- Net Sales Increased 29.2% with

Double-Digit Gains in All Product Groups -

- Net Income Increased Significantly to

$17.2 Million -

- Adjusted EBITDA Rose 42.3% to $49.5

Million -

GMS Inc. (NYSE:GMS), a leading North American distributor of

wallboard and suspended ceilings systems, today reported financial

results for the second quarter of fiscal 2017 ended

October 31, 2016.

Second Quarter Fiscal 2017 Highlights Compared to Second

Quarter Fiscal 2016

- Net sales increased 29.2% to $591.8

million; base business net sales up 10.8%

- Wallboard unit volume grew 27.2% to 891

million square feet

- Gross margin expanded 120 basis points

to 32.6%

- Net income increased to $17.2 million,

or $0.42 per share, compared to $2.8 million, or $0.09 per

share

- Adjusted EBITDA margin improved 80

basis points to 8.4% as a percentage of net sales

- Completed four acquisitions, adding ten

branches in Pennsylvania, Florida, Ohio and Michigan

- Opened three greenfield branches in

Arizona, Maryland and South Carolina

Mike Callahan, President and CEO of GMS, stated, “Our strong

track record of executing profitable growth continued into the

second quarter of fiscal 2017 with Adjusted EBITDA up 42.3% to

$49.5 million. We increased net sales by 29.2%, which reflects our

multi-faceted approach to delivering above market revenue growth

and earnings expansion for our shareholders. While acquisitions

contributed approximately two-thirds of our sales growth, the

growth in our base business operations was also strong, with net

sales up in each product group. In particular, we capitalized on

stronger residential activity in wallboard and other products. In

the commercial markets, end market demand was healthy resulting in

higher ceilings and steel framing volumes. On this positive sales

momentum, we delivered a 120 basis point increase in gross margin

to 32.6%, which is in line with our longer-term margin expectation.

As we look to the balance of fiscal 2017, we are encouraged by our

bright outlook for positive sales momentum, strong gross margins

and our robust acquisition pipeline.”

Second Quarter Fiscal 2017 Results

Net sales for the second quarter of fiscal 2017 ended

October 31, 2016 were $591.8 million, compared to $458.1

million for the second quarter of fiscal 2016 ended

October 31, 2015.

- Wallboard sales of $270.0 million

increased 26.0%, compared to the second quarter of fiscal 2016.

Wallboard unit volume grew 27.2% million to 891 million square

feet, helped by greater end market demand, primarily in residential

markets, and the positive contribution from acquisitions.

- Ceilings sales of $85.4 million rose

14.5%, compared to the second quarter of fiscal 2016, mainly due to

improved pricing, higher ceiling grid volumes, and the positive

impact from acquisitions.

- Steel framing sales of $96.1 million

grew 36.7%, compared to the second quarter of fiscal 2016, due to

greater commercial activity and modest price gains, along with the

benefit from acquisitions.

- Other product sales of $140.4 million

were up 42.0%, compared to the second quarter of fiscal 2016, as a

result of stronger cross-selling activity, acquisitions, price

gains and greater end market demand.

Gross profit of $193.2 million grew 34.3%, compared to $143.9

million in the second quarter of fiscal 2016. Gross margin of 32.6%

expanded by 120 basis points, compared to 31.4% in the second

quarter of fiscal 2016 mainly attributable to increased product

margins.

Net income of $17.2 million, or $0.42 per share, increased $14.4

million, compared to $2.8 million, or $0.09 per share, in the

second quarter of fiscal 2016. Adjusted net income of $19.0

million, or $0.46 per diluted share, grew $6.4 million, compared to

$12.6 million, or $0.38 per diluted share, in the first quarter of

fiscal 2016.

Adjusted EBITDA of $49.5 million rose 42.3%, compared to $34.8

million in the second quarter of fiscal 2016. Adjusted EBITDA

margin was 8.4% as a percentage of net sales for the second quarter

of fiscal 2017, compared to 7.6% in the second quarter of fiscal

2016, largely reflecting a higher gross margin.

Capital Resources

In September 2016, the Company closed on the refinancing of its

existing term loan. The new borrowings consist of a $481.2

million term loan facility due in 2021. Borrowings under the

new term loan will bear interest at a floating rate based on LIBOR,

with a 1.00% floor, plus 3.50%, compared to the previous term loan

which had a floating rate based on LIBOR, with a 1.00% floor, plus

3.75%. Net proceeds plus cash on hand were used to repay its

existing first lien term loan of $381.0 million and will be applied

to repay approximately $99.0 million of loans under its asset based

revolving credit facility.

