FCPT Announces Acquisition of Four Burger King Restaurant Properties for $7.7 Million

December 28 2016 - 5:39PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real

estate investment trust engaged in the ownership of high-quality,

net-leased restaurant properties (“FCPT” or the “Company”), is

pleased to announce the acquisition of four Burger King properties

leased to Cambridge Franchise Holdings (“Cambridge”) for $7.7

million. The four properties are located in Tennessee and are

occupied under new, individual triple-net leases with 20-year terms

and above brand average performance. The transaction is a follow-on

from the previous transaction with Cambridge in October at the same

going-in cash cap rate. Cambridge, a 102-unit franchisee, will

actively invest and renovate these properties over the next few

years.

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the acquisition and leasing

of restaurant properties. The Company will seek to grow its

portfolio by acquiring additional real estate to lease, on a

triple-net basis, for use in the restaurant and related food

services industry. Additional information about FCPT can be found

on the website at http://www.fourcornerspropertytrust.com/.

About Cambridge Franchise Holdings

Cambridge Franchise Holdings was formed in 2014 by Matt Perelman

and Alex Sloane in partnership with Ray Meeks, a 30-year Burger

King franchisee and seasoned restaurant operator. Cambridge

Franchise Holdings owns and operates 102 Restaurants, 5 Convenience

Stores and real estate in Alabama, Arkansas, Louisiana,

Mississippi, North Carolina, Kentucky, Tennessee and Virginia. The

company aims to grow its restaurants and its team through

consistent, high quality, profitable operations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161228005437/en/

Four Corners Property TrustBill Lenehan, 415-965-8031CEOGerry

Morgan, 415-965-8032CFO

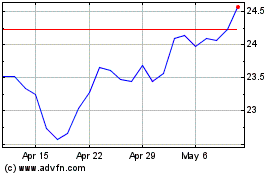

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

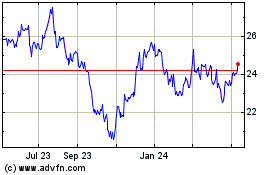

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Apr 2023 to Apr 2024