As filed with the Securities and Exchange

Commission on December 16, 2016

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

(Exact name of Registrant as specified in

its charter)

Advanced Semiconductor Engineering, Inc.

(Translation of Registrant’s name into

English)

|

Republic of China

|

Not Applicable

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

+886-7-361-7131

|

|

(Address and telephone number of Registrant’s principal executive offices)

|

|

|

National Corporate Research Ltd.

10E, 40th Street, 10th Floor

New York, NY 10016

1 (800) 221 0102

|

|

|

|

(Name, address, and telephone number of agent for service)

|

|

|

|

|

|

|

Copy to:

|

|

James C. Lin, Esq.

Davis Polk & Wardwell LLP

c/o 18th Floor, The Hong Kong Club Building

3A Chater Road

Hong Kong

+852-2533-3300

|

|

|

|

|

|

Approximate date of commencement of proposed

sale to the public:

From time to time after the effective date of this registration statement, as determined by market conditions

and other factors.

If the only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

☐

If any of the

securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, check the following box.

☒

If this Form

is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form

is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☒

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to Be Registered

|

Amount to be Registered/ Proposed Maximum Offering Price per Unit/Proposed Maximum Aggregate Offering Price

(1)

|

Amount of Registration Fee

(2)

|

|

Common Shares, par value NT$10 per share

(3)(4)

|

|

|

|

Rights to subscribe for Common Shares

(5)

|

|

|

|

|

(1)

|

An indeterminate aggregate initial offering price or amount of securities of each identified class is being registered as may

from time to time be offered at indeterminate prices. Separate consideration may or may not be received for securities that are

issuable on exercise, conversion or exchange of other securities or that are issued in units or represented by depositary shares.

|

|

|

(2)

|

The Registrant is deferring payment of the registration fee in accordance with Rules 456(b) and 457(r) under the Securities

Act. In connection with the securities offered hereby, the registrant will pay “pay-as-you-go registration fees” in

accordance with Rule 456(b).

|

|

|

(3)

|

A separate registration statement on Form F-6 (Registration No. 333-174694) has been filed with respect to American depositary

shares issuable upon deposit of common shares of the Registrant. Each American depositary share represents five common shares

of the Registrant.

|

|

|

(4)

|

The securities to be registered include Common Shares that may be offered and sold in the United States and Common Shares that

are to be initially offered and sold outside the United States but may be resold from time to time in the United States in transactions

requiring registration under the Securities Act.

|

|

|

(5)

|

No separate consideration will be received by the registrant for the rights offered hereby.

|

PROSPECTUS

Advanced Semiconductor Engineering, Inc.

(Incorporated as a company limited by shares

in the Republic of China)

Common Shares

Rights to Subscribe for Common Shares

We may, from time to time, offer and sell

common shares, par value NT$10 per share, or rights to subscribe for common shares on terms to be determined at the time of offering.

This prospectus provides you with a general

description of the securities that we may offer. Each time we sell securities, we will provide a prospectus supplement that contains

specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained

in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in any

of our securities.

We may offer and sell these securities

directly to you or through one or more underwriters, dealers or agents, or through a combination of these methods. If any underwriter,

dealer or agent is involved in the sale of any securities offered by this prospectus, we will name them and describe their compensation

in the applicable prospectus supplement.

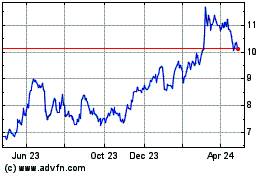

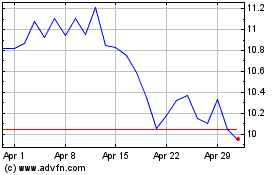

Our ADSs are listed on the New York Stock

Exchange under the symbol “ASX.” Our common shares are listed on the Taiwan Stock Exchange under the stock code “2311.”

Investing in our securities involves

risks. See “Risk Factors” before you make your investment decision.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or completeness

of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus may not be used to sell

securities unless accompanied by the applicable prospectus supplement.

Prospectus dated December

16, 2016.

Table

of Contents

Page

|

About this Prospectus

|

ii

|

|

Where You Can Find More Information

|

iii

|

|

Incorporation of Documents by Reference

|

iv

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

v

|

|

Our Company

|

1

|

|

Risk Factors

|

2

|

|

Use of Proceeds

|

2

|

|

Description of Common Shares

|

3

|

|

Description of Rights to Subscribe for Common Shares

|

9

|

|

Enforceability of Civil Liabilities

|

10

|

|

Taxation

|

11

|

|

Plan of Distribution

|

13

|

|

Legal Matters

|

15

|

|

Experts

|

15

|

About this

Prospectus

This prospectus is part of a registration

statement on Form F-3 that we filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act

of 1933, as amended (the “Securities Act”), using a shelf registration process. Under this process, we may, from time

to time, offer and sell common shares, par value NT$10 per share, including in the form of rights to subscribe for common shares

or ADSs in one or more offerings.

This prospectus only provides you with

a general description of the securities that we may offer. Each time securities are offered under this prospectus, we will provide

a prospectus supplement that contains specific information about the terms of the offering. The prospectus supplement may also

add, update or change information contained in this prospectus. Before purchasing any securities, you should carefully read this

prospectus and the applicable prospectus supplement and any free writing prospectus prepared by or on behalf of us, together with

the additional information described under the heading “Where You Can Find More Information.”

Unless otherwise stated, the information

contained in this prospectus is accurate as of the date on the front cover and the information incorporated by reference into this

prospectus is accurate as of the date of the relevant document incorporated by reference. You should not assume that the information

contained in or incorporated by reference into this prospectus is accurate as of any other date.

We have not authorized anyone to provide

you with any information other than that contained in or incorporated by reference into this prospectus, the applicable prospectus

supplement or any free writing prospectus prepared by or on behalf of us. We take no responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you.