At October 31, 2016, GMS had cash of $16.4 million and

total debt of $644.5 million, as compared to cash of $19.1 million

and total debt of $644.6 million at April, 30, 2016.

Subsequent to October 31, 2016, GMS amended its existing ABL

Credit Agreement. Under the agreement, the ABL Facility has, among

other things, expanded to $345 million from $300 million, lowered

the applicable rate per annum by 0.25%, reduced the unused line

fees and extended the term until November 2021.

Acquisition Activity

During the second quarter of fiscal 2017, the Company completed

four acquisitions, of Steven F. Kempf Building

Materials, Inc., or SKBM, Olympia Building Supplies, LLC, or

Olympia, United Building Materials, Inc., or UBM, and Ryan Building

Materials Inc., or RBM, for a purchase price in the aggregate

amount of approximately $118.2 million. SKBM, Olympia, UBM and RBM

distribute wallboard and related building materials in

Pennsylvania, Florida, Ohio and Michigan, respectively, from a

total of ten locations. For the twelve months ended October 31,

2016, the acquired companies generated approximately $156.7 million

in net sales and the earnings of these entities would have

contributed approximately $17.6 million to Adjusted EBITDA for that

period, including operating synergies.

Subsequent to October 31, 2016, the Company acquired Interior

Products Supply, or IPS. IPS distributes wallboard and related

building materials from a single location in Indiana. For the

twelve months ended October 31, 2016, IPS generated approximately

$12.3 million in net sales.

Conference Call and Webcast

GMS will host a conference call and webcast to discuss its

results for the second quarter ended October 31, 2016 at 10:00

a.m. Eastern Time on December 13, 2016. Investors who

wish to participate in the call should dial 888-221-9554 (domestic)

or 913-981-5556 (international) at least 5 minutes prior to the

start of the call. The live webcast will be available on the

Investors section of the Company’s website at www.gms.com. There

will be a slide presentation of the Company’s second quarter

results available on that page of the website as well. Replays

of the call will be available through January 13, 2017 and can

be accessed at 877-870-5176 (domestic) or 858-384-5517

(international) and entering the pass code 5717037.

About GMS Inc.

Founded in 1971, GMS operates a national network of distribution

centers across the United States. GMS’s extensive product offering

of wallboard, suspended ceilings systems, or ceilings, and

complementary interior construction products is designed to provide

a comprehensive one-stop-shop for our core customer, the interior

contractor who installs these products in commercial and

residential buildings.

Use of Non-GAAP Financial Measures

GMS reports its financial results in accordance with GAAP.

However, it presents Adjusted net income, Adjusted EBITDA, Adjusted

EBITDA margin and base business growth, which are not recognized

financial measures under GAAP. GMS believes that Adjusted net

income, Adjusted EBITDA and Adjusted EBITDA margin assist investors

and analysts in comparing its operating performance across

reporting periods on a consistent basis by excluding items that the

Company does not believe are indicative of its core operating

performance. The Company’s management believes Adjusted net income,

Adjusted EBITDA, Adjusted EBITDA margin and base business growth

are helpful in highlighting trends in its operating results, while

other measures can differ significantly depending on long-term

strategic decisions regarding capital structure, the tax

jurisdictions in which companies operate and capital investments.

In addition, the Company utilizes Adjusted EBITDA in certain

calculations under its senior secured asset based revolving credit

facility and its senior secured first lien term loan facility.

You are encouraged to evaluate each adjustment and the reasons

GMS considers it appropriate for supplemental analysis. In

addition, in evaluating Adjusted net income and Adjusted EBITDA,

you should be aware that in the future, the Company may incur

expenses similar to the adjustments in the presentation of Adjusted

net income and Adjusted EBITDA. The Company’s presentation of

Adjusted net income and Adjusted EBITDA should not be construed as

an inference that its future results will be unaffected by unusual

or non-recurring items. In addition, Adjusted net income and

Adjusted EBITDA may not be comparable to similarly titled measures

used by other companies in GMS’s industry or across different

industries.

