Tender Offer Statement by Issuer (sc To-i)

December 14 2016 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION

14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

MATINAS BIOPHARMA HOLDINGS, INC.

(Name of Subject Company (Issuer) and

Filing Person (Offeror))

WARRANTS TO PURCHASE COMMON STOCK

(Title of Class of Securities)

576810 105

(CUSIP Number of Common Stock Underlying

Warrants)

Roelof Rongen

Chief Executive Officer

Matinas BioPharma Holdings, Inc.

1545 Route 206 South, Suite 302

Bedminster, New Jersey 07921

Telephone: 908-443-1860 (Name, Address

and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person)

WITH COPY TO:

Michael Lerner, Esq.

Steven Skolnick, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

Telephone: (212) 262-6700

CALCULATION OF FILING FEE:

|

Transaction

valuation

(1)

|

|

Amount

of filing fee

(1)(2)

|

|

$50,685,485

|

|

$5,874.45

|

|

(1)

|

Estimated for purposes of calculating the amount of the filing fee only. An offer to amend and exercise warrants to purchase an aggregate of 36,728,612 shares of common stock (the “

Offer to Amend and Exercise

”), including: (i) outstanding warrants to purchase 4,000,000 shares of the Company’s common stock issued to investors in connection with our formation in June 2013, with an exercise price of $2.00 per share (the “Formation Warrants”); (ii) outstanding warrants to purchase 1,000,000 shares of the Company’s common stock issued to former stockholders of Matinas BioPharma, Inc. in connection with the merger of Matinas BioPharma, Inc. and Matinas BioPharma Holdings, Inc. in July 2013, with an exercise price of $2.00 per share (the “Merger Warrants”); (iii) outstanding warrants to purchase 7,500,000 shares of the Company’s common stock issued to investors participating in the Company’s private placement financings closed in July and August 2013, with an exercise price of $2.00 per share (the “2013 Investor Warrants”); (iv) outstanding warrants to purchase 500,000 shares of the Company’s common stock issued to investors in the Company’s warrant private placement transaction completed in July 2013, with an exercise price of $2.00 per share (the “Private Placement Warrants”); (v) outstanding warrants to purchase 19,580,000 shares of the Company’s common stock issued to investors participating in the Company’s private placement financings closed in March and April 2015, with an exercise price of $0.75 per share (the “2015 Investor Warrants”); (vi) outstanding warrants to purchase 750,000 shares of the Company’s common stock issued to the placement agent in the private placement financings closed in July and August 2013, with an exercise price of $2.00 per share (the “$2.00 PA Warrants”); (vii) outstanding warrants to purchase 1,427,937 shares of the Company’s common stock issued to the placement agent in the private placement financings closed in July and August 2013, with an exercise price of $1.00 per share (the “$1.00 PA Warrants”); and (viii) outstanding warrants to purchase 1,970,675 shares of the Company’s common stock issued to the placement agent in the private placement financings closed in March and April 2015, with an exercise price of $0.75 per share (the “$0.75 PA Warrants” and collectively with the Formation Warrants, the Merger Warrants, the 2013 Investor Warrants, the Private Placement Warrants, the 2015 Investor Warrants, the $2.00 PA Warrants and the $1.00 PA Warrants, the “Original Warrants”). The transaction value is calculated pursuant to Rule 0-11 using $1.38 per share of common stock, which represents the average of the high and low sales price of the common stock on December 13, 2016.

|

|

(2)

|

Calculated by multiplying the transaction value

by 0.0001159.

|

|

¨

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing.

|

|

|

Amount Previously Paid: N/A

|

|

Filing Party: N/A

|

|

|

Form or Registration Number: N/A

|

|

Date Filed: N/A

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

|

|

|

|

Check the appropriate boxes below to

designate any transactions to which the statement relates:

|

|

|

¨

|

third party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

¨

|

going private transaction subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment

reporting the results of a tender offer:

¨

The alphabetical subsections used in the Item responses below

correspond to the alphabetical subsections of the applicable items of Regulation M-A promulgated under the federal securities laws.