This prospectus is not an offer to sell

nor is it seeking an offer to buy any securities in any jurisdiction where the offer or sale is not permitted.

All references

herein to

|

|

i.

|

the “Company,” “ASE Inc.,” “ASE,” “we,” “us,” “our company”

or “our” are to Advanced Semiconductor Engineering, Inc. and, unless the context requires otherwise, its subsidiaries;

|

|

|

ii.

|

“ADSs” are to our American depositary shares, each representing five common shares, par value NT$10 per share,

of our company;

|

|

|

iii.

|

“ADRs” refers to American depositary receipts evidencing our ADSs;

|

|

|

iv.

|

“Taiwan” or the “ROC” are to the Republic of China, including Taiwan and certain other possessions;

|

|

|

v.

|

“China” or the “PRC” refers to the People’s Republic of China, excluding, for the purpose of

this prospectus only, Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan;

|

|

|

vi.

|

“NT dollar” or “NT$” refers to New Taiwan Dollar, the lawful currency of the ROC;

|

|

|

vii.

|

“IFRS” are to International Financial Reporting Standards, International Accounting Standards and Interpretations

as issued by the International Accounting Standards Board;

|

|

|

viii.

|

“ROC GAAP” are to generally accepted accounting principles in the ROC; and

|

|

|

ix.

|

“U.S. GAAP” are to accounting principles generally accepted in the U.S.

|

For your convenience, this prospectus contains

translations of certain NT dollar amounts into U.S. dollar amounts at a rate of NT$31.27 to US$1.00, the exchange rate set forth

in the H.10 statistical release of the Federal Reserve Board on September 30, 2016, unless otherwise stated. We make no representation

that any NT dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or NT dollars, as the case

may be, at any particular rate, or at all.

Where You

Can Find More Information

We are subject to periodic reporting and

other informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable

to foreign private issuers. Accordingly, we are required to file reports, including annual reports on Form 20-F, and file or furnish

other information to the SEC. All information filed or furnished to the SEC is available through the SEC’s Electronic Data

Gathering, Analysis and Retrieval system, which may be accessed through the SEC’s website at http://www.sec.gov. Information

filed with the SEC may also be inspected and copied at the public reference room maintained by the SEC at 100 F Street, N.E., Washington,

D.C. 20549. You can request copies of these documents upon payment of a duplicating fee from the SEC. You can obtain further information

on the SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

Our website address is http://www.aseglobal.com.

The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

We have filed with the SEC a registration

statement on Form F-3 under the Securities Act with respect to the securities offered by this prospectus. As permitted by the SEC’s

rules, this prospectus does not contain all the information set forth in the registration statement and its exhibits. You should

review the registration statement and its exhibits for more information about us and the securities that we may offer. Statements

in this prospectus or the applicable prospectus supplement regarding the contents of any documents filed as exhibits to the registration

statement are not necessarily complete and are qualified in all respects by reference to these exhibits. You should refer to the

actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement

through the SEC’s website or at the SEC’s public reference room.

As a foreign private issuer, we are exempt

under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our

executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports

and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the

Exchange Act.

Incorporation

of Documents by Reference

The SEC allows us to “incorporate

by reference” the information we file or furnish to them. This means that we can disclose important information to you by

referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and

the incorporation by reference of such documents shall not create any implication that there has been no change in our affairs

since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information

incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the

information contained in documents that have been incorporated by reference by making future filings with the SEC, the information

incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case

of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference into

this prospectus, you should rely on the information contained in the document that was filed later.

We incorporate by reference the documents

listed below:

|

|

·

|

Our annual report on Form 20-F for the fiscal year ended December 31, 2015 filed with the SEC on April 29, 2016;

|

|

|

·

|

Our report on Form 6-K furnished to the SEC on November 22, 2016; and

|

|

|

·

|

All our future annual reports on Form 20-F that we file with the SEC and certain reports on Form 6-K, if they state that they

are incorporated by reference into this prospectus, that we furnish to the SEC on or after the date on which the registration statement

is first filed with the SEC and until all of the securities offered by this prospectus are sold.

|

Copies of all documents incorporated by

reference in this prospectus, other than exhibits to those documents unless such exhibits are specially incorporated by reference

in this prospectus, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus

on the written or oral request of that person made to:

Advanced Semiconductor Engineering, Inc.

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaoshiung, Taiwan

Republic of China

+886-7-361-7131

You should rely only on the information

that we incorporate by reference or provide in this prospectus. We have not authorized anyone to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it.

Cautionary

Statement Regarding Forward-Looking Statements

This prospectus and the documents incorporated by reference

contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act, including statements regarding our future results of operations and business prospects. Although these forward-looking

statements, which may include statements regarding our future results of operations, financial condition or business prospects,

are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance

on these forward-looking statements, which apply only as of the date of this prospectus or the relevant document incorporated by

reference that contains such statements. We were not involved in the preparation of these projections. The words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions,

as they relate to us, are intended to identify these forward-looking statements in this prospectus and the documents incorporated

by reference. Our actual results of operations, financial condition or business prospects may differ materially from those expressed

or implied in these forward-looking statements for a variety of reasons, including risks associated with cyclicality and market

conditions in the semiconductor or electronics industry; changes in our regulatory environment, including our ability to comply

with new or stricter environmental regulations and to resolve environmental liabilities; demand for the outsourced semiconductor

packaging, testing and electronic manufacturing services we offer and for such outsourced services generally; the highly competitive

semiconductor or manufacturing industry we are involved in; our ability to introduce new technologies in order to remain competitive;

international business activities; our business strategy; our future expansion plans and capital expenditures; the uncertainties

as to whether we can complete the acquisition of 100% of SPIL shares not otherwise owned by ASE; the strained relationship between

the ROC and the PRC; general economic and political conditions; the recent global economic crisis; possible disruptions in commercial

activities caused by natural or human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For

a discussion of these risks and other factors, see “Item 3. Key Information—Risk Factors” in our most recently

filed annual report on Form 20-F, which is incorporated into this prospectus by reference, and, if applicable, under the heading

“Risk Factors” in the applicable prospectus supplement.

