FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2016

Commission File Number: 001-15002

ICICI

Bank Limited

(Translation of registrant’s name into English)

ICICI Bank

Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes”

is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table of Contents

|

Item

|

|

|

|

|

|

1.

|

Semi-Annual

Report filed with the Kanto Local Finance Bureau, Japan on December 28, 2016

|

Item 1

[Form

No. 10]

Cover

Page

|

Document Name:

|

Semi-Annual Report

|

|

|

|

|

Filed with:

|

Director of Kanto Local Finance Bureau

|

|

|

|

|

Date of Filing:

|

December 28, 2016

|

|

|

|

|

For Six-month Period:

|

From April 1, 2016 through September 30, 2016

|

|

|

|

|

Corporate Name:

|

ICICI Bank Limited

|

|

|

|

|

Name and Title of Representative:

|

Sanker Parameswaran

|

|

|

Senior General Manager (Legal) & Company

Secretary

|

|

|

|

|

Location of Registered Office:

|

ICICI Bank Tower, Near Chakli Circle, Old Padra

Road, Vadodara 390 007, Gujarat, India

|

|

|

|

|

Personal Name or Corporate Name

|

Hironori Shibata, Attorney-at-Law

|

|

of Attorney-in-Fact:

|

|

|

|

|

|

Address or Location of

|

Anderson Mori & Tomotsune

|

|

Attorney-in-Fact:

|

Akasaka K-Tower

|

|

|

2-7, Motoakasaka 1-chome

|

|

|

Minato-ku,

Tokyo

|

|

|

|

|

|

|

|

Telephone Number:

|

03-6888-1182

|

|

|

|

|

Name of Person to Contact with:

|

Yoshiki Mizoguchi, Attorney-at-Law

|

|

|

|

|

Place to Contact with:

|

Anderson Mori & Tomotsune

|

|

|

Akasaka K-Tower

|

|

|

2-7, Motoakasaka 1-chome

|

|

|

Minato-ku, Tokyo

|

|

|

|

|

Telephone Number:

|

03-6894-4047

|

|

|

|

|

Place(s) for Public Inspection:

|

Not applicable.

|

|

|

1.

|

In

this Semi-Annual Report, all references to "we", "our" and "us"

are, unless the context otherwise requires, to ICICI Bank Limited

on

an unconsolidated basis

. References to specific data applicable to particular

subsidiaries or other consolidated entities are made by reference to the name of that

particular entity. References to "ICICI Bank" or "the Bank" are,

as the context requires, to ICICI Bank Limited on an unconsolidated basis.

|

|

|

2.

|

In

this document, references to "US$" are to United States dollars, references

to "Rs." are to Indian rupees, and references to "¥" or "JPY"

are to Japanese yen. For purposes of readability, certain US dollar amounts have been

converted into Japanese yen at the mean of the telegraphic transfer spot selling and

buying rates vis-à-vis customers as at December 1, 2016 as quoted by The Bank

of Tokyo-Mitsubishi UFJ, Ltd. in Tokyo (US$ 1 = ¥ 114.39), and certain rupee amounts

have been converted into Japanese yen at the reference rate of Rs. 1 = ¥ 1.83 based

on the foreign exchange rate as announced by The Bank of Tokyo-Mitsubishi UFJ, Ltd. in

Tokyo as at December 1, 2016.

|

|

|

3.

|

The

fiscal year of the Bank commences on April 1 and ends at March 31 of each year. References

to a particular "fiscal" year are to our fiscal year ending at March 31 of

that particular year. For example, "fiscal 2017" refers to the year beginning

on April 1, 2016 and ending at March 31, 2017.

|

|

|

4.

|

Where

figures in tables have been rounded, the totals may not necessarily agree with the arithmetic

sum of the figures.

|

TABLE

OF CONTENTS (for reference purpose only)

COVER

SHEET

|

PART I.

|

CORPORATE INFORMATION

|

|

|

|

|

|

|

|

I.

|

SUMMARY OF LEGAL AND OTHER SYSTEMS IN HOME COUNTRY

|

1

|

|

|

|

|

|

II.

|

OUTLINE OF COMPANY

|

2

|

|

|

|

|

|

|

|

1.

|

Trends in Major Business Indices, etc.

|

2

|

|

|

|

|

|

|

|

|

2.

|

Nature of Business

|

10

|

|

|

|

|

|

|

|

|

3.

|

State of Affiliated Companies

|

10

|

|

|

|

|

|

|

|

|

4.

|

State of Employees

|

10

|

|

|

|

|

|

|

|

III.

|

STATEMENT OF BUSINESS

|

11

|

|

|

|

|

|

|

|

1.

|

Outline of Results of Operations, etc.

|

11

|

|

|

|

|

|

|

|

|

2.

|

State of Production, Orders Accepted and Sales

|

11

|

|

|

|

|

|

|

|

|

3.

|

Problems to be Coped with

|

11

|

|

|

|

|

|

|

|

|

4.

|

Risks in Business, etc.

|

11

|

|

|

|

|

|

|

|

|

5.

|

Material Contracts Relating to Management, etc.

|

11

|

|

|

|

|

|

|

|

|

6.

|

Research and Development Activities

|

11

|

|

|

|

|

|

|

|

|

7.

|

Analysis of Financial Condition, Operating Results and Statement of Cash Flows

|

11

|

|

|

|

|

|

|

|

IV.

|

STATEMENT OF FACILITIES

|

29

|

|

|

|

|

|

|

|

1.

|

State of Major Facilities

|

29

|

|

|

|

|

|

|

|

|

2.

|

Plan for Installation, Retirement, etc. of Facilities

|

29

|

|

|

|

|

|

|

|

V.

|

STATEMENT OF FILING COMPANY

|

30

|

|

|

|

|

|

|

|

1.

|

State of Shares, etc.

|

30

|

|

|

|

|

|

|

|

|

|

(1)

|

Total Number of Shares, etc.

|

30

|

|

|

|

|

|

|

|

|

|

|

(i) Total Number of Shares

|

30

|

|

|

|

|

(ii) Issued Shares

|

30

|

|

|

|

|

|

|

|

|

|

(2)

|

State of Exercise of Bonds with Stock Acquisition Rights etc. with Moving Strike Clause

|

31

|

|

|

|

(3)

|

Total Number of Issued Shares and Capital Stock

|

31

|

|

|

|

|

|

|

|

|

|

(4)

|

Major Shareholders

|

32

|

|

|

|

|

|

|

|

|

2.

|

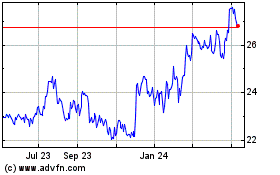

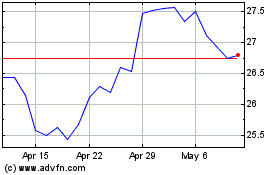

Trends in Stock Prices

|

33

|

|

|

|

|

|

|

|

3.

