Current Report Filing (8-k)

December 14 2016 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT Pursuant

to

Section 13 or 15(

d

) of the

Securities

Exchange Act of 1934

|

Date of report (Date of earliest event

reported)

|

December 14, 2016

|

Hudson

Technologies, Inc.

(Exact Name of Registrant as Specified in

Its Charter)

New York

(State or Other Jurisdiction of Incorporation)

|

1-13412

|

|

13-3641539

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

PO Box

1541, 1 Blue Hill Plaza, Pearl River, New York

|

|

10965

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(845)

735-6000

(Registrant's Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (

see

General Instruction A.2. below):

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On December 14, 2016, Hudson Technologies,

Inc. (the “Company”) closed its previously-announced underwritten public offering of 7,392,856 shares of common stock,

par value $0.01 per share (which amount includes the full exercise of the underwriter’s option to purchase 964,285 shares

to cover overallotments), at a price to the public of $7.00 per share, resulting in net proceeds of approximately $48.4 million,

after deducting underwriting discounts and commissions and estimated offering expenses. The Company intends to use the net proceeds

from the offering for working capital and general corporate purposes which may include, among other things, funding acquisitions,

although the Company has no present commitments or agreements with respect to any such transactions. The Company may also use a

portion of the proceeds to reduce or repay indebtedness under its loan agreement with its existing commercial lender. William Blair

& Company, L.L.C. and Craig-Hallum Capital Group LLC acted as joint book-running managers. Roth Capital Partners and B. Riley

& Co., LLC acted as co-managers for the offering.

On December 14, 2016, the Company issued

a press release announcing the closing of the offering. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated

herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

|

99.1

|

Press Release of Hudson Technologies, Inc., dated

December 14, 2016

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: December 14, 2016

|

|

|

|

|

|

HUDSON TECHNOLOGIES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen P. Mandracchia

|

|

|

|

Name:

|

Stephen P. Mandracchia

|

|

|

|

Title:

|

Vice President Legal & Regulatory

|

|

|

|

|

Secretary

|

|

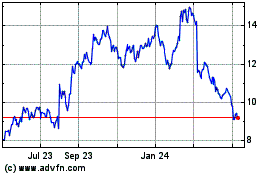

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024