We undertake no obligation to update any

forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the

occurrence of unanticipated events.

Our Company

We are among the leading providers of semiconductor

packaging and testing services based on our 2015 revenues. Our services include semiconductor packaging, production of interconnect

materials, front-end engineering testing, wafer probing and final testing services, as well as integrated solutions for electronic

manufacturing services in relation to computers, peripherals, communications, industrial, automotive, and storage and server applications.

We were incorporated on March 23, 1984

as a company limited by shares under the ROC Company Law, with facilities in the Nantze Export Processing Zone located in Kaohsiung,

Taiwan.

Our principal executive offices are located

at 26 Chin Third Road, Nantze Export Processing Zone, Nantze, Kaohsiung, Taiwan, Republic of China and our telephone number at

the above address is +886-7-361-7131.

Our common shares have been listed on the

Taiwan Stock Exchange under the symbol “2311” since July 1989 and our ADSs have been listed on the New York Stock Exchange

under the symbol “ASX” since September 2000.

Risk Factors

Investing in our securities involves risk.

See the risk factors set forth under the heading “Item 3. Key Information—Risk Factors” in our most recently

filed annual report on Form 20-F, which is incorporated into this prospectus by reference, and, if applicable, the risk factors

set forth under the heading “Risk Factors” in the applicable prospectus supplement.

Before making an investment decision, you

should carefully consider these risks as well as other information we include in or incorporate by reference into this prospectus.

These risks could materially affect our business, results of operations or financial condition and cause the value of our securities

to decline. You could lose all or part of your investment.

Use of Proceeds

We intend to use the net proceeds from

the sale of the securities as set forth in the applicable prospectus supplement.

Description

of Common Shares

The following summary describes certain

provisions of our articles of incorporation, the ROC Securities and Exchange Law, the regulations promulgated under the ROC Securities

and Exchange Law and the ROC Company Law relating to our common shares. This description does not purport to be complete and is

subject to, and qualified in its entirety by reference to, the provisions of our articles of incorporation, which are incorporated

by reference as an exhibit to the registration statement of which this prospectus forms a part.

General

We were incorporated on March 23,

1984 as a company limited by shares under the ROC Company Law. Our authorized share capital is NT$100 billion, divided into

10 billion common shares. As of September 30, 2016, 7,936,689,546 common shares were issued and outstanding. We do not have

any equity in the form of preference shares or otherwise outstanding as of the date of this prospectus.

With the approval of our board of directors

and the ROC Financial Supervisory Commission, we may grant stock options to our employees, provided that NT$8 billion of our authorized

capital (800 million common shares) is reserved for employee stock options and that the shares to be issued under any option plan

shall not exceed 10% of our outstanding common shares and the total number of shares to be issued under all option plans shall

not exceed 15% of our outstanding common shares. The exercise price of an option shall not be less than the closing price of our

common shares on the Taiwan Stock Exchange on the grant date of the option. As of September 30, 2016, we had granted 480,075,500

options pursuant to employee stock option plans established on November 22, 2007, April 20, 2010 and April 17, 2015 to our full-time

employees, including those from our domestic and foreign subsidiaries.

All common shares presently issued, including

those underlying our existing ADSs, are fully paid and in registered form, and existing shareholders are not obligated to contribute

additional capital.

Dividends and Distributions

Except under limited circumstances, we

are not permitted to distribute dividends or make other distributions to shareholders in any year in which we did not record net

income or retained earnings (excluding reserves). Our Articles of Incorporation provides that if we are profitable, 5.25% (inclusive)

to 8.25% (inclusive) of the profits shall be allocated as compensation to employees and 0.75% (inclusive) or less of the profits

should be allocated as remuneration to directors, each recorded as expense items prior to any distribution; however, if we have

accumulated losses, the profit shall be set aside to compensate losses before such allocation.

In the event we plan to make distributions,

our Articles of Incorporation provides that the annual net income shall be distributed in the order of sequences below:

|

|

·

|

replenishment of deficits;

|

|

|

·

|

special reserve appropriated or reserved in accordance with laws or regulations set forth by the authorities concerned; and

|

|

|

·

|

addition or deduction of realized gains or losses on equity instruments at fair value through other comprehensive income.

|

At the annual general meeting

of shareholders, our board of directors submits to the shareholders for their approval any proposal for the distribution of dividends

or the making of any other distribution to shareholders from our net income for the preceding fiscal year. All common shares outstanding

and fully paid as of the relevant record date are entitled to share equally in any dividend or other distribution so approved.

Dividends may be distributed in cash, in the form of common shares or a combination of the two, as determined by the shareholders

at the meeting. According to our Articles of Incorporation, we have a general policy that cash dividend distribution should not

be lower than 30% of the total dividend amount and the remainder be distributed as stock dividends.

We are also permitted to make distributions

to our shareholders in cash or in the form of common shares from reserves if we have no accumulated loss. However, the distribution

payable out of our legal reserve can only come from the amount exceeding 25% of the total paid-in capital.

For information on the dividends paid by

us and taxes on dividends in recent years, see “Item 8. Financial Information—Dividends and Dividend Policy”

and “Item 10. Additional Information—Taxation—ROC Taxation—Dividends” in our most recently filed

annual report on Form 20-F.

Changes in Share Capital

Under ROC Company Law, any change in the

authorized share capital of a company limited by shares requires an amendment to its Articles of Incorporation. In the case of

a public company such as ourselves, we must also obtain the approval of, or submit a report to, the ROC Financial Supervisory Commission

and the Kaohsiung Export Processing Zone Administration. Authorized but unissued common shares may be issued, subject to applicable

ROC law, upon terms as our board of directors may determine.