|

Statement of Directors and Officers

|

33

|

|

|

|

|

|

|

VI.

|

FINANCIAL CONDITION

|

35

|

|

|

|

|

|

|

1.

|

Interim Financial Statements

|

35

|

|

|

|

|

|

|

|

2.

|

Other Information

|

38

|

|

|

|

|

|

|

|

|

(1)

|

Legal and Regulatory Proceedings

|

38

|

|

|

|

|

|

|

|

|

|

(2)

|

Subsequent Events

|

42

|

|

|

|

|

|

|

|

|

3.

|

Major Differences between United States and

Japanese Accounting Principles and Practices

|

42

|

|

|

|

|

|

|

|

|

4.

|

Major Differences between Indian and

Japanese Accounting Principles and Practices

|

45

|

|

|

|

|

|

|

|

VII.

|

TRENDS IN FOREIGN EXCHANGE RATES

|

50

|

|

|

|

|

|

VIII.

|

REFERENCE INFORMATION OF FILING COMPANY

|

51

|

|

|

|

|

|

PART

II.

|

INFORMATION ON GUARANTY COMPANY

OF

FILING COMPANY, ETC.

|

52

|

|

|

|

|

|

I.

|

INFORMATION ON GUARANTY COMPANY

|

52

|

|

|

|

|

|

II.

|

INFORMATION ON COMPANIES OTHER THAN

GUARANTY

COMPANY

|

52

|

|

|

|

|

|

|

|

III.

|

INFORMATION ON BUSINESS INDICES, ETC.

|

52

|

PART

I. CORPORATE INFORMATION

|

|

I.

|

SUMMARY OF LEGAL AND OTHER SYSTEMS

IN HOME COUNTRY

|

There

has been no material change in legal and other systems in India, since the last Annual Securities Report ("ASR") filed

on September 30, 2016 for fiscal 2016.

|

|

1.

|

Trends in Major Business Indices,

etc.

|

The

following data is derived from the audited unconsolidated financial results of ICICI Bank Limited prepared in accordance with

generally accepted accounting principles in India ("Indian GAAP").

Unconsolidated

financial results

(Rs. in crore/JPY in ten-million)

|

|

|

|

|

Six months ended

|

|

Year ended

|

|

Sr. No.

|

|

Particulars

|

|

September

30, 2016

|

|

September

30, 2016

|

|

September

30, 2015

|

|

September

30, 2014

|

|

March

31, 2016

|

|

March

31, 2016

|

|

March

31, 2015

|

|

|

|

|

|

(Audited)

|

|

|

|

(Audited)

|

|

(Audited)

|

|

(Audited)

|

|

|

|

(Audited)

|

|

1.

|

|

Interest earned (a)+(b)+(c)+(d)

|

|

|

Rs. 26,969.65

|

|

|

|

JPY 49,354.46

|

|

|

|

Rs. 25,911.43

|

|

|

|

Rs. 23,917.46

|

|

|

|

Rs. 52,739.43

|

|

|

|

JPY 96,513.16

|

|

|

|

Rs. 49,091.14

|

|

|

|

|

a) Interest/discount on advances/bills

|

|

|

19,742.67

|

|

|

|

36,129.09

|

|

|

|

19,039.77

|

|

|

|

17,266.22

|

|

|

|

38,943.15

|

|

|

|

71,265.96

|

|

|

|

35,631.08

|

|

|

|

|

b) Income on investments

|

|

|

5,807.73

|

|

|

|

10,628.15

|

|

|

|

5,320.52

|

|

|

|

5,311.87

|

|

|

|

10,625.35

|

|

|

|

19,444.39

|

|

|

|

10,592.77

|

|

|

|

|

c) Interest on balances with Reserve Bank of India and other inter-bank funds

|

|

|

87.98

|

|

|

|

161.00

|

|

|

|

63.00

|

|

|

|

103.04

|

|

|

|

158.24

|

|

|

|

289.58

|

|

|

|

195.10

|

|

|

|

|

d) Others

|

|

|

1,331.27

|

|

|

|

2,436.22

|

|

|

|

1,488.14

|

|

|

|

1,236.33

|

|

|

|

3,012.69

|

|

|

|

5,513.22

|

|

|

|

2,672.19

|

|

|

2.

|

|

Other income

|

|

|

12,548.94

|

|

|

|

22,964.56

|

|

|

|

5,997.24

|

|

|

|

5,588.20

|

|

|

|

15,323.05

|

|

|

|

28,041.18

|

|

|

|

12,176.13

|

|

|

3.

|

|

TOTAL INCOME (1)+(2)

|

|

|

39,518.59

|

|

|

|

72,319.02

|

|

|

|

31,908.67

|

|

|

|

29,505.66

|

|

|

|

68,062.48

|

|

|

|

124,554.34

|

|

|

|

61,267.27

|

|

|

4.

|

|

Interest expended

|

|

|

16,557.84

|

|

|

|

30,300.85

|

|

|

|

15,544.86

|

|

|

|

14,768.93

|

|

|

|

31,515.39

|

|

|

|

57,673.16

|

|

|

|

30,051.53

|

|

|

5.

|

|

Operating expenses (e)+(f)

|

|

|

7,109.95

|

|

|

|

13,011.21

|

|

|

|

6,167.58

|

|

|

|

5,522.10

|

|

|

|

12,683.56

|

|

|

|

23,210.91

|

|

|

|

11,495.83

|

|

|

|

|

e) Employee cost

|

|

|

2,847.31

|

|

|

|

5,210.58

|

|

|

|

2,479.87

|

|

|

|

2,333.25

|

|

|

|

5,002.35

|

|

|

|

9,154.30

|

|

|

|

4,749.88

|

|

|

|

|

f) Other operating expenses

|

|

|

4,262.64

|

|

|

|

7,800.63

|

|

|

|

3,687.71

|

|

|

|

3,188.85

|

|

|

|

7,681.21

|

|

|

|

14,056.61

|

|

|

|

6,745.95

|

|

|

6.

|

|

TOTAL EXPENDITURE (4)+(5)

(excluding provisions and contingencies)

|

|

|

23,667.79

|

|

|

|

43,312.06

|

|

|

|

21,712.44

|

|

|

|

20,291.03

|

|

|

|

44,198.95

|

|

|

|

80,884.08

|

|

|

|

41,547.36

|

|

|

7.

|

|

OPERATING PROFIT (3)-(6)

