrued

payroll and other expenses 563,377 481,610 Accrued bonuses to

officers 15,250 121,000 Income taxes payable 100,942 - Other

current liabilities 3,309 8,274 Current portion - Contracts payable

1,000,000 1,000,000 Billings in excess of revenues 196,799 230,100

Deferred revenue

152,290

176,422 Total current liabilities

2,243,767 2,125,517

Long-term liabilities Deferred income taxes

2,905,061 2,956,206 Total

liabilities

$ 5,148,828 $

5,081,723 Commitments and contingencies

Shareholders' equity Preferred stock, $0.001 par

value 10,000,000 shares authorized no shares issued and outstanding

$ - $ - Common stock, $0.001 par value 50,000,000 shares authorized

17,230,478 and 17,225,478 shares issued and outstanding 7,231 7,227

Additional paid-in capital 11,497,832 11,376,007 Retained earnings

11,849,603 11,349,360 Total

shareholders' equity

$ 23,354,666

$ 22,732,594

Total liabilities and shareholders' equity

$ 28,503,494

$ 27,814,317

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

For the three months ended November

30,

(Unaudited)

2016

2015

Net Revenues $ 5,417,934 $ 4,838,620

Cost of

revenues 1,335,983

1,083,347 Gross margin

4,081,951 3,755,273

Operating expenses Selling, general, and administrative

1,863,555 1,676,433 Research and development

290,300 351,307

Total operating expenses

2,153,855

2,027,740 Income from

operations 1,928,096

1,727,533 Other income (expense)

Interest income 4,456 4,467 Gain(loss) on currency exchange

34,928 (14,895

)

Total other income (expense)

39,384 (10,428

)

Income from operations before provision

for income taxes

1,967,480 1,717,105 Provision for income taxes

(605,915 ) (610,632

) Net Income $

1,361,565 $

1,106,473 Earnings per

share Basic

$ 0.08 $ 0.07 Diluted

$ 0.08 $ 0.06

Weighted-average common shares outstanding Basic

17,226,192 16,966,089 Diluted

17,409,134

17,255,068

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170109006345/en/

Simulations Plus Investor

RelationsMs. Renee Bouche,

661-723-7723renee@simulations-plus.comorHayden IRMr. Cameron Donahue,

651-653-1854cameron@haydenir.com

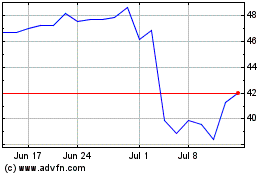

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

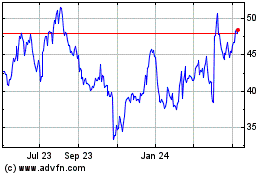

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Apr 2023 to Apr 2024