Preemptive Rights

Under the ROC Company Law, when an ROC

company issues new shares for cash, existing shareholders who are listed on the shareholders’ register as of the record date

have preemptive rights to subscribe for the new issue in proportion to their existing shareholdings, while a company’s employees,

whether or not they are shareholders of the company, have rights to subscribe for 10% to 15% of the new issue. Any new shares that

remain unsubscribed at the expiration of the subscription period may be freely offered, subject to compliance with applicable ROC

law.

In addition, in accordance with the ROC

Securities and Exchange Law, a public company that intends to offer new shares for cash must offer to the public at least 10% of

the shares to be sold, except under certain circumstances or when exempted by the ROC Financial Supervisory Commission. This percentage

can be increased by a resolution passed at a shareholders’ meeting, which would diminish the number of new shares subject

to the preemptive rights of existing shareholders.

These preemptive rights provisions do not

apply to offerings of new shares through a private placement approved at a shareholders’ meeting.

Meetings of Shareholders

We are required to hold an annual general

meeting of our shareholders within six months following the end of each fiscal year. These meetings are generally held in Kaohsiung,

Taiwan. Any shareholder who holds 1% or more of our issued and outstanding shares may submit one written proposal for discussion

at our annual general meeting. Extraordinary shareholders’ meetings may be convened by resolution of the board of directors

or by the board of directors upon the written request of any shareholder or shareholders who have held 3% or more of the outstanding

common shares for a period of one year or longer. Shareholders’ meetings may also be convened by a supervisor. Notice in

writing of meetings of shareholders, stating the place, time and purpose, must be dispatched to each shareholder at least 30 days,

in the case of annual general meetings, and 15 days, in the case of extraordinary meetings, before the date set for each meeting.

A majority of the holders of all issued and outstanding common shares present at a shareholders’ meeting constitutes a quorum

for meetings of shareholders.

Voting Rights

Under the ROC Company Law, except under

limited circumstances, shareholders have one vote for each common share held. Under the ROC Company Law, our directors and supervisors

are elected at a shareholders’ meeting through cumulative voting.

In general, a resolution can be adopted

by the holders of at least a majority of the common shares represented at a shareholders’ meeting at which the holders of

a majority of all issued and outstanding common shares are present.

Under ROC Company Law, the approval by

at least a majority of the common shares represented at a shareholders’ meeting in which a quorum of at least two-thirds

of all issued and outstanding common shares are represented is required for major corporate actions, including:

|

|

·

|

amendment to the Articles of Incorporation, including increase of authorized share capital and any changes of the rights of

different classes of shares;

|

|

|

·

|

execution, amendment or termination of any contract through which the company leases its entire business to others, or the

company appoints others to operate its business or the company operates its business with others on a continuous basis;

|

|

|

·

|

transfer of entire business or assets or a substantial part of its business or assets;

|

|

|

·

|

acquisition of the entire business or assets of any other company, which would have a significant impact on the company’s

operations;

|

|

|

·

|

distribution of any stock dividend;

|

|

|

·

|

dissolution, merger or spin-off of the company; and

|

|

|

·

|

removal of the directors or supervisors.

|

A shareholder may be represented at an

annual general or extraordinary meeting by proxy if a valid proxy form is delivered to us five days before the commencement of

the annual general or extraordinary shareholders’ meeting. Shareholders may exercise their voting rights by way of a written

ballot or by way of electronic transmission if the voting decision is delivered to us two days before the commencement of the annual

general or extraordinary shareholders’ meeting.

Holders of ADSs do not have the right to

exercise voting rights with respect to the underlying common shares, except as described in the deposit agreement.

Other Rights of Shareholders

Under the ROC Company Law, dissenting shareholders

are entitled to appraisal rights in certain major corporate actions such as a proposed amalgamation by the company. If agreement

with the company cannot be reached, dissenting shareholders may seek a court order for the company to redeem all of their shares.

Shareholders may exercise their appraisal rights by serving written notice on the company prior to or at the related shareholders’

meeting and/or by raising and registering an objection at the shareholders’ meeting. In addition to appraisal rights, shareholders

have the right to sue for the annulment of any resolution adopted at a shareholders’ meeting where the procedures were legally

defective within 30 days after the date of the shareholders’ meeting. One or more shareholders who have held 3% or more of

the issued and outstanding shares of a company for a period of one year or longer may require a supervisor to bring a derivative

action on behalf of the company against a director as a result of the director’s unlawful actions or failure to act.

Rights of Holders of Deposited Securities

Except as described below, holders of ADSs

generally have no right under the deposit agreement to instruct the depositary to exercise the voting rights for the common shares

represented by the ADSs. Instead, by accepting ADSs or any beneficial interest in ADSs, holders of ADSs are deemed to have authorized

and directed the depositary to appoint our chairman or his designee to represent them at our shareholders’ meetings and to

vote the common shares deposited with the custodian according to the terms of the deposit agreement.

The depositary will mail to holders of

ADSs any notice of shareholders’ meeting received from us together with information explaining how to instruct the depositary

to exercise the voting rights of the securities represented by ADSs.

If we fail to timely provide the depositary

with an English language translation of our notice of meeting or other materials related to any meeting of owners of common shares,

the depositary will endeavor to cause all the deposited securities represented by ADSs to be present at the applicable meeting,

insofar as practicable and permitted under applicable law, but will not cause those securities to be voted.

If the depositary timely receives voting

instructions from owners of at least 51% of the outstanding ADSs to vote in the same direction regarding one or more resolutions

to be proposed at the meeting, including election of directors and supervisors, the depositary will notify our chairman or his

designee to attend the meeting and vote all the securities represented by the holders’ ADSs in accordance with the direction

received from owners of at least 51% of the outstanding ADSs.

