Current Report Filing (8-k)

January 04 2017 - 8:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): January 4, 2017 (December 30, 2016)

____________________

GLOBAL MEDICAL REIT INC.

(Exact name of registrant as specified in its charter)

____________________

|

Maryland

|

8091371022

|

46-4757266

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

4800 Montgomery Lane, Suite 450

Bethesda, MD

20814

|

|

|

|

(Address of Principal Executive Offices)

(Zip Code)

|

|

|

|

|

|

|

|

(202) 524-6851

|

|

|

(Registrant’s Telephone Number, Including Area Code)

|

____________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement

On December 30, 2016, the Company entered into a purchase contract

with Great Bend Surgical Properties, LLC (“GB Seller”) to acquire, through a wholly owned subsidiary of the Company’s

operating partnership, Global Medical REIT L.P., the buildings and land known as Great Bend Regional Hospital (the “GB Property”)

located in Great Bend, Kansas for a purchase price of $24,500,000. Upon the satisfaction of customary closing conditions, the Company

expects to close this acquisition in the first quarter of 2017. The Company expects to fund this acquisition using borrowings from

the Company’s credit facility or other available cash.

The GB Property is a 33-bed acute care hospital

containing approximately 58,000 square feet and is the sole community provider in its medical service area, where it provides

services including women’s health, surgical, ancillary, hospital, and walk-in treatment. The building was completed in

2001, with a significant expansion completed in 2005, and is operated by Great Bend Regional Hospital, LLC (“GB

Tenant”), a physician owned group. Upon the closing of the acquisition of the GB Property, the Company intends to lease

the GB Property back to GB Tenant under a 15-year triple-net lease (the “GB Lease”), with two ten-year renewal

options. The GB Lease will be guaranteed by the physician owners of the GB Tenant. Eventually the GB Lease will also be

guaranteed by an employee stock ownership plan (“ESOP”). When the Company determines that the creditworthiness,

operating history, and financial results of the ESOP are acceptable, the physicians will be released from the lease

guarantee, and the ESOP will become the sole guarantor.

The aggregate annual rent under the GB Lease will be $2,143,750,

subject to annual rent escalations equal to the greater of 2% or Consumer Price Index.

The above description of the terms and conditions of

the GB Property purchase contract and the transactions contemplated thereby is only a summary and is not intended to be a

complete description of the terms and conditions. All of the terms and conditions of the purchase contract are set forth in

the purchase contract that is filed as Exhibit 10.1 to this Current Report on Form 8-K and are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

Announcement of Property Acquisitions

The Company announced in a press release on January 4, 2017,

that it had entered into the purchase contract for the GB Property acquisition. A copy of the Company’s press release is

furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Forward-Looking Statements

This report contains statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange

Act, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”,

“plan”, “outlook”, and “project” and other similar expressions that predict or indicate future

events or trends or that are not statements of historical matters. Forward-looking statements should not be read as a guarantee

of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance

or results will be achieved. Forward-looking statements are based on information available at the time those statements are made

and/or management’s good faith belief as of that time with respect to future events. These statements relate to, among other

things, the Company’s expectations regarding the completion of the acquisition described in this report on the terms and

conditions described herein, the lease and lease guarantees, and the expected closing date of the acquisition. These forward-looking

statements are subject to various risks and uncertainties, not all of which are known to the Company and many of which are beyond

the Company’s control, which could cause actual performance or results to differ materially from those expressed in or suggested

by the forward-looking statements. These risks and uncertainties are described in greater detail in the Company’s other filings

with the United States Securities and Exchange Commission (the “Commission”), including without limitation the Company’s

annual and periodic reports and other documents filed with the Commission. Unless legally required, the Company disclaims any obligation

to update any forward-looking statements, whether as a result of new information, future events or otherwise. The Company undertakes

no obligation to update these statements after the date of this report.

The information in Exhibit 99.1 referenced in Item 9.01 below

is being “furnished” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be incorporated

by reference into any registration statement or other document filed by the Company pursuant to the Securities Act of 1933, as

amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Purchase Agreement, dated as of the 30th day of December, 2016, by and between GLOBAL MEDICAL REIT, INC., a Maryland corporation (“

Purchaser

”), and GREAT BEND SURGICAL PROPERTIES, LLC, a Kansas limited liability company (“

Seller

”).

|

|

99.1

|

|

Press release dated January 4, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GLOBAL MEDICAL REIT INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Conn Flanigan

|

|

|

|

Conn Flanigan

|

|

|

|

Secretary and General Counsel

|

Dated: January 4, 2017

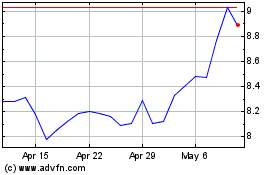

Global Med REIT (NYSE:GMRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

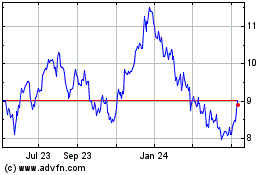

Global Med REIT (NYSE:GMRE)

Historical Stock Chart

From Apr 2023 to Apr 2024