Amended Securities Registration (foreign Private Issuer) (f-4/a)

January 09 2017 - 8:24AM

Edgar (US Regulatory)

As filed with the Securities and

Exchange Commission on January 6, 2017

Registration

No. 333-214752

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No.1

To

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified

in Its Charter)

Advanced

Semiconductor Engineering, Inc.

(Translation of Registrant’s name

into English)

|

Republic of China

|

3674

|

Not Applicable

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

|

|

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

|

|

|

|

|

|

|

(Address, including zip code, and telephone number, including area code, or registrant’s principal executive offices)

|

|

|

National Corporate Research, Ltd.

10 E. 40th Street, 10th floor

New York, NY 10016

1 (800) 221 0102

|

|

|

(Name, address, including Zip code, and telephone number, including area code, of agent for service)

|

Copies to:

|

George R. Bason, Jr., Esq. James C. Lin,

Esq.

Davis Polk & Wardwell LLP

c/o 18th Floor, The Hong Kong Club Building

3A Chater Road

Hong Kong

|

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective

and the consummation of the share exchange described herein.

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering.

☐

If this Form

is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

☐

If applicable,

place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Exchange Act

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount To Be

Registered

|

Proposed Maximum Offering Price per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of

Registration Fee

|

|

Common Shares

of ASE Industrial Holding Co., Ltd., par value NT$10 per share (1)

|

903,623,606

(2)

|

Not

Applicable

|

$1,837,925,791.22

(2)(3)

|

$213,015.60 (4)

|

|

|

(1)

|

American depositary shares issuable upon deposit of the shares registered hereby will be registered under a separate registration

statement on Form F-6. Each American depositary share will represent 2 common shares of ASE Industrial Holding Co., Ltd.

|

|

|

(2)

|

Based upon the estimated number of common shares of ASE Industrial Holding Co., Ltd. that may be issued to U.S. holders of

the common shares of the Registrant in connection with the share exchange described herein, using the share exchange ratios

described herein. This estimate is based upon (a) the actual number of shares of the common shares represented by outstanding

American depositary shares of Registrant as of August 21, 2016, and (b) the estimated number of shares of common shares of

Advanced Semiconductor Engineering, Inc. (excluding shares represented by American depositary shares but including the number

of shares of ASE Industrial Holding Co., Ltd. that may be sold in the Taiwanese market in respect of the fractional shares

that otherwise would be received by U.S. holders of the Registrant’s common shares in the share exchange) as of August

21, 2016, the most recent date for which information with respect to U.S. resident holders can be determined. The securities

to be issued in connection with the transaction outside of the United States are not registered under this registration statement.

|

|

|

(3)

|

Pursuant to Rule 457(f) under the Securities Act of 1933, the

filing fee was calculated based on the market value of the securities of the Registrant

to be exchanged in the share exchange described herein for securities of ASE Industrial

Holding Co., Ltd., calculated pursuant to Rule 457(c) by taking the average of the high

and low prices per share of the Registrant’s common shares as reported on the Taiwan

Stock Exchange as of January 4, 2017 (converted into U.S. dollars based on NT$32.40 =

US$1.00, which is the exchange rate set forth in the H.10 statistical release of the

Federal Reserve Board as in effect on December 30, 2016, the latest available exchange

rate set forth in the H.10 statistical release of the Federal Reserve Board) multiplied

by 1,807,247,212, which is the total number of shares of the Registrant’s common

shares held of record by U.S. holders on August 21, 2016, the most recent date for which

information with respect to the Registrant’s U.S. record holders can be determined),

and multiplying the result by 0.0001159.

|

|

|

(4)

|

The Registrant previously paid a registration fee of US$222,019.64

in connection with the initial filing of the registration statement on Form F-4 (No.

333-214752) previously filed on November 22, 2016.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective

date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement

shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

The information in this proxy statement/prospectus is subject to completion and amendment. A registration

statement relating to the securities described in this proxy statement/prospectus has been filed with the Securities and Exchange

Commission. These securities may not be sold nor may offers to buy these securities be accepted prior to the time the registration

statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of any offer

to buy nor shall there be any sale of these securities in any jurisdiction, in which such offer, solicitation or sale would be

unlawful prior to registration under the securities laws of any such jurisdiction.

|

PRELIMINARY—SUBJECT

TO COMPLETION, DATED

JANUARY 6, 2017

PROXY STATEMENT/PROSPECTUS PROPOSED SHARE

EXCHANGE

—YOUR VOTE IS IMPORTANT

Dear ASE Shareholders:

We are pleased to report that Advanced

Semiconductor Engineering, Inc. (“ASE”) and Siliconware Precision Industries Co., Ltd. (“SPIL”) have entered

into a joint share exchange agreement (“Joint Share Exchange Agreement”) pursuant to which a holding company, ASE Industrial

Holding Co., Ltd. (“HoldCo”), will be formed by means of a statutory share exchange pursuant to the laws of the Republic

of China, and HoldCo will (i) acquire all issued shares of ASE in exchange for shares of HoldCo using the share exchange ratio

as described below, and (ii) acquire all issued shares of SPIL using the cash consideration as described below (the “Share

Exchange”). Upon the consummation of the Share Exchange, ASE and SPIL will become wholly owned subsidiaries of HoldCo concurrently.

Subject to the Share Exchange, the Joint Share Exchange Agreement and the other transactions contemplated thereby being approved

by shareholders of ASE and SPIL, and upon the satisfaction of the other conditions for completing the Share Exchange, HoldCo will

be formed — and the Share Exchange is expected to become effective — on or around [DATE], 2017.

Pursuant to the terms and subject to the

conditions set forth in the Joint Share Exchange Agreement, at the effective time of the Share Exchange (the “Effective Time”):

|

|

(i)

|

for SPIL shareholders:

|

|

|

·

|

each SPIL common share, par value NT$10 per share (“SPIL Common Share”), issued immediately prior to the Effective

Time (including SPIL’s treasury shares and the SPIL Common Shares beneficially owned by ASE), will be transferred to HoldCo

in consideration for the right to receive NT$51.2, which represents NT$55,

minus

a cash dividend and a return of capital

reserve of NT$3.8 per SPIL Common Share distributed by SPIL on July 1, 2016, payable in cash in NT dollars, without interest and

net of any applicable withholding taxes (“SPIL Common Shares Cash Consideration”); and

|

|

|

·

|

each SPIL American depositary share, currently representing five SPIL Common Shares (“SPIL ADS”) will be cancelled

in exchange for the right to receive through JPMorgan Chase Bank, N.A., as depositary for the SPIL ADSs (“SPIL Depositary”),

the US dollar equivalent of NT$256 (representing five times of the SPIL Common Shares Cash Consideration)

minus

(i) all

processing fees and expenses per SPIL ADS in relation to the conversion from NT dollars into US dollars, and (ii) US$0.05 per SPIL

ADS cancellation fees pursuant to the terms of the deposit agreement dated January 6, 2015 by and among SPIL, SPIL Depositary and

the holders and beneficial owners from time to time of the SPIL ADSs issued thereunder, payable in cash in US dollars, without

interest and net of any applicable withholding taxes (“SPIL ADS Cash Consideration,” together with the SPIL Common

Shares Cash Consideration, “Cash Consideration”).

|

The Cash Consideration will be subject

to adjustments if SPIL issues shares or pays cash dividends during the period from the execution date of the Joint Share Exchange

Agreement to the Effective Time, provided, however, that the Cash Consideration shall not be subject to adjustment if the aggregate

amount of the cash dividends distributed by SPIL in fiscal year 2017 is less than 85% of its after-tax net profit for fiscal year

2016.

|

|

(ii)

|

for ASE shareholders:

|

|

|

·

|

each

ASE common

share (“ASE Common Share”), par value NT$10 per share, issued immediately prior to the Effective Time (including ASE’s

treasury shares), will be transferred to HoldCo in consideration for the right to receive 0.5 HoldCo common shares (“HoldCo