If we have timely provided the depositary

with the materials described in the deposit agreement and the depositary has not timely received instructions from holders of at

least 51% of the outstanding ADSs to vote in the same direction regarding any resolution to be considered at the meeting, then,

holders of ADSs will be deemed to have authorized and directed the depositary bank to give a discretionary proxy to our chairman

or his designee to attend and vote at the meeting the common shares represented by the ADSs in any manner, our chairman or his

designee may wish, which may not be in the interests of holders.

The ability of the depositary to carry

out voting instructions may be limited by practical and legal limitations and the terms of the securities on deposit. We cannot

assure ADS holders that they will receive voting materials in time to enable them to return voting instructions to the depositary

in a timely manner.

While shareholders who own 1% or more of

our outstanding shares are entitled to submit one proposal to be considered at our annual general meetings, only holders representing

at least 51% of our ADSs outstanding at the relevant record date are entitled to submit one proposal to be considered at our annual

general meetings. Hence, only one proposal may be submitted on behalf of all ADS holders.

Register of Shareholders and Record Dates

Our share registrar, President Securities

Corp., maintains our register of shareholders at its offices in Taipei, Taiwan. Under the ROC Company Law and our Articles of Incorporation,

we may, by giving advance public notice, set a record date and close the register of shareholders for a specified period in order

for us to determine the shareholders or pledgees that are entitled to rights pertaining to the common shares. The specified period

required is as follows:

|

|

·

|

annual general meeting—60 days;

|

|

|

·

|

extraordinary shareholders’ meeting—30 days; and

|

|

|

·

|

relevant record date—5 days.

|

Annual Financial Statements

At least ten days before the annual general

meeting, our annual financial statements must be available at our principal executive office in Kaohsiung, Taiwan for inspection

by the shareholders.

Transfer of Common Shares

The transfer of common shares in registered

form is effected by endorsement and delivery of the related share certificates but, in order to assert shareholders’ rights

against us, the transferee must have his name and address registered on our register of shareholders. Shareholders are required

to file their respective specimen seals, also known as chops, with us. Chops are official stamps widely used in Taiwan by individuals

and other entities to

authenticate the execution of official

and commercial documents. The settlement of trading in the common shares is normally carried out on the book-entry system maintained

by the Taiwan Depository & Clearing Corporation.

Acquisition of Common Shares by ASE Inc.

Under the ROC Securities and Exchange Law,

we may purchase our own common shares for treasury stock in limited circumstances, including:

|

|

·

|

to transfer shares to our employees;

|

|

|

·

|

to deliver shares upon the conversion or exercise of bonds with warrants, preferred shares with warrants, convertible bonds,

convertible preferred shares or warrants issued by us; and

|

|

|

·

|

to maintain our credit and our shareholders’ equity, provided that the shares so purchased shall be canceled.

|

We may purchase our common shares on the

Taiwan Stock Exchange or by means of a public tender offer. These transactions require the approval of a majority of our board

of directors at a meeting in which at least two-thirds of the directors are in attendance. The total amount of common shares purchased

for treasury stock may not exceed 10% of the total issued shares. In addition, the total cost of the purchased shares shall not

exceed the aggregate amount of our retained earnings, any premium from share issuances and the realized portion of our capital

reserve.

We may not pledge or hypothecate any of

our shares purchased by us. In addition, we may not exercise any shareholders’ right attaching to such shares. In the event

that we purchase our shares on the Taiwan Stock Exchange, our affiliates, directors, supervisors, managers, and their respective

spouses and minor children and/or nominees are prohibited from selling any of our shares during the period in which we are purchasing

our shares.

Pursuant to the ROC Company Law, an entity

in which our company directly or indirectly owns more than 50% of the voting shares or paid-in capital, which is referred to as

a controlled entity, may not purchase our shares. Also, if our company and a controlled entity jointly own, directly or indirectly,

more than 50% of the voting shares or paid-in capital of another entity, which is referred to as a third entity, the third entity

may not purchase shares in either our company or a controlled entity.

Liquidation Rights

In the event of our liquidation, the assets

remaining after payment of all debts, liquidation expenses and taxes will be distributed pro rata to the shareholders in accordance

with the relevant provisions of the ROC Company Law and our Articles of Incorporation.

Transfer Restrictions

Substantial Shareholders

The ROC Securities and Exchange Law currently

requires:

|

|

·

|

each director, supervisor, manager, or

substantial shareholder (that is, a shareholder who holds more than 10% shares of a company), and their respective spouses, minor

children or nominees, to report any change in that person’s shareholding to the issuer of the shares and the ROC Financial

Supervisory Commission; and

|

|

|

·

|

each director, supervisor, manager, or substantial shareholder, and their respective spouses, minor children or nominees, after

acquiring the status of director, supervisor, manager, or substantial shareholder for a period of six months, to report his or

her intent to transfer any shares on the Taiwan

|

Stock Exchange to the ROC Financial

Supervisory Commission at least three days before the intended transfer, unless the number of shares to be transferred does not

exceed 10,000 shares.

In addition, the number of shares that

can be sold or transferred on the Taiwan Stock Exchange by any person subject to the restrictions described above on any given

day may not exceed:

|

|

·

|

0.2% of the outstanding shares of the company in the case of a company with no more than 30 million outstanding shares; or

|

|

|

·

|

0.2% of 30 million shares plus 0.1% of the outstanding shares exceeding 30 million shares in the case of a company with more

than 30 million outstanding shares; or

|

|

|

·

|

in any case, 5% of the average trading volume (number of shares) on the Taiwan Stock Exchange for the ten consecutive trading

days preceding the reporting day on which the director, supervisor, manager or substantial shareholder reports the intended share

transfer to the ROC Financial Supervisory Commission.

|

These restrictions do not apply to sales

or transfers of our ADSs.

