Item 1.01. Entry into a Material Definitive Agreement.

On December 16, 2016, Editas Medicine, Inc. (the “Company”) entered into a License Agreement (the “Cpf1 License Agreement”) with the Broad Institute, Inc. (“Broad”), for specified patent rights (the “Cpf1 Patent Rights”) related primarily to Cpf1 compositions of matter and their use for

gene editing.

The Company and Broad, together with President and Fellows of Harvard College (“Harvard”), had previously entered into a license agreement, dated as of October 29, 2014 (as amended by the Amendment (as defined below), the “Existing License Agreement”),

pursuant to which the Company has licensed certain patent rights of Broad, Harvard, the Massachusetts Institute of Technology (“MIT”) for CRISPR/Cas9 and transcription activator-like effector (“TALE”)-related compositions of matter and their use for

gene editing and to certain CRISPR/Cas9 and TALE-related delivery technologies. Concurrently with entering into the Cpf1 License Agreement, the Company, Broad, and Harvard amended and restated the Existing License Agreement (the “Amendment”) and the Company and Broad entered into a License Agreement (the “Cas9-II License Agreement”) for specified patent rights (the “Cas9-II Patent Rights”) related primarily to

certain Cas9 compositions of matter and their use for

gene editing.

Cpf1 License Agreement

Pursuant to the Cpf1 License Agreement, Broad, on behalf of itself, Harvard, MIT Wageningen University (“Wageningen”

) and the University of Tokyo (“UTokyo” and, together with Broad, Harvard, MIT

, and Wageningen, the “Cpf1 Institutions”), granted the Company an exclusive, worldwide, royalty-bearing

, sublicensable license to the Cpf1 Patent Rights, to make, have made, use, have used, sell, offer for sale, have sold, export and import products in the field of the prevention

or treatment of human disease using gene therapy, editing of genetic material, or targeting of genetic material, subject to certain limitations and retained rights (collectively, the “Exclusive Field”), as well as a non-exclusive, worldwide, royalty-bearing

sublicensable license to the Cpf1 Patent Rights for all other purposes, subject to certain limitations and retained rights. The licenses granted to the Company under the Cpf1 License Agreement exclude certain fields, including human germline modification; the stimulation of biased inheritance of particular genes or traits within a population of plants or animals; the research, development, manufacturing, or commercialization of sterile seeds; and the modification of the tobacco plant with specified exceptions.

The Company is obligated to use commercially reasonable efforts to research, develop, and commercialize products in the Exclusive Field. The Company is also required to achieve certain development milestones within specified time periods for products covered by the Cpf1 Patent Rights, with Broad having the right to terminate the Cpf1 License Agreement if the Company fails to achieve these milestones within the required time periods.

The Company has the right to sublicense its licensed rights provided that the sublicense agreement must be in compliance and consistent with the terms of the Cpf1 License Agreement. Any sublicense agreement cannot include the right to grant further sublicenses without the written consent of Broad. In addition, any sublicense agreements must contain certain terms, including a provision requiring the sublicensee to indemnify the Cpf1 Institutions according to the same terms as are provided in the Cpf1 License Agreement and a statement that Broad is an intended third party beneficiary of the sublicense agreement for certain purposes.

The licenses granted to the Company under the Cpf1 License Agreement are subject to any retained rights of the U.S. government in the Cpf1 Patent Rights and rights retained by the Cpf1 Institutions on behalf of themselves and other academic, government and non-profit entities, to practice the Cpf1 Patent Rights for research, teaching, or educational purposes. The Company’s exclusive license rights also are subject to rights retained by the Cpf1 Institutions for themselves and any third party to research, develop, make, have made, use, offer for sale, sell, have sold, import or otherwise exploit the Cpf1 Patent Rights and licensed products as research products or research tools, or for research purposes.

Under the Cpf1 License Agreement, Broad also retained rights to grant further licenses under specified circumstances to third parties that wish to develop and commercialize products that target a particular gene and that otherwise would fall within the scope of the Company’s exclusive license from Broad. If, after a specified period of time, a third party requests a license under the Cpf1 Patent Rights for the development and commercialization of a product that would be subject to the Company’s exclusive license grant from Broad (a “Third Party Proposed Product Request”), Broad may notify the Company of the request. A Third Party Proposed Product Request must be accompanied by a research, development and commercialization plan reasonably satisfactory to Broad, including evidence that the third party has, or reasonably expects to have, access to any necessary intellectual property and funding. Broad may not grant a Third Party Proposed Product Request

(i) if the Company, directly or through any of its affiliates, sublicensees, or collaborators is researching, developing, or commercializing a product directed to the same gene target that is the subject of the Third Party Proposed Product Request (a “Licensee Product”)

or (ii) if the Company, directly or through any of its affiliates

or sublicensees, wishes to do so either alone or with a collaboration partner,

and the Company can demonstrate to Broad’s reasonable satisfaction that the Company is interested in researching, developing, and commercializing a Licensee Product, that it has a commercially reasonable research, development, and commercialization plan to do so, and it commences and continues reasonable commercial efforts under

such plan. If the Company, directly or through any of its affiliates, sublicensees, or collaborators, is not researching, developing, or commercializing a Licensee Product nor able to develop and implement a plan reasonably satisfactory to Broad, Broad may grant a license to the third party on a gene target-by-gene target basis.