Common Shares”), par value NT$10 per share; and

|

|

|

·

|

each ASE American depositary share, currently representing

five ASE Common Shares (“ASE ADSs”), will represent the right to receive 1.25 HoldCo American depositary shares, each

representing two HoldCo Common Shares (“HoldCo ADSs”) upon surrender for cancellation to Citibank, N.A., as depositary

for the ASE ADSs, after the Effective Time. The ratio at which ASE Common Shares will be exchanged for HoldCo Common Shares and

ASE ADSs will be exchanged for HoldCo ADSs is hereinafter referred to as the “Exchange Ratio.”

|

Under Republic of China law, if any fractional

HoldCo Common Shares representing less than one common share would otherwise be allotted to former holders of ASE Common Shares

in connection with the Share Exchange, those fractional shares will not be issued to those shareholders. Pursuant to the Joint

Share Exchange Agreement, ASE will aggregate the fractional entitlements and sell the aggregated ASE Common Shares using the closing

price of ASE Common Shares on the Taiwan Stock Exchange (the “TWSE”) on the ninth (9

th

) ROC Trading Day

(as defined below) prior to the Effective Time, to an appointee of the Chairman of HoldCo. The cash proceeds from the sale will

be distributed to the former holders of ASE Common Shares by HoldCo on a proportionate basis in accordance with their respective

fractions at the Effective Time.

If you hold ASE ADSs, you will be able

to exchange those ASE ADSs for HoldCo ADSs by delivering your ASE ADSs to Citibank, N.A., as depositary, after the Effective Time.

Citibank, N.A., as depositary for the ASE ADSs, will only distribute whole HoldCo ADSs. Citibank, N.A., as depositary for the ASE

ADSs, will aggregate the fractional entitlements to HoldCo ADSs, will use commercially reasonable efforts to sell the aggregated

HoldCo ADS entitlements in the open market and will distribute the net cash proceeds to the holders of ASE ADSs entitled to them.

Subject to approval at the ASE EGM (as

defined below), HoldCo will issue 3,961,811,298 HoldCo Common Shares (based on the number of issued shares of ASE on September

30, 2016) in connection with the Share Exchange.

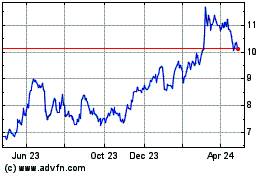

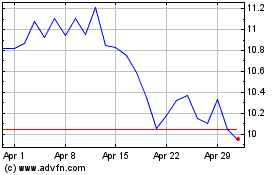

ASE Common Shares are listed and traded

on the TWSE under the ticker “2311” and ASE ADSs are listed and traded on the New York Stock Exchange (“NYSE”)

under the ticker symbol “ASX.” On [DATE], 2017, the most recent practicable trading day prior to the printing of this

proxy statement/prospectus, the closing price per ASE Common Share on the TWSE was NT$[

·

]

(US$[

·

]), and the closing price per ASE ADS on the NYSE was US$[

·

].

SPIL Common Shares are listed and traded on the TWSE under the ticker “2325” and SPIL ADSs are listed and traded on

the NASDAQ National Market (“NASDAQ”) under the ticker symbol “SPIL.” On [DATE], 2017, the most recent

practicable trading day prior to the printing of this proxy statement/prospectus, the closing price per SPIL Common Share on the

TWSE was NT$[

·

] (US$[

·

]), and the

closing price per SPIL ADS on NASDAQ was US$[

·

]. Following completion of the Share

Exchange, ASE anticipates that the HoldCo Common Shares will trade on the TWSE and HoldCo ADSs will trade on the NYSE.

Before the Share Exchange can be completed,

ASE shareholders must vote to approve, among other things, the Share Exchange and the other transactions contemplated by the Joint

Share Exchange Agreement, and SPIL shareholders must vote to approve the Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement. If you are an ASE shareholder, ASE is sending you this proxy statement/prospectus to ask

you to vote in favor of these matters.

The extraordinary general shareholders’

meeting of ASE shareholders (the “ASE EGM”) is expected to be held on [DATE], 2017, at [TIME] (Taiwan time), at Zhuang

Jing Auditorium, 600 Jiachang Road, Nantze Export Processing Zone, Nantze District, Kaohsiung

City, Taiwan, Republic of China. At this ASE EGM, ASE shareholders will be asked to approve, among other things, the Share Exchange

and the other transactions contemplated by the Joint Share Exchange Agreement. More information about the proposals to be voted

on at this ASE EGM is contained in this proxy statement/prospectus.

The board of directors of ASE has unanimously determined

that (i) the Exchange Ratio constitutes fair value for each ASE Common Share and each ASE ADS, and (ii) the Joint Share Exchange

Agreement and the transactions contemplated thereby are advisable, fair to and in the best interests of ASE and its shareholders.

The board of directors of ASE recommends that ASE shareholders vote “FOR” the approval of the Share Exchange and the

other transactions contemplated by the Joint Share Exchange Agreement and “FOR” the approval of the other proposals

to be voted on at this ASE EGM as described in this proxy statement/prospectus.

To attend and vote at the ASE EGM under

Republic of China law, holders of ASE Common Shares must follow the procedures outlined in the convocation notice, which will be

sent to those holders by ASE. To give voting instructions to the depositary for the ASE ADSs, holders of ASE ADSs must follow the

procedures outlined in the notice of the ASE EGM that Citibank, N.A., as depositary for the ASE ADSs, will separately send to those

ASE ADS holders.

This proxy statement/prospectus is

an important document containing answers to frequently asked questions, a summary description of the transactions contemplated

by the Joint Share Exchange Agreement and more detailed information about ASE, SPIL, the Joint Share Exchange Agreement, the Share

Exchange and the other transactions contemplated by the Joint Share Exchange Agreement and the other matters to be voted upon

by ASE shareholders as part of the ASE EGM. We urge you to read this proxy statement/prospectus and the documents incorporated

by reference carefully and in their entirety.

In particular, you should consider the matters discussed in the section entitled

“Risk Factors” beginning on page 61.

Thank you for your cooperation and continued

support.

Sincerely,

|

Jason C.S. Chang

Chairman and Chief Executive Officer

Advanced Semiconductor Engineering, Inc.

|

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of the Share Exchange or the securities to be issued

in connection therewith, or determined if this proxy statement/prospectus is accurate or complete. Any representation to the contrary

is a criminal offense.

You may have dissenters’ rights

in connection with the transactions under the laws of the Republic of China. See page 57 for a complete discussion of your dissenters’

rights, if any.

This document is dated [DATE], 2017 and

is first being delivered to ASE shareholders on or about [DATE], 2017.

NOTICE OF EXTRAORDINARY GENERAL MEETING

To

Be Held On [DATE], 2017

Dear Shareholders:

This is a notice that Advanced Semiconductor

Engineering, Inc. (“ASE”) will hold an Extraordinary General Meeting (the “ASE EGM”) on [DATE], 2017, at

[TIME], and the location is expected to be at Zhuang Jing Auditorium, 600 Jiachang Road, Nantze Export Processing Zone, Nantze

District, Kaohsiung City, Taiwan, Republic of China.

At the ASE EGM, we will discuss, and ASE

shareholders will vote on, the following proposals:

|

|

·

|

Proposal

1. To consider and to vote upon the joint share exchange agreement entered into between

Advanced Semiconductor Engineering, Inc. and Siliconware Precision Industries Co., Ltd.

on June 30, 2016 (the “Joint Share Exchange Agreement”) and the proposed

share exchange and the other transactions contemplated by the Joint Share Exchange Agreement

|

|

|

·

|

Proposal 2. To consider and to vote upon the adoption of the articles of incorporation of ASE Industrial Holding Co.,

Ltd.

|

|

|

·

|

Proposal 3. To consider and to vote upon the Rules of Procedure for Shareholders' Meetings of ASE Industrial Holding

Co., Ltd.

|

|

|

·

|

Proposal 4. To consider and to vote upon the Rules Governing the Election of Directors and Supervisors of ASE Industrial

Holding Co., Ltd.

|

|

|

·

|

Proposal 5. To consider and to vote upon the Procedures for Lending Funds to Other Parties of ASE Industrial Holdings

Co. Ltd. and Procedures of Making the Endorsement and Guarantees of ASE Industrial Holding Co., Ltd.

|

|

|

·

|

Proposal 6. To consider and to vote upon the Procedures for Acquisition or Disposal of Assets of ASE Industrial Holding

Co., Ltd.

|

|

|

·

|

Proposal 7. To consider and elect the members of the board of directors and supervisors of ASE Industrial Holding

Co., Ltd.

|

|

|

·

|

Proposal 8. To consider and to vote upon the proposal to waive the non-competition clauses applicable to newly elected

directors of ASE Industrial Holding Co., Ltd.

|

This proxy statement/prospectus

describes the proposals listed above in more detail. Please refer to the attached document, including the Joint Share Exchange

Agreement and all other annexes and including any documents incorporated by reference, for further information with respect to

the business to be transacted at the ASE EGM. You are encouraged to read the entire document carefully before voting.

