By Theo Francis and Vipal Monga

U.S. companies are preparing to invest again after years on the

sidelines, and rising interest rates are unlikely to impede

them.

Executives have grown more optimistic about growth, in part

anticipating that President-elect Donald Trump's administration and

Republican congressional majorities will bring regulatory

rollbacks, corporate tax breaks and increased infrastructure

spending.

The Federal Reserve last month signaled interest rates would

rise at a faster pace than previously projected, showing increasing

optimism about the U.S. economy as it unanimously approved its

second rate increase in a decade.

Despite years of near-zero interest rates that made borrowing

cheap, many big U.S. corporations have been hoarding cash or

plowing money into safer pursuits in the wake of the recession.

Some, like General Motors Co. and railroad CSX Corp., borrowed to

prop up pension plans. Others, including Home Depot Inc. and Yum

Brands Inc., used cheap debt to repurchase shares. Meanwhile,

overall spending on building new factories or upgrading aging

equipment languished.

That is likely to change soon.

"We could be in store for a significant [capital-expenditure]

boom," said Charles Mulford, an accounting professor at Georgia

Institute of Technology in Atlanta.

Steel company Klöckner & Co., which generates about 40% of

its sales from its 50 sites in the U.S., expects to increase

spending on steel-shaping machinery here in the coming year. The

German company delayed such U.S. investments when demand slowed

from industrial customers that make everything from railcars to

storage tanks for oil producers.

Rising interest rates won't interfere with the planned

investments, said Gisbert Rühl, chairman of Klöckner's management

board. "If we have to pay 100 basis points more, that's not an

issue for us," Mr. Rühl said. "Even 200 basis points is not an

issue...It's still cheap." Fed officials have signaled that they

expect to raise rates by another 0.75 percentage point this year,

likely in three quarter-point moves.

The new optimism could mean the U.S. is poised to emerge from a

pattern that has frustrated the usual business investment cycle.

During downturns, businesses typically cut capital investment --

spending that increases or improves physical assets like buildings,

equipment and computers. As the economy picks up, they rapidly ramp

up spending, or risk being overtaken by more aggressive

competitors.

Business investment dropped sharply during the financial crisis,

falling more than 17% for S&P 500 companies in the 12 months

after Lehman Brothers' September 2008 collapse. But even as the

economy recovered, total expenditures took three years to regain

the precrisis level, according to data from S&P Dow Jones

Indices.

Companies saw little reason to invest when U.S. economic growth

was sluggish. Quarterly gross domestic product has averaged an

annualized 1.5% growth since the Lehman collapse, compared with a

decadeslong average -- going back to 1930 -- of more than 3%.

Another culprit was a resistance among corporate leaders to

lower the minimum rate of return on investment -- known as a hurdle

rate -- they would accept from new spending, largely out of fear of

disappointing shareholders.

"If returns are down and your hurdle rate hasn't changed, you'll

stop investing," said William Plummer, finance chief at

construction rental firm United Rentals Inc.

Instead, many businesses pursued safer alternatives. In 2015

alone, companies in the Russell 3000 index bought back nearly $700

billion of their own shares, the most since 2007, according to

research firm Birinyi Associates Inc. Last year through November,

those firms spent another $488 billion on buybacks.

Companies in the S&P 1500 pumped $550 billion into their

pensions between 2008 and Nov. 30 last year, according to Mercer

Investment Consulting LLC.

"Businesses simply haven't adjusted to a world of low interest

rates," said Paul Ashworth, chief North American economist for

Capital Economics Ltd., a research firm. "They're still looking for

5% or 6% returns, or 10% returns, on investment projects, and not

realizing the cost of borrowing is actually much lower."

Some companies continue to promise returns echoing those common

before the financial crisis. General Electric Co., for example, in

2016 tied pay for its executives to a 16% to 18% benchmark for

return on capital, in addition to measures of profitability and

growth in cash and earnings.

A GE spokeswoman said investors expect returns in that

range.

Many executives believed the Fed would raise interest rates

relatively soon after the recession ended, said Aldo Pagliari,

chief financial officer at toolmaker Snap-On Inc. That led

companies to put off lowering their estimates of what it would cost

to raise money to fund upgrades or new projects.

"If you look at 2009, 2010, or 2011, no one thought rates would

stay that low," he said. Snap-On now estimates cost of capital at

roughly 9.2%, down just slightly from the 10% it assumed before the

financial crisis.

In 2010, videogame retailer GameStop Corp. committed to spend

$300 million on share repurchases and $200 million on new stores

and other investments. The company had built up cash on its balance

sheet and executives felt they needed to return some to

shareholders in the absence of better alternatives. "The

interest-rate environment wasn't giving you anything for parked

cash," said Robert Lloyd, GameStop's finance chief.

More recently, the company has shifted tactics. GameStop has

boosted capital spending to roughly $160 million in 2016 from $125

million in 2013 for store refurbishments and expansion into new

categories like collectibles. Last year, it cut its buyback in

half. "It was the right thing for us to diversify the company and

make those investments," Mr. Lloyd said.

Write to Theo Francis at theo.francis@wsj.com and Vipal Monga at

vipal.monga@wsj.com

(END) Dow Jones Newswires

January 02, 2017 11:04 ET (16:04 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

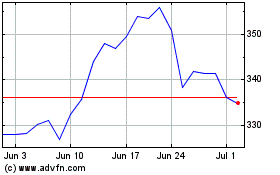

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024