(Profit

before provisions and contingencies)

|

|

|

15,850.80

|

|

|

|

29,006.96

|

|

|

|

10,196.23

|

|

|

|

9,214.63

|

|

|

|

23,863.53

|

|

|

|

43,670.26

|

|

|

|

19,719.91

|

|

|

8.

|

|

Provisions (other than tax) and contingencies (refer note no. 8)

|

|

|

9,597.21

|

|

|

|

17,562.89

|

|

|

|

1,897.55

|

|

|

|

1,575.57

|

|

|

|

8,067.81

|

|

|

|

14,764.09

|

|

|

|

3,899.99

|

|

9.

|

|

PROFIT / (LOSS) FROM ORDINARY ACTIVITIES BEFORE EXCEPTIONAL ITEMS AND TAX (7)-(8)

|

|

|

6,253.59

|

|

|

|

11,444.07

|

|

|

|

8,298.68

|

|

|

|

7,639.06

|

|

|

|

15,795.72

|

|

|

|

28,906.17

|

|

|

|

15,819.92

|

|

|

10.

|

|

Exceptional items (refer note no. 6)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

3,600.00

|

|

|

|

6,588.00

|

|

|

|

..

|

|

|

11.

|

|

PROFIT / (LOSS) FROM ORDINARY ACTIVITIES BEFORE TAX (9)-(10)

|

|

|

6,253.59

|

|

|

|

11,444.07

|

|

|

|

8,298.68

|

|

|

|

7,639.06

|

|

|

|

12,195.72

|

|

|

|

22,318.17

|

|

|

|

15,819.92

|

|

|

12.

|

|

Tax expense (g)+(h)

|

|

|

918.97

|

|

|

|

1,681.72

|

|

|

|

2,292.41

|

|

|

|

2,274.75

|

|

|

|

2,469.43

|

|

|

|

4,519.06

|

|

|

|

4,644.57

|

|

|

|

|

g)

Current period tax

|

|

|

2,187.70

|

|

|

|

4,003.49

|

|

|

|

2,679.17

|

|

|

|

2,246.70

|

|

|

|

5,788.61

|

|

|

|

10,593.16

|

|

|

|

4,864.14

|

|

|

|

|

h) Deferred tax adjustment

|

|

|

(1,268.73

|

)

|

|

|

(2,321.78

|

)

|

|

|

(386.76

|

)

|

|

|

28.05

|

|

|

|

(3,319.18

|

)

|

|

|

(6,074.10

|

)

|

|

|

(219.57

|

)

|

13.

|

|

NET PROFIT / (LOSS) FROM ORDINARY ACTIVITIES AFTER TAX (11)-(12)

|

|

|

5,334.62

|

|

|

|

9,762.35

|

|

|

|

6,006.27

|

|

|

|

5,364.31

|

|

|

|

9,726.29

|

|

|

|

17,799.11

|

|

|

|

11,175.35

|

|

|

14.

|

|

Extraordinary items (net of tax expense)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

15.

|

|

NET PROFIT / (LOSS) FOR THE PERIOD (13)-(14)

|

|

|

5,334.62

|

|

|

|

9,762.35

|

|

|

|

6,006.27

|

|

|

|

5,364.31

|

|

|

|

9,726.29

|

|

|

|

17,799.11

|

|

|

|

11,175.35

|

|

|

16.

|

|

Paid-up equity share capital (face value Rs. 2/- each)

|

|

|

1,164.01

|

|

|

|

2,130.14

|

|

|

|

1,161.75

|

|

|

|

1,157.46

|

|

|

|

1,163.17

|

|

|

|

2,128.60

|

|

|

|

1,159.66

|

|

|

17.

|

|

Reserves excluding revaluation reserves

|

|

|

91,021.77

|

|

|

|

166,569.84

|

|

|

|

85,396.93

|

|

|

|

77,712.85

|

|

|

|

85,748.24

|

|

|

|

156,919.28

|

|

|

|

79,262.26

|

|

|

18.

|

|

Analytical ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i) Percentage of shares held by Government of India

|

|

|

0.12

|

|

|

|

..

|

|

|

|

0.08

|

|

|

|

0.05

|

|

|

|

0.14

|

|

|

|

..

|

|

|

|

0.06

|

|

|

|

|

ii) Capital adequacy ratio (Basel III)

|

|

|

16.14

|

%

|

|

|

..

|

|

|

|

16.15

|

%

|

|

|

16.64

|

%

|

|

|

16.64

|

%

|

|

|

..

|

|

|

|

17.02

|

%

|

|

|

|

iii) Earnings per share (EPS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Basic EPS before and after extraordinary items, net of tax expense (not annualized for six months) (in Rs./JPY)

|

|

|

9.17

|

|

|

|

16.78

|

|

|

|

10.35

|

|

|

|

9.28

|

|

|

|

16.75

|

|

|

|

30.65

|

|

|

|

19.32

|

|

|

|

|

b) Diluted EPS before and after extraordinary items, net of tax expense (not annualized for six months) (in Rs./JPY)

|

|

|

9.14

|

|

|

|

16.73

|

|

|

|

10.27

|

|

|

|

9.20

|

|

|

|

16.65

|

|

|

|

30.47

|

|

|

|

19.13

|

|

|

19.

|

|

NPA Ratio

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i) Gross non-performing advances (net of write-off)

|

|

|

32,178.60

|

|

|

|

58,886.84

|

|

|

|

15,857.82

|

|

|

|

11,546.70

|

|

|

|

26,221.25

|

|

|

|

47,984.89

|

|

|

|

15,094.69

|

|

|

|

|

ii) Net non-performing advances

|

|

|

16,214.86

|

|

|

|

29,673.19

|

|

|

|

6,759.29

|

|

|

|

3,942.33

|

|

|

|

12,963.08

|

|

|

|

23,722.44

|

|

|

|

6,255.53

|

|

|

|

|

iii) % of gross non-performing advances (net of write-off) to gross advances

|

|

|

6.82

|

%

|

|

|

..

|

|

|

|

3.77

|

%

|

|

|

3.12

|

%

|

|

|

5.82

|

%

|

|

|

..

|

|

|

|

3.78

|

%

|

|

|

|

iv) % of net non-performing advances to net advances

|

|

|

3.57

|

%

|

|

|

..

|

|

|

|

1.65

|

%

|

|

|

1.09

|

%

|

|

|

2.98

|

%

|

|

|

..

|

|

|

|

1.61

|

%

|

|

20.

|

|

Return on assets (annualized)

|

|

|

1.49

|

%

|

|

|

..

|

|

|

|

1.90

|

%

|

|

|

1.82

|

%

|

|

|

1.49

|

%

|

|

|

..

|

|

|

|

1.86

|

%

|

|

21.

|

|

Public shareholding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i) No. of shares

|

|

|

5,818,976,105

|

|

|

|

..

