Company files Forms 10-K and 10-Q for periods

ended June 30, 2016 and September 30, 2016,

respectively Expects to regain compliance with Nasdaq listing

rules First Quarter of Fiscal 2017 Revenue Increased 21.0%

year-over-year Fourth Quarter of Fiscal Year 2016 Revenue

Increased 17.1% year-over-year Fiscal Year 2016 Revenue

Increased 8.5% to $206.5 million Company Initiates Fiscal 2017

Guidance

LifeVantage Corporation (Nasdaq:LFVN) today reported financial

results for its fourth fiscal quarter and full fiscal year ended

June 30, 2016; and its first fiscal quarter of 2017.

“Today we filed our Form 10-K for fiscal 2016

and our Form 10-Q for the first fiscal quarter of 2017 and are

again current with our SEC filings, which puts us back into

compliance with our loan covenants and is expected to put us back

into compliance with Nasdaq listing rules,” stated LifeVantage

President and Chief Executive Officer Darren Jensen. “This

unanticipated delay in our financial reporting was necessary as we

look to ensure that we have the appropriate internal policies and

procedures in place to support our international growth.”

First Quarter Fiscal 2017 Highlights:

- Revenue increased 21.0% to $54.9 million, compared to $45.4

million in the first fiscal quarter of 2016;

- Revenue in the Americas increased 15.6% and revenue in

Asia/Pacific & Europe increased 38.9%, both when compared to

the comparable period of fiscal 2016;

- Adjusted EBITDA decreased 2.8% to $4.3 million, compared to

$4.5 million in the comparable period of fiscal 2016;

- Earnings per diluted share were $0.08, compared to $0.08 in the

first fiscal quarter of 2016; and

- Adjusted earnings per diluted share were $0.13, compared to

$0.13 in the first fiscal quarter of 2016.

Fourth Quarter Fiscal 2016 Highlights:

- Revenue increased 17.1% to $53.0 million, compared to $45.3

million in the fourth fiscal quarter of 2015;

- Revenue in the Americas increased 17.1% and revenue in

Asia/Pacific & Europe increased 16.9%, both when compared to

the comparable period of fiscal 2015;

- Adjusted EBITDA increased 78.3% to $5.6 million, compared to

$3.1 million in the comparable period of fiscal 2015;

- Earnings per diluted share increased to $0.16, compared to

$0.02 in the fourth fiscal quarter of 2015; and

- Adjusted earnings per diluted share increased to $0.22,

compared to $0.05 in the fourth fiscal quarter of 2015.

Fiscal Year 2016 Highlights:

- Revenue increased 8.5% to $206.5 million, compared to $190.3

million in fiscal 2015;

- Revenue in the Americas increased 14.6% and revenue in

Asia/Pacific & Europe decreased 7.6%, both when compared to

fiscal 2015;

- Adjusted EBITDA increased 12.7% to $19.7 million, compared to

$17.4 million in fiscal 2015;

- Earnings per diluted share decreased 16.1% to $0.41, compared

to $0.49 in fiscal 2015; and

- Adjusted earnings per diluted share increased 31.8% to $0.62,

compared to $0.47 in fiscal 2015.

First Quarter Fiscal 2017

ResultsFor the first fiscal quarter ended September 30,

2016, the Company reported revenue of $54.9 million, a 21.0%

increase compared to $45.4 million for the comparable period in

fiscal 2016. Year-over-year quarterly revenue reflects an increase

of 15.6% in the Americas and a 38.9% increase in the Asia/Pacific

& Europe region. Revenue for the first fiscal quarter of 2017

was positively impacted by $2.1 million, or 4.6%, by foreign

currency fluctuations, primarily associated with revenue in

Japan.

Commissions and incentives expense for the first

fiscal quarter of 2017 was $26.3 million, or 47.9% of revenue,

compared to $22.0 million, or 48.6% of revenue, for the same period

in fiscal 2016. Selling, general and administrative expense

(SG&A) for the fourth fiscal quarter of 2016 was $17.8 million,

or 32.4% of revenue, compared to $13.7 million, or 30.1% of

revenue, in the comparable period of fiscal 2016.

Operating income for the first fiscal quarter of

2017 was $2.0 million, compared to $2.7 million for the first

fiscal quarter of 2016. Operating income during the first quarter

of fiscal 2017 included approximately $1.0 million of costs

associated with the Audit Committee’s independent review. Operating

income during the first fiscal quarter of 2016 included

approximately $1.1 million of executive transition costs. Adjusted

EBITDA was $4.3 million for the first fiscal quarter of 2017,

compared to $4.5 million for the comparable period in fiscal

2016.

