By Joseph Adinolfi and Sara Sjolin, MarketWatch

Investors focus on Wednesday's Fed's interest-rate decision

The Dow Jones Industrial Average opened at a fresh record high

on Tuesday as the blue-chip gauge continued its march toward

20,000.

Investors remain fixated on the Federal Reserve's interest-rate

decision due Wednesday, with little in the way of important U.S.

economic data.

Investors are pricing in a nearly 100% chance of a hike on

Wednesday, but it is the tone of the Fed's statement, as well as

its latest batch of economic forecasts, that will be closely

scrutinized for clues to the central bank's plans for 2017, said

James Abate, chief investment officer at Centre Asset

Management.

"It's really going to be expectations for commentary from the

Fed related to the pace of rate increases in 2017," Abate said.

See:Yellen to tell the markets to 'cool your jets'

(http://www.marketwatch.com/story/yellen-to-tell-the-markets-to-cool-your-jets-2016-12-12)

The Dow climbed 106 points, or 0.6%, to 19,905. If the Dow

finishes higher, it will notch its seventh straight gain. Sharp

rises in shares of Apple Inc.(AAPL), UnitedHealth Group Inc. (UNH),

and Goldman Sachs Group Inc. (GS), were contributing the most to

the rise in the stock gauge. Shares of 3M Co.(MMM) and Coca-Cola

Co. (KO) were the only early laggards.

The benchmark on Monday bucked a negative trend across the U.S.

stock markets and closed at an all-time high

(http://www.marketwatch.com/story/dow-20000-within-sight-but-caution-over-fed-wont-make-it-easy-2016-12-12).

U.S. stocks have rallied aggressively since President-elect

Donald Trump defeated Democrat Hillary Clinton in an upset victory

in the Nov. 8 U.S. election. Investors are betting that Trump's

proposed policies, including corporate tax cuts, infrastructure

spending and deregulation, will be unequivocally pro-business, if

passed.

Read:Time to cash in your bank stocks, going by this chart

(http://www.marketwatch.com/story/time-to-cash-in-your-bank-stocks-going-by-this-chart-2016-12-13)

(http://www.marketwatch.com/story/time-to-cash-in-your-bank-stocks-going-by-this-chart-2016-12-13)These

expectations have increased investors' willingness to embrace risky

assets like stocks, said Mike Antonelli, equity sales trader at

R.W. Baird & Co.

"The move is not a head fake. The kind of strength and

resilience we've seen since the election has diminished the notion

that this might be [temporary]," Antonelli said. "I think the rally

will continue through year-end."

See:Is stock-market 'Trumpophoria' running out of room?

(http://www.marketwatch.com/story/is-stock-market-trumpophoria-running-out-of-room-2016-12-12)

(http://www.marketwatch.com/story/is-stock-market-trumpophoria-running-out-of-room-2016-12-12)Antonelli

said he doesn't expect the Dow to surpass the 20,000 milestone on

Tuesday, but believes it will happen before New Year's.

Read:5 things to know about the Dow's attempt to rally to 20,000

and beyond

(http://www.marketwatch.com/story/5-things-to-know-about-the-dows-attempt-to-rally-to-20000-and-beyond-2016-12-12)

Meanwhile, the S&P 500 index gained 10.45 points, or 0.5%,

to 2,267, with all 11 sectors in the green, led by a more than 1%

rise in technology and a 0.9% advance in telecommunications.

The tech-heavy Nasdaq Composite Index added 48 points, or 0.9%,

to 5,461.

Both the S&P 500 index and Nasdaq Composite ended lower on

Monday, with investors appearing reluctant to push shares higher

ahead of the Fed meeting.

U.S. stocks also benefited from an uptick in demand for risky

European assets. Earlier, UniCredit said it plans to shed EUR17.7

billion ($18.9 billion) in bad debt

(http://www.marketwatch.com/story/unicredit-looks-to-raise-14-bln-cut-14000-jobs-2016-12-13).

The move, which will help to restore Italy's largest lender to

health, assuaged fears about Italy's troubled banking sector. The

European Stoxx 600

(http://www.marketwatch.com/story/italian-stocks-lead-european-equities-back-to-11-month-high-2016-12-13)

was up 0.7% to 256.33. Asian markets closed slightly higher

(http://www.marketwatch.com/story/asian-markets-largely-flat-ahead-of-fed-meeting-2016-12-12).