|

|

|

|

5,807,681,135

|

|

|

|

5,786,261,175

|

|

|

|

5,814,768,430

|

|

|

|

..

|

|

|

|

5,797,244,645

|

|

|

|

|

ii) Percentage of shareholding

|

|

|

100

|

|

|

|

..

|

|

|

|

100

|

|

|

|

100

|

|

|

|

100

|

|

|

|

..

|

|

|

|

100

|

|

|

22.

|

|

Promoter and promoter group shareholding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i) Pledged/encumbered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) No. of shares

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

b) Percentage of shares (as a % of the total shareholding of promoter and promoter group)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

c) Percentage of shares (as a % of the total share capital of the Bank)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

ii) Non-encumbered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) No. of shares

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

b) Percentage of shares (as a % of the total shareholding of promoter and promoter group)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

c) Percentage of shares (as a % of the total share capital of the Bank)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

1.

|

At September

30, 2016, the percentage of gross non-performing customer assets to gross customer assets

was 6.12% and net non-performing customer assets to net customer assets was 3.21%. Customer

assets include advances and credit substitutes.

|

Unconsolidated

segmental results of ICICI Bank Limited

(Rs.

in crore/JPY in ten-million)

|

|

|

|

|

Six months ended

|

|

Year ended

|

|

Sr. No.

|

|

Particulars

|

|

September 30, 2016

|

|

September 30, 2016

|

|

September 30, 2015

|

|

September 30, 2014

|

|

March 31, 2016

|

|

March 31,

2016

|

|

March 31, 2015

|

|

|

|

|

|

(Audited)

|

|

|

|

(Audited)

|

|

(Audited)

|

|

(Audited)

|

|

|

|

(Audited)

|

|

1.

|

|

Segment revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a

|

|

Retail Banking

|

|

|

Rs. 21,809.53

|

|

|

|

JPY 39,911.44

|

|

|

|

Rs. 18,989.59

|

|

|

|

Rs. 15,724.53

|

|

|

|

Rs. 39,187.80

|

|

|

|

JPY 71,713.67

|

|

|

|

Rs. 32,991.18

|

|

|

b

|

|

Wholesale Banking (before exceptional items)

|

|

|

15,457.54

|

|

|

|

28,287.30

|

|

|

|

16,241.79

|

|

|

|

16,648.60

|

|

|

|

32,892.35

|

|

|

|

60,193.00

|

|

|

|

33,502.51

|

|

|

c

|

|

Treasury

|

|

|

30,330.30

|

|

|

|

55,504.45

|

|

|

|

22,527.78

|

|

|

|

21,179.46

|

|

|

|

48,749.62

|

|

|

|

89,211.80

|

|

|

|

43,931.06

|

|

|

d

|

|

Other Banking

|

|

|

954.34

|

|

|

|

1,746.44

|

|

|

|

852.59

|

|

|

|

752.10

|

|

|

|

1,817.85

|

|

|

|

3,326.67

|

|

|

|

1,581.51

|

|

|

|

|

Total segment revenue

|

|

|

68,551.71

|

|

|

|

125,449.63

|

|

|

|

58,611.75

|

|

|

|

54,304.69

|

|

|

|

122,647.62

|

|

|

|

224,445.14

|

|

|

|

112,006.26

|

|

|

|

|

Less: Inter segment revenue

|

|

|

29,033.12

|

|

|

|

53,130.61

|

|

|

|

26,703.08

|

|

|

|

24,799.03

|

|

|

|

54,585.14

|

|

|

|

99,890.81

|

|

|

|

50,738.99

|

|

|

|

|

Income from operations

|

|

|

39,518.59

|

|

|

|

72,319.02

|

|

|

|

31,908.67

|

|

|

|

29,505.66

|

|

|

|

68,062.48

|

|

|

|

124,554.34

|

|

|

|

61,267.27

|

|

|

2.

|

|

Segmental results (i.e. Profit before tax)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a

|

|

Retail Banking

|

|

|

2,361.71

|

|

|

|

4,321.93

|

|

|

|

1,731.78

|

|

|

|

1,268.99

|

|

|

|

3,897.74

|

|

|

|

7,132.86

|

|

|

|

2,724.28

|

|

|

b.i

|

|

Wholesale Banking (before exceptional items)

|

|

|

(5,616.07

|

)

|

|

|

(10,277.41

|

)

|

|

|

3,307.15

|

|

|

|

3,271.21

|

|

|

|

2,354.57

|

|

|

|

4,308.86

|

|

|

|

6,224.07

|

|

|

b.ii

|

|

Less: Exceptional items (refer note no. 6)

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

3,600.00

|

|

|

|

6,588.00

|

|

|

|

..

|

|

|

b.iii

|

|

Wholesale Banking (after exceptional items)

|

|

|

(5,616.07

|

)

|

|

|

(10,277.41

|

)

|

|

|

3,307.15

|

|

|

|

3,271.21

|

|

|

|

(1,245.43

|

)

|

|

|

(2,279.14

|

)

|

|

|

6,224.07

|

|

|

c

|

|

Treasury

|

|

|

9,258.33

|

|

|

|

16,942.74

|

|

|

|

3,100.76

|

|

|

|

2,896.42

|

|

|

|

9,097.41

|

|

|

|

16,648.26

|

|

|

|

6,449.95

|

|

|

d

|

|

Other Banking

|

|

|

249.62

|

|

|

|

456.80

|

|

|

|

158.99

|

|

|

|

202.44

|

|

|

|

446.00

|

|

|

|

816.18

|

|

|

|

421.62

|

|

|

|

|

Total segment results

|

|

|

6,253.59

|

|

|

|

11,444.07

|

|

|

|

8,298.68

|

|

|

|

7,639.06

|

|

|

|

12,195.72

|

|

|

|

22,318.17

|

|

|

|

15,819.92

|

|

|

|

|

Unallocated expenses

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

Profit before tax

|

|

|

6,253.59

|

|

|

|

11,444.07

|

|

|

|

8,298.68

|

|

|

|

7,639.06

|

|

|

|

12,195.72

|

|

|

|

22,318.17

|

|

|

|

15,819.92

|

|

|

3.