In particular,

see the section entitled “Risk Factors.”

The record date for the determination of

shareholders entitled to vote at the ASE EGM will be [DATE], 2017 (the “ASE EGM Record Date”). Only ASE shareholders

who hold common shares of ASE, par value NT$10 per share (“ASE Common Shares”), of

record on the ASE EGM Record Date are entitled to vote at the ASE EGM, or to exercise the appraisal rights conferred on dissenting

shareholders by the laws of the Republic of China. Each ASE Common Share entitles its holder to one vote at the ASE EGM on each

of the proposals. You may exercise voting rights by electronic means or by attending the ASE EGM in person or by proxy using a

duly authorized power of attorney in the prescribed form attached to the notice of convocation distributed by ASE prior to the

ASE EGM. You may exercise your voting right by electronic means beginning from the fifteenth (15

th

) calendar day prior

to the ASE EGM until the third calendar day prior to the day of the ASE EGM. Shareholders who intend to exercise voting right electronically

must log in to the website maintained by the Taiwan Depository & Clearing Corporation (“TDCC”) (https://www.stockvote.com.tw)

and proceed in accordance with the instructions provided therein.

If you own American depositary shares of

ASE (“ASE ADSs”), each representing five ASE Common Shares, Citibank, N.A. (“Citibank”), as depositary

for the ASE ADSs (the “ASE Depositary”), will send to holders of ASE ADSs as of [DATE], 2017, a voting instruction

card and notice which outlines the procedures those holders must follow to give proper voting instructions to the ASE Depositary.

In accordance with and subject to the terms of the amended and restated deposit agreement, dated as of September 29, 2000 and as

amended and restated (as so amended and restated, the “ASE Deposit Agreement”), by and among Citibank, as ASE Depositary,

ASE, and the holders and beneficial owners of ASE ADSs, holders of ASE ADSs have no individual voting rights with respect to the

ASE Common Shares represented by their ASE ADSs. Pursuant to the ASE Deposit Agreement, each holder of ASE ADSs is deemed to have

authorized and directed the ASE Depositary to appoint the Chairman of ASE or his/her designate (the Chairman or his/her designate,

the “Voting Representative”), as representative of the ASE Depositary, the custodian or the nominee who is registered

in the Republic of China as representative of the holders of ASE ADSs to vote the ASE Common Shares represented by ASE ADSs as

more fully described below.

In accordance with and subject to the terms

of the ASE Deposit Agreement, if holders of ASE ADSs together holding at least 51% of all the ASE ADSs outstanding as of the record

date set by the ASE Depositary for the ASE EGM to vote on the proposed Share Exchange and the other transactions contemplated by

the Joint Share Exchange Agreement, instruct the ASE Depositary, prior to the ASE ADS voting instructions deadline, to vote in

the same manner with respect to the Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement,

the ASE Depositary shall notify the Voting Representative and appoint the Voting Representative as the representative of the ASE

Depositary and the holders of ASE ADSs to attend the ASE EGM and vote all ASE Common Shares represented by ASE ADSs outstanding

in the manner so instructed by such holders. If voting instructions are received from an ASE ADS holder by the ASE Depositary as

of the ASE ADS voting instructions deadline, which are signed but without further indication as to voting instructions, the ASE

Depositary shall deem such holder to have instructed a vote in favor of the items set forth in such instructions.

Furthermore, in accordance with and subject

to the terms of the ASE Deposit Agreement, if, for any reason, the ASE Depositary has not, prior to the ASE ADS voting instructions

deadline, received instructions from holders of ASE ADSs together holding at least 51% of all ASE ADSs outstanding as of the record

date set by the ASE Depositary for the ASE EGM to vote for the proposed Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement, to vote in the same manner with respect to the proposed Share Exchange and the other transactions

contemplated by the Joint Share Exchange Agreement, the holders of all ASE ADSs shall be deemed to have authorized and directed

the ASE Depositary to give a discretionary proxy to the Voting Representative, as the representative of the holders of ASE ADSs,

to attend the ASE EGM and vote all the ASE Common Shares represented by ASE ADSs then outstanding in his/her discretion; provided,

however, that the ASE Depositary will not give a discretionary proxy as described if it fails to receive under the terms of the

ASE Deposit Agreement a satisfactory opinion from ASE’s counsel prior to the ASE EGM. In such circumstances, the Voting Representative

shall be free to exercise the votes attaching to the ASE Common Shares represented by ASE in any manner he/she wishes, which may

not be in the best interests of the ASE ADS holders. [The Voting Representative has informed ASE that he plans as of the date of

this proxy statement/prospectus to vote in favor of all of the proposals at the ASE EGM, although he has not entered into any agreement

obligating him to do so.]

The board of directors of ASE has unanimously

determined that the Joint Share Exchange Agreement and the transactions contemplated thereby, including the proposed Share Exchange,

are advisable, fair to and in the best interests of ASE and its shareholders. The board of directors of ASE recommends that ASE

shareholders vote “FOR” each of the proposals set forth above.

YOUR VOTE IS VERY IMPORTANT REGARDLESS

OF THE NUMBER OF SHARES THAT YOU OWN

. The proposed Share Exchange cannot be completed without ASE shareholders approving, among

other things, the completion by ASE of the proposed

Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement by either (x) the approval of one-half

of the shares present at the ASE EGM if at least two-thirds of ASE’s outstanding shares attend the ASE EGM, or (y) the approval

of two-thirds of the shares present at the ASE EGM if at least one-half of ASE’s outstanding shares attend the ASE EGM.

ASE is not asking for a proxy and you

are not required to send a proxy to ASE. However, ASE Enterprises Limited, a shareholder of ASE has advised us that it intends

to solicit proxies in favor of the authorization and approval of the proposed Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement.

If you have any questions concerning the

Joint Share Exchange Agreement or the other transactions contemplated by the Joint Share Exchange Agreement, including the proposed

Share Exchange, or this proxy statement/prospectus, or would like additional copies or need help voting your ASE Common Shares,

please contact ASE Investor Relations Department at +886-2-6636-5678 or ir@aseglobal.com, or Citibank Shareholder Services at 1-877-CITI-ADR

(248-4237) for questions related to your ASE ADSs.

|

On behalf of the Board of Directors

|

|

|

|

Jason C.S. Chang

Chairman of the Board of Directors

|

ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates

important business and financial information about ASE and SPIL that is not included in or delivered with this proxy statement/prospectus.

This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated

by reference into this proxy statement/prospectus free of charge by requesting them in writing or by telephone from ASE at the

following address and telephone number:

Advanced Semiconductor Engineering,

Inc.

e-mail:

ir@aseglobal.com

Tel: +886-2-6636-5678

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, Taiwan, 110

Republic of China

Attention: Investor Relations

|

If you would like to request any documents,

please do so by [DATE], 2017 in order to receive them before the ASE EGM.

For a more detailed description of the

information incorporated by reference into this proxy statement/prospectus and how you may obtain it, see the section entitled

“Where You Can Find More Information.”

