Report of Foreign Issuer (6-k)

December 14 2016 - 8:37AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2016

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

Gafisa Announces Sale of Stake in Construtora Tenda

FOR IMMEDIATE RELEASE

-

São Paulo, December 14, 2016 - Gafisa S.A. (Bovespa: GFSA3; NYSE: GFA) (“the Company”), a leading Brazilian real estate developer, announced today to its shareholders and the market in general that:

In accordance with the Material Fact released today, the Company has entered into a share purchase and sale agreement with Jaguar Growth Asset Management, LLC for the acquisition of up to 30% of the shares issued by Tenda at a price of R$8.13 per share. Under the terms of the agreement, Gafisa will receive cash proceeds of R$231.7 million, valuing Tenda’s full share capital at R$539.0 million. Jaguar Growth Asset Management, LLC is a real estate private equity firm focused exclusively on global growth markets outside of the United States, and founded by investment professionals with significant real estate market expertise and 15 years of experience in Brazil.

The transaction follows the decision by Gafisa’s Board of Directors to discontinue efforts to conduct a secondary public offering of Tenda’s shares, with the consequent cancellation of the application for registration of said Offering before the Brazilian Securities and Exchange Commission (CVM).

The execution of this transaction is subject to the verification of certain precedent conditions, among which the following are highlighted:

(i)

The reduction of Tenda's capital stock, without cancellation of shares, with a refund to Gafisa, currently its sole shareholder, of R$100.0 million adjusted based on the SELIC rate, being: (a)

R$50.0 million with settlement by December 31, 2018; and (b) the balance to be paid by December 31, 2019, with the possibility of prepayment due to certain financial covenants provided for in the agreement;

(ii)

The reduction of Gafisa's capital stock in the form of a distribution of shares to its shareholders corresponding to 50% of Tenda's capital stock; and

(iii)

The conclusion of the proceedings related to the exercise by Gafisa shareholders of their preemptive rights for the acquisition of shares, at the price per share referenced in the transaction., noting that Gafisa will offer within this scope to its shareholders 50% of the shares representative of

Tenda’s capital stock, and not only the 30% subject to the offer received from Jaguar, given Gafisa's decision to sell such shares.

Stock Spin Off

Since the conclusion of the sale of a 70% stake in Alphaville in December 2013 and as part of a broader plan implemented by management to improve and reinforce the ability of both business units to generate value, the Company informed the market via a Material Fact disclosed on February 7, 2014 that it was initiating studies to proceed with an operational and corporate separation of the Gafisa and Tenda business units.

In addition to maximizing value for shareholders, the main goals of the separation process were determined as follows:

(i)

To allow shareholders to allocate resources between the two companies according to their investment interests and strategies;

(ii)

To allow the two companies to respond more quickly to the opportunities in their target markets;

(iii)

To establish sustainable capital structures for each of the companies, based on their risk profile and strategic priorities;

(iv)

To give greater visibility to the market on the isolated performance of the companies, allowing for a more accurate evaluation of their intrinsic value;

(v)

To increase the capacity to attract and retain talent through the development of appropriate cultures and compensation structures consistent with the specific results of each business.

Over the past 3 years, the Company has been able to achieve a number of the requirements related to effectively separating the Gafisa and Tenda administrative structures, so that both would be prepared to move ahead with their operations in an independent manner. The closing of the transaction

and consequent inflow of proceeds will contribute to the improvement of Gafisa's liquidity position and capital structure.

With the conclusion of the Tenda share purchase and sale agreement with Jaguar, and subsequent fulfillment of all precedent conditions, Gafisa will receive proceeds of at least R$231.7 million, implying a valuation multiple of 0.48x over 3Q16 Shareholders' Equity.

In addition, and as one of the aforementioned precedent conditions, the Company has consolidated the corporate separation and the consequent distribution, as of today, of 50% of Tenda’s shares totaling 27 million shares to Gafisa shareholders, awarding them a relevant stake in Tenda's share capital upon completion of the transaction.

As a result, Gafisa's shareholders will be able to maximize their ability to generate value based on their exposure to Tenda and its operational excellence, lower level of risk, consistent profitability and the plan to expand and develop new projects within the New Business Model.

Finally, Gafisa’s current shareholders will also have the option of exercising their preemptive rights, at the same price per share offered and as established by current legislation, on 50% of Tenda’s shares currently owned by Gafisa. If the 20% additional shares offered by Gafisa, in addition to the 30% subject to the offer presented by Jaguar, are also sold within the scope of this transaction, Gafisa will receive additional proceeds of R$87.8 million, taking the transaction to a total consideration of R$319.5 million.