|

|

Segment assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a

|

|

Retail Banking

|

|

|

191,484.27

|

|

|

|

350,416.21

|

|

|

|

152,291.87

|

|

|

|

109,721.74

|

|

|

|

172,480.55

|

|

|

|

315,639.41

|

|

|

|

129,727.55

|

|

|

b

|

|

Wholesale Banking

|

|

|

264,923.83

|

|

|

|

484,810.61

|

|

|

|

257,971.33

|

|

|

|

254,046.50

|

|

|

|

266,365.91

|

|

|

|

487,449.62

|

|

|

|

261,221.18

|

|

|

c

|

|

Treasury

|

|

|

269,931.58

|

|

|

|

493,974.79

|

|

|

|

227,890.55

|

|

|

|

232,106.20

|

|

|

|

258,052.97

|

|

|

|

472,236.94

|

|

|

|

237,933.96

|

|

|

d

|

|

Other Banking

|

|

|

17,592.21

|

|

|

|

32,193.74

|

|

|

|

13,763.83

|

|

|

|

11,806.47

|

|

|

|

16,005.62

|

|

|

|

29,290.28

|

|

|

|

12,568.76

|

|

|

e

|

|

Unallocated

|

|

|

8,007.61

|

|

|

|

14,653.93

|

|

|

|

5,138.40

|

|

|

|

3,461.84

|

|

|

|

7,790.05

|

|

|

|

14,255.79

|

|

|

|

4,677.85

|

|

|

|

|

Total segment assets

|

|

|

751,939.50

|

|

|

|

1,376,049.29

|

|

|

|

657,055.98

|

|

|

|

611,142.75

|

|

|

|

720,695.10

|

|

|

|

1,318,872.03

|

|

|

|

646,129.30

|

|

|

4.

|

|

Segment liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a

|

|

Retail Banking

|

|

|

330,407.45

|

|

|

|

604,645.63

|

|

|

|

285,145.69

|

|

|

|

253,967.85

|

|

|

|

313,393.27

|

|

|

|

573,509.68

|

|

|

|

266,162.01

|

|

|

b

|

|

Wholesale Banking

|

|

|

134,452.92

|

|

|

|

246,048.84

|

|

|

|

108,475.94

|

|

|

|

107,411.74

|

|

|

|

119,785.32

|

|

|

|

219,207.14

|

|

|

|

103,824.32

|

|

|

c

|

|

Treasury

|

|

|

180,707.70

|

|

|

|

330,695.09

|

|

|

|

165,696.01

|

|

|

|

160,321.75

|

|

|

|

186,680.55

|

|

|

|

341,625.41

|

|

|

|

185,186.34

|

|

|

d

|

|

Other Banking

|

|

|

11,355.80

|

|

|

|

20,781.11

|

|

|

|

11,172.74

|

|

|

|

10,564.22

|

|

|

|

11,100.38

|

|

|

|

20,313.70

|

|

|

|

10,527.26

|

|

|

e

|

|

Unallocated

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

..

|

|

|

|

|

Total segment liabilities

|

|

|

656,923.87

|

|

|

|

1,202,170.68

|

|

|

|

570,490.38

|

|

|

|

532,265.56

|

|

|

|

630,959.52

|

|

|

|

1,154,655.92

|

|

|

|

565,699.94

|

|

|

5.

|

|

Capital employed (i.e. Segment assets – Segment liabilities)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a

|

|

Retail Banking

|

|

|

(138,923.18

|

)

|

|

|

(254,229.42

|

)

|

|

|

(132,853.82

|

)

|

|

|

(144,246.11

|

)

|

|

|

(140,912.72

|

)

|

|

|

(257,870.28

|

)

|

|

|

(136,434.46

|

)

|

|

b

|

|

Wholesale Banking

|

|

|

130,470.91

|

|

|

|

238,761.77

|

|

|

|

149,495.39

|

|

|

|

146,634.76

|

|

|

|

146,580.59

|

|

|

|

268,242.48

|

|

|

|

157,396.86

|

|

|

c

|

|

Treasury

|

|

|

89,223.88

|

|

|

|

163,279.70

|

|

|

|

62,194.54

|

|

|

|

71,784.45

|

|

|

|

71,372.42

|

|

|

|

130,611.53

|

|

|

|

52,747.62

|

|

|

d

|

|

Other Banking

|

|

|

6,236.41

|

|

|

|

11,412.63

|

|

|

|

2,591.09

|

|

|

|

1,242.25

|

|

|

|

4,905.24

|

|

|

|

8,976.59

|

|

|

|

2,041.50

|

|

|

e

|

|

Unallocated

|

|

|

8,007.61

|

|

|

|

14,653.93

|

|

|

|

5,138.40

|

|

|

|

3,461.84

|

|

|

|

7,790.05

|

|

|

|

14,255.79

|

|

|

|

4,677.84

|

|

|

|

|

Total capital employed

|

|

|

Rs. 95,015.63

|

|

|

|

JPY 173,878.60

|

|

|

|

Rs. 86,565.60

|

|

|

|

Rs. 78,877.19

|

|

|

|

Rs. 89,735.58

|

|

|

|

JPY 164,216.11

|

|

|

|

Rs. 80,429.36

|

|

Notes

on segmental results:

|

|

1.

|

The

disclosure on segmental reporting has been prepared in accordance with the Reserve Bank

of India circular no. DBOD.No.BP.BC.81/21.04.018/2006-07 dated April 18, 2007 on guidelines

on enhanced disclosures on “Segmental Reporting” which is effective from

the reporting period ended March 31, 2008 and Securities and Exchange Board of India

(SEBI) circular no. CIR/CFD/FAC/62/2016 dated July 5, 2016 on Revised Formats for Financial

Results and Implementation of Ind-AS by Listed Entities.

|

|

|

2.

|

“Retail

Banking” includes exposures which satisfy the four criteria of orientation, product,

granularity and low value of individual exposures for retail exposures laid down in Basel

committee on Banking Supervision document “International Convergence of Capital

Measurement and Capital Standards: A Revised Framework”. This segment also includes

income from credit cards, debit card, third party product distribution and the associated

costs.

|

|

|

3.

|

“Wholesale

Banking” includes all advances to trusts, partnership firms, companies and statutory

bodies, which are not included under Retail Banking.

|

|

|

4.

|

“Treasury”

includes the entire investment and derivative portfolio of the Bank.

|

|

|

5.

|

“Other

Banking” includes leasing operations and other items not attributable to any particular

business segment of the Bank.

|

|

|

1.

|

The

above financial results have been approved by the Board of Directors at its meeting held

on November 7, 2016.

|

|

|

2.

|

The

financial statements have been prepared in accordance with Accounting Standard (AS) 25

on “Interim Financial Reporting”.

|

|

|

3.

|

In

accordance with the Reserve Bank of India guidelines on 'Basel III Capital Regulations'

read together with the Reserve Bank of India circular dated July 1, 2015, the consolidated

Pillar 3 disclosure (unaudited) at September 30, 2016 including leverage ratio and liquidity

coverage ratio is available at http://www.icicibank.com/regulatory-disclosure.page.

|

|

|

4.

|

Other

income includes net foreign exchange gain relating to overseas operations amounting to