Forward-Looking Statements and Information:

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. You can generally identify forward-looking statements by the

Company’s use of forward-looking terminology such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “potential,” “predict,” “seek,” or

“should,” or the negative thereof or other variations thereon or

comparable terminology. In particular, statements about the markets

in which GMS operates, including the potential for growth in the

commercial, residential and repair and remodeling, or R&R,

markets, statements about its expectations, beliefs, plans,

strategies, objectives, prospects, assumptions or future events or

performance, statements related to net sales, gross profit and

capital expenditures, as well as non-GAAP financial measures such

as Adjusted EBITDA, Adjusted net income and base business growth

and statements regarding potential acquisitions and future

greenfield locations contained in this press release are

forward-looking statements. The Company has based these

forward-looking statements on its current expectations,

assumptions, estimates and projections. While the Company believes

these expectations, assumptions, estimates and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond its control. Forward-looking statements involve

risks and uncertainties, including, but not limited to, economic,

competitive, governmental and technological factors outside of the

Company’s control, that may cause its business, strategy or actual

results to differ materially from the forward-looking statements.

These risks and uncertainties may include, among other things:

changes in the prices, supply, and/or demand for products which GMS

distributes; general economic and business conditions in the United

States; the activities of competitors; changes in significant

operating expenses; changes in the availability of capital and

interest rates; adverse weather patterns or conditions; acts of

cyber intrusion; variations in the performance of the financial

markets, including the credit markets; and other factors described

in the “Risk Factors” section in the Company’s Annual Report on

Form 10-K for the fiscal year ended April 30, 2016, and

in its other periodic reports filed with the SEC. In addition, the

statements in this release are made as of December 13, 2016.

The Company undertakes no obligation to update any of the forward

looking statements made herein, whether as a result of new

information, future events, changes in expectation or otherwise.

These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to

December 13, 2016.

GMS Inc.

Condensed Consolidated Statements of

Operations and Comprehensive Income (Unaudited)

Three and Six Months Ended

October 31, 2016 and 2015

(in thousands of dollars, except for

share and per share data)

Three Months Ended Six Months Ended October

31, October 31, 2016 2015

2016 2015 Net sales $ 591,846 $ 458,077 $ 1,141,646 $

910,518

Cost of sales (exclusive of depreciation

and amortization shownseparately below)

398,622 314,164 769,837 625,717 Gross

profit 193,224 143,913 371,809 284,801

Operating expenses: Selling, general and administrative 149,798

114,352 284,856 224,562 Depreciation and amortization 17,368

15,262 33,163 31,327 Total operating expenses

167,166 129,614 318,019 255,889

Operating income 26,058 14,299 53,790 28,912 Other (expense)

income: Interest expense (7,154) (9,260) (14,731) (18,517)

Write-off of debt discount and deferred financing fees (1,466) —

(6,892) — Other income, net 496 409 1,089

919 Total other (expense), net (8,124) (8,851)

(20,534) (17,598) Income before taxes 17,934 5,448

33,256 11,314 Provision for income taxes 710 2,623

6,869 5,478 Net income $ 17,224 $ 2,825 $ 26,387 $

5,836 Weighted average shares outstanding: Basic 40,942,905

32,737,956 39,579,244 32,707,297 Diluted 41,319,651 32,898,075

39,955,990 32,915,871 Net income per share: Basic $ 0.42 $ 0.09 $

0.67 $ 0.18 Diluted $ 0.42 $ 0.09 $ 0.66 $ 0.18 Comprehensive

income: Net income $ 17,224 $ 2,825 $ 26,387 $ 5,836

Increase (decrease) in fair value of

financial instrument, net oftax

100 (524) 12 (705) Comprehensive income

$ 17,324 $ 2,301 $ 26,399 $ 5,131

GMS Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

October 31, 2016 and

April 30, 2016

(in thousands of dollars, except share

data)

October 31, April 30, 2016 2016

Assets Current assets: Cash and cash equivalents $ 16,387 $

19,072 Trade accounts and notes receivable, net of allowances of

$10,119 and $8,607, respectively 324,622 270,257 Inventories, net

192,422 165,766 Prepaid expenses and other current assets

20,523 16,548 Total current assets 553,954

471,643 Property and equipment, net of accumulated depreciation of

$64,103 and $54,377, respectively 157,995 153,260 Goodwill 423,735

386,306 Intangible assets, net 271,879 221,790 Other assets

7,150 7,815 Total assets $ 1,414,713 $ 1,240,814

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable $ 106,889 $ 91,500 Accrued compensation and

employee benefits 39,420 51,680 Other accrued expenses and current

liabilities 42,174 41,814 Current portion of long-term debt 11,168

8,667 Revolving credit facility — 26,914 Total

current liabilities 199,651 220,575 Non-current

liabilities: Long-term debt, less current portion 633,325 609,029

Deferred income taxes, net 34,662 41,203 Other liabilities 34,758

33,600 Liabilities to noncontrolling interest holders, less current

portion 22,063 25,247 Total liabilities

924,459 929,654 Commitments and contingencies Stockholders’

equity:

Common stock, par value $0.01 per share,

authorized 500,000,000 shares; 40,942,905 and32,892,905 shares

issued at October 31, 2016 and April 30, 2016, respectively

409 329

Preferred stock, par value $0.01 per

share, authorized 50,000,000 shares; 0 shares issued atOctober 31,

2016 and April 30, 2016, respectively

— — Additional paid-in capital 486,859 334,244 Retained earnings

(accumulated deficit) 4,122 (22,265) Accumulated other

comprehensive loss (1,136) (1,148) Total

stockholders’ equity 490,254 311,160 Total

liabilities and stockholders’ equity $ 1,414,713 $ 1,240,814

GMS Inc.

Condensed Consolidated Statements of

Cash Flows (Unaudited)

Six Months Ended

October 31, 2016 and 2015

(in thousands of dollars)

Six Months Ended October 31, 2016

2015 Cash flows from operating activities: Net income

$ 26,387 $ 5,836 Adjustments to reconcile net income to net cash

provided by (used in) operating activities: Depreciation and

amortization of property and equipment 12,930 13,749 Accretion and

amortization of debt discount and deferred financing fees 8,264

1,708 Amortization of intangible assets 20,233 17,589 Provision for

losses on accounts and notes receivable (230) 328 Provision for

obsolescence of inventory (85) 39 Equity-based compensation 1,499

2,669 Net (gain) loss on sale or impairment of assets (130) 281

Deferred income tax benefit (12,373) (11,089) Prepaid expenses and

other assets (3,105) (4,484) Accrued compensation and employee

benefits (13,783) (18,170) Other accrued expenses and liabilities

3,851 8,366 Liabilities to noncontrolling interest holders 907

1,030 Income tax receivable / payable (11,520) 2,562

32,845 20,414 Changes in primary working capital components, net of

acquisitions: Trade accounts and notes receivable (19,316) (23,969)

Inventories (13,444) (247) Accounts payable 606 1,475

Cash provided by (used in) operating activities 691

(2,327)

Cash flows from investing activities: Purchases of

property and equipment (5,024) (2,670) Proceeds from sale of assets

1,319 6,089 Acquisition of businesses, net of cash acquired

(135,613) (859) Cash (used in) provided by investing

activities (139,318) 2,560

Cash flows from

financing activities: Repayments on the revolving credit

facility (635,732) (305,358) Borrowings from the revolving credit

facility 686,216 309,902 Payments of principal on long-term debt

(2,178) (1,981) Principal repayments of capital lease obligations

(2,492) (2,096) Proceeds from issuance of common stock in initial

public offering, net of underwriting discounts 156,941 — Repayment

of term loan (160,000) — Proceeds from term loan amendment 481,225

— Repayments on term loan amendment (381,225) — Debt issuance costs

on term loan amendment (2,487) — Stock repurchases — (5,827)

Exercise of stock options — 5,412 Payments of contingent

consideration (4,326) (3,149) Cash provided by (used

in) financing activities 135,942 (3,097) Decrease in

cash and cash equivalents (2,685) (2,864) Balance, beginning of

period 19,072 12,284 Balance, end of period $ 16,387

$ 9,420 Supplemental cash flow disclosures: Cash paid for income

taxes $ 30,790 $ 14,219 Cash paid for interest 13,163 16,570

Supplemental schedule of noncash activities: Assets acquired under

capital lease $ 5,180 $ 3,191 Change in fair value of derivative

instrument (187) 1,097 Issuance of installment notes associated

with equity-based compensation liability awards 5,353 1,157

Increase (decrease) in insurance claims payable and insurance

recoverable 2,106 (25,350)

GMS Inc.

Net Sales by Product Group

(Unaudited)

Three and Six Months Ended

October 31, 2016 and 2015

(in thousands of dollars)

Three Months Ended Six Months Ended October

31, % of October 31, % of October

31, % of October 31, % of 2016

Total 2015 Total 2016

Total 2015 Total (dollars in thousands)

(dollars in thousands) Wallboard $ 269,975 45.6 % $ 214,254

46.8 % $ 521,271 45.7 % $ 425,177 46.7 % Ceilings 85,400 14.4 %

74,613 16.3 % 171,749 15.0 % 153,581 16.9 % Steel framing 96,075

16.2 % 70,307 15.3 % 180,417 15.8 % 137,639 15.1 % Other products

140,396 23.7 % 98,903 21.6 % 268,209 23.5 %

194,121 21.3 % Total net sales $ 591,846 $ 458,077 $

1,141,646 $ 910,518

GMS Inc.