Description

of Rights to Subscribe for Common Shares

We may issue rights to subscribe for shares

of our common shares. These rights may or may not be transferable by the security holder receiving the rights. In connection with

any offering of rights, we may or may not enter into a standby arrangement with one or more underwriters or other purchasers pursuant

to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed after such offering.

The terms of the rights to subscribe for

shares of our common shares will be set forth in a prospectus supplement which, will describe, among other things:

|

|

·

|

the aggregate number of rights to be issued;

|

|

|

·

|

the number of shares purchasable upon exercise of each right;

|

|

|

·

|

the terms of the common shares issuable upon exercise of the rights;

|

|

|

·

|

the procedures for exercising the right;

|

|

|

·

|

the record date, if any, to determine who is entitled to the rights and the ex-rights date;

|

|

|

·

|

the date upon which the exercise of rights will commence;

|

|

|

·

|

the extent to which the rights are transferable;

|

|

|

·

|

the extent to which the rights may include an over-subscription privilege with respect to unsubscribed shares;

|

|

|

·

|

if applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with

the offering of the rights;

|

|

|

·

|

a discussion of the material U.S. federal and ROC income and other tax considerations; and

|

|

|

·

|

any other material terms of the rights.

|

Enforceability

of Civil Liabilities

We are a company limited by shares and

incorporated under the ROC Company Law. The majority of our directors, and executive officers and some of the experts named in

this prospectus are residents of the ROC and substantially all of the assets of our company and such persons are located in the

ROC. As a result, it may not be possible for investors to effect service of process on ASE or such persons outside the ROC, or

to enforce against any of their judgments obtained in courts outside of the ROC. ROC counsel has advised that any final judgment

obtained against us or such persons in any court other than the courts of the ROC in respect of any legal suit or proceeding arising

out of or relating to the Share Exchange will be enforced by the courts of the ROC without further review of the merits only if

the court of the ROC in which enforcement is sought is satisfied that:

|

|

·

|

the court rendering the judgment had jurisdiction over the subject matter according to the laws of the ROC;

|

|

|

·

|

the judgment and the court procedures resulting in the judgment are not contrary to the public order or good morals of the

ROC;

|

|

|

·

|

if the judgment was rendered by default by the court rendering the judgment, (i) we or such persons were duly served in the

jurisdiction of such court within a reasonable period of time in accordance with the laws and regulations of such jurisdiction,

or (ii) process was served on us or such persons with judicial assistance of the ROC; and

|

|

|

·

|

judgments of the courts of the ROC are recognized in the jurisdiction of the court rendering the judgment on a reciprocal basis.

|

A party seeking to enforce a foreign judgment

in the ROC would, except under limited circumstances, be required to obtain foreign exchange approval from the Central Bank of

the Republic of China (Taiwan) for the remittance out of the ROC of any amounts exceeding US$100,000 or its equivalent recovered

in respect of such judgment denominated in a currency other than NT dollars.

Taxation

The following is a discussion of material ROC and income

tax consequences to U.S. Holders described below of the receipt, exercise and disposition of rights (“rights”) to

subscribe for our common shares (the “New Shares”) and the ownership and disposition of New Shares acquired pursuant

to an offering hereunder. To the extent that the discussion relates to matters of ROC tax law, it is the opinion of Baker &

McKenzie, our ROC counsel.

Material ROC Taxation Considerations

The following are the principal ROC tax

consequences of receipt, exercise and disposition of the rights and New Shares to a non-resident individual or non-resident entity

(a “non-ROC holder”) on the assumption that New Shares will be listed on the Taiwan Stock Exchange as scheduled. As

used in the preceding sentence, a “non-resident individual” is a non-ROC national who is granted the rights or owns

New Shares, as the case may be, and is not physically present in the ROC for 183 days or more during any calendar year, and a “non-resident

entity” is a corporation or a non-corporate body which owns the rights or New Shares, as the case may be, is organized under

the law of a jurisdiction other than the ROC and has no fixed place of business or business agent in the ROC.

The statements regarding ROC tax laws set

forth below are based on the laws in force and applicable as of the date hereof, which are subject to change, possibly on a retroactive

basis.

This summary is not exhaustive of all possible

tax considerations, which may apply to a particular non-ROC holder and potential non-ROC holders are advised to discuss the overall

tax consequences of the acquisition, ownership and disposition of the rights or New Shares, including specifically the tax consequences

under ROC law, the laws of the jurisdiction of which they are residents, and any tax treaty between ROC and their country of residence

with their tax advisors.

Taxation of the Rights

Distributions of the rights to subscribe

for the New Shares and exercise of rights are not subject to ROC tax.

Proceeds derived from sales of the rights

which are not evidenced by securities, such as the rights, are subject to capital gains tax at the rate of 20% of the gains realized

by a non-resident entity and by a non-resident individual. Subject to compliance with ROC law, ASE has the sole discretion to determine

whether the rights shall be evidenced by securities.

Tax Consequences of Owning the New Shares

Dividends

Dividends (whether in cash or common shares)

by ASE out of retained earnings and distributed to a non-ROC holder are subject to ROC withholding tax, at a rate of 20% (unless

a preferable tax rate is provided under a tax treaty between the ROC and the jurisdiction where the non-ROC holder is a resident)

on the amount of the distribution (in the case of cash dividends) or on the par value of the distributed common shares (in the

case of stock dividends). A 10% undistributed earning tax is imposed on a ROC company for its after-tax earnings generated after

January 1, 1998 that are not distributed in the following year. The undistributed earning tax so paid by the ROC company will reduce

the retained earnings available for future distributions. When ASE declares a dividend out of those retained earnings, an amount

in respect of the undistributed earnings tax, up to a maximum amount of 5% of the dividend to be distributed, will be credited

against the withholding tax imposed on the non-ROC holders.

Distributions of stock dividends out of

capital reserves will not be subject to withholding tax, except under limited circumstances.