Rs. 206.06 crore, Rs. 536.97 crore and Rs. 268.20 crore for the six months ended September

30, 2016, September 30, 2015 and September 30, 2014 respectively, Rs. 941.19 crore and

Rs. 642.11 crore for the year ended March 31, 2016 and March 31, 2015 respectively.

|

|

|

5.

|

Pursuant

to approval by the Board of Directors of the Bank on April 29, 2016, the Bank sold equity

shares representing 12.63% shareholding in ICICI Prudential Life Insurance Company Limited

in the initial public offer during the three months ended September 30, 2016 for a total

consideration of Rs. 6,056.79 crore. The unconsolidated financial results and consolidated

financial results include a gain (before tax and after initial public offer related expenses)

of Rs. 5,682.03 crore and Rs. 5,129.88 crore respectively on this sale in the three months

and six months ended September 30, 2016.

|

For

the year ended March 31, 2016, the unconsolidated financial results and consolidated financial results include a gain (before

tax) of Rs. 1,859.83 crore and Rs. 1,614.88 crore respectively on sale of shares of ICICI Prudential Life Insurance Company Limited

and Rs. 1,508.54 crore and Rs. 1,234.85 crore respectively on sale of shares of ICICI Lombard General Insurance Company Limited.

|

|

6.

|

During

the year ended March 31, 2016, the weak global economic environment, the sharp downturn

in the commodity cycle and the gradual nature of the domestic economic recovery adversely

impacted the borrowers in certain sectors like iron and steel, mining, power, rigs and

cement. In view of the above, the Bank had on a prudent basis made a collective contingency

and related reserve during the three months ended March 31, 2016, amounting to Rs. 3,600.00

crore towards exposures to these sectors. This was over and above provisions made for

non-performing and restructured loans as per the Reserve Bank of India guidelines. The

Bank utilized an amount of Rs. 1,544.90 crore during the six months ended September 30,

2016 from collective contingency and related reserve.

|

|

|

7.

|

In

accordance with the Reserve Bank of India circular on 'Prudential norms on income recognition,

asset classification and provisioning pertaining to advances – spread over of shortfall

on sale of non-performing assets to securitization company /reconstruction company dated

June 13, 2016, banks are permitted to spread over any shortfall on sale of non-performing

assets to securitization company /reconstruction company during the year ending March

31, 2017 over a period of four quarters. The Bank recognized this deferred loss fully

during the six months ended September 30, 2016 on a prudent basis. The Bank accordingly

recognized a loss of Rs. 702.73 crore during the six months ended September 30, 2016.

|

Further,

the Bank had a gain of Rs. 188.38 crore during the six months ended September 30, 2016 on sale of non-performing assets to Asset

Reconstruction Companies which is

set

aside towards the security receipts received on such sale.

|

|

8.

|

During

the six months ended September 30, 2016, the Bank made additional provisions/loss of

Rs. 3,588.04 crore comprising the following:

|

|

|

i.

|

Additional

provision of Rs. 1,677.63 crore for standard loans;

|

|

|

ii.

|

Incremental

loss amounting to Rs. 395.41 crore by recognizing the entire loss on sale of non-performing

assets to Asset Reconstruction Companies which is permitted to be amortized as per the

Reserve Bank of India guideline (refer note no. 7); and

|

|

|

iii.

|

Floating

provision of Rs. 1,515.00 crore, which has been reduced from the gross non-performing

loans while computing the net non-performing assets.

|

|

|

9.

|

During

the six months ended September 30, 2016, pursuant to the press release dated July 6,

2016 issued by the Ministry of Finance, the Bank has reversed the tax provision and corresponding

deferred tax amounting to Rs. 462.41 crore created for the year ended March 31, 2016

on account of Income Computation and Disclosure Standards. Income Computation and Disclosure

Standards are applicable from the year ending March 31, 2017, therefore the tax provision

and deferred tax for the six months ended September 30, 2016 have been computed after

considering its impact.

|

|

|

10.

|

The

shareholders of the Bank approved the sub-division of each equity share having a face

value of Rs. 10 into five equity shares having a face value of Rs. 2 each through postal

ballot on November 20, 2014. The record date for the subdivision was December 5, 2014.

All share and per share information in the financial results reflect the effect of subdivision

for each of period presented.

|

|

|

11.

|

During

the six months ended September 30, 2016, the Bank has allotted 4,207,675 equity shares

of Rs. 2 each pursuant to exercise of employee stock options.

|

|

|

12.

|

Previous

period/year figures have been re-grouped/re-classified where necessary to conform to

current period classification.

|

|

|

13.

|

The

above unconsolidated financial results are audited by the statutory auditors, B S R &

Co. LLP, Chartered Accountants.

|

|

|

14.

|

Rs.

1 crore = Rs. 10.0 million.

|

There

has been no material change since the last ASR filed on September 30, 2016 for fiscal 2016.

|

|

3.

|

State of Affiliated Companies

|

There

has been no material change since the last ASR filed on September 30, 2016 for fiscal 2016.

At

September 30, 2016, the Bank had 80,475 employees, including interns, sales executives and employees on fixed-term contracts.

|

|

III.

|

STATEMENT

OF BUSINESS

|

|

|

1.

|

Outline of Results of Operations,

etc.

|

Please

refer to “ - 7. Analysis of Financial Condition, Operating Results and Statement of Cash Flows”.

|

|

2.

|

State of Production, Orders

Accepted and Sales

|

Please

refer to “ - 7. Analysis of Financial Condition, Operating Results and Statement of Cash Flows”.

|

|

3.

|

Problems to be Coped with

|

There

has been no material change since the last ASR filed on September 30, 2016 for fiscal 2016.

|

|

4.

|

Risks in Business, etc.

|

The

demonetization of high denomination Indian currency notes could impact our business and financial performance.

In

November 2016, the Indian government demonetized all Rs. 1,000 and Rs. 500 denominated currency notes and introduced a revised

Rs. 500 and new Rs. 2,000 denominated currency notes. This step was taken with the aim to curb the parallel economy and eliminate

the use of counterfeit notes. The extant Rs. 500 and Rs. 1,000 denominated notes accounted for approximately Rs. 15.0 trillion

or approximately 86%, of the total currency in circulation. The impact of the demonetization on economic growth, credit demand,

credit quality, liquidity and interest rates is uncertain. These factors, the likely lower economic growth and credit demand in

the near term, the costs associated with the transition and the reduction in revenues due to accompanying measures such as reduction

or waiver of transaction charges for ATM and card transactions for specified periods, may adversely impact our business and financial

performance.

|

|

5.

|

Material Contracts Relating

to Management, etc.

|

There

has been no material change since the last ASR filed on September 30, 2016 for fiscal 2016.

|

|

6.

|

Research and Development Activities

|

Please

refer to “ - II. - 2. Nature of Business”.

|

|

7.

|

Analysis

of Financial Condition, Operating Results and Statement of Cash Flows

|

The

following discussion is based on the audited unconsolidated financial results of the Bank for the six months ended on September

30, 2016.

