Current Report Filing (8-k)

January 05 2017 - 7:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 4, 2017

PIERIS PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Nevada

|

|

001-37471

|

|

EIN 30-0784346

|

|

(State of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

255 State Street, 9

th

Floor

Boston, MA 02109

(Address

of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 857-246-8998

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement.

On January 4, 2017, Pieris Pharmaceuticals, Inc. (the “Company”) and Pieris Pharmaceuticals GmbH, a wholly-owned subsidiary of the Company

(together with the Company, “Pieris”), entered into a License and Collaboration Agreement (the “Collaboration Agreement”) and a Non-Exclusive Anticalin

®

Platform Technology

License Agreement (the “License Agreement” and together with the Collaboration Agreement, the “Agreements”) with Les Laboratoires Servier and Institut de Recherches Internationales Servier (collectively, “Servier”),

pursuant to which Pieris and Servier will initially pursue five bispecific therapeutic programs, led by Pieris’ PRS-332 program, a PD-1-targeting bispecific checkpoint inhibitor. Pieris and Servier will jointly develop PRS-332 and split

commercial rights geographically, with Pieris retaining all commercial rights in the United States and Servier having commercial rights in the rest of the world. The four additional committed programs have been defined, which may combine antibodies

from the Servier portfolio with one or more Anticalin proteins based on Pieris’ proprietary platform to generate innovative immuno-oncology bispecific drug candidates. The collaboration may be expanded by up to three additional therapeutic

programs. Pieris has the option to co-develop and retain commercial rights in the United States for up to three programs beyond PRS-332, while Servier will be responsible for development and commercialization of the other programs worldwide.

Under the Agreements, Pieris will receive an upfront payment of EUR30 million (approximately 31.3 million USD). Pieris may also receive FTE funding for

specific projects, as well as development-dependent and commercial milestone payments for PRS-332 and each additional program. The total development, regulatory and sales-based milestone payments to Pieris could exceed EUR1.7 billion (approximately

1.8 billion USD) over the life of the collaboration and are dependent on the final number of projects pursued and the number of co-development options exercised by Pieris. Pieris and Servier will share preclinical and clinical development costs for

each co-developed program. In addition, Pieris will be entitled to receive tiered royalties up to low double digits on the sales of commercialized products in the Servier territories.

The term of each Agreement ends upon the expiration of all of Servier’s payment obligations under such Agreement. The Agreements may be terminated

by Servier for convenience beginning 12 months after their effective date upon 180 days’ notice. The Agreements may also be terminated by Servier or Pieris for material breach upon 90 days’ or 120 days’ notice of a material breach,

with respect to the Collaboration Agreement and License Agreement, respectively, provided that the applicable party has not cured such breach by the applicable 90-day or 120-day permitted cure period, and dispute resolution procedures specified in

the applicable Agreement have been followed. The Agreements may also be terminated due to the other party’s insolvency or for a safety issue and may in certain instances be terminated on a product-by-product and/or country-by-country basis. The

License Agreement will terminate upon termination of the Collaboration Agreement, on a product-by-product and/or country-by-country basis.

The foregoing

description of the Agreements does not purport to be complete and is qualified in its entirety by reference to the Agreements, which Pieris intends to file as exhibits to its Annual Report on Form 10-K for the year ending December 31, 2016. A

copy of the press release announcing the Agreements is attached to this Current Report as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits.

|

|

|

|

|

|

|

|

99.1

|

|

Joint Press Release, dated January 5, 2017.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Dated: January 5, 2017

|

|

|

|

PIERIS PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Darlene Deptula-Hicks

|

|

|

|

|

|

Name:

|

|

Darlene Deptula-Hicks

|

|

|

|

|

|

Title:

|

|

Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Joint Press Release, dated January 5, 2017.

|

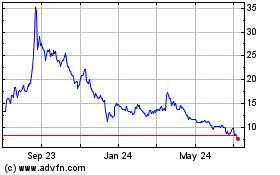

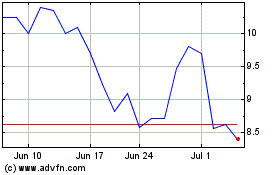

Pieris Pharmaceuticals (NASDAQ:PIRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pieris Pharmaceuticals (NASDAQ:PIRS)

Historical Stock Chart

From Apr 2023 to Apr 2024