If applicable, check the appropriate box(es) below to designate

the appropriate note provision(s):

|

|

¨

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

¨

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

TABLE OF CONTENTS

EX-99(a)(1)(B)

EX-99(a)(1)(C)

EX-99(a)(1)(D)

EX-99(a)(1)(E)

EX-99(a)(1)(F)

EX-99(A)(1)(G)

EX-99(A)(1)(H)

EX-99(A)(1)(I)

EX-99(A)(1)(J)

EX-99(A)(1)(K)

EX-99(A)(1)(L)

EX-99(A)(1)(M)

EX-99(d)(1)

|

|

Item 1.

|

SUMMARY

TERM SHEET

|

The information under

the heading “Summary of Terms” in the Offer to Amend and Exercise filed as Exhibit (a)(1)(B) to this Schedule TO is

incorporated herein by reference.

|

|

Item 2.

|

SUBJECT

COMPANY INFORMATION

|

|

|

(a)

|

The name of the subject company (issuer) and filing person (offeror) is Matinas BioPharma Holdings,

Inc., a Delaware corporation (the “Company”). The address and telephone number of its principal executive offices are

1545 Route 206 South, Suite 302, Bedminster, New Jersey 07921, telephone (908) 443-1860.

|

|

|

(b)

|

As of December 14, 2016, the Company has: (i) outstanding warrants to purchase 4,000,000 shares

of the Company’s common stock issued to investors in connection with our formation in June 2013, with an exercise price of

$2.00 per share (the “Formation Warrants”); (ii) outstanding warrants to purchase 1,000,000 shares of the Company’s

common stock issued to former stockholders of Matinas BioPharma, Inc. in connection with the merger of Matinas BioPharma, Inc.

and Matinas BioPharma Holdings, Inc. in July 2013, with an exercise price of $2.00 per share (the “Merger Warrants”);

(iii) outstanding warrants to purchase 7,500,000 shares of the Company’s common stock issued to investors participating in

the Company’s private placement financings closed in July and August 2013, with an exercise price of $2.00 per share (the

“2013 Investor Warrants”); (iv) outstanding warrants to purchase 500,000 shares of the Company’s common stock

issued to investors in the Company’s warrant private placement transaction completed in July 2013, with an exercise price

of $2.00 per share (the “Private Placement Warrants”); (v) outstanding warrants to purchase 19,580,000 shares of the

Company’s common stock issued to investors participating in the Company’s private placement financings closed in March

and April 2015, with an exercise price of $0.75 per share (the “2015 Investor Warrants”); (vi) outstanding warrants

to purchase 750,000 shares of the Company’s common stock issued to the placement agent in the private placement financings

closed in July and August 2013, with an exercise price of $2.00 per share (the “$2.00 PA Warrants”); (vii) outstanding

warrants to purchase 1,427,937 shares of the Company’s common stock issued to the placement agent in the private placement

financings closed in July and August 2013, with an exercise price of $1.00 per share (the “$1.00 PA Warrants”); and

(viii) outstanding warrants to purchase 1,970,675 shares of the Company’s common stock issued to the placement agent in the

private placement financings closed in March and April 2015, with an exercise price of $0.75 per share (the “$0.75 PA Warrants”

and collectively with the Formation Warrants, the Merger Warrants, the 2013 Investor Warrants, the Private Placement Warrants,

the 2015 Investor Warrants, the $2.00 PA Warrants and the $1.00 PA Warrants, the “Original Warrants”). Pursuant to

the Offer to Amend and Exercise, the Original Warrants will be amended to reduce the exercise price of the Original Warrants from

$2.00 per share, $1.00 per share or $0.75 per share, as applicable, to $0.50 per share of common stock in cash on the terms and

conditions set forth in the Offer to Amend and Exercise. There is no minimum participation requirement with respect to the Offer

to Amend and Exercise.

|

As of December 14,

2016, the Company had: (i) 58,109,495 shares of common stock outstanding; (ii) 1,600,000 shares of Series A Preferred Stock

outstanding; (iii) outstanding warrants to purchase 40,255,234 shares of common stock (including, the Original Warrants); and

(iv) outstanding options to purchase 8,320,694 shares of common stock issued pursuant to the Company’s 2013 Equity

Compensation Plan (the “Plan”). In addition, the Company has reserved an additional 2,523,519 shares of common

stock for issuance pursuant to the Plan.

|

|

(c)

|

No trading market exists for the Original Warrants or the Amended Warrants offered pursuant to

the Offer to Amend and Exercise. Information about the trading market and price of the Company’s common stock under Section

12: “Trading Market and Price Range of Common Stock” of the Offer to Amend and Exercise is incorporated herein by reference.

