Today's Top Supply Chain and Logistics News From WSJ

January 05 2017 - 7:15AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

A dispute between two of the biggest intermodal shipping

operators in the U.S. will put the changing business of truck-rail

shipping under scrutiny. BNSF Railway and J.B. Hunt Transport

Services Inc., its main trucking partner, are headed to arbitration

over how to split the revenue the companies generate from moving

shipping containers and trailers. WSJ Logistics Report's Jennifer

Smith writes the partnership is important to both companies'

fortunes, funneling large numbers of containers into their

transportation networks and accounting for around $2 billion in

revenue for J.B. Hunt. The impasse comes as intermodal rates paid

by shippers are falling even as the railroad's share of the revenue

appears to be growing. The companies are fighting over a shrinking

intermodal pie: the Association of American Railroads says U.S.

intermodal volume fell 1.6% last year despite a sharp surge at the

end of the year.

The sales operation at Tesla Motors Inc. is moving faster than

the auto maker's supply chain . The Silicon Valley business

reported record high orders in the fourth quarter, with sales up

27% over the same period a year ago. But the WSJ's Tim Higgins

reports Tesla couldn't make and ship the vehicles fast enough to

head off delays after introducing new hardware to the Autopilot

semiautonomous driving feature in the vehicles. That suggests Tesla

is still struggling to get its parts delivery, production and

distribution bulked up to meet ambitions that included delivering

80,000 vehicles last year. Tesla fell several thousand cars short

in part because of last-minute delays transporting vehicles it had

sold. The big auto makers deliver far more cars than Tesla, of

course, and the company may look for ways to match their supply

chains as its own ambitions grow.

U.S. companies that have been holding their cash on the

sidelines are preparing to invest again, and that could mean a new

rush of goods heading into depleted domestic supply chains.

Executives expecting regulatory rollbacks, corporate tax breaks and

increased infrastructure spending from Washington have grown more

optimistic about growth, the WSJ's Theo Francis and Vipal Monga

report, and rising interest rates are unlikely to impede them.

German steel company Klöckner & Co., which generates about 40%

of its sales from its 50 U.S. sites, expects to increase spending

on steel-shaping machinery in the coming year, for instance, after

holding back investment amid slowing demand from industrial

customers that make railcars and oil storage tanks. Although the

Federal Reserve appears poised to raise interest rates, which would

make borrowing more costly, many companies say they won't be

deterred by higher expenses if the promise of strong returns

remains.

E-COMMERCE

The world's biggest container shipping line is stepping into the

e-commerce waters. Maersk Line, the shipping unit of A.P.

Moeller-Maersk A/S, and Alibaba Group Holding Ltd. struck a deal

that will allow the Chinese online sales giant to book space on

Maersk vessels for its customers. Reuters reports Alibaba started

offering the booking late last month under the OneTouch service

that targets small and medium-sized Chinese exporters with online

services such as customs clearance and logistics. Other technology

startups have launched services to bypass the traditional

third-party shipping services of freight forwarders. And Amazon.com

Inc. is already in the freight forwarding business. But Alibaba's

entry gives such efforts another high-profile standard bearer and

will give Maersk -- and the carrier's competitors -- a chance to

see how retail e-commerce capabilities fit into the purely

industrial shipping business.

QUOTABLE

IN OTHER NEWS

Warehouse operator Global Logistic Properties Ltd. is seeking

buyers . (WSJ)

Auto makers rolled out stronger-than-expected December U.S.

sales, leaving the industry on track to set an annual record in

2016. (WSJ)

Eurozone consumer prices rose at the fastest annual rate in more

than three years in December. (WSJ)

Macy's Inc. outlined restructuring plans that will eliminate

some 10,000 jobs and shut about 63 department stores this spring.

(WSJ)

Kohl's Corp. slashed its guidance for 2016 as the retailer said

fourth-quarter sales were worse than expected. (WSJ)

Apple Inc. plans to invest $1 billion in SoftBank Group Corp.'s

new technology fund to help finance technologies it could use in

the future. (WSJ)

The Mexican peso hit a record low against the dollar a day after

Ford Motor Co. canceled plans to build a new plant in San Luis

Potosi. (MarketWatch)

Senate Democratic Leader Charles Schumer says a Republican plan

for private tax credits for infrastructure won't "get the job done"

to finance projects. (The Hill)

Union Pacific Corp. acquired the refrigerated distribution

assets of Railex LLC. (American Shipper)

China Cosco Shipping Corp. Ltd. will acquire a 10% stake in

Shanghai Rural Commercial Bank for $660 million. (MarineLink)

Germany's government approved a controversial proposal to allow

longer trucks, dubbed "gigaliners," on highways. (Deutsche

Welle)

Diesel prices in the U.S. reached their highest point since

August 2015 to start the year. (Commercial Carrier Journal)

New Jersey based trucking and logistics operator NFI bought

Canadian freight services firm Dominion Warehousing &

Distribution. (Philadelphia Inquirer)

Warehouse leasing rates in central Pennsylvania are rising

despite record capacity expansion, according to CBRE Group Inc.

(Central Penn Business Journal)

A Chinese autonomous-driving startup says it will test use of

its technology for truck "platooning" operations by October. (Heavy

Duty Trucking)

Tank Holding Corp. bought the material handling division of

Canada's Agri Plastics. (Plastics News)

Daimler AG's Mercedes-Benz Vans unit is displaying a modified

cargo van aimed at hosting last-mile delivery drones.

(Trucks.com)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 05, 2017 07:00 ET (12:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

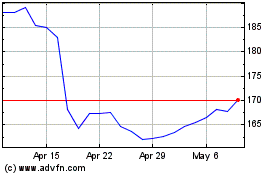

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

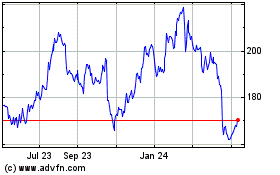

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Apr 2023 to Apr 2024