Current Report Filing (8-k)

December 21 2016 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 20, 2016

|

|

|

|

|

EXELIXIS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

0-30235

|

04-3257395

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

210 East Grand Ave.

South San Francisco, California 94080

(Address of principal executive offices) (Zip Code)

(650) 837-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

On December 20, 2016, Exelixis, Inc. (“Exelixis”) and Ipsen Pharma SAS (“Ipsen") entered into an amendment (the “Amendment”) to the existing Collaboration and License Agreement between the parties dated February 29, 2016, to include commercialization rights for cabozantinib in Canada for Ipsen.

In consideration for the exclusive license to commercialize cabozantinib in Canada contained in the Amendment, Ipsen will pay Exelixis an upfront payment of $10.0 million. Exelixis will also be eligible to receive regulatory milestones, including a $5.0 million milestone payment upon approval of cabozantinib by Health Canada in advanced renal cell carcinoma (“RCC”), a $3.0 million milestone payment upon approval of cabozantinib by Health Canada in first line RCC or right to promote in first line RCC in connection with approval by Health Canada for cabozantinib in advanced RCC, whichever is earlier, a $2.0 million milestone payment upon approval of cabozantinib by Health Canada in second line hepatocellular carcinoma, as well as additional aggregate regulatory milestone payments of up to $4.0 million for potential further indications. The Amendment also provides that Exelixis will be eligible to receive payments of up to CAD$26.5 million associated with potential commercial milestone payments. Exelixis will also receive tiered royalties from 22% to 26% on annual net sales of cabozantinib in Canada, which tiers will be reset each year.

The description of the Amendment in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the amendment, a copy of which will be included as an exhibit to Exelixis’ Annual Report on Form 10-K for the fiscal year ending December 30, 2016, to be filed with the Securities and Exchange Commission (“SEC”).

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements, including, without limitation, statements related to: the payment to Exelixis of an upfront payment; Exelixis’ potential receipt of regulatory and sales milestones, as well as royalties on sales of products. Words such as “will,” “eligible,” “potential,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Exelixis’ current plans, assumptions, beliefs and expectations. Forward-looking statements involve risks and uncertainties. Exelixis’ actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: the complexities and challenges associated with regulatory review and approval processes; Exelixis’ dependence on its relationship with Ipsen, including, the level of Ipsen’s investment in the resources necessary to successfully commercialize cabozantinib in Canada and other territories where it is approved; the degree of market acceptance of CABOMETYX and the availability of coverage and reimbursement for CABOMETYX;

the risk that unanticipated developments could adversely affect the commercialization of CABOMETYX; Exelixis’ ability to conduct clinical trials of cabozantinib sufficient to achieve a positive completion; risks related to the potential failure of cabozantinib to demonstrate safety and efficacy in clinical testing; market competition; and changes in economic and business conditions. These and other risk factors are discussed under “Risk Factors” and elsewhere in Exelixis’ quarterly report on Form 10-Q filed with the SEC on November 3, 2016, and in Exelixis’ future filings with the SEC. Exelixis expressly disclaims any duty, obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Exelixis’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

EXELIXIS, INC.

|

|

|

|

|

|

|

|

December 21, 2016

|

|

/s/ J

EFFREY

J. H

ESSEKIEL

|

|

|

Date

|

|

Jeffrey J. Hessekiel

|

|

|

|

|

Executive Vice President and General Counsel

|

|

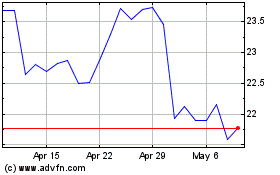

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

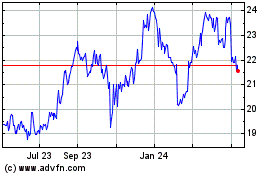

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From Apr 2023 to Apr 2024