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which

forms part of a registration statement on Form F-4 filed by ASE with the U.S. Securities and Exchange Commission (the “SEC”),

constitutes a prospectus of ASE under the Securities Act of 1933, as amended (the “Securities Act”), with respect

to the HoldCo Common Shares to be issued to ASE shareholders in connection with the Share Exchange. This proxy statement/prospectus

also constitutes a proxy statement for ASE under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

It also constitutes a notice of meeting with respect to the ASE EGM.

You should rely only on the information

contained in or incorporated by reference into this proxy statement/prospectus. No one has been authorized to provide you with

information that is different from that contained in, or incorporated by reference into, this proxy statement/prospectus. This

proxy statement/prospectus is dated January 6, 2017, and you should assume that the information contained in this proxy statement/prospectus

is accurate only as of such date. You should also assume that the information incorporated by reference into this proxy statement/prospectus

is only accurate as of the date of such information.

This proxy statement/prospectus does

not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction

in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction. Information contained

in this proxy statement/prospectus regarding ASE has been provided by ASE and information contained in this proxy statement/prospectus

regarding SPIL has been provided by SPIL.

table

of contents

Page

Definitions

As used in this proxy statement/prospectus,

the following defined terms have the following respective meanings:

|

|

·

|

“ASE” or the “Registrant” refers to Advanced Semiconductor Engineering, Inc. and, as the context requires,

its subsidiaries;

|

|

|

·

|

“ASE ADS(s)” refers to the American depositary share(s) issued by the ASE Depositary under the ASE Deposit Agreement.

Each ASE ADS represents five ASE Common Shares;

|

|

|

·

|

“ASE Common Share(s)” refers to the common share(s) of ASE, par value NT$10 per share;

|

|

|

·

|

“ASE Depositary” or “Citibank” refers to Citibank, N.A., as depositary for the ASE ADSs under the ASE

Deposit Agreement;

|

|

|

·

|

“ASE Deposit Agreement” refers to the Amended and Restated Deposit Agreement, dated as of September 29, 2000, by

and among ASE, Citibank and the Holders and Beneficial Owners of ASE ADSs, as amended by Amendment No. 1 to Amended and Restated

Deposit Agreement, dated as of April 6, 2006, and by Amendment No. 2 to Amended and Restated Deposit Agreement, dated as of November

27, 2006;

|

|

|

·

|

“ASE Share(s)” refers to ASE Common Share(s) and ASE ADS(s), collectively;

|

|

|

·

|

“Effective Time” refers to the effective time of the Share Exchange;

|

|

|

·

|

“Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended;

|

|

|

·

|

“FSC” refers to Financial Supervisory Commission of the ROC;

|

|

|

·

|

“HoldCo” refers to ASE Industrial Holding Co., Ltd., the holding company that will be formed at the Effective Time

as the parent company of ASE and SPIL as a result of the Share Exchange;

|

|

|

·

|

“HoldCo ADS(s)” refers to the American depositary share(s) that will be issued to ASE ADS holders upon the consummation

of the Share Exchange pursuant to a new American depositary receipt facility to be established by HoldCo with the HoldCo Depositary

upon the terms of the HoldCo Deposit Agreement. Each HoldCo ADS will represent two HoldCo Common Shares;

|

|

|

·

|

“HoldCo Common Share(s)” refers to the common share(s) of HoldCo, par value NT$10 per share, that will be issued

upon the consummation of the Share Exchange;

|

|

|

·

|

“HoldCo Depositary” refers to Citibank, N.A. in its capacity as depositary for the HoldCo ADSs pursuant to the

terms of the HoldCo Deposit Agreement;

|

|

|

·

|

“HoldCo Deposit Agreement” refers to the deposit agreement for the HoldCo ADSs to be entered into by HoldCo and

Citibank, N.A., as HoldCo Depositary, at the Effective Time of the Share Exchange, and to which the holders and beneficial owners

of HoldCo ADSs become parties upon acceptance of HoldCo ADSs;

|

|

|

·

|

“HoldCo Shares” refers to HoldCo Common Shares and HoldCo ADSs, collectively;

|

|

|

·

|

“IFRS” refers to International Financial Reporting Standards as issued by the International Accounting Standards

Board;

|

|

|

·

|

“Joint Share Exchange Agreement” refers to the Joint Share Exchange Agreement, dated June 30, 2016, by and between

ASE and SPIL; an English translation is included as Annex A to this proxy statement/prospectus;

|

|

|

·

|

“NASDAQ” refers to the NASDAQ National Market;

|

|

|

·

|

“non-ROC holder” refers to a non-resident individual or non-resident entity that owns ASE Common Shares or ADSs

or HoldCo Common Shares or ADSs. As used in the preceding sentence, a “non-resident individual” is a non-ROC national

who owns ASE Common Shares or ADSs or HoldCo Common Shares or ADSs and is not physically present in the ROC for 183 days or more

during any calendar year, and a “non-resident entity” is a corporation or a non-corporate body that owns ASE Common

Shares or ADSs or HoldCo Common Shares or ADSs, is organized under the laws of a jurisdiction other than the ROC and has no fixed

place of business or business agent in the ROC;

|

|

|

·

|

“NT$” and “NT dollars” refers to New Taiwan dollars, the official currency of the ROC;

|

|

|

·

|

“NYSE” refers to the New York Stock Exchange;

|

|

|

·

|

“PRC” or “China” refers to the People’s Republic of China, excluding, for purposes of this proxy

statement/prospectus, Hong Kong, the Macau Special Administrative Region and Taiwan;

|

|

|

·

|

“ROC” or “Taiwan” refers to the Republic of China;

|

|

|

·

|

“ROC Company Law” refers to the Company Law of the ROC;

|

|

|

·

|

“ROC Mergers and Acquisitions Act” refers to the Business Mergers and Acquisitions Act of the ROC;

|

|

|

·

|

“ROC Trading Day” refers to a day when TWSE is open for business;

|

|

|

·

|

“Share Exchange”

refers to the transactions pursuant to

which ASE will file an application with the TWSE and other competent authorities to establish HoldCo by means of a statutory share

exchange, HoldCo will acquire all issued shares of each of ASE and SPIL and ASE and SPIL will become wholly owned subsidiaries

of HoldCo concurrently

;

|

|

|

·

|

“Securities Act” refers to the U.S. Securities Act of 1933, as amended;

|

|

|

·

|

“SEC” refers to the U.S. Securities and Exchange Commission;

|

|

|

·

|

“SPIL” refers to Siliconware Precision Industries Co., Ltd., and, as the context requires, its subsidiaries;

|

|

|

·

|

“SPIL ADS(s)” refers to the American depositary shares issued by the SPIL Depositary under the SPIL Deposit Agreement.

Each SPIL ADS represents five SPIL Common Shares;

|

|

|

·

|

“SPIL Common Share(s)” refers to the common share(s) of SPIL, par value NT$10 per share;

|

|

|

·

|

“SPIL Depositary” refers to JPMorgan Chase Bank, N.A., as depositary for the SPIL ADSs under the SPIL Deposit Agreement;

|

|

|

·

|

“SPIL Deposit Agreement” refers to the Amended and Restated Deposit Agreement, dated as of January 6, 2015, by

and among SPIL, JPMorgan Chase Bank, N.A., as SPIL Depositary, and the Holders and Beneficial Owners of SPIL ADSs, as amended;

|

|

|

·

|

“TWSE” refers to the Taiwan Stock Exchange;

|

|

|

·

|

“U.S.” refers to the United States of America; and

|

|

|

·

|

“US$” and “U.S. dollars” refers to United States dollars, the official currency of the United States

of America.

|

For your convenience, this prospectus contains

translations of certain NT dollar amounts into U.S. dollar amounts at a rate of NT$31.27 to US$1.00, the exchange rate set forth

in the H.10 statistical release of the Federal Reserve Board on September 30, 2016, unless otherwise stated. We make no representation

that any NT dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or NT dollars, as the case

may be, at any particular rate, or at all.

