Current Report Filing (8-k)

December 22 2016 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 22, 2016

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-33958

|

|

20-8099512

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

|

|

|

|

|

|

(Address of Principal Executive Offices) (Zip Code)

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (855) 855-4253

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SEC Investigation

On December 22, 2016, Galena Biopharma, Inc. (Galena) and its former Chief Executive Officer (CEO) reached an agreement in principle to a proposed settlement that would resolve an investigation by the staff of the Securities and Exchange Commission (SEC) involving conduct in the period 2012-2014 regarding the commissioning of internet publications by outside promotional firms.

Under the terms of the proposed settlement framework, Galena and the former CEO would consent to the entry of an administrative order requiring that we and the former CEO cease and desist from any future violations of Sections 5(a), 5(b), 5(c), 17(a), and 17(b) of the Securities Act of 1933, as amended, and Section 10(b), 13(a), and 13(b)(2)(A) of the Securities Exchange Act of 1934, as amended, and various rules thereunder, without admitting or denying the findings in the order. Based upon the proposed settlement framework, the Company will make a $200,000 penalty payment. In addition to other remedies, the proposed settlement framework would require the former CEO to make a disgorgement and prejudgment interest payment as well as a penalty payment to the Commission. To address the issues raised by the SEC staff’s investigation, in addition to previous governance enhancements we have implemented, we have voluntarily undertaken to implement a number of remedial actions relating to securities offerings and our interactions with investor relations and public relations firms. The proposed settlement is subject to approval by the Commission and would acknowledge our cooperation in the investigation and confirm our voluntary undertaking to continue that cooperation. If the Commission does not approve the settlement, we may need to enter into further discussions with the SEC staff to resolve the investigated matters on different terms and conditions. As a result, there can be no assurance as to the final terms of any resolution including its financial impact or any future adjustment to the financial statements.

A special committee of the board of directors has determined in response to an indemnification claim by the former CEO that we are required under Delaware law to indemnify our former CEO for the disgorgement and prejudgment interest payment of approximately $750,000 that he would be required to pay if and when the settlement is approved by the Commission. Any penalty payment that the former CEO will be required to make in connection with this matter ($600,000 under the proposed settlement framework) will be the responsibility of the former CEO.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GALENA BIOPHARMA, INC.

|

|

|

|

|

|

|

|

Date:

|

|

December 22, 2016

|

|

|

|

By:

|

|

/s/ Mark W. Schwartz

|

|

|

|

|

|

|

|

|

|

Mark W. Schwartz Ph.D.

President and Chief Executive Officer

|

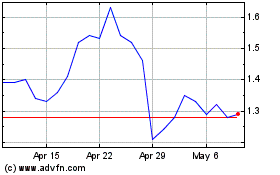

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

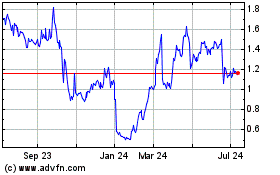

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024