Economic and Financial Details of the Transaction

1

(R$ Thousand / Quantity)

|

Table 1

|

Base: December / 2016

|

|

Calculation of Value Attributed to Tenda Shares in the Transaction

|

|

Number of Tenda Shares

|

54,000,000

|

|

(x) Price per Share (R$)

|

8.13

|

|

(=) Value of Acquisition of Tenda Shares

|

439,020.00

|

|

(+) Reduction of Capital to Gafisa

|

100,000.00

|

|

(=) Value Attributed to Tenda Shares

|

539,020.00

|

|

(/) Shareholder’s Equity (3Q16)

|

1,128,446.00

|

|

(=) Valuation Implied Multiple (P/BV)

|

0.48x

|

|

Table 2

|

|

|

Gafisa’s Capital Reduction

(Spin Off)

|

|

Number of Tenda Shares Distributed

2

|

27,000,000

|

|

Table 3

|

|

|

Proceeds Received by Gafisa in the Transaction

|

|

|

Number of Target Shares

3

|

16,200,000

|

|

(x) Price per Share (R$)

|

8.21

|

|

(=) Value Received at the Close of the Transaction

|

131,706.00

|

|

(+) Value to be Received on a Future Date

4

|

100,000.00

|

|

(=) Total Amount to be Received by Gafisa

|

231,706.00

|

|

(+) Exercise of Preemptive Rights

Additional to the Offer

|

87,804.00

|

|

(=) Maximum Amount to be Received by Gafisa

|

319,510.00

|

|

|

|

¹ Result subject to certain precedent conditions set out in the agreement;

2

Number of shares corresponding to 50% of the total shares issued by Tenda.

3

Exercise limited to 30% of the total shares issued by Tenda, as established in the agreement;

4

Value referring to the capital reduction of Tenda to Gafisa, with disbursement as scheduled and upon conditions laid out in the agrément.

The conclusion of this transaction and the consequent distribution of Tenda’s stock capital to Gafisa’s shareholders marks the final stage of a process that was initiated in 2011 with the development of a new strategic plan for Gafisa and Tenda. This process included the sale of a 70% stake in Alphaville, which resulted in an improvement in Gafisa’s liquidity position and capital structure, and the effective operational and corporate separation of the Gafisa and Tenda business units. The Company's management considers that, with the conclusion of this process and the resulting new corporate structure, Gafisa’s shareholders are being given a valuable opportunity to capture value in the Brazilian real estate market, through operational solidity, brand recognition and the strategic consolidation of both business units.

Gafisa remains committed to capital discipline, increasing profitability and generating value for its shareholders.

Rothschild & Co. acted as financial advisor and BMA - Barbosa, Müssnich & Aragão acted as legal advisor to the Company in this transaction.

|

|

About Gafisa

Gafisa is one Brazil’s leading residential and commercial properties development and construction companies. Founded over 60 years ago, the Company is dedicated to growth and innovation oriented to enhancing the well-being, comfort and safety of an increasing number of households. More than 15 million square meters have been built, and approximately 1,100 projects delivered under the Gafisa brand - more than any other company in Brazil. Recognized as one of the foremost professionally managed homebuilders, Gafisa’s brand is also one of the most respected, signifying both quality and consistency. In addition to serving the upper-middle and upper class segments through the Gafisa brand, the Company also focuses on low income developments through its Tenda brand. And, it participates through its 30% interest in Alphaville, a leading urban developer, in the national development and sale of residential lots. Gafisa S.A. is a Corporation traded on the Novo Mercado of the BM&FBOVESPA (BOVESPA:GFSA3) and is the only Brazilian homebuilder listed on the New York Stock Exchange (NYSE:GFA) with an ADR Level III, which ensures best practices in terms of transparency and corporate governance.

This release contains forward-looking statements about the business prospects, estimates for operating and financial results and Gafisa’s growth prospects. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors; therefore, they are subject to change without prior notice.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 14, 2016

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

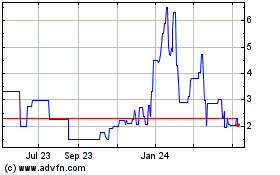

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

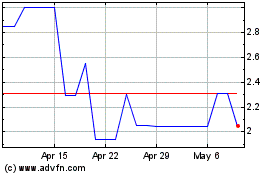

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024