Net income for the first fiscal quarter of 2017

was $1.2 million, or $0.08 per diluted share, calculated on 14.5

million fully diluted shares. This compares to net income for

the first fiscal quarter of 2016 of $1.1 million, or $0.08 per

diluted share, calculated on 13.8 million fully diluted shares.

Adjusted for costs associated with the audit committee’s

independent review of $0.7 million, net of tax, adjusted Non-GAAP

net income was $1.9 million for the first fiscal quarter of 2017,

or $0.13 per diluted share; compared to $1.7 million, or $0.13 per

diluted share for the comparable period of fiscal 2016. Non-GAAP

adjustments to net income during the first fiscal quarter of 2016

included $0.7 million of executive team transition costs, net of

tax.

Fourth Quarter Fiscal 2016

ResultsFor the fourth fiscal quarter ended June 30, 2016,

the Company reported revenue of $53.0 million, a 17.1% increase

compared to $45.3 million for the comparable period in fiscal 2015.

Year-over-year quarterly revenue reflects an increase of 17.1% in

the Americas and a 16.9% increase in the Asia/Pacific & Europe

region. Revenue for the fourth fiscal quarter of 2016 was

positively impacted by $0.9 million, or 2.1%, by foreign currency

fluctuations, primarily associated with revenue in Japan.

Commissions and incentives expense for the

fourth fiscal quarter of 2016 was $25.6 million, or 48.3% of

revenue, compared to $21.7 million, or 47.8% of revenue, for the

same period in fiscal 2015. Selling, general and administrative

expense (SG&A) for the fourth fiscal quarter of 2016 was $14.0

million, or 26.3% of revenue, compared to $14.8 million, or 32.6%

of revenue, in the comparable prior year period.

Operating income for the fourth fiscal quarter

of 2016 was $4.1 million, compared to $1.6 million for the fourth

fiscal quarter of 2015. Operating income during the fourth quarter

of fiscal 2015 included approximately $0.7 million of executive

transition expenses. Adjusted EBITDA was $5.6 million for the

fourth fiscal quarter of 2016, compared to $3.1 million for the

comparable period in fiscal 2015.

Net income for the fourth fiscal quarter of 2016

was $2.4 million, or $0.16 per diluted share, calculated on 14.6

million fully diluted shares. This compares to net income for

the fourth fiscal quarter of 2015 of $0.2 million, or $0.02 per

diluted share, calculated on 13.8 million fully diluted shares.

Adjusted primarily for a write-off of capitalized software

development costs of $0.8 million, net of tax, adjusted Non-GAAP

net income was $3.2 million for the fourth fiscal quarter of 2016,

or $0.22 per diluted share; compared to $0.7 million, or $0.05 per

diluted share for the comparable prior year period. Non-GAAP

adjustments to net income during the fourth fiscal quarter of 2015

included $0.5 million of executive team transition costs, net of

tax.

Fiscal 2016 Full Year

ResultsFor the fiscal year ended June 30, 2016, the

Company reported net revenue of $206.5 million, an increase of 8.5%

compared to $190.3 million for fiscal 2015. Revenue in the Americas

increased 14.6%, while revenue in Asia/Pacific & Europe

decreased 7.6% due predominantly to lower sales in Japan that

occurred primarily during the first quarter of fiscal 2016. Revenue

for fiscal year 2016 was negatively impacted $1.8 million, or 1.0%,

by foreign currency fluctuations associated with revenue generated

in several international markets.

Commissions and incentives expense for fiscal

2016 was $103.1 million, or 49.9% of revenue, compared to $91.0

million, or 47.8% of revenue, for fiscal 2015. Selling, general and

administrative expense (SG&A) for fiscal 2016 was $56.1

million, or 27.1% of revenue, compared to $57.4 million, or 30.1%

of revenue, in the prior year.

Operating income for fiscal 2016 was $13.4

million, compared to $13.9 million for fiscal 2015. Operating

income for the fiscal year ended June 30, 2016 includes $1.7

million of the previously announced executive transition expenses

and costs associated with the reverse split during fiscal 2016.

Operating income in fiscal 2015 includes the benefit of

approximately $2.0 million from proceeds recovered and related to

the Company's December 2012 product recall, partially offset by

severance and executive team transition costs of $1.4 million.