Capital Gains

Starting from January 1, 2016, capital

gains realized upon the sale or other disposition of New Shares are exempt from ROC income tax.

Securities Transaction Tax

Securities transaction tax will be imposed

on a holder of our New Shares upon a sale of such shares at the rate of 0.3% of the transaction price.

Estate and Gift Tax

ROC estate tax is payable on any property

within the ROC left by a deceased non-resident individual, and ROC gift tax is payable on any property within the ROC donated by

a non-resident individual. Estate tax and gift tax are imposed at the rate of 10%. Under the ROC Estate and Gift Tax Act, common

shares issued by ROC companies, such as the New Shares, are deemed located in the ROC without regard to the location of the owner.

Tax Treaty

At present, the ROC has income tax treaties with Indonesia,

Singapore, New Zealand, Australia, the United Kingdom, South Africa, Gambia, Swaziland, Malaysia, Macedonia, the Netherlands, Senegal,

Sweden, Belgium, Denmark, Israel, Vietnam, Paraguay, Hungary, France, India, Slovakia, Switzerland, Germany, Thailand, Kiribati,

Luxembourg, Austria, Italy and Japan. These tax treaties may limit the rate of ROC withholding tax on dividends paid with respect

to common shares issued by ROC companies, including the New Shares. The United States does not have an income tax treaty with the

ROC.

U.S. Federal Income Taxation

The applicable prospectus supplement will describe material U.S. federal income tax consequences of the ownership and disposition

of the securities offered thereunder to certain U.S. persons.

Plan of

Distribution

We may sell or distribute the securities

included in this prospectus through underwriters, through agents, to dealers, or directly to purchasers, at market prices prevailing

at the time of sale, at prices related to the prevailing market prices, or at negotiated prices.

We may sell some or all of the securities

included in this prospectus through:

|

|

·

|

a block trade in which a broker-dealer may resell a portion of the block, as principal, in order to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account; or

|

|

|

·

|

ordinary brokerage transactions and transactions in which a broker solicits purchasers.

|

We may enter into hedging transactions

with respect to our securities. For example, we may:

|

|

·

|

enter into transactions involving short sales of our common shares by broker-dealers;

|

|

|

·

|

sell our common shares short themselves and deliver the shares to close out short positions;

|

|

|

·

|

enter into option or other types of transactions that require us to deliver common shares to a broker-dealer, who will then

resell or transfer the common shares under this prospectus; or

|

|

|

·

|

loan or pledge our common shares to a broker-dealer, who may sell the loaned shares or, in the event of default, sell the pledged

shares.

|

We may enter into derivative transactions

with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If

the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered

by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use

securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of securities,

and may use securities received from us in settlement of those derivatives to close out any related open borrowings of securities.

The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be identified

in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities

to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial

institution or other third party may transfer its economic short position to investors in our securities or in connection with

a concurrent offering of other securities.

Any broker-dealers or other persons that

participate with us in the distribution of the securities may be deemed to be underwriters and any commissions received or profit

realized by them on the resale of the shares may be deemed to be underwriting discounts and commissions under the Securities Act.

At the time that any particular offering

of securities is made, to the extent required by the Securities Act, a prospectus supplement will be distributed, setting forth

the terms of the offering, including the aggregate number of securities being offered, the purchase price of the securities, the

initial offering price of the securities, the names of any underwriters, dealers or agents, any discounts, commissions and other

items constituting compensation from us and any discounts, commissions or concessions allowed or reallowed or paid to dealers.

Underwriters or agents could make sales

in privately negotiated transactions and/or any other method permitted by law, including sales deemed to be an at-the-market offering

as defined in Rule 415 promulgated under the Securities Act, which includes sales made directly on or through the New York

Stock Exchange, the Taiwan Stock Exchange, or sales made to or through a market maker other than on an exchange.

Any underwriter may also engage in stabilizing

transactions, syndicate covering transactions and penalty bids in accordance with Rule 104 under the Exchange Act. Stabilizing

transactions involve bids to purchase the underlying security in the open market for the purpose of pegging, fixing or maintaining

the price of the securities. Syndicate

covering transactions involve purchases of the securities in

the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty bids permit the underwriters to

reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased

in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions

and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters

may, if they commence these transactions, discontinue them at any time.

Agents, underwriters, and dealers may be

entitled, under agreements entered into with us, to indemnification by us, against certain liabilities, including liabilities under

the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage in transactions with

or perform services for us or our affiliates, in the ordinary course of business for which they may receive customary compensation.

Legal Matters

Certain legal matters as to United States

federal law and New York State law will be passed upon for us by Davis Polk & Wardwell LLP, New York, New York. Certain

other legal matters as to ROC law will be passed upon for us by Baker & McKenzie, Taipei, Taiwan.

Experts

The consolidated financial statements as

of December 31, 2014 and 2015, and for each of the three years in the period ended December 31, 2015, incorporated in this prospectus

by reference from ASE’s Annual Report on Form 20-F for the year ended December 31, 2015, and the effectiveness of ASE’s

internal control over financial reporting have been audited by Deloitte & Touche, an independent registered public accounting

firm, as stated in their reports, which reports (1) express an unqualified opinion on the consolidated financial statements and

include an explanatory paragraph referring to the convenience translation of New Taiwan dollar amounts into U.S. dollar amounts

and (2) express an unqualified opinion on the effectiveness of internal control over financial reporting and are incorporated by

reference herein. Such consolidated financial statements have been so incorporated in reliance upon the reports of such firm given

upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

ITEM 8.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

The relationship between Advanced Semiconductor

Engineering, Inc. (“ASE Inc.”) and its directors and officers is governed by the Republic of China (“ROC”)

Civil Code, ROC Company Law and ASE Inc.’s Articles of Incorporation. There is no written contract between ASE Inc. and its

directors and officers governing the rights and obligations of such parties. Each person who was or is a party or is threatened

to be made a party to, or is involved in any threatened, pending or completed action, suit or proceeding by reason of the fact

that such person is or was a director or officer of ASE Inc. in the absence of willful misconduct or negligence on the part of

such person in connection with such person’s performance of duties as a director or officer, as the case may be, may be indemnified

and held harmless by ASE Inc.

