Current Report Filing (8-k)

January 03 2017 - 8:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

December 30, 2016

|

The Hartford Financial Services Group, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-13958

|

13-3317783

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

One Hartford Plaza, Hartford, Connecticut

|

|

6155

|

|

________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

860-547-5000

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On December 30, 2016, Hartford Fire Insurance Company and certain of its affiliates (collectively, the “Hartford Insurers”), which are wholly owned insurance company subsidiaries of The Hartford Financial Services Group, Inc. (the “Company”), entered into an Aggregate Excess of Loss Reinsurance Agreement (the “Reinsurance Agreement”) with National Indemnity Company (“NICO”), a subsidiary of Berkshire Hathaway Inc. (“Berkshire”). The Company and the Hartford Insurers concurrently entered into certain other related agreements with NICO and certain of its affiliates (collectively with the Reinsurance Agreement, the “Agreements”) to effectuate the terms of the transaction.

The Agreements, which are effective as of December 31, 2016, provide as follows: (i) the Hartford Insurers will pay NICO a reinsurance premium of $650 million in exchange for $1.5 billion of reinsurance for adverse net loss reserve development above the Company’s existing net asbestos and environmental (“A&E”) reserves as of December 31, 2016; (ii) the Company will retain the risk of collection on the Hartford Insurers’ third-party reinsurance; (iii) the Company will retain responsibility for claims handling and other administrative services, subject to certain conditions; (iv) the $650 million reinsurance premium paid to NICO will be placed into a collateral trust account as security for NICO’s claim payment obligations to the Hartford Insurers, and (v) Berkshire will provide a parental guarantee to secure the obligations of NICO under the Agreements. The reinsurance will cover adverse development on substantially all the Company’s A&E reserves, excluding those held by the Company’s U.K. Property and Casualty run-off subsidiaries (under contract to be sold with a closing projected for the first quarter 2017), as well as other non-U.S. operations with less than $3 million in A&E reserves.

The transaction will be accounted for as retroactive reinsurance in the Company’s GAAP financial statements and is expected to result in a net loss of approximately $423 million, after-tax, in the fourth quarter of 2016.

Item 7.01 Regulation FD Disclosure

On January 3, 2017, the Company issued a press release relating to the Agreements described above in Item 1.01. The press release is furnished as Exhibit 99.1 to this Form 8-K.

The information under Item 7.01 in this Form 8-K is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 7.01 in this Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press Release of The Hartford Financial Services Group, Inc. dated January 3, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Hartford Financial Services Group, Inc.

|

|

|

|

|

|

|

|

January 3, 2017

|

|

By:

|

|

/s/ Beth Bombara

|

|

|

|

|

|

|

|

|

|

|

|

Name: Beth Bombara

|

|

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

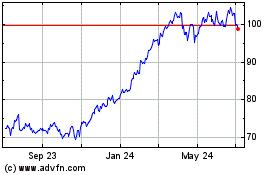

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

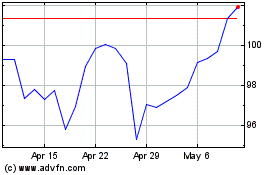

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024