UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)

ENOVA

INTERNATIONAL, INC.

(Name of Issuer)

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

29357K103

(CUSIP Number)

Eleftheria Kollosi

Archiepiskopou Makariou III, 73,

Methonis Tower, 7th Floor, Flat/office 703,

P.C. 1070, Nicosia, Cyprus

with a copy to

Alex

Kravchenko

Vlad Dulgerov

8 Presnenskaya Naberezhnaya, Building 1, office. 12B,

Moscow 123317, Russia

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 14, 2016

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule

13d-1(e),

13d-1(f)

or

13d-1(g),

check the following box. ¨

Note:

Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7

for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

|

|

1.

|

|

Name of

Reporting Persons

I.R.S. Identification Nos. of above persons (entities only)

Nakula Management Limited

00-0000000

|

|

2.

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds

WC

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6.

|

|

Citizenship or Place of

Organization

Cyprus

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

2,245,475 shares of Common Stock

|

|

|

8.

|

|

Shared Voting Power

0

|

|

|

9.

|

|

Sole Dispositive Power

2,245,475 shares of Common Stock

|

|

|

10.

|

|

Shared Dispositive Power

0

|

|

11.

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,245,475 shares of Common Stock

|

|

12.

|

|

Check If the Aggregate Amount in Row

(11) Excludes Certain Shares

☐

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.7% of Common Stock*

|

|

14.

|

|

Type of Reporting Person

OO

|

|

*

|

The Reporting Person is the direct beneficial owner of approximately 6.7% of the Issuer’s outstanding voting capital stock. See Item 5. The calculated percentages are based on 33,214,594 shares of Common Stock

outstanding as stated in the Issuer’s Quarterly Report on Form

10-Q

for the quarterly period ended September 30, 2016, filed with the Securities and Exchange Commission on November 2, 2016.

|

|

|

|

|

|

|

|

|

|

1.

|

|

Name of

Reporting Persons

I.R.S. Identification Nos. of above persons (entities only)

Eleftheria Kollosi

|

|

2.

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds

AF

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6.

|

|

Citizenship or Place of

Organization

Greece

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

2,245,475 shares of Common Stock*

|

|

|

8.

|

|

Shared Voting Power

0

|

|

|

9.

|

|

Sole Dispositive Power

2,245,475 shares of Common Stock

|

|

|

10.

|

|

Shared Dispositive Power

0

|

|

11.

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,245,475 shares of Common Stock

|

|

12.

|

|

Check If the Aggregate Amount in Row

(11) Excludes Certain Shares

☐

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.7% of Common Stock*

|

|

14.

|

|

Type of Reporting Person

IN

|

|

*

|

The Reporting Person is the direct beneficial owner of approximately 6.7% of the Issuer’s outstanding voting capital stock. See Item 5. The calculated percentages are based on 33,214,594 shares of Common Stock

outstanding as stated in the Issuer’s Quarterly Report on Form

10-Q

for the quarterly period ended September 30, 2016, filed with the Securities and Exchange Commission on November 2, 2016.

|

|

|

|

|

|

|

|

|

|

1.

|

|

Name of

Reporting Persons

I.R.S. Identification Nos. of above persons (entities only)

Mr. Oleg V. Boyko

|

|

2.

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds

AF

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6.

|

|

Citizenship or Place of

Organization

Russia, Italy

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

2,245,475 shares of Common Stock

|

|

|

8.

|

|

Shared Voting Power

0

|

|

|

9.

|

|

Sole Dispositive Power

2,245,475 shares of Common Stock

|

|

|

10.

|

|

Shared Dispositive Power

0

|

|

11.

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,245,475 shares of Common Stock

|

|

12.

|

|

Check If the Aggregate Amount in Row

(11) Excludes Certain Shares

☐

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.7% of Common Stock*

|

|

14.

|

|

Type of Reporting Person

IN

|

|

*

|

The Reporting Person is the direct beneficial owner of approximately 6.7% of the Issuer’s outstanding voting capital stock. See Item 5. The calculated percentages are based on 33,214,594 shares of Common Stock

outstanding as stated in the Issuer’s Quarterly Report on Form

10-Q

for the quarterly period ended September 30, 2016, filed with the Securities and Exchange Commission on November 2, 2016.

|

Amendment No. 5 to Schedule 13D

This Amendment No. 5 (this “Amendment”) to the Schedule 13D filed with the U.S. Securities and Exchange Commission (the “SEC”) on

September 11, 2015, as amended by Amendment No. 1 filed with the SEC on September 28, 2015, Amendment No. 2 filed with the SEC on October 16, 2015, Amendment No. 3 filed with the SEC on November 9, 2015 and

Amendment No. 4 filed with the SEC on November 15, 2016 (the “Schedule 13D”) is being filed on behalf of Nakula Management Limited, a Cyprus limited liability company (“Nakula”), Eleftheria Kollosi, the sole director of

Nakula (“Ms. Kollosi”), and Mr. Oleg V. Boyko, the ultimate beneficial owner of Nakula (“Mr. Boyko” and, collectively with Nakula and Ms. Kollosi, the “Reporting Persons”), relating to Common

Stock ($.00001 par value) (the “Common Stock”) of Enova International, Inc. (“Enova”).