The Cpf1 License Agreement also provides Broad with the right, after a specified period of time and subject to certain limitations, to designate gene targets for which Broad, whether alone or together with an affiliate or third party, has an interest in researching and developing products that would otherwise be covered by rights licensed to the Company under the Cpf1 License Agreement or the Existing License Agreement. Broad may not so designate any gene target for which the Company, directly or through any of its affiliates, sublicensees, or collaborators, is researching, developing, or commercializing a product, or for which the Company can demonstrate to Broad’s reasonable satisfaction that the Company is interested in researching, developing, and commercializing a product, that the Company has a commercially reasonable research, development, and commercialization plan to do so, and the Company commences and continues reasonable commercial efforts under

such plan. If the Company directly or through any of its affiliates, sublicensees, or collaborators, is not researching, developing, or commercializing a product directed toward the gene target designated by Broad and is not able to develop and implement a plan reasonably satisfactory to Broad, Broad is entitled to reserve all rights under the Cpf1 License Agreement and the Existing License Agreement, including the right to grant exclusive or non-exclusive licenses to third parties, to develop and commercialize products directed to such gene target and the Company will not be entitled under the Cpf1 License Agreement or the Existing License Agreement to develop and commercialize products directed to that gene target.

Under the Cpf1 License Agreement, the Company will pay Broad and Wageningen an aggregate upfront license fee in the mid seven digits and issue to Broad and Wageningen promissory notes (the “Initial Promissory Notes”) in an aggregate principal amount of $10.0 million. The Initial Promissory Notes will bear interest at 4.8% per annum. Principal and interest on the Initial Promissory Notes will be payable

on the first anniversary of the issuance date (or if earlier, a specified period of time following a Company sale event) and the Initial Promissory Notes will be convertible, at the option of the Company, into common stock of the Company subject to certain conditions. In the event of a change of control of the Company or a Company sale, the Company is required to pay all remaining principal and accrued interest on the Initial Promissory Notes in cash within a specified period following such event.

Broad and Wageningen are collectively entitled to receive clinical and regulatory milestone payments totaling up to $20.0 million in the aggregate per licensed product approved in the United States, European Union and Japan for the prevention or treatment of a human disease that afflicts at least a specified number of patients in the aggregate in the United States. If the Company undergoes a change of control during the term of the Cpf1 License Agreement, certain of these clinical and regulatory milestone payments will be increased by a certain percentage in the mid double-digits. The Company is also obligated to make additional payments to Broad and Wageningen, collectively, of up to an aggregate of $54.0 million upon the occurrence of certain sales milestones per licensed product for the prevention or treatment of a

human disease that afflicts at least a specified number of patients in the aggregate in the United States. Broad and Wageningen are collectively entitled to receive clinical and regulatory milestone payments totaling up to $6.0 million in the aggregate per licensed product approved in the United States, European Union and Japan for the prevention or treatment of a human disease that afflicts fewer than a specified number of patients in the aggregate in the United States or a specified number of patients per year in the United States (an “Ultra-Orphan Disease”). The Company is also obligated to make additional payments to Broad and Wageningen, collectively, of up to an aggregate of $36.0 million upon the occurrence of certain sales milestones per licensed product for the prevention or treatment of an Ultra-Orphan Disease.

Broad and Wageningen, collectively, are entitled to receive mid single-digit percentage royalties on net sales of products for the prevention or treatment of human disease, and ranging from sub single-digit to high single-digit percentage royalties on net sales of other products and services, made by the Company, its affiliates, or its sublicensees. The royalty percentage depends on the product and service, and whether such licensed product or licensed service is covered by a valid claim within the Cpf1 Patent Rights. If the Company is legally required to pay royalties to a third party on net sales of the Company’s products because such third party holds patent rights that cover such licensed product, then the Company can credit up to a mid double-digit percentage of the amount paid to such third party against the royalties due to Broad and Wageningen in the same period. The Company’s obligation to pay royalties will expire on a product-by-product and country-by-country basis upon the later of the expiration of the last to expire valid claim of the Cpf1 Patent Rights that covers each licensed product or service in each country or the tenth anniversary of the date of the first commercial sale of the product or service. If the Company sublicenses any of the Cpf1 Patent Rights to a third party, Broad and Wageningen, collectively, have the right to receive high single-digit to low double-digit percentages of the sublicense income, depending on the stage of development of the products or services in question at the time of the sublicense.