Adjusted EBITDA was $19.7 million for the full fiscal year of 2016,

compared to $17.4 million in fiscal 2015.

Net income for fiscal 2016 was $6.0 million, or

$0.41 per diluted share, compared to $7.0 million, or $0.49 per

diluted share for fiscal 2015. On a tax adjusted basis, adjusting

for previously announced executive transition expenses and costs

associated with the reverse split of $1.2 million, collectively,

along with a $0.8 million write-off of capitalized software

development costs and a $1.1 million write-off of deferred debt

transaction costs during fiscal 2016, adjusted Non-GAAP net income

for the fiscal year ended June 30, 2016 was $9.1 million, or $0.62

per diluted share. On a tax adjusted basis, adjusting for the

one-time insurance benefit during fiscal 2015 of $1.3 million,

partially offset by $0.9 million of executive transition costs,

adjusted Non-GAAP net income for the fiscal year ended June 30,

2015 was $6.6 million or $0.47 per diluted share.

Balance Sheet &

LiquidityThe Company generated $6.0 million of cash from

operations during fiscal year 2016 and $2.9 million of cash from

operations during the first quarter of fiscal 2017, compared to

$13.2 million and $2.8 million during the same respective prior

year periods. The year-over-year reduction in cash provided by

operations during fiscal 2016 primarily relates to increased

inventory investments during the fiscal year. The Company's cash

and cash equivalents at September 30, 2016 were $10.2 million

compared to $7.9 million at the end of fiscal year 2016.

“We reported strong year-over-year revenue

growth in both the fourth fiscal quarter of 2016 and the first

fiscal quarter of 2017,” commented LifeVantage President and Chief

Executive Officer Darren Jensen. “However, we anticipate some

revenue disruptions near-term from recent policy changes affecting

some international markets.”

Fiscal Year 2017 Guidance The

Company is introducing fiscal year 2017 annual guidance. The

Company expects to generate revenue in the range of $207 million to

$212 million during fiscal year 2017, and anticipates adjusted

earnings per diluted share in the range of $0.40 to $0.47. The

Company’s earnings per diluted share guidance excludes any

non-operating or non-recurring expenses that may materialize during

fiscal 2017, including estimated costs of $2.5 million to $3.0

million associated with the recently completed review by the Audit

Committee of the Board of Directors.

Second Quarter of Fiscal 2017

OutlookThe company is providing its revenue outlook for

the second fiscal quarter of 2017 ending December 31, 2016. During

the second fiscal quarter of 2017, the Company anticipates revenue

in the range of $48 million to $49 million. It is not the Company’s

practice to provide quarterly revenue guidance, nor is it the

Company’s intention to provide quarterly guidance on an ongoing

basis.

Conference Call InformationThe

Company will hold an investor conference call today at 3:00 p.m.

MST (5:00 p.m. EST). Investors interested in participating in the

live call can dial (888) 820-9408 from the U.S. International

callers can dial (913) 312-0647. A telephone replay will be

available approximately two hours after the call concludes and will

be available through Monday, December 19, 2016, by dialing (877)

870-5176 from the U.S. and entering confirmation code 2517311, or

(858) 384-5517 from international locations, and entering

confirmation code 2517311.

There will also be a simultaneous, live webcast

available on the Investor Relations section of the Company's web

site at http://investor.lifevantage.com/events.cfm. The webcast

will be archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq:LFVN), is a

science-based direct selling company dedicated to visionary science

that looks to transform health, wellness and anti-aging internally

and externally at the cellular level. The company is the maker of

Protandim® Nrf2 and NRF1 Synergizers, its line of

scientifically-validated dietary supplements, the TrueScience®

Anti-Aging Skin Care Regimen, Canine Health®, the AXIO® energy

product line and the PhysIQ™ Smart Weight Management System.

LifeVantage was founded in 2003 and is headquartered in Salt Lake

City, Utah. www.lifevantage.com

Forward Looking StatementsThis

document contains forward-looking statements made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Words and expressions reflecting optimism,