Our

profit after tax decreased by 11.2% from Rs. 60.06 billion in the six months ended September 30, 2015 to Rs. 53.35 billion in

the six months ended September 30,

2016.

Net

interest income increased marginally by 0.4% from Rs. 103.67 billion in the six months ended September 30, 2015 to Rs. 104.12

billion in the six months ended September 30, 2016. The net interest margin decreased by 38 basis points from 3.53% in the six

months ended September 30, 2015 to 3.15% in the six months ended September 30, 2016. This was offset by a 12.3% increase in average

interest-earning assets. Net interest margin decreased primarily due to higher additions to gross non-performing assets, implementation/invocation

of Strategic Debt Restructuring in respect of certain borrowers as the Bank does not accrue interest on these loans, and reduction

in the Base Rate by 65 basis points in three phases during the year ended March 31, 2016.

Non-interest

income primarily includes fee and commission income, income from treasury-related activities, dividend from subsidiaries and other

income (including lease income). The non-interest income increased from Rs. 59.97 billion in the six months ended September 30,

2015 to Rs. 125.49 billion in the six months ended September 30, 2016 primarily due to an increase in income from treasury-related

activities due to a gain of Rs. 56.82 billion on sale of stake in ICICI Prudential Life Insurance Company through listing of its

equity shares and higher gains on sale of government securities and other fixed income positions.

Non-interest

expenses primarily include employee expenses, depreciation on assets and other administrative expenses. Non-interest expenses

increased by 15.3% from Rs. 61.68 billion in the six months ended September 30, 2015 to Rs. 71.10 billion in the six months ended

September 30, 2016 primarily due to an increase in employee related expenses.

Provisions

and contingencies (excluding provisions for tax) increased from Rs. 18.98 billion in the six months ended September 30, 2015 to

Rs. 95.97 billion in the six months ended September 30, 2016. Provision on advances included additional provision/loss of Rs.

35.88 billion comprising floating provision of Rs. 15.15 billion, additional provision of Rs. 16.78 billion for standard loans

and incremental loss of Rs. 3.95 billion due to accounting for the entire loss on sale of non-performing assets to asset reconstruction

companies, which is permitted to be amortized as per the Reserve Bank of India guidelines. Excluding the above additional provisions

of Rs. 35.88 billion, provisions and contingencies (excluding provisions for tax) increased from Rs. 18.97 billion in the six

months ended September 30, 2015 to Rs. 60.09 billion in the six months ended September 30, 2016 primarily due to higher additions

to gross non-performing assets in the corporate and small and medium enterprise portfolios and higher provision on investments.

Total

assets increased by 14.4% from Rs. 6,570.56 billion at September 30, 2015 to Rs. 7,519.40 billion at September 30, 2016. Total

deposits increased by 16.8% from Rs. 3,846.18 billion at September 30, 2015 to Rs. 4,490.71 billion at September 30, 2016. Savings

account deposits increased by 21.7% from Rs. 1,207.20 billion at September 30, 2015 to Rs. 1,468.99 billion at September 30, 2016.

The current and savings account ratio as a percentage of total deposits was 45.7% at September 30, 2016 compared to 45.1% at September

30, 2015. Term deposits increased by 15.5% from Rs. 2,111.29 billion at September 30, 2015 to Rs. 2,438.15 billion at September

30, 2016. Total advances increased by 10.9% from Rs. 4,096.93 billion at September 30, 2015 to

Rs.

4,542.56 billion at September 30, 2016 primarily due to an increase in domestic advances, offset, in part, by a decrease in overseas

advances. Net non-performing assets increased from Rs. 68.28 billion at September 30, 2015 to Rs. 164.83 billion at September

30, 2016 and the ratio of net non-performing assets to net customer assets increased from 1.5% at September 30, 2015 to 3.2% at

September 30, 2016.

We

continued to expand our branch network in India. Our branch network in India increased from 4,054 branches at September 30, 2015

to 4,468 branches at September 30, 2016. We also increased our ATM network from 12,964 ATMs at September 30, 2015 to 14,295 ATMs

at September 30, 2016.

The

total capital adequacy ratio of ICICI Bank on a standalone basis at September 30, 2016, in accordance with the Reserve Bank of

India guidelines on Basel III, was 16.14% with a Tier-1 capital adequacy ratio of 12.72%, without including profit for the six

months ended September 30, 2016 as compared to total capital adequacy ratio of 16.15% with a Tier-1 capital adequacy ratio of

12.09%, without including profit for the six months ended September 30, 2015.

Net

Interest Income

The

following table sets forth, for the periods indicated, the principal components of net interest income.

|

|

|

Six months ended September 30,

|

|

Particulars

|

|

2015

|

|

2016

|

|

2016

|

|

2016/2015

% change

|

|

|

|

(in million, except percentages)

|

|

Interest income

|

|

|

Rs. 259,114.3

|

|

|

|

Rs. 269,696.5

|

|

|

|

JPY 493,544.6

|

|

|

|

4.1

|

%

|

|

Interest expense

|

|

|

(155,448.6

|

)

|

|

|

(165,578.4

|

)

|

|

|

(303,008.5

|

)

|

|

|

6.5

|

%

|

|

Net interest income

|

|

|

Rs. 103,665.7

|

|

|

|

Rs. 104,118.1

|

|

|

|

JPY 190,536.1

|

|

|

|

0.4

|

%

|

Net

interest income increased marginally by 0.4% from Rs. 103.67 billion in

the six months ended September

30, 2015

to Rs. 104.12 billion in the six months ended September 30, 2016 reflecting an increase of 12.3% in the average

volume of interest-earning assets, offset, in part, by a decrease in net interest margin by 38 basis points.

Net

Interest Margin

The

net interest margin decreased by 38 basis points from 3.53% in the six months ended September 30, 2015 to 3.15% in the six months

ended September 30, 2016 primarily due to a decrease in the yield on interest-earning assets, offset, in part, by a decrease in

the cost of funds. The net interest margin was also impacted due to acquisition of non-banking assets in satisfaction of claims,

which do not earn any interest income, under debt-asset swap transactions from certain borrowers during the year ended March 31,

2016 and the six months ended September 30, 2016.

Net

interest margin of overseas branches decreased from 1.94% in the six months

ended

September 30, 2015 to 1.65% in the six months ended September 30, 2016.