|

|

|

Item 3.

|

IDENTITY

AND BACKGROUND OF FILING PERSON

|

|

|

(a)

|

The Company is the filing person and the subject company. The address and telephone number of each

of the Company’s executive officers and directors is c/o Matinas BioPharma Holdings, Inc., 1545 Route 206 South, Suite 302,

Bedminster, New Jersey 07921, telephone (908) 443-1860.

|

Pursuant to General Instruction

C to Schedule TO promulgated by the United States Securities and Exchange Commission (the “SEC”), the following persons

are executive officers, directors and/or control persons of the Company:

|

Name

|

|

Position(s)

|

|

Herbert Conrad

|

|

Chairman of the Board

|

|

Roelof Rongen

|

|

Chief Executive Officer

|

|

Jerome D. Jabbour

|

|

President

|

|

Raphael J. Mannino

|

|

Senior Vice President and Chief Technology Officer

|

|

Abdel A. Fawzy

|

|

Executive Vice President, Pharmaceutical Development and Supply Chain

|

|

Gary Gaglione

|

|

Vice President of Finance and Accounting and Acting Chief Financial Officer

|

|

Douglas F. Kling

|

|

Senior Vice President for Clinical Development and Project Management

|

|

Stefano Ferrari

|

|

Director

|

|

Adam Stern

|

|

Director

|

|

James S. Scibetta

|

|

Director

|

|

|

Item 4.

|

TERMS

OF THE TRANSACTION

|

|

|

(a)

|

Information about the terms of the transaction under the headings “Summary of Terms”

and “Description of Offer to Amend and Exercise” of the Offer to Amend and Exercise is incorporated herein by reference.

|

|

|

(b)

|

See Item 8 below for a description of the executive officers, directors and affiliates who hold

Original Warrants and who will have an opportunity to participate in the Offer to Amend and Exercise on the same terms and conditions

as the other holders of Original Warrants.

|

|

|

Item 5.

|

PAST

CONTRACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

|

|

|

(e)

|

See Item 9 below for a description of the Company’s retention of Aegis Capital Corp. (“Aegis

Capital”) to serve as the Warrant Agent for the Offer to Amend and Exercise. Adam K. Stern, one of the Company’s directors,

is the Head of Private Equity Banking at Aegis Capital.

|

|

|

Item 6.

|

PURPOSES

OF THE TRANSACTION AND PLANS OR PROPOSALS

|

|

|

(a)

|

The information about the purposes of the transaction under Section 2: “Purposes of the Offer

to Amend and Exercise and Use of Proceeds” of the Offer to Amend and Exercise is incorporated herein by reference.

|

|

|

(b)

|

The Company intends to cancel the Original Warrants upon the exercise of the Original Warrants

by the holders thereof. Pursuant to the Offer to Amend and Exercise, Original Warrants that are not so exercised will remain outstanding

pursuant to their original terms.

|

|

|

(c)

|

No plans or proposals described in this Schedule TO or in any materials sent to the holders of

the Original Warrants in connection with this Offer to Amend and Exercise relate to or would result in the conditions or transactions

described in Regulation M-A, Item 1006(c)(1) through (10), except as follows:

|

Any holder of Original

Warrants who elects to exercise his, her or its Original Warrants will acquire additional shares of common stock of the

Company as a result of such exercise. As of December 14, 2016, the Company had 58,109,495 shares of common stock

outstanding. The Original Warrants are exercisable for an aggregate of 36,728,612 shares of common stock. Assuming all

Original Warrants are exercised for cash, the Company’s outstanding shares of common stock would increase to

838,107 shares, with the shares issued upon exercise of the Original Warrants representing approximately 39% of the then

outstanding shares of common stock.

|

|

Item 7.

|

SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

|

Item 8.

|

INTEREST

IN SECURITIES OF THE SUBJECT COMPANY

|

|

|

(a)

|

As of December 14, 2016, there are outstanding Original Warrants to purchase an aggregate of