Under the Cpf1 License Agreement, Broad and Wageningen are also entitled, collectively, to receive success payments in the event the Company’s market capitalization reaches specified thresholds ascending from a high nine digit dollar amount to $10 billion (“Market Cap Success Payments”) or a Company sale for consideration in excess of those thresholds (“Company Sale Success Payments” and, collectively with the Market Cap Success Payments, the “Success Payments”). The Success Payments paid to Broad and Wageningen collectively will not exceed, in aggregate, $125.0 million, which maximum would be payable only if the Company reaches a market capitalization threshold of $10 billion and has at least one product candidate covered by a claim of a patent right licensed to the Company under either the Cpf1 License Agreement or the Existing License Agreement that is or was the subject of a clinical trial pursuant to development efforts by the Company or any Company affiliate or sublicensee. Market Cap Success Payments

are payable by the Company in cash or in the form of promissory notes on substantially the same terms and conditions as the Initial Promissory Notes, except that the maturity date of such notes will, subject to certain exceptions, be 150 days following issuance. Following a change in control of the Company, Market Cap Success Payments are required to be made in cash. Company Sale Success Payments are payable solely in cash.

In addition, in the event that a Company sale or change of control has occurred and the maximum amount of potential Success Payments under the Cpf1 License Agreement has not been paid to Broad and Wageningen, Broad and Wageningen are entitled to receive, upon the subsequent achievement of specified regulatory milestones, percentages ranging from high single digits to mid-to-low double digits of the remaining unpaid maximum amount of Success Payments. Broad and Wageningen are further entitled to receive up to the full remaining unpaid maximum amount of Success Payments upon the subsequent achievement of specified sales milestones. All such post-sale or post-change of control milestone payments are required to be made in cash.

Broad retains control of the prosecution and maintenance of the Cpf1 Patent Rights. The Company has the right to provide input in the prosecution of the Cpf1 Patent Rights, including to direct Broad to file and prosecute patents in certain countries.

The Company is also obligated to reimburse Broad and Wageningen for all unreimbursed expenses incurred by them in connection with the prosecution and maintenance of the Cpf1 Patent Rights prior to the date of the

Cpf1 License Agreement, and to reimburse Broad for expenses associated with the prosecution and maintenance of the Cpf1 Patent Rights following the date of the Cpf1 License Agreement.

The Company has the first right, but not the obligation, to enforce the Cpf1 Patent Rights with respect to its licensed products in the Exclusive Field so long as certain conditions are met, such as providing Broad and the applicable Institutions with evidence demonstrating a good faith basis for bringing suit against a third party. The Company is solely responsible for the costs of any lawsuits it elects to initiate and cannot enter into a settlement without the prior written consent of Broad. Any sums recovered in such lawsuits will be shared between the Company, Broad, and Wageningen.

Unless terminated earlier, the term of the Cpf1 License Agreement will expire on a country-by-country basis, upon the expiration of the last to expire valid claim of the Cpf1 Patent Rights in such country. However, the Company’s royalty obligations, discussed above, may survive expiration or termination. The Company has the right to terminate the Cpf1 License Agreement at will upon four months' written notice to Broad. Either party may terminate the Cpf1 License Agreement upon a specified period of notice in the event of the other party’s uncured material breach of a material obligation, such notice period varying depending on the nature of the breach. Broad may terminate the Cpf1 License Agreement immediately if the Company challenges the enforceability, validity, or scope of any Patent Right or assist a third party to do so, or in the event of the Company’s bankruptcy or insolvency.

Amendment and Restatement of Existing License Agreement

The Amendment excluded additional fields from the scope of the exclusive license granted by Broad and Harvard under the Existing License Agreement, including plant-based agricultural products as well as, subject to certain limitations, products providing nutritional benefits. In addition, the Amendment excluded the following from the scope of both the exclusive and non-exclusive licenses granted by Broad and Harvard under the Existing License Agreement: human germline modification; the stimulation of biased inheritance of particular genes or traits within a population of plants or animals; the research, development, manufacturing, or commercialization of sterile seeds; and the modification of the tobacco plant with specified exceptions. The Amendment also provided that the licenses granted to the Company under the Existing License Agreement with respect to three targets would become non-exclusive, subject to the limitation that each of Broad and Harvard will be permitted to grant a license to only one third party at a time with respect to each such target within the field of the exclusive license under the Existing License Agreement.