This Amendment relates to Common Stock of

Enova sold by Nakula (the “Nakula Account”). Nakula may direct the vote and disposition of the 2,245,475 shares of Common Stock that it holds directly. Each of Ms. Kollosi, as the director of Nakula, and Mr. Boyko, as the

ultimate beneficial owner of Nakula, may direct the vote and disposition of the 2,245,475 shares of Common Stock held by the Nakula Account.

Item 5. Interest in Securities of the Issuer.

Item 5(a) and (b) of the Schedule 13D are hereby amended and restated to read as follows:

(a) As of the morning of December 22, 2016, Nakula is the direct beneficial owner of 2,245,475 shares of Common Stock, representing approximately 6.73% of

Enova’s outstanding Common Stock. Each of Nakula, Ms. Kollosi, as the director of Nakula, and Mr. Boyko, as the ultimate beneficial owner of Nakula, may be deemed the beneficial owner of the 2,245,475 shares of Common Stock,

representing approximately 6.73% of Enova’s outstanding Common Stock, held by the Nakula Account.

Neither the filing of this Amendment nor any of

its contents will be deemed to constitute an admission that any of the Reporting Persons is the beneficial owner of any shares of Enova (other than as described in this Item 5(a)) for the purposes of Section 13(d) of the Securities Exchange Act of

1934, as amended, or for any other purposes, and such beneficial ownership is expressly disclaimed.

* The calculated percentages are based on 33,214,594

shares of Common Stock outstanding as stated in the Issuer’s Quarterly Report on Form

10-Q

for the quarterly period ended September 30, 2016, filed with the SEC on November 2, 2016.

Mr. Boyko holds the shares of Nakula through Feldmans Services Limited, which serves as his nominee.

(b) Each of Nakula and Mr. Boyko may be deemed to have sole power to direct the voting and disposition of 2,268,969 shares of Common Stock held directly.

Ms. Kollosi has the sole ability to vote the 2,245,475 shares of Common Stock held by the Nakula Account.

Item 5(c) is supplemented as follows:

(c)

The following sales of a total of 456,096 shares of Common Stock were made by Nakula since the last amendment in the open market with and through

broker dealers, inclusive of any transaction effective through 9:30 A.M. New York City time on December 22, 2016. All prices reported include net reductions for commissions.

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Quantity

|

|

|

Price, USD

|

|

|

November 22, 2016

|

|

|

111,300

|

|

|

$

|

11.88

|

|

|

November 23, 2016

|

|

|

32,889

|

|

|

$

|

11.90

|

|

|

December 1, 2016

|

|

|

57,030

|

|

|

$

|

11.62

|

|

|

December 2, 2016

|

|

|

856

|

|

|

$

|

11.58

|

|

|

December 7, 2016

|

|

|

50,000

|

|

|

$

|

12.83

|

|

|

December 9, 2016

|

|

|

50,000

|

|

|

$

|

13.52

|

|

|

December 13, 2016

|

|

|

25,558

|

|

|

$

|

13.00

|

|

|

December 14, 2016

|

|

|

21,315

|

|

|

$

|

12.80

|

|

|

December 16, 2016

|

|

|

33,654

|

|

|

$

|

12.54

|

|

|

December 20, 2016

|

|

|

50,000

|

|

|

$

|

12.53

|

|

|

December 21, 2016

|

|

|

23,494

|

|

|

$

|

12.71

|

|

SIGNATURES

After

reasonable inquiry and to the best of his or her knowledge and belief, each of the undersigned certifies that the information in this Schedule 13D is true, complete and correct.

Date: December 22, 2016

|

|

|

|

|

NAKULA MANAGEMENT LIMITED

|

|

|

|

|

By:

|

|

/s/ Eleftheria Kollosi

|

|

Name: Eleftheria Kollosi

|

|

Title: Director

|

Date: December 22, 2016

|

|

|

|

|

ELEFTHERIA KOLLOSI

|

|

|

|

/s/ Eleftheria Kollosi

|

|

|

|

Date: December 22, 2016

|

|

|

|

OLEG V. BOYKO

|

|

|

|

/s/ Oleg V. Boyko

|

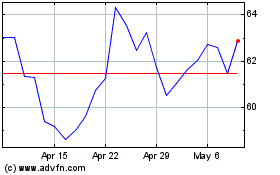

Enova (NYSE:ENVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

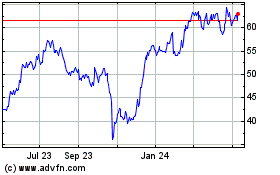

Enova (NYSE:ENVA)

Historical Stock Chart

From Apr 2023 to Apr 2024