36,728,612 shares of common stock. The Company’s executive officers, directors and control persons, as described below, hold

the following Original Warrants and will be entitled to participate in the Offer to Amend and Exercise on the same terms and conditions

as the other holders of Original Warrants:

|

|

Name

|

|

Position with the Company

|

|

Number of Original

Warrants Held

|

|

|

Percentage of Original

Warrants Held

|

|

|

Roelof Rongen

|

|

Chief Executive Officer and Director

|

|

|

50,000

|

|

|

|

*

|

|

|

Herbert Conrad

|

|

Chairman of the Board

|

|

|

1,875,000

|

|

|

|

5.1

|

%

|

|

Stefano Ferrari

|

|

Director

|

|

|

250,000

|

|

|

|

*

|

|

|

James Scibetta

|

|

Director

|

|

|

100,000

|

|

|

|

*

|

|

|

Adam Stern

|

|

Director

|

|

|

4,216,492

|

(1)

|

|

|

11.6

|

%

|

|

Gary Gaglione

|

|

Acting Chief Financial Officer

|

|

|

20,000

|

|

|

|

*

|

|

|

Douglas Kling

|

|

|

|

|

40,000

|

|

|

|

*

|

|

|

Affiliates of Aegis Capital (including Adam Stern)

|

|

|

|

|

7,375,137

|

|

|

|

20.1

|

%

|

|

1.

|

Includes 2,166,492 placement agent warrants which may

be exercised on a “cashless basis” at Mr. Stern’s election.

|

Except as set forth above, none of the

Company’s other executive officers or directors hold Original Warrants.

|

|

(b)

|

Except with respect to the Warrant Agent Agreement described in Item 9 below, none of our directors

or executive officers participated in any transaction involving the Original Warrants during the past 60 days.

|

|

|

Item 9.

|

PERSONS/ASSETS,

RETAINED, EMPLOYED, COMPENSATED OR USED

|

|

|

(a)

|

The Company has retained Aegis Capital to act as its Warrant Agent for the Offer to Amend and Exercise

pursuant to a Warrant Agent Agreement, attached as Exhibit (d)(1) to this Schedule TO. Aegis Capital, in accordance with the terms

of the Warrant Agent Agreement, shall use reasonable commercial efforts to contact holders of the Original Warrants by mail, telephone,

facsimile, or other electronic means and solicit their participation in the Offer to Amend and Exercise and to amend and exercise

their Original Warrants. Aegis Capital will receive a fee equal to 5% of the cash exercise prices paid by holders of the Original

Warrants (excluding the placement agent warrants) who participate in the Offer to Amend and Exercise and amend and exercise their

Original Warrants. In addition, the Company has agreed to reimburse Aegis Capital for its reasonable out-of-pocket expenses and

attorney’s fees, including a $35,000 non-accountable expense allowance. The Company has agreed to indemnify Aegis Capital

against certain liabilities in connection with the Offer to Amend and Exercise, including certain liabilities under the federal

securities laws. As of September 30, 2016, affiliates of Aegis Capital own an aggregate of approximately 8.9% of our outstanding

Common Stock and on a beneficial ownership basis, inclusive of their warrants and options, approximately 23.1% of our Common Stock,

including approximately 20.1% of the Original Warrants subject to this Offer to Amend and Exercise.

|

The Company may also use the services

of its officers and employees to solicit holders of the Original Warrants to participate in the Offer to Amend and Exercise without

additional compensation.

|

|

Item 10.

|

FINANCIAL

STATEMENTS

|

|

|

(a)

|

The financial information required by Item 1010(a) is included under Section 16 “Historical and Pro-Forma Financial Information Regarding the Company” of the Offer to Amend and Exercise, as amended and supplemented, is incorporated by reference.

|

|

|

(b)

|

The pro forma financial information required by Item 1010(b) is included under Section 16 “Historical and Pro-Forma Financial Information Regarding the Company” of the Offer to Amend and Exercise, as amended and supplemented, is incorporated by reference.

|

|

|

Item 11.

|

ADDITIONAL

INFORMATION

|

|

|

(a)

|

(1)

|

Except as set forth in Items 5, 8 and 9 above, there are no present or proposed contracts, arrangements, understandings or

relationships between the Company and its executive officers, directors or affiliates relating, directly or indirectly, to the

Offer to Amend and Exercise.

|

|

|

|

(2)

|

There are no applicable regulatory requirements or approvals needed for the Offer to Amend and

Exercise.

|

|

|

|

(3)

|

There are no applicable anti-trust laws.

|

|

|

|

(4)

|

The margin requirements of Section 7 of the Securities Exchange Act of 1934, as amended, and the

applicable regulations are inapplicable.

