- Comprehensive critical illness coverage with various plan levels

for flexible budgeting

- Guaranteed step-up protection of up to 400% of original sum

insured depending on plan level without further underwriting

HONG KONG, Jan 3, 2017 - (ACN Newswire) - Cigna Worldwide General

Insurance Company Limited ("Cigna Hong Kong") has launched "Cigna

HealthSecure Protection Booster", a new product that offers

critical illness protection to customers throughout their every

life stages. Taking into account customers' health protection and

financial needs as they age, the sum insured increases by

HK$500,000 every five years, up to 400% of the original sum insured

depending on the plan level. By joining the plan early in life,

customers can enjoy peace of mind and guaranteed protection without

further underwriting.

According to the Centre for Health Protection of the Department of

Health 1, critical illnesses such as cancer, stroke, heart diseases

and dementia together made up 53% of the leading causes of death in

2015 in Hong Kong. In addition, report from the Hong Kong Cancer

Registry, Hospital Authority2 indicated that the risk of critical

illness such as cancer rises with age. In 2014, 62% of new cancer

cases and 77% of cancer deaths occurred in people over the age of

60. These data point to the importance for an individual to have

insurance protection early in life when in better health condition,

and ensure to get adequate protection if the health condition

deteriorates at a later stage in life.

Building on Cigna's dedication to serve customers throughout

different stages of their life journeys, "Cigna HealthSecure

Protection Booster" provides a basic benefit amount of HK$500,000

at policy commencement. Customers can choose from three different

plan levels. Depending on the plan levels, they can enjoy

guaranteed increase in the sum insured after a designated period,

or opt for retaining the sum insured when they enter another stage

of life and their financial needs change for flexible

budgeting.

Customers can choose from three different levels according to their

own preference. For option 1, customers will pay level premium and

enjoy an automatic increase of sum insured to HK$1,000,000 after

age 55. The sum insured remains unchanged thereafter. For option 2,

customers will also pay level premium but enjoy an automatic

HK$500,000 increase of the sum insured every five years after age

55 up to HK$2,000,000. Option 3 allows customers to pay a yearly

adjustable premium which automatically increases the sum insured by

HK$500,000 every five policy years up to HK$2,000,000. This option

also gives customers the flexibility to retain the sum insured at

HK$1,000,000 or HK$1,500,000 for the remaining years of the

policy.

The product covers 53 critical illnesses, including cancer, stroke

and heart disease, which are common in Hong Kong3. In the

unfortunate event that the person insured is first diagnosed and

confirmed to have any of those illnesses, 100% of the sum insured

will be paid to provide financial support to the customer during

difficult times.

Mr. Austin Marsh, CEO and Country Manager, Cigna Hong Kong, said,

"As our customers' active health and well-being partner, we

understand customers want to be well protected with financial

support when they suffer from critical illnesses. With 'Cigna

HealthSecure Protection Booster', customers can pay a smaller

premium purchasing a lower benefit amount at younger ages when the

risk on critical illness is lower, and have a guaranteed increase

in sum insured as they age. Customers can have flexibility in

budgeting and at the same time enjoying comprehensive critical

illness protection."

"At Cigna, we are dedicated to working together with our customers

all the way, helping them plan in advance for medical and financial

protection that gives them peace of mind throughout their life

journeys," added Mr. Marsh.

Notes

1. Source: Centre for Health Protection of the Department of Health

(http://www.chp.gov.hk/en/data/4/10/27/117.html)

2. Source: Overview of Hong Kong Cancer Statistics of 2014, Hong

Kong Cancer Registry, Hospital Authority, Hong Kong

(http://www3.ha.org.hk/cancereg/pdf/overview/Summary%20of%20CanStat%202014.pdf)

3. Source: Public Health Information and Statistics of Hong Kong

2014

(http://www.healthyhk.gov.hk/phisweb/plain/zh/healthy_facts/disease_burden/major_causes_death/major_causes_death)

4. The benefit will take effect after 90 days of Waiting Period.

Waiting Period refers to each of the period after (a) the policy

issue date or the commencement date (whichever is later), (b) the

approval date of any reinstatement if this policy is subsequently

reinstated.

5. For more details, please refer to our product brochure on our

company website.

About Cigna

Cigna Corporation (NYSE:CI) is a global health service company

dedicated to helping people improve their health, well-being and

sense of security. All products and services are provided

exclusively by or through operating subsidiaries of Cigna

Corporation, including Connecticut General Life Insurance Company,

Cigna Health and Life Insurance Company, Life Insurance Company of

North America and Cigna Life Insurance Company of New York. Such

products and services include an integrated suite of health

services, such as medical, dental, behavioral health, pharmacy,

vision, supplemental benefits, and other related products including

group life, accident and disability insurance. Cigna maintains

sales capability in 30 countries and jurisdictions, and has more

than 90 million customer relationships throughout the world.

About Cigna Hong Kong

Since its presence in Hong Kong in 1933, Cigna Hong Kong has been

offering insurance solutions at the right place and the right time,

providing advice to customers throughout the different stages of

their life journey. Cigna delivers comprehensive health and

wellness solutions to employers, employees and individual

customers. Leveraging an extensive global healthcare network, Cigna

provides group medical benefits that are suitable for international

companies with a worldwide workforce, but also tailor

cost-effective plans for local small and medium-sized enterprises

that fit specific needs of the company and its employees. For

individual customers, Cigna offers a full suite of health insurance

products that caters to consumers' diverse needs.

For more details, please visit www.cigna.com.hk.

MEDIA CONTACTS:

Cigna Hong Kong

Brenda Ngo

Email: brenda.ngo@cigna.com

Tel: (+852) 2539 9138

Strategic Financial Relations Limited

Courtney Ngai

Email: courtney.ngai@sprg.com.hk

Tel: (+852) 2114 4952

Rita Fong

Email: rita.fong@sprg.com.hk

Tel: (+852) 2114 4939

James Fung

Email: james.fung@sprg.com.hk

Tel: (+852) 2114 4956

Source: Cigna Hong Kong

Copyright 2017 ACN Newswire . All rights reserved.

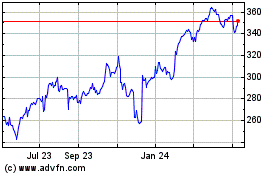

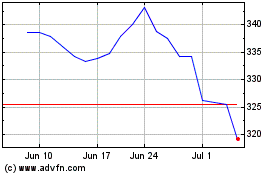

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024