Questions

and Answers about the Share Exchange

|

|

Q.

|

Why am I receiving this document?

|

|

|

A.

|

ASE and SPIL have entered into a Joint Share Exchange Agreement pursuant to which a holding company, HoldCo, will be established

by means of a statutory share exchange pursuant to the laws of the ROC, and HoldCo will (i) acquire all issued shares of ASE in

exchange for shares of HoldCo using the Exchange Ratio as described below, and (ii) acquire all issued SPIL Common Shares using

the cash consideration as described below. Upon the consummation of the Share Exchange, ASE and SPIL will become wholly owned subsidiaries

of HoldCo concurrently.

|

Before the Share Exchange can be

completed, ASE shareholders must vote to approve, among other things, the Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement. If you are an ASE shareholder, ASE is sending you this proxy statement/prospectus to ask

you to vote in favor of these matters. ASE will hold the ASE EGM on [DATE], 2017 to obtain these approvals and the approval of

certain other proposals that are not conditions to the completion of the Share Exchange.

This proxy statement/prospectus,

which you should read carefully, contains important information about the Joint Share Exchange Agreement, the Share Exchange and

the other transactions contemplated by the Joint Share Exchange and other matters being considered at the ASE EGM. The enclosed

voting materials allow you to vote your shares without attending the applicable shareholders’ meeting. Your vote is very

important and we encourage you to submit your vote or proxy as soon as possible.

|

|

Q.

|

What will SPIL shareholders receive in the Share Exchange?

|

|

|

A.

|

As of the Effective Time of the Share Exchange:

|

|

|

·

|

each SPIL Common Share, par value NT$10 per share, issued immediately prior to the Effective Time (including SPIL’s treasury

shares and the SPIL Common Shares beneficially owned by ASE), will be transferred to HoldCo in consideration for the right to receive NT$51.2,

which represents NT$55

minus

a cash dividend and a return of capital reserve of NT$3.8 per SPIL Common Share distributed

by SPIL on July 1, 2016, payable by HoldCo in cash in NT dollars, without interest and net of any applicable withholding taxes;

and

|

|

|

·

|

each SPIL ADS will be cancelled in exchange for the right

to receive through SPIL Depositary, the US dollar equivalent of NT$256 (representing five times of the SPIL Common Shares Cash

Consideration)

minus

(i) all processing fees and expenses per SPIL ADS in relation to the conversion from NT dollars into

US dollars, and (ii) US$0.05 per SPIL ADS cancellation fees pursuant to the terms of the SPIL Deposit Agreement payable in cash

in US dollars, without interest and net of any applicable withholding taxes.

|

The Cash Consideration will be subject

to adjustments if SPIL issues shares or pays cash dividends during the period from the execution date of the Joint Share Exchange

Agreement to the Effective Time, provided, however, that the Cash Consideration shall not be subject to adjustment if the aggregate

amount of the cash dividends distributed by SPIL in fiscal year 2017 is less than 85% of its after-tax net profit for fiscal year

2016, which is described further in the section entitled “The Joint Share Exchange Agreement—Adjustment to the Consideration.”

|

|

Q.

|

What will ASE shareholders receive in the Share Exchange?

|

|

|

A.

|

As of the Effective Time:

|

|

|

·

|

each

ASE Common

Share, par value NT$10 per share, issued immediately prior to the Effective Time (including ASE’s treasury shares), will

be transferred to HoldCo in consideration for the right to receive 0.5 HoldCo Common Shares; and

|

|

|

·

|

each ASE ADS, currently representing five ASE Common Shares, will, after the Effective Time, represent the right to receive

1.25 HoldCo ADSs, each HoldCo ADS representing two HoldCo Common Shares, upon surrender for cancellation to the ASE Depositary

after the Effective Time.

|

|

|

Q:

|

How will fractional entitlements to HoldCo Common Shares be handled in the Share Exchange?

|

|

|

A:

|

ASE will aggregate the fractional entitlements to HoldCo Common Shares and sell the aggregated HoldCo Common Shares using the

closing price of ASE Common Shares on the TWSE on the ninth (9

th

) ROC Trading Day prior to the Effective Time, to an

appointee of the Chairman of HoldCo. The cash proceeds from the sale will be distributed to the former holders of ASE Common Shares

by HoldCo on a proportionate basis in accordance with their respective fractions at the Effective Time.

|

|

|

Q:

|

How will fractional entitlements to HoldCo ADSs be handled in the Share Exchange?

|

|

|

A:

|

The ASE Depositary (Citibank) will aggregate the fractional entitlements to HoldCo ADSs, use commercially reasonable efforts

to sell the aggregated fractional entitlements to HoldCo ADSs on the open market, and remit the net cash proceeds (after deducting

applicable taxes, fees and expenses, including sales commissions) to the holders of ASE ADSs entitled to them.

|

|

|

Q.

|

How do the HoldCo Common Shares differ from ASE Common Shares?

|

|

|

A.

|

HoldCo Common Shares will not materially differ from ASE Common Shares from a legal perspective.

|

|

|

Q.

|

How do the HoldCo ADSs differ from ASE ADSs?

|

|

|

A.

|

HoldCo ADSs will not materially differ from ASE ADSs from a legal perspective.

|

|

|

Q.

|

When is the Share Exchange expected to be completed?

|

|

|

A.

|

The Share Exchange is expected to be completed on or promptly after [DATE], 2017.

|

|

|

Q.

|

What is the record date for voting at the ASE EGM?

|

|

|

A.

|

The record date for voting at the ASE EGM is on or about [DATE], 2017.

|

|

|

Q.

|

How do I vote at the ASE EGM?

|

|

|

A.

|

You may exercise voting rights as a shareholder by electronic means or by attending the ASE EGM, as applicable, in person or

by proxy.

|

You may exercise your voting right

by electronic means beginning from the fifteenth (15

th

) calendar day prior to the ASE EGM, as applicable, until the

third calendar day prior to the day of the ASE EGM (the “Electronic Voting Period”). Shareholders who intend to exercise

voting rights electronically must login to the website maintained by the TDCC (

https://www.stockvote.com.tw

) and proceed

in accordance with the instructions provided therein.

You may exercise your voting rights

by attending the ASE EGM in person or by proxy using a duly authorized power of attorney in the prescribed form attached to the

notice of convocation distributed by ASE prior to the respective ASE EGM.

|

|

Q:

|

How will shares being represented at the ASE EGM by voting cards be treated?

|

|

|

A:

|

The voting cards used for the ASE EGM will describe the proposals to be voted on by shareholders at the ASE EGM, as applicable,

including approval of the Share Exchange. The voting cards will allow shareholders to indicate a ‘‘for’’

or ‘‘against’’ vote with respect to each proposal.

|

If you previously voted through

the electronic voting website, you may change or revoke your previous voting by logging in to the electronic voting website anytime

within the Electronic Voting Period. If you revoked your electronic voting within the Electronic Voting Period, you may attend

the ASE EGM, as applicable, and vote in person.

If you previously presented a valid

proxy or exercised your vote through the electronic voting website but then wish to attend the ASE EGM in person, you are required

to revoke your proxy in writing addressed to ASE or revoke your electronic vote by logging in to the electronic voting website

at least two (2) calendar days prior to the ASE EGM. Otherwise, the voting right exercised by your proxy or through the electronic

voting website will prevail.

|

|

Q:

|

How do I vote if I own ASE ADSs?

|

|

|

A:

|

The ASE Depositary will send to holders of ASE ADSs as of [DATE], 2017, a voting instruction card and notice, which outlines

the procedures those holders must follow to give proper voting instructions to the ASE Depositary.

|

|

|

Q:

|

If I own ASE ADSs, what steps must I take to exchange my ASE ADSs for HoldCo ADSs?

|

|

|

A:

|

If you hold physical certificates, also known as ASE American depositary receipts (“ASE ADRs”), representing ASE

ADSs, you will be sent a letter of transmittal after the Effective Time by the ASE Depositary, which is to be used to surrender

your ASE ADSs to the ASE Depositary in exchange for HoldCo ADSs. The letter of transmittal will contain instructions explaining

the procedure for surrendering the ASE ADSs in exchange for the HoldCo ADSs. YOU SHOULD NOT RETURN ASE ADRs WITH THE ENCLOSED PROXY

CARD. The HoldCo ADSs will be issued in uncertificated, book-entry form, unless a physical HoldCo ADR is subsequently requested.

|

If you hold ASE ADSs in uncertificated

form registered directly on the books of the ASE Depositary, you will not be required to take any action after the Effective Time.

