Five Below, Inc. Announces Holiday Sales Results for Quarter-To-Date Through January 7, 2017; Updates Fourth Quarter and Full...

January 09 2017 - 8:25AM

Five Below, Inc. (NASDAQ:FIVE) (“Five Below” or the “Company”)

today announced net sales results for the quarter-to-date period

from October 30, 2016 through January 7, 2017 ("Holiday Period")

and updated guidance for its fourth quarter and full year for

fiscal 2016 ending January 28, 2017.

The Company announced that net sales for the Holiday Period,

which includes New Year’s Day in both periods, increased by 18.0%

to $349.3 million from $296.2 million in the comparable fiscal week

period of 2015. Comparable sales for the Holiday Period increased

by 0.5%.

Joel Anderson, CEO of Five Below, stated: "After a solid start

to the holiday season, we experienced softness in mid-December,

including Super Saturday, with sales accelerating later in the

holiday season. We had strong performance in our tech and room

categories that were not up against the strong license and

trend-driven comparisons from last year, as well as good

performance in markets where we ran TV for the first time. In

addition, our new 2016 stores continue to perform well and are on

track to be one of our strongest classes ever."

Mr. Anderson added, “Given our holiday performance, we are

updating our outlook for the full year 2016 and now expect sales

growth of 20% and EPS growth of 22% to 23%. We remain committed to

delivering on our goals of 20% top line and 20% bottom line growth

through 2020, and we look forward to discussing 2016 and our

outlook for 2017 on our fourth quarter earnings call in March.”

Based on the quarter-to-date performance, the Company updated

its guidance for the fourth quarter and fiscal year 2016. For the

fourth quarter, net sales are now expected to be in the range of

$386 million to $388 million, or growth of 18% to 19% assuming a

comparable sales increase of approximately 1%. Diluted income per

common share for the fourth quarter is expected to be in the range

of $0.88 to $0.89, or approximately 14% to 16% growth.

For the full year fiscal 2016, net sales are now expected to be

in the range of $998 million to $1,000 million, or growth of 20%

assuming a comparable sales increase of approximately 2%. Diluted

income per common share for fiscal 2016 is expected to be in the

range of $1.28 to $1.29, or approximately 22% to 23% growth.

The Company also announced that management will participate in

the 19th Annual ICR Conference held at the JW Marriott Orlando

Grande Lakes in Orlando, Florida. Management is currently scheduled

to conduct a fireside chat on Tuesday, January 10, 2017 at 8:30

a.m. Eastern Time. The fireside chat will be webcast live at

http://investor.fivebelow.com/. An archived replay will be

available two hours after the conclusion of the live event.

About Five Below:Five Below is a rapidly

growing specialty value retailer offering a broad range of

trend-right, high-quality merchandise targeted at the teen and

pre-teen customer. Five Below offers a dynamic, edited assortment

of exciting products in a fun and differentiated store environment,

all priced at $5 and below. Select brands and licensed merchandise

fall into the Five Below worlds: Style, Room, Sports, Tech, Crafts,

Party, Candy, and Now. Five Below was founded in 2002 and is

headquartered in Philadelphia, Pennsylvania, with over 500 stores

in 31 states. For more information, please visit

www.fivebelow.com or come into one of our stores!

Forward-Looking Statements:This news release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 as contained in

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, which reflect management's current

views and estimates regarding the Company's industry, business

strategy, goals and expectations concerning its market position,

future operations, margins, profitability, capital expenditures,

liquidity and capital resources and other financial and operating

information. Investors can identify these statements by the fact

that they use words such as "anticipate," "assume," "believe,"

"continue," "could," "estimate," "expect," "intend," "may," "plan,"

"potential," "predict," "project," "future" and similar terms and

phrases. The Company cannot assure investors that future

developments affecting the Company will be those that it has

anticipated. Actual results may differ materially from these

expectations due to risks related to the Company's strategy and

expansion plans, risks related to the inability to successfully

implement our expansion into online retail, the availability of

suitable new store locations and the dependence on the success of

shopping centers in which our stores are located, risks that

consumer spending may decline and that U.S. and global

macroeconomic conditions may worsen, risks related to the Company's

continued retention of its senior management and other key

personnel, risks related to changes in consumer preferences and

economic conditions, risks related to increased operating costs,

including wage rates, risks related to extreme weather, risks

related to the Company's distribution centers, quality or safety

concerns about the Company's merchandise, events that may affect

the Company's vendors, increased competition from other retailers

including online retailers, risks related to cyber security, risks

related to customers' payment methods, risks related to trade

restrictions, and risks associated with leasing substantial amounts

of space. For further details and a discussion of these risks and

uncertainties, see the Company's periodic reports, including the

annual report on Form 10-K, quarterly reports on Form 10-Q and

current reports on Form 8-K, filed with or furnished to the

Securities and Exchange Commission and available at www.sec.gov. If

one or more of these risks or uncertainties materialize, or if any

of the Company's assumptions prove incorrect, the Company's actual

results may vary in material respects from those projected in these

forward-looking statements. Any forward-looking statement made by

the Company in this news release speaks only as of the date on

which the Company makes it. Factors or events that could cause the

Company's actual results to differ may emerge from time to time,

and it is not possible for the Company to predict all of them. The

Company undertakes no obligation to publicly update any forward

looking statement, whether as a result of new information, future

developments or otherwise, except as may be required by any

applicable securities laws.

Investor Contact:

Five Below, Inc.

Christiane Pelz

215-207-2658

Christiane.Pelz@fivebelow.com

ICR, Inc.

Farah Soi/Caitlin Morahan

203-682-8200

Farah.Soi@icrinc.com/Caitlin.Morahan@icrinc.com

Media Contact:

ICR, Inc.

Jessica Liddell/Julia Young

203-682-8200

FivePR@icrinc.com

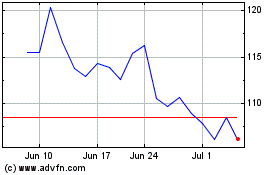

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

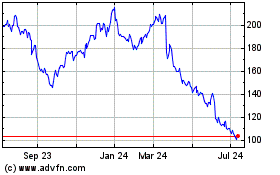

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Apr 2023 to Apr 2024