JetBlue Unveils Cost-Cutting Plan Worth Up to $300 Million by 2020

December 13 2016 - 1:10PM

Dow Jones News

JetBlue Airways Corp. is expected to announce cost-cutting

initiatives that will deliver $250 million to $300 million in

structural savings by 2020 in a presentation to investors

Tuesday.

New York-based JetBlue also said it plans to double its

stock-repurchase authorization to $500 million through 2019.

Earlier, it had approved $250 million of buybacks through 2018, and

the company bought $120 million of stock in an accelerated share

buyback in the current quarter.

Two years ago, JetBlue outlined a plan aimed at boosting its

revenue and on Tuesday reaffirmed it is on track to realize that

goal of $415 million in improvements. Among the components: more

revenue from an array of fare options that give passengers more

choice in ticket prices and amenities; a new branded credit card

agreement that is driving increased customer spending; and adding

seats to its aircraft.

On top of that, JetBlue's premium Mint service, only available

on certain long-haul flights, is boosting operating margins on

routes where the outfitted planes operate, the company said.

JetBlue is rolling out new Mint planes and routes, with the

eventual goal of offering 70 or more daily flights to 13

destinations on the two U.S. coasts and in the Caribbean.

Currently the nation's fifth-largest carrier by traffic, JetBlue

is shifting some of its attention to cost savings, mainly in the

areas of maintenance, airports and crew scheduling. The steps will

include introducing software tools to allow its technical and

spare-parts operations to run more efficiently, updating its crew

resources capabilities to optimize crew scheduling, and adding more

sophistication to its airport kiosks so passengers can handle rote

transactions on their own.

Jim Leddy, JetBlue's interim chief financial officer, said the

cost-saving steps will be phased in over three years and should

yield permanent structuring savings by 2020.

In the investor presentation, JetBlue said it expects to

increase its capacity in 2017 by 6.5% to 8.5%, with the most growth

on transcontinental routes, and on the East and West coasts. It

expects its unit cost excluding fuel to rise by 1% to 3% next

year.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

December 13, 2016 12:55 ET (17:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

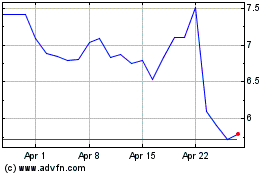

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

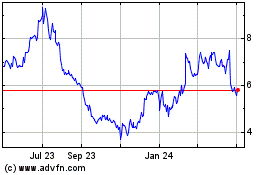

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024