The

yield on average interest-earning assets decreased primarily due to the following factors:

|

|

·

|

The

yield on average interest-earning assets decreased by 67 basis points from 8.82% in the

six months ended September 30, 2015 to 8.15% in the six months ended September 30, 2016

due to a decrease in yield on average advances, yield on average investments and yield

on average other interest-earning assets. The yield on average advances decreased by

74 basis points from 9.68% in the six months ended September 30, 2015 to 8.94% in the

six months ended September 30, 2016, the yield on average investments decreased by 38

basis point from 7.77% in the six months ended September 30, 2015 to 7.39% in the six

months ended September 30, 2016 and the yield on average other interest-earning assets

decreased from 5.43% in the six months ended September 30, 2015 to 4.53% in the six months

ended September 30, 2016.

|

|

|

·

|

The

yield on average advances decreased by 74 basis points primarily due to the following

reasons:

|

|

|

·

|

There

have been higher additions to non-performing assets and loans where Strategic Debt Restructuring

has been invoked/implemented during the year ended March 31, 2016 and the six months

ended September 30, 2016. The Bank does not accrue interest income on non-performing

assets and loans where Strategic Debt Restructuring has been invoked/implemented.

|

|

|

·

|

The

Bank reduced its Base Rate by 65 basis points in three phases during the year ended March

31, 2016. Further, the incremental lending by the Bank was at lower rates.

|

Yield

on overseas advances decreased marginally from 4.43% in the six months ended September 30, 2015 to 4.40% in the six months ended

September 30, 2016.

|

|

·

|

The

yield on average interest-earning investments decreased by 38 basis points from 7.77%

in the six months ended September 30, 2015 to 7.39% in the six months ended September

30, 2016. Yield on statutory liquidity ratio investments decreased by 33 basis points

from 7.90% in the six months ended September 30, 2015 to 7.57% in the six months ended

September 30, 2016 primarily due to a reduction in the yield on government securities

and reset of interest rates on floating rate bonds at lower levels. Yield on non-statutory

liquidity ratio investments decreased by 48 basis points from 7.36% in the six months

ended September 30, 2015 to 6.88% in the six months ended September 30, 2016 primarily

due to a decrease in yield on corporate bonds and debentures, certificate of deposits,

mutual fund and commercial paper due to softening of interest rates, offset, in part

by, higher yield on pass through certificates.

|

|

|

·

|

The

yield on other interest-earning assets decreased by 90 basis points from 5.43% in the

six months ended September 30, 2015 to 4.53% in the six months ended September 30, 2016

primarily due to an increase in low yielding call money lent, an increase in balance

with the Reserve Bank of India and lower interest income on non-trading interest rate

swaps.

|

Interest

on income tax refund decreased from Rs. 1.16 billion in the six months ended September 30, 2015 to Rs. 1.12 billion in the six

months ended September 30, 2016. The receipt, amount and timing of such income depend on the nature and timing of determinations

by tax authorities and are neither consistent nor predictable.

The

cost of funds decreased by 34 basis points from 5.98% in the six months ended September 30, 2015 to 5.64% in the six months ended

September 30, 2016 primarily due to the following factors:

|

|

·

|

The

cost of average deposits decreased by 42 basis points from 6.00% in the six months ended

September 30, 2015 to 5.58% in the six months ended September 30, 2016 primarily due

to a decrease in cost of term deposits. The cost of term deposits decreased by 66 basis

points from 8.07% in the six months ended September 30, 2015 to 7.41% in the six months

ended September 30, 2016 primarily due to softening of interest rates.

|

The

Reserve Bank of India reduced the repo rate by 50 basis points from 6.75% to 6.25% in two phases during the year ended March 31,

2017.

The

Bank reduced retail term deposits rates for select maturities in phases during the year ended March 31, 2016 and the six months

ended September 30, 2016.

|

|

·

|

The

cost of borrowings decreased by 17 basis points from 5.94% in the six months ended September

30, 2015 to 5.77% in the six months ended September 30, 2016.

|

The

increase in additions to non-performing loans and loans subjected to restructuring or special structuring under applicable regulatory

guidelines during fiscal 2016 and the six months ended September 30, 2016 impacted our interest income, yield on advances, net

interest income and net interest margin, as we do not accrue interest on non-performing loans. This is expected to continue to

adversely impact our net interest margin in fiscal 2017 as well. If we continue to see an increase in our non-performing loans,

our net interest margin would be further adversely impacted. Further, focus on increasing the proportion of secured retail loans

and higher rated corporate loans, which are lower-yielding, in the portfolio would also result in lower incremental yields on

advances and lower net interest margin.

Interest-Earning

Assets

The

average volume of interest-earning assets increased by 12.3% from Rs. 5,872.97 billion in the six months ended September 30, 2015

to Rs. 6,598.19 billion in the six months ended September 30, 2016. The increase in average interest-earning assets was primarily

on account of an increase in average advances by Rs. 473.35 billion and average interest-earning investments by Rs. 197.41 billion.

Average

advances increased by 12.0% from Rs. 3,932.92 billion in the six months ended September 30, 2015 to Rs. 4,406.27 billion in the

six months ended September 30,

2016

primarily due to an increase in domestic advances.

Average

interest-earning investments increased by 14.4% from Rs. 1,369.10 billion in the six months ended September 30, 2015 to Rs. 1,566.51

billion in the six months ended September 30, 2016 primarily due to an increase in statutory liquidity ratio investments by 11.4%

from Rs. 1,049.47 billion in the six months ended September 30, 2015 to Rs. 1,168.95 billion in the six months ended September

30, 2016 and an increase in non- statutory liquidity ratio investments by 24.4% from Rs. 319.63 billion in the six months ended

September 30, 2015 to Rs. 397.56 billion in the six months ended September 30, 2016. Average interest-earning non-statutory liquidity

ratio investments primarily include investments in corporate bonds and debentures, pass through certificates, commercial papers,

certificates of deposits and investments in liquid mutual funds to deploy excess liquidity. Average interest-earning non-statutory

liquidity ratio investments increased primarily due to an increase in investments in mutual funds and commercial papers.

There

was an increase in average other interest-earning assets by 9.5% from Rs. 570.95 billion in the six months ended September 30,

2015 to Rs. 625.41 billion in the six months ended September 30, 2016 primarily due to an increase in call money lent and balance

with the Reserve Bank of India, offset, in part, by a decrease in deposits with the Rural Infrastructure and Development Fund

and related deposits.

Interest-Bearing

Liabilities

Average

interest-bearing liabilities increased by 12.7% from Rs. 5,198.35 billion in the six months ended September 30, 2015 to Rs. 5,856.64

billion in the six months ended September 30, 2016 on account of an increase of Rs. 558.13 billion in average deposits and an

increase of Rs. 100.16 billion in average borrowings.

Average