|

The following are attached as exhibits

to this Schedule TO:

|

|

(a)

|

(1)(A)

|

Letter to Holders of Original Warrants

|

|

|

(1)(B)

|

Offer to Amend and Exercise

|

|

|

(1)(C)

|

Form of Election to Participate and Exercise Warrant

|

|

|

(1)(D)

|

Form of Notice of Withdrawal

|

|

|

(1)(E)

|

Form of Formation Amended Warrant

|

|

|

(1)(F)

|

Form of Merger Amended Warrant

|

|

|

(1)(G)

|

Form of Private Placement Amended Warrant

|

|

|

(1)(H)

|

Form of 2013 Investor Amended Warrant

|

|

|

(1)(I)

|

Form of 2015 Investor Amended Warrant

|

|

|

(1)(J)

|

Form of $2.00 PA Amended Warrant

|

|

|

(1)(K)

|

Form of $1.00 PA Amended Warrant

|

|

|

(1)(L)

|

Form of $0.75 PA Amended Warrant

|

|

|

(1)(M)

|

Company Supplemental Information, dated December 14, 2016

|

|

|

(5)(A)

|

Annual Report on Form 10-K containing audited financial statements for the fiscal years ended December

31, 2015 and 2014 (as filed with the SEC on March 30, 2016 and incorporated herein by reference)

|

|

|

(5)(B)

|

Report on Form 10-Q for the quarter ended March 31, 2016 (as filed with the SEC on May 13, 2016

and incorporated herein by reference)

|

|

|

(5)(C)

|

Report on Form 10-Q for the quarter ended June 30, 2016 (as filed with the SEC on August 15, 2016

and incorporated herein by reference)

|

|

|

(5)(D)

|

Report on Form 10-Q for the quarter ended September 30, 2016 (as filed with the SEC on November

14, 2016 and incorporated herein by reference)

|

|

|

(5)(E)

|

Form of Warrant of Matinas BioPharma Holdings, Inc. (incorporated by reference to Exhibit 4.1 to

the Company’s Registration Statement on Form S-1, as filed with the SEC on February 7, 2014)

|

|

|

(5)(F)

|

Form of Placement Agent Warrant of Matinas BioPharma Holdings, Inc. (incorporated by reference

to Exhibit 4.2 to the Company’s Registration Statement on Form S-1, as filed with the SEC on February 7, 2014)

|

|

|

(5)(G)

|

Form of 2015 Investor Warrant of Matinas BioPharma Holdings, Inc. (incorporated by reference to

Exhibit 4.4 to the Company’s Post-Effective Amendment to Registration Statement on Form S-1, as filed with the SEC on April

17, 2015)

|

|

|

(5)(H)

|

Form of 2015 Placement Agent Warrant of Matinas BioPharma Holdings, Inc. (incorporated by reference

to Exhibit 4.5 to the Company’s Post-Effective Amendment to Registration Statement on Form S-1, as filed with the SEC on

April 17, 2015)

|

|

|

(5)(I)

|

Registration Statement on Form S-1 (File No. 333-204825), which registers the resale of the shares

of common stock underlying the 2015 Investor Warrants (as declared effective and filed with the SEC on April 27, 2016 and incorporated

herein by reference)

|

|

|

(5)(J)

|

Registration Statement on Form S-1 (File No. 333-214391), which registers the resale of the shares

of common stock underlying the Formation Warrants, the Merger Warrants, the Private Placement Warrants and the 2013 Investor Warrants

(as declared effective and filed with the SEC on November 18, 2016 and incorporated herein by reference)

|

|

|

(d)

|

(1) Warrant Agent Agreement, dated December 14, 2016, by and between the Company and Aegis

Capital Corp.

|

|

|

Item 13.

|

INFORMATION

REQUIRED BY SCHEDULE 13E-3.

|

Not Applicable.

SIGNATURE

After due inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

MATINAS BIOPHARMA HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Roelof Rongen

|

|

|

Name:

|

Roelof Rongen

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

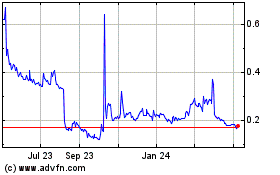

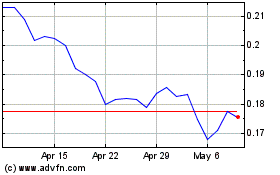

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Apr 2023 to Apr 2024