The Amendment also revised the provisions of the Existing License Agreement relating to the rights of Harvard and Broad to grant further licenses under specified circumstances to third parties that wish to develop and commercialize products that target a particular gene and that otherwise would fall within the scope of the Company’s exclusive license under the Existing License Agreement, so that, after a specified period of time, Harvard and Broad together would have rights substantially similar to the equivalent rights possessed by Broad under the Cpf1 License Agreement. The Amendment also provided Harvard and Broad with rights, after a specified period of time, substantially similar to the equivalent rights possessed by Broad under the Cpf1 License Agreement to designate gene targets for which the designating institution, whether alone or together with an affiliate or third party, has an interest in researching and developing products that would otherwise be covered by rights licensed by Harvard and/or Broad to the Company under the Existing License Agreement, the Cpf1 License Agreement, or the Cas9-II License Agreement.

Cas9-II License Agreement

Pursuant to the Cas9-II License Agreement, Broad, on behalf of itself, MIT,

Harvard, and the University of Iowa Research Foundation (collectively, the “Cas9-II Institutions”), granted the Company an exclusive, worldwide, royalty-bearing

sublicensable license to certain of the Cas9-II Patent Rights as well as a non-exclusive, worldwide, royalty-bearing

sublicensable license to all of the Cas9-II Patent Rights, in each case on terms substantially similar to the licenses granted to the Company under Cpf1 License Agreement, except that:

|

|

·

|

|

the terms relating to retained rights of the Cas9-II Institutions to grant licenses to the Cas9-II Patent Rights under specified circumstances to third parties, including to third parties that wish to develop and commercialize products that target a particular gene and that otherwise would fall within the scope of the Company’s exclusive license, are on terms substantially similar to those under the Existing License Agreement;

|

|

|

·

|

|

the upfront license fee is in the low seven digits and is payable in cash;

|

|

|

·

|

|

the Company is required to pay an annual license maintenance fee in the mid-five figures;

|

|

|

·

|

|

the clinical and regulatory milestone payments per licensed product approved in the United States, European Union and Japan for the prevention or treatment of a human disease that afflicts at least a specified number of patients in the aggregate in the United States total up to $3.7 million in the aggregate, and the sales milestone payments for any such licensed product total up to $13.5 million in the aggregate;

|

|

|

·

|

|

the Company is required to pay clinical and regulatory milestone payments totaling up to $1.1 million in the aggregate per licensed product approved in the United States and the European Union or Japan for the prevention or treatment of an Ultra-Orphan Disease, plus sales milestone payments of up to $9.0 million for any such licensed product;

|

|

|

·

|

|

the royalty rate on net sales of products for the prevention or treatment of human disease is a low single-digit percentage, and the royalty rate on net sales of other products and services ranges from sub single-digit to low single-digit percentages;

and

the potential Success Payments are payable based on the Company’s market capitalization reaching specified thresholds ascending from a low ten digit dollar amount to $9 billion or a Company sale for consideration in excess of those thresholds, and

|

|

|

·

|

|

the potential Success Payments will not exceed, in aggregate, $30.0 million, which maximum would be owed only if the Company reaches a market capitalization threshold of $9 billion and has at least one product candidate covered by a claim of a patent right licensed to the Company under either the Cas9 II License Agreement or the Existing License Agreement that is or was the subject of a clinical trial pursuant to development efforts by the Company or any Company affiliate or sublicensee.

|

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Upon the Company’s entry into the Cpf1 License Agreement, the Company became obligated to issue the Initial Promissory Notes. In addition, under the Cpf1 License Agreement and the Cas9-II License Agreement, the Company has the option, subject to specified conditions, to make Market Cap Success Payments in the form of promissory notes. The information included in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 of this Current Report on Form 8-K by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EDITAS MEDICINE, INC.

|

|

|

|

|

|

Date: December 21, 2016

|

By:

|

/s/ Andrew A. F. Hack

|

|

|

|

Andrew A. F. Hack

|

|

|

|

Chief Financial Officer

|

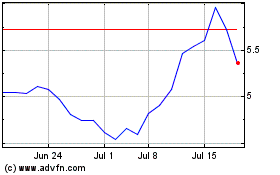

Editas Medicine (NASDAQ:EDIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

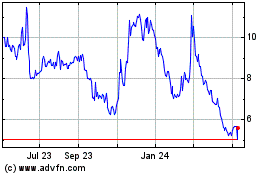

Editas Medicine (NASDAQ:EDIT)

Historical Stock Chart

From Apr 2023 to Apr 2024