The ASE Depositary will, after the Effective Time, exchange your ASE ADSs for the applicable HoldCo ADSs and send you a statement

reflecting HoldCo ADSs issued in your name as a result of the Share Exchange and a check for the cash in lieu of any fractional

HoldCo ADS to which you are entitled as a result of the Share Exchange.

Beneficial holders of ASE ADSs held

in “street name” through a bank, broker or other financial institution with an account in The Depository Trust Company

(“DTC”) will not be required to take any action after the Effective Time to exchange ASE ADSs for HoldCo ADSs. After

the Effective Time, ASE ADSs held in “street name” will be exchanged by the ASE Depositary via DTC for the applicable

HoldCo ADSs and delivered in book-entry form via DTC to the applicable banks, brokers and other financial institutions for credit

to their clients the beneficial owners of ASE ADSs.

|

|

Q:

|

If I own ASE ADSs, will I be required to pay any service fees to exchange my ASE ADSs for HoldCo ADSs?

|

|

|

A:

|

There is a US$0.02 cancellation fee per ASE ADS held payable by holders of ASE ADSs to the ASE Depositary in connection with

the exchange of ASE ADSs for HoldCo ADSs.

|

|

|

Q:

|

How will trading in ASE Common Shares and ASE ADSs be affected by the Share Exchange?

|

|

|

A:

|

ASE expects that ASE Common Shares will be suspended from trading on the TWSE starting from the eighth (8

th

) ROC

Trading Day prior to the Effective Time of the Share Exchange. ASE expects that HoldCo Common Shares will begin trading in Taiwan

during TWSE trading hours, at the Effective Time of the Share Exchange. ASE expects that the ASE ADSs will be suspended from trading

on the NYSE starting from the eighth (8

th

) trading day on the NYSE prior to the Effective Time of the Share Exchange.

ASE expects that HoldCo ADSs will begin trading on the NYSE during NYSE trading hours, at the Effective Time of the Share Exchange.

You will not be able to trade ASE Common Shares and ASE ADSs during these gaps in trading.

|

|

|

Q.

|

Whom can I call with questions?

|

|

|

A.

|

If you have more questions about the Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement,

you should contact:

|

Kenneth Hsiang

Email:

ir@aseglobal.com

Tel: +886-2-6636-5678

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, Taiwan, 110, Republic of China

Attention: Head of Investor Relations

|

|

Summary

The following summary highlights selected

information described in more detail elsewhere in this proxy statement/prospectus and the documents incorporated by reference into

this proxy statement/prospectus and may not contain all the information that may be important to you. To understand the Share Exchange

and the other transactions contemplated by the Joint Share Exchange Agreement and the matters being voted on by ASE shareholders

and SPIL shareholders at their respective extraordinary shareholders’ meeting more fully, and to obtain a more complete description

of the legal terms of the Joint Share Exchange Agreement, you should carefully read this entire document, including the annexes,

and the documents to which ASE refers you. Each item in this summary includes a page reference directing you to a more complete

description of that topic. See the section entitled “Where You Can Find More Information.”

The Parties (see page 72)

Advanced Semiconductor Engineering, Inc.

ASE is a company limited by shares incorporated

under the laws of the ROC. ASE’s services include semiconductor packaging, production of interconnect materials, front-end

engineering testing, wafer probing and final testing services, as well as integrated solutions for electronics manufacturing services

in relation to computers, peripherals, communications, industrial, automotive, and storage and server applications.

ASE Common Shares are traded on the TWSE

under the ticker “2311” and ASE ADSs are traded on the NYSE under the symbol “ASX.” ASE’s principal

executive offices are located at 26 Chin Third Road, Nantze Export Processing Zone, Nantze, Kaohsiung, Taiwan, Republic of China,

and the telephone number at the above address is +886-7-361-7131.

Siliconware Precision Industries Co.,

Ltd.

SPIL is a company limited by shares incorporated

under the laws of the ROC. SPIL offers a full range of packaging and testing solutions, including advanced packages, substrate

packages and lead-frame packages, as well as testing for logic and mixed signal devices. SPIL currently targets customers in the

personal computer, communications, consumer integrated circuits and non-commodity memory semiconductor markets.

SPIL Common Shares are traded on TWSE under

the ticker “2325” and SPIL ADSs are traded on NASDAQ under the symbol “SPIL.” The principal executive offices

of SPIL are located at No. 123, Sec. 3, Da Fong Road, Tantzu, Taichung, Taiwan, Republic of China, and the telephone number is

886-4-2534-1525.

ASE Industrial Holding Co., Ltd.

It is expected that HoldCo will be a company

limited by shares incorporated under the laws of the ROC and will be formed at the Effective Time. HoldCo will initially serve

exclusively as the holding company for the ASE, SPIL, as well as their subsidiaries and investees. HoldCo will not have substantive

assets or operations.

It is expected that HoldCo Common Shares

will traded on the TWSE and HoldCo ADSs will be traded on the NYSE. It is expected that HoldCo’s principal executive offices

will be located at Room 1901, No. 333, Section 1 Keelung Rd. Taipei, Taiwan, Republic of China and its telephone number at the

above address will be +886-2-6636-5678.

The Share Exchange (see page 76)

ASE and SPIL have entered into a Joint

Share Exchange Agreement pursuant to which a holding company, HoldCo, will be formed by means of a statutory share exchange pursuant

to ROC law, and at the Effective Time, HoldCo will (i) acquire all issued shares of ASE in exchange for shares of HoldCo using

the Exchange Ratio as described below, and (ii) acquire all issued shares of SPIL using the Cash Consideration as described below.

Upon the consummation of the Share Exchange, ASE and SPIL will become wholly owned subsidiaries of HoldCo concurrently. Subject

to the Share Exchange and the Joint Share Exchange Agreement being approved by shareholders of ASE and SPIL, and upon the satisfaction

of the other conditions for completing the Share Exchange, HoldCo will be formed — and the Share Exchange is expected to

become effective — on or around [DATE], 2017.

|

Pursuant to the terms and subject to the

conditions set forth in the Joint Share Exchange Agreement, at the Effective Time:

|

|

(i)

|

for SPIL shareholders:

|

|

|

·

|

each SPIL Common Share, par value NT$10 per share, issued immediately prior to the Effective Time (including SPIL’s treasury

shares and the SPIL Common Shares beneficially owned by ASE), will be transferred to HoldCo in consideration for the right to receive NT$51.2,

which represents NT$55

minus

a cash dividend and a return of capital reserve of NT$3.8 per SPIL Common Share distributed

by SPIL on July 1, 2016, payable by HoldCo in cash in NT dollars, without interest and net of any applicable withholding taxes;

and

|

|

|

·

|

each SPIL ADS will be cancelled in exchange for the right

to receive through SPIL Depositary, the US dollar equivalent of NT$256 (representing five times of the SPIL Common Shares Cash

Consideration)

minus

(i) all processing fees and expenses per SPIL ADS in relation to the conversion from NT dollars into

US dollars, and (ii) US$0.05 per SPIL ADS cancellation fees pursuant to the terms of the SPIL Deposit Agreement payable in cash

in US dollars, without interest and net of any applicable withholding taxes.

|

The Cash Consideration will be subject

to adjustments if SPIL issues shares or pays cash dividends during the period from the execution date of the Joint Share Exchange

Agreement to the Effective Time; provided, however, that the Cash Consideration shall not be subject to adjustment if the aggregate

amount of the cash dividends distributed by SPIL in fiscal year 2017 is less than 85% of its after-tax net profit for fiscal year

2016.

|

|

(ii)

|

for ASE shareholders:

|

|

|

·

|

each

ASE Common Share, par value NT$10 per share, issued immediately prior to the Effective

Time (including ASE’s treasury shares), will be transferred to HoldCo in consideration for the right to receive 0.5 HoldCo

Common Shares; and

|

|

|

·

|

each ASE ADS, currently representing five ASE Common Shares, will, after the Effective Time, represent the right to receive

1.25 HoldCo ADSs, each HoldCo ADS representing two HoldCo Common Shares, upon surrender for cancellation to the ASE Depositary

after the Effective Time.

|

Under ROC law, if any fractional HoldCo

Common Shares representing less than one common share would otherwise be allotted to former holders of ASE Common Shares in connection

with the Share Exchange, those fractional shares will not be issued to those shareholders. Pursuant to the Joint Share Exchange

Agreement, ASE will aggregate the fractional entitlements and sell the aggregated ASE Common Shares using the closing price of

ASE Common Shares on the TWSE on the ninth (9

th

) ROC Trading Day prior to the Effective Time, to an appointee of the

Chairman of HoldCo. The cash proceeds from the sale will be distributed to the former holders of ASE Common Shares by HoldCo on

a proportionate basis in accordance with their respective fractions at the Effective Time.

