London Arbitration Tribunal Rules Contract Between Corporacion Navios S.A. and Vale International S.A. in Full Force

December 22 2016 - 9:15AM

Navios Maritime Holdings Inc. (NYSE:NM) and its subsidiary, Navios

South American Logistics Inc. ("Navios"), announced today that on

December 21, 2016, a London arbitration tribunal ruled the 20-year

contract (the “Contract”) between Corporacion Navios S.A. and Vale

International S.A. (“Vale”) for the iron ore port under

construction to be in full force and effect.

After receiving written notice from Vale repudiating the

Contract, Navios initiated arbitration proceedings in London

pursuant to the dispute resolution provisions of the Contract. On

December 21, 2016 the arbitration tribunal issued its decision that

the Contract remains in full force and effect. The

arbitration tribunal also determined that Navios may elect to

terminate the Contract if Vale were to further repudiate or

renounce the Contract and then would be entitled to damages

calculated by reference to guaranteed volumes and agreed tariffs

for the remaining period of the Contract.

About Navios Maritime Holdings Inc.Navios

Maritime Holdings Inc. (NYSE:NM) is a global, vertically integrated

seaborne shipping and logistics company focused on the transport

and transshipment of dry bulk commodities including iron ore, coal

and grain. For more information about Navios Holdings please visit

our website: www.navios.com

About Navios South American Logistics

Inc.Navios South American Logistics Inc. is one of the

largest logistics companies in the Hidrovia region of South

America, focusing on the Hidrovia region river system, the main

navigable river system in the region, and on cabotage trades along

the eastern coast of South America. Navios Logistics serves the

storage and marine transportation needs of its petroleum,

agricultural and mining customers through its port terminals, river

barge and coastal cabotage operations. For more information about

Navios Logistics please visit its website:

www.navios-logistics.com.

Forward Looking Statements - Safe HarborThis

press release contains forward-looking statements (as defined in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended) concerning

future events, including 2016 and 2017 cash flow generation, future

contracted revenues, potential capital gains, our ability to take

advantage of dislocation in the market, and Navios Holdings' growth

strategy and measures to implement such strategy; including

expected vessel acquisitions and entering into further time

charters. Words such as “may,” “expects,” “intends,” “plans,”

“believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify

forward-looking statements. Such statements include comments

regarding expected revenue and time charters. These forward-looking

statements are based on the information available to, and the

expectations and assumptions deemed reasonable by Navios Holdings

at the time these statements were made. Although Navios Holdings

believes that the expectations reflected in such forward-looking

statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. These statements

involve known and unknown risks and are based upon a number of

assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Holdings. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to uncertainty relating to

global trade, including prices of seaborne commodities and

continuing issues related to seaborne volume and ton miles, our

continued ability to enter into long-term time charters, our

ability to maximize the use of our vessels, expected demand in the

dry cargo shipping sector in general and the demand for our

Panamax, Capesize and UltraHandymax vessels in particular,

fluctuations in charter rates for dry cargo carriers vessels, the

aging of our fleet and resultant increases in operations costs, the

loss of any customer or charter or vessel, the financial condition

of our customers, changes in the availability and costs of funding

due to conditions in the bank market, capital markets and other

factors, increases in costs and expenses, including but not limited

to: crew wages, insurance, provisions, port expenses, lube oil,

bunkers, repairs, maintenance, and general and administrative

expenses, the expected cost of, and our ability to comply with,

governmental regulations and maritime self-regulatory organization

standards, as well as standard regulations imposed by our

charterers applicable to our business, general domestic and

international political conditions, competitive factors in the

market in which Navios Holdings operates; risks associated with

operations outside the United States; and other factors listed from

time to time in Navios Holdings' filings with the Securities and

Exchange Commission, including its Form 20-F’s and Form 6-K’s.

Navios Holdings expressly disclaims any obligations or undertaking

to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Navios

Holdings' expectations with respect thereto or any change in

events, conditions or circumstances on which any statement is

based. Navios Holdings makes no prediction or statement about the

performance of its common stock.

Contact:

Navios Maritime Holdings Inc.

+1.212.906.8643

investors@navios.com

Navios South American Logistics Inc.

+1.212.906.8646

investors@navios-logistics.com

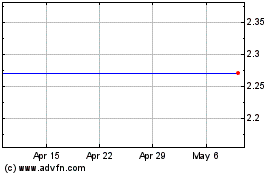

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

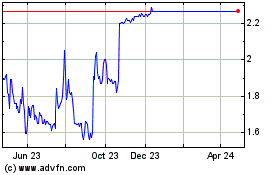

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024