Reconciliation of Net Income to

Adjusted EBITDA (Unaudited)

Three and Six Months Ended

October 31, 2016 and 2015

(in thousands of dollars)

Three Months Ended Six Months Ended October

31, October 31, 2016 2015 2016

2015 (dollars in thousands) (dollars in

thousands) Net income $ 17,224 $ 2,825 $ 26,387 $ 5,836

Interest expense 8,620 9,260 21,623 18,517 Interest income (35)

(208) (78) (438) Income tax expense 710 2,623 6,869 5,478

Depreciation expense 6,548 6,465 12,930 13,738 Amortization expense

10,820 8,797 20,233 17,589 EBITDA $

43,887 $ 29,762 $ 87,964 $ 60,720 Stock appreciation rights

expense(a) $ (144) $ 692 $ (236) $ 1,286 Redeemable noncontrolling

interests(b) 2,531 451 2,823 1,005 Equity-based compensation(c) 686

863 1,359 1,361 Severance and other permitted costs(d) 118 824 258

1,381 Transaction costs (acquisitions and other)(e) 1,827 1,340

2,481 1,755 Loss (gain) on disposal of assets 68 305 (130) 280

Management fee to related party(f) — 563 188 1,125 Effects of fair

value adjustments to inventory(g) 457 — 621 — Interest rate cap

mark-to-market(h) 89 — 132 — EBITDA

add-backs 5,632 5,038 7,496 8,193

Adjusted EBITDA $ 49,519 $ 34,800 $ 95,460 $ 68,913 Adjusted EBITDA

margin 8.4 % 7.6 % 8.4 % 7.6 %

(a) Represents non-cash compensation expense related to stock

appreciation rights agreements(b) Represents non-cash compensation

expense related to changes in the fair values of noncontrolling

interests(c) Represents non-cash equity-based compensation expense

related to the issuance of stock options(d) Represents severance

and other costs permitted in calculations under the ABL Facility

and the Term Loan Facilities(e) Represents one-time costs related

to the IPO and acquisitions paid to third party advisors(f)

Represents management fees paid to AEA, which were discontinued

after the IPO(g) Represents non-cash cost of sales impact of

purchase accounting adjustments to increase inventory to its

estimated fair value(h) Represents mark-to-market adjustments for

certain financial instruments

GMS Inc.

Reconciliation of Net Income to

Adjusted Net Income (Unaudited)

Three and Six Months Ended

October 31, 2016 and 2015

(in thousands of dollars, except for

share and per share data)

Three Months Ended Six Months Ended October

31, October 31, 2016 2015 2016

2015 (dollars in thousands) (dollars in

thousands) Income before taxes $ 17,934 $ 5,448 $ 33,256 $

11,314 EBITDA add-backs 5,632 5,038 7,496 8,193 Write-off of debt

discount and deferred financing fees 1,466 — 6,892 — Purchase

accounting depreciation & amortization (1) 7,650

11,230 15,649 21,675 Adjusted pre-tax income 32,682

21,716 63,293 41,182 Adjusted income tax expense 13,694 9,099

26,520 17,255 Adjusted net income $ 18,988 $ 12,617 $ 36,773 $

23,927 Effective tax rate (2) 41.9 % 41.9 % 41.9 % 41.9 %

Weighted average shares outstanding: Basic 40,942,905 32,737,956

39,579,244 32,707,297 Diluted 41,319,651 32,898,075 39,955,990

32,915,871 Adjusted net income per share: Basic $ 0.46 $ 0.39 $

0.93 $ 0.73 Diluted $ 0.46 $ 0.38 $ 0.92 $ 0.73 (1)

Depreciation and amortization from the increase in value of certain

long-term assets associated with the April 1, 2014 acquisition of

the predecessor company. Full year projected amounts are $29.6

million and $21.8 million for FY17 and FY18, respectively. (2)

Normalized effective tax rate excluding the impact of purchase

accounting and certain other deferred tax amounts.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161213005424/en/

GMS Inc.Investor Relations:678-353-2883ir@gms.comorMedia

Relations:770-723-3378marketing@gms.com

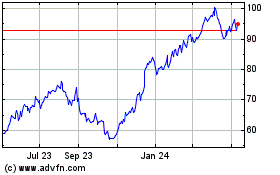

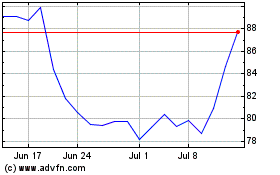

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

GMS (NYSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024