If you hold physical certificates, also

known as ASE American depositary receipts (“ASE ADRs”), representing ASE ADSs, you will be sent a letter of transmittal

after the Effective Time by the ASE Depositary, which is to be used to surrender your ASE ADSs to the ASE Depositary in exchange

for HoldCo ADSs. The letter of transmittal will contain instructions explaining the procedure for surrendering the ASE ADSs in

exchange for the HoldCo ADSs. YOU SHOULD NOT RETURN ASE ADRs WITH THE ENCLOSED PROXY CARD. The HoldCo ADSs will be issued in uncertificated,

book-entry form, unless a physical HoldCo ADR is subsequently requested.

If you hold ASE ADSs in uncertificated

form registered directly on the books of the ASE Depositary, you will not be required to take any action after the Effective Time.

The ASE Depositary will, after the Effective Time, exchange your ASE ADSs for the applicable HoldCo ADSs and send you a statement

reflecting HoldCo ADSs issued in your name as a result of the Share Exchange and a check for the cash in lieu of any fractional

HoldCo ADS to which you are entitled as a result of the Share Exchange.

Beneficial holders of ASE ADSs held in

“street name” through a bank, broker or other financial institution with an account in DTC will not be required to

take any action after the Effective Time to exchange ASE ADSs for HoldCo ADSs. After the Effective Time, ASE ADSs held in “street

name” will be exchanged by the ASE Depositary via DTC for the applicable HoldCo ADSs and delivered in book-entry form via

DTC to the applicable banks, brokers and other financial institutions for credit to their clients the beneficial owners of ASE

ADSs.

The ASE Depositary will only distribute

whole HoldCo ADSs. It will use commercially reasonable efforts to sell the fractional entitlements to HoldCo ADSs and distribute

the net cash proceeds to the holders of ASE ADSs entitled to it.

Subject to approval at the ASE EGM, HoldCo

will issue 3,961,811,298 HoldCo Common Shares (based on the number of issued shares of ASE on September 30, 2016) in connection

with the Share Exchange.

The following chart depicts the organizational

structure of each of ASE and SPIL before the Share Exchange as of the date of this proxy statement/prospectus and immediately after

the Effective Time.

Before the Share Exchange as of the date

of this proxy statement/prospectus:

Immediately after the Effective Time:

The ASE EGM (see page 73)

Date, Time and Place

. The

ASE EGM to vote for the Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement is expected

to be held at [TIME] A.M. on [DATE], 2017 (Taiwan time), at Zhuang Jing Auditorium, 600 Jiachang Road, Nantze Export Processing

Zone, Nantze District, Kaohsiung City, Taiwan, Republic of China.

Purpose

. The ASE EGM is being

held to consider and vote on:

|

|

·

|

Proposal

1.

To

consider and to vote upon the joint share exchange agreement entered into between Advanced

Semiconductor Engineering, Inc. and Siliconware Precision Industries Co., Ltd. on June

30, 2016 (the “Joint Share Exchange Agreement”) and the proposed share exchange

and the other transactions contemplated by the Joint Share Exchange Agreement

|

|

|

·

|

Proposal 2.

To

consider and to vote upon the adoption of the articles of incorporation of ASE Industrial Holding Co., Ltd.

|

|

|

·

|

Proposal 3. To consider and to vote upon the Rules of Procedure for Shareholders’ Meetings of ASE Industrial

Holding Co., Ltd.

|

|

|

·

|

Proposal 4. To consider and to vote upon the Rules Governing the Election of Directors and Supervisors of ASE Industrial

Holding Co., Ltd.

|

|

|

·

|

Proposal 5. To consider and to vote upon the Procedures for Lending Funds to Other Parties of ASE Industrial Holding

Co., Ltd. and Procedures of Making of Endorsement and Guarantees of ASE Industrial Holding Co., Ltd.

|

|

|

·

|

Proposal 6. To consider and to vote upon the Procedures for Acquisition or Disposal of Assets of ASE Industrial Holding

Co., Ltd.

|

|

|

·

|

Proposal 7.

To consider and elect

the members of the board of directors and supervisors of ASE Industrial Holding Co., Ltd.

|

|

|

·

|

Proposal 8. To consider and to vote upon the proposal to waive the non-competition clauses applicable to newly elected

directors of ASE Industrial Holding Co., Ltd.

|

Record Date; Voting Rights

.

Holders of ASE Common Shares will be entitled to exercise voting rights by electronic means or by attending the ASE EGM in person

or by proxy, if they are recorded on ASE’s stockholder register on [DATE], 2017 (“ASE EGM Record Date”). Only

ASE shareholders who hold ASE Common Shares of record on the ASE EGM Record Date are entitled to vote at the ASE EGM, or to exercise

the appraisal rights conferred on dissenting shareholders by the laws of the ROC. Each ASE Common Share entitles its holder to

one vote at the ASE EGM on each of the proposals. You may exercise voting rights by electronic means or by attending the ASE EGM

in person or by proxy using a duly authorized power of attorney in the prescribed form attached to the notice of convocation distributed

by ASE prior to the ASE EGM. You may exercise your voting right by electronic means beginning from the 15

th

calendar

day prior to the ASE EGM until the third calendar day prior to the day of the ASE EGM. Shareholders who intend to exercise their

voting rights, electronically must log in to the website maintained by the TDCC (https://www.stockvote.com.tw) and proceed in accordance

with the instructions provided therein.

Holders of ASE ADSs will be entitled to

instruct the ASE Depositary (Citibank) as to how to vote the ASE Common Shares represented by ASE ADSs at the ASE EGM in accordance

with the procedures set forth in this prospectus, if those holders were recorded on the ASE Depositary’s register on [DATE],

2017. In accordance with and subject to the terms of the ASE Deposit Agreement, holders of ASE ADSs have no individual voting rights

with respect to the ASE Common Shares represented by their ASE ADSs. Pursuant to the ASE Deposit Agreement, each holder of ASE

ADSs is deemed to have authorized and directed the ASE Depositary to appoint the Chairman of ASE or his/her designee, as Voting

Representative of the ASE Depositary, the custodian or the nominee who is registered in the ROC as representative of the holders

of ASE ADSs to vote the ASE Common Shares represented by ASE ADSs as more fully described below.

In accordance with and subject to the

terms of the ASE Deposit Agreement, if holders of ASE ADSs together holding at least 51% of all the ASE ADSs outstanding as of

the record date set by the ASE Depositary for the ASE EGM to vote on the proposed Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement, instruct the ASE Depositary, prior to the ASE ADS voting instructions deadline, to vote

in the same manner with respect to the Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement,

the ASE Depositary shall notify the Voting Representative and appoint the Voting Representative as the representative of the ASE

Depositary and the holders of ASE ADSs to attend the ASE EGM and vote all ASE Common Shares represented by ASE ADSs outstanding

in the manner so instructed by such holders. If voting instructions are received from an ASE ADS holder by the ASE Depositary

as of the ASE ADS voting instructions deadline which are signed but without further indication as to voting instructions, the

ASE Depositary shall deem such holder to have instructed a vote in favor of the items set forth in such instructions.