See Exhibit Index beginning on page II-7

of this registration statement.

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement;

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or any decrease in volume of securities offered

(if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i),

(a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form F-3 and the information required

to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the

SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial

bona fide

offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) To

file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A of Form

20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required

by Section 10(a)(3) of the Act need not be furnished, provided that the Registrant includes in the prospectus, by means of a post-effective

amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other

information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing,

with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements

and information required by Section 10(a)(3) of the Act or Rule 3-19 of Regulation S-K if such financial statements and information

are contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d)

of the Securities Act of 1934 that are incorporated by reference in this Form F-3.

(5) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial

bona fide

offering thereof. Provided, however, that no statement made in

a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date.

(6) That,

for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if

the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule

424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to

by the undersigned Registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant

or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each

filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the

Securities Exchange Act of 1934 that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(c) The

undersigned Registrant hereby undertakes to supplement the prospectus, after the expiration of the subscription period, to set

forth the results of the subscription offer, the amount of unsubscribed securities to be purchased, and the terms of any subsequent

reoffering thereof. If any public offering by the underwriters is to be made on terms differing from those set forth on the cover

page of the prospectus, a post-effective amendment will be filed to set forth the terms of such offering.

(d) The undersigned Registrant hereby undertakes

to deliver or cause to be delivered with the prospectus, to each person to whom the prospectus is sent or given, the latest annual

report to security holders that is incorporated by reference in the prospectus and furnished pursuant to and meeting the requirements

of Rule 14a-3 or Rule 14c-3 under the Securities Exchange Act of 1934; and, where interim financial information required to be

presented by Article 3 of Regulation S-X are not set forth in the prospectus, to deliver, or cause to be delivered to each person

to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus

to provide such interim financial information.

(e) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion

of the SEC such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933

will be governed by the final adjudication of such issue.

(f) The undersigned registrant hereby undertakes

that:

(1) For purposes of determining

any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration

statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) (1)

or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared

effective.

(2) For the purpose of determining

any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in Taipei, Taiwan, on December 16, 2016.

|

|

|

|

ADVANCED SEMICONDUCTOR ENGINEERING,

INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Jason C.S. Chang

|

|

|

|

|

|

|

Name:

|

Jason C.S. Chang

|

|

|

|

|

|

|

Title:

|

Chairman

|

|

|

|

|

|

|

|

|

|

POWER OF ATTORNEY

Each person whose

signature appears below constitutes and appoints each of Jason C.S. Chang and Joseph Tung as an attorney-in-fact, each with full

power of substitution, for him in any and all capacities, to do any and all acts and all things and to execute any and all instruments

which said attorney and agent may deem necessary or desirable to enable the Registrant to comply with the Securities Act of 1933,

as amended (the “Securities Act”), and any rules, regulations and requirements of the Securities and Exchange Commission

thereunder, in connection with the registration under the Securities Act of securities of the Registrant, including, without limitation,

the power and authority to sign the name of each of the undersigned in the capacities indicated below to the registration statement

on Form F-3 (the “Registration Statement”) to be filed with the Securities and Exchange Commission with respect

to such securities, to any and all amendments or supplements to such Registration Statement, whether such amendments or supplements

are filed before or after the effective date of such Registration Statement, to any related Registration Statement filed pursuant

to Rule 462(b) under the Securities Act, and to any and all instruments or documents filed as part of or in connection with

such Registration Statement or any and all amendments thereto, whether such amendments are filed before or after the effective

date of such Registration Statement; and each of the undersigned hereby ratifies and confirms all that such attorney and agent

shall do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons in the capacities indicated and on December 16, 2016.

|

Signature

|

Title

|

|

/s/ Jason C.S. Chang

|

Director, Chairman of the Board of Directors and

Chief Executive Officer

|

|

Jason C.S. Chang

|

(principal executive officer)

|

|

s/ Richard H.P. Chang

|

Director, Vice Chairman of the Board of Directors and President

|

|

Richard H.P. Chang

|

|

|

s/ Tien Wu

|

Director and Chief Operating Officer

|

|

Tien Wu

|

|

|

s/ Joseph Tung

|

Director and Chief Financial Officer

|

|

Joseph Tung

|

(principal financial officer)

|

|

s/ Shen-Fu Yu

|

Independent Director

|

|

Shen-Fu Yu

|

|

|

s/ Ta-Lin Hsu

|

Independent Director

|

|

Ta-Lin Hsu

|

|

|

s/ Mei-Yueh Ho

|

Independent Director

|

|

Mei-Yueh Ho

|

|

|

s/ Murphy Kuo

|

Controller and Vice President

|

|

Murphy Kuo

|

(principal accounting officer)

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE

OF THE REGISTRANT

Pursuant to the Securities Act of 1933,

the undersigned, the duly authorized representative in the United States of Advanced Semiconductor Engineering, Inc., has signed

this registration statement or amendment thereto in the City of New York, New York, on December 16, 2016.

|

|

|

|

National Corporate Research, Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Colleen A. DeVries

|

|

|

|

|

|

|

Name:

|

Colleen A. DeVries

|

|

|

|

|

|

|

Title:

|

Senior Vice-President

|

|

|

|

|

|

|

|

|

|

INDEX TO EXHIBITS

|

Exhibit

Number

|

Description

of Document

|

|

1.1*

|

Form of Underwriting Agreement (equity).

|

|

5.1

|

Opinion of Baker & McKenzie regarding the validity of common shares and rights.

|

|

8.1

|