Fed meeting: The central bank kicks off its two-day

policy-setting meeting on Tuesday and will deliver its rate

announcement on Wednesday at 2 p.m. Eastern Time. The bank is

widely expected to raise its benchmark rate by 25 basis points, so

the big question for traders is how hawkish or dovish the statement

will be.

"Stock traders appear to be betting on a dovish Fed," said Ipek

Ozkardeskaya, senior market analyst at London Capital Group, in

emailed comments.

Read:Look for the Fed to hike rates and to ignore the elephant

in the room

(http://www.marketwatch.com/story/fed-to-hike-interest-rates-next-week-while-ignoring-the-elephant-in-the-room-2016-12-09)

The dollar inched higher

(http://www.marketwatch.com/story/dollar-eases-slightly-vs-yen-as-some-say-rally-may-be-running-out-of-steam-2016-12-13)

against most other major currencies, with the ICE U.S. Dollar

index, a widely watched gauge of the greenback's strength against a

basket of six prominent rivals, rose 0.1% to 101.11, leaving it

just shy of its highest levels since 2003.

Oil prices extended their gains on Tuesday, with crude futures

traded on the New York Mercantile Exchange

(http://www.marketwatch.com/story/oil-prices-slip-as-investor-doubts-grow-about-opecs-plans-to-cut-production-2016-12-13)

rising 0.5% to $53.07 a barrel after the International Energy

Agency lifted its demand forecasts

(http://www.marketwatch.com/story/opec-output-at-record-high-as-deal-was-struck-iea-2016-12-13)

for 2016. Metals were mostly lower.

Commitments by members of the Organization of the Petroleum

Exporting Countries, and a host of nonmember exporters, to cut oil

production have boosted oil prices in recent days.

Strong readings on Chinese industrial production and retail

sales provided more evidence that the world's second-largest

economy steadied in November, helping to boost global risk

sentiment.

See:Will oil output cuts work? Watch these 7 factors

(http://www.marketwatch.com/story/will-oil-output-cuts-work-watch-these-7-things-2016-12-12)

In other economic news on Tuesday, the NFIB small-business index

jumped by the largest monthly amount in more than seven years

(http://www.marketwatch.com/story/small-business-sentiment-surges-after-republican-sweep-2016-12-13)

in November on optimism Trump's administration will spur an

increase in business activity.

Movers and shakers: Energy shares, including Chesapeake Energy

Corp.(CHK) and Noble Energy Inc.(NBL), received a boost from the

oil-price rally.

U.S.-listed shares of Unilever PLC(ULVR.LN) (ULVR.LN) climbed

1.8% after Jefferies upgraded the consumer products company to buy

from hold.

Inovalon Holdings Inc.(INOV) sank 35% after the data-analytics

company late Monday slashed its yearly guidance.

VeriFone Systems Inc.(PAY) shares fell 0.6% Tuesday despite

topping Wall Street estimates

(http://www.marketwatch.com/story/verifone-shares-tick-higher-as-earnings-beat-outlook-misses-2016-12-12)

for the quarter in an earnings report released late Monday.

U.S.-listed shares of Anheuser-Busch InBev SA(ABI.BT) (ABI.BT)

added 1.2% after news Asahi Group Holdings Ltd. (2502.TO) will buy

five Eastern European beer brands

(http://www.marketwatch.com/story/asahi-to-pay-78-bln-for-5-ab-inbev-beer-brands-2016-12-13-44853827)

from the brewer.

Apple Inc.(AAPL) rose 0.6% after The Wall Street Journal

reported that the tech giant is eager to invest in a $100 billion

fund

(http://www.marketwatch.com/story/apple-said-to-be-interested-in-softbanks-100-billion-tech-fund-2016-12-12)

being raised by Japanese internet and telecommunications giant

SoftBank Group Corp. (9984.TO).

Wal-Mart Stores Inc.(WMT)shares rose 0.6% even after U.K.

supermarket chain Asda, a subsidiary of Wal-Mart, saw its market

share fall to 15.3%, from 16.2% for the comparable 12 weeks.

Read: Wal-Mart shares are poised for more gains, but could Trump

spoil the party?

(http://www.marketwatch.com/story/wal-mart-shares-poised-for-more-gains-but-could-trump-spoil-the-party-2016-12-13)

(END) Dow Jones Newswires

December 13, 2016 09:54 ET (14:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

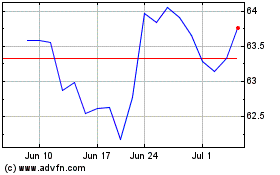

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024