Furthermore, in accordance with and subject

to the terms of the ASE Deposit Agreement, if, for any reason, the ASE Depositary has not, prior to the ASE ADS voting instructions

deadline, received instructions from holders of ASE ADSs together holding at least 51% of all ASE ADSs outstanding as of the record

date set by the ASE Depositary for the ASE EGM to vote for the proposed Share Exchange and the other transactions contemplated

by the Joint Share Exchange Agreement, to vote in the same manner with respect to the proposed Share Exchange and the other transactions

contemplated by the Joint Share Exchange Agreement, the holders of all ASE ADSs shall be deemed to have authorized and directed

the ASE Depositary to give a discretionary proxy to the Voting Representative, as the representative of the holders of ASE ADSs,

to attend the ASE EGM and vote all the ASE Common Shares represented by ASE ADSs then outstanding in his/her discretion; provided,

however, that the ASE Depositary will not give a discretionary proxy as described if it fails to receive under the terms of the

ASE Deposit Agreement a satisfactory opinion from ASE’s counsel prior to the ASE EGM. In such circumstances, the Voting Representative

shall be free to exercise the votes attaching to the ASE Common Shares represented by ASE in any manner he/she wishes, which may

not be in the best interests of the ASE ADS holders. [The Voting Representative has informed ASE that he plans as of the date of

this proxy statement/prospectus to vote in favor of all of the proposals at the ASE EGM, although he has not entered into any agreement

obligating him to do so.]

Vote Required

. The Share

Exchange cannot be completed without ASE shareholders approving, among other things, the completion by ASE of the Share Exchange

and the other transactions contemplated by the Joint Share Exchange Agreement by either (x) the approval of one-half of the

ASE Common shares present at the ASE EGM if at least two-thirds of the outstanding ASE Common Shares attend the ASE EGM, or (y) the

approval of two-thirds of the ASE Common Shares present at the ASE EGM if at least one-half of the outstanding ASE Common Shares

attend the ASE EGM. Each ASE shareholder is entitled to one vote per share.

As of [

·

],

2017, there were [

·

] ASE Common Shares (including those represented by ASE ADSs)

outstanding. As of [

·

], 2017, ASE directors and executive officers, as a group,

beneficially owned and were entitled to vote [

·

] ASE Common Shares, or approximately

[

·

]% of the total outstanding share capital of ASE. ASE currently expects that

these directors and executive officers will vote their ASE Common Shares that are held at the ASE EGM Record Date in favor of all

of the proposals at the ASE EGM, although none of them has entered into any agreement obligating them to do so.

Under ROC law, ASE is prohibited from soliciting

proxies, consents or authorizations at its shareholders’ meetings, including the ASE EGM which the Share Exchange and the

other transactions contemplated by the Joint Share Exchange Agreement will be voted upon. However, ASE Enterprises Limited (“ASEE”),

a shareholder of ASE beneficially holding approximately [

·

]% of the total outstanding

share capital of ASE as of the date of this proxy statement/prospectus, has expressed that it plans to vote in favor of all of

the proposals at the ASE EGM and intends to solicit proxies in favor of the authorization and approval of the Share Exchange and

the other transactions contemplated by the Joint Share Exchange Agreement prior to the ASE EGM. ASEE is controlled by ASE’s

Chairman and Chief Executive Officer Jason C.S. Chang.

Recommendation and Approval of the ASE Board and Reasons

for the Share Exchange (see page 36)

The ASE Board recommends that ASE shareholders

vote “FOR” each of the proposals to be presented at the ASE EGM.

In the course of reaching its decision

to approve the Share Exchange and the other transactions contemplated by the Joint Share Exchange Agreement, the ASE board of directors

(the “ASE Board”) considered a number of factors in its deliberations. For a more complete

discussion of these factors, see the section entitled “Special Factors —Recommendation and Approval of the ASE Board

and Reasons for the Share Exchange.”

Interests of ASE in SPIL Common Shares and ADSs (see

page 38)

On October 1, 2015, ASE closed its

acquisition of, and paid for, 779,000,000 SPIL Common Shares (including those represented by SPIL ADSs) pursuant to the tender

offers in the U.S. and in the ROC (the “Initial ASE Tender Offers”). In March and April 2016, ASE acquired an additional

258,300,000 SPIL Common Shares (including those represented by SPIL ADSs) through open market purchases. As of the date of this

proxy statement/prospectus, ASE held 988,847,740 SPIL Common Shares and 9,690,452 SPIL ADSs, representing 33.29% of the issue and

outstanding share of SPIL.

Except as set forth elsewhere in this proxy

statement/prospectus: (a) none of ASE and, to ASE's knowledge, any associate or majority-owned subsidiary of ASE beneficially

owns or has a right to acquire any SPIL Common Shares, SPIL ADSs or other equity securities of SPIL; (b) none of ASE and,

to ASE's knowledge, any associate or majority-owned subsidiary of ASE has effected any transaction in SPIL Common Shares, SPIL

ADSs or other equity securities of SPIL during the past 60 days; and (c) during the two years before the date of this

proxy statement/prospectus, there have been no transactions between ASE, its subsidiaries, on the one hand, and SPIL or any of

its executive officers, directors, controlling shareholders or affiliates, on the other hand, that would require reporting under

SEC rules and regulations.

Opinions of ASE’s Independent Expert (see

page 39)

On May 25, 2016, Mr. Ji-Sheng Chiu, CPA,

of Crowe Horwath (TW) CPAs Firm, an independent expert engaged by ASE, delivered to ASE its written opinion (the “First Crowe

Horwath Opinion”) that the cash consideration of NT$55 per SPIL Common Share to be paid by HoldCo under the Share Exchange

and the Exchange Ratio in which ASE Common Shares will be exchanged for HoldCo Common Shares as stipulated in the Joint Share Exchange

Memorandum of Understanding (“Joint Share Exchange MOU”) were reasonable and fair. On June 29, 2016, Mr. Ji-Sheng Chiu

delivered to ASE an opinion that the Cash Consideration (including conditions for adjustments) per SPIL Common Share to be paid

by HoldCo in the Share Exchange and the Exchange Ratio in which ASE Common Shares will be exchanged for HoldCo Common Shares as

stipulated in the Joint Share Exchange Agreement were reasonable and fair (the “Second Crowe Horwath Opinion,” and

together with the First Crowe Horwath Opinion, the “Crowe Horwath Opinions”). The Crowe Horwath Opinions will be available

for any interested ASE shareholder (or any representative of an ASE shareholder who has been so designated in writing) to inspect

and copy at ASE’s principal executive offices during regular business hours.

Financing of the Share Exchange (see page 48)

HoldCo intends to fund the Cash Consideration

(including the NT$51.2 per SPIL Common Share Cash Consideration payable to holders of the foreign convertible bonds issued by

SPIL on October 31, 2014 (“SPIL Convertible Bonds”) that have not been otherwise redeemed or repurchased by the SPIL,

or cancelled or converted prior to the Effective Time), which is an aggregate amount of approximately NT$173.16 billion (US$5.54

billion), with a combination of ASE’s cash on hand and debt financing. Subject to the amount of cash on hand at the time

when ASE arranges for financing, ASE may arrange bank loans up to NT$173 billion (US$5.53 billion) with a combination of a syndication

loan of NT$120 billion (US$3.84 billion) and a short-term bridge loan of NT$53 billion (US$1.69 billion). In a highly confident

letter dated November 7, 2016 issued by Citibank Taiwan Limited (“Citibank”) to ASE, Citibank stated that it is highly

confident of its ability to arrange debt facilities for the Share Exchange up to an amount of US$3.8 billion equivalent. In another

highly confident letter dated November 16, 2016 issued by DBS Bank Ltd., Taipei Branch (“DBS”) to ASE, DBS stated

that it is confident of its ability to arrange debt facilities for the Share Exchange up to an amount of NT$53 billion (US$1.69

billion). Both highly confident letters contained certain customary conditions to the arrangement of such facilities, including

the following material conditions: (i) the applicable bank being appointed as the bookrunner and arranger of the facility, (ii)