satisfaction or disappointment with current prospects, as well as

words such as "believe", "hopes", "intends", "estimates",

"expects", "projects", "plans", "anticipates", "look forward to",

"goal", “may be” "ideal fit", and variations thereof, identify

forward-looking statements, but their absence does not mean that a

statement is not forward-looking. Examples of forward-looking

statements include, but are not limited to, statements we make

regarding our leadership in the global market, new product

launches, the effectiveness of our policies and procedures, future

growth and expected financial performance. Such forward-looking

statements are not guarantees of performance and the Company's

actual results could differ materially from those contained in such

statements. These forward-looking statements are based on the

Company's current expectations and beliefs concerning future events

affecting the Company and involve known and unknown risks and

uncertainties that may cause the Company's actual results or

outcomes to be materially different from those anticipated and

discussed herein. These risks and uncertainties include, among

others, those discussed in greater detail in the Company's Annual

Report on Form 10-K and the Company's Quarterly Report on Form 10-Q

under the caption "Risk Factors," and in other documents filed by

the Company from time to time with the Securities and Exchange

Commission. The Company cautions investors not to place undue

reliance on the forward-looking statements contained in this

document. All forward-looking statements are based on information

currently available to the Company on the date hereof, and the

Company undertakes no obligation to revise or update these

forward-looking statements to reflect events or circumstances after

the date of this document, except as required by law.

About Non-GAAP Financial Measures

We define Non-GAAP EBITDA as earnings before

interest expense, income taxes, depreciation and amortization and

Non-GAAP Adjusted EBITDA as earnings before interest expense,

income taxes, depreciation and amortization, stock compensation

expense, other income, net, and certain other adjustments. Non-GAAP

EBITDA and Non-GAAP Adjusted EBITDA may not be comparable to

similarly titled measures reported by other companies. We

define Non-GAAP Net Income and Earnings per Share as GAAP net

income less certain tax adjusted non-recurring one-time expenses

incurred during the period.

We are presenting Non-GAAP EBITDA, Non-GAAP

Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP Earnings Per

Share because management believes that they provide additional ways

to view our operations when considered with both our GAAP results

and the reconciliation to net income, which we believe provides a

more complete understanding of our business than could be obtained

absent this disclosure. Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA,

Non-GAAP Net Income and Non-GAAP Earnings Per Share are presented

solely as supplemental disclosure because: (i) we believe these

measures are a useful tool for investors to assess the operating

performance of the business without the effect of these items; (ii)

we believe that investors will find this data useful in assessing

shareholder value; and (iii) we use Non-GAAP EBITDA, Non-GAAP

Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP Earnings Per

Share internally as benchmarks to evaluate our operating

performance or compare our performance to that of our competitors.

The use of Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA, Non-GAAP Net

Income and Non-GAAP Earnings per Share has limitations and you

should not consider these measures in isolation from or as an

alternative to the relevant GAAP measure of net income prepared in

accordance with GAAP, or as a measure of profitability or

liquidity.

The tables set forth below present Non-GAAP

EBITDA, Non-GAAP Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP

Earnings per Share which are non-GAAP financial measures to Net

Income and Earnings per Share, our most directly comparable

financial measures presented in accordance with GAAP.

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (unaudited) |

| |

|

|

|

|

| (In

thousands, except per share data) |

As of |

| ASSETS |

September 30, 2016 |

|

June 30, 2016 |

| |

Current assets |

|

|

|

| |

Cash and

cash equivalents |

$ |

10,225 |

|

|

$ |

7,883 |

|

| |

Accounts

receivable |

|

1,434 |

|

|

|

1,552 |

|

| |

Income

tax receivable |

|

133.00 |

|

|

|

- |

|

| |

Inventory, net |

|

23,917 |

|

|

|

25,116 |

|

| |

Current

deferred income tax asset |

|

- |

|

|

|

2,776 |

|

| |

Prepaid

expenses and deposits |

|

3,863 |

|

|

|

5,082 |

|

| |

Total

current assets |

|

39,572 |

|

|

|

42,409 |

|

| |

|

|

|

|

| |

Property

and equipment, net |

|

3,163 |

|

|

|

3,456 |

|

| |

Intangible assets, net |

|

1,731 |

|

|

|

1,744 |

|

| |

Long-term

deferred income tax asset |

|

3,906 |

|

|

|

1,130 |

|

| |

Other

long-term assets |

|

1,424 |

|

|

|

1,520 |

|

| TOTAL

ASSETS |

$ |

49,796 |

|

|

$ |

50,259 |

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

| |

Current

liabilities |

|

|

|

| |

Accounts

payable |

$ |

7,730 |

|

|

$ |

8,891 |

|

| |

Commissions payable |

|

7,484 |

|

|

|

7,719 |

|

| |

Income

tax payable |

|

- |

|

|

|

1,206 |

|

| |

Other

accrued expenses |

|

9,494 |

|

|

|

8,734 |

|

| |

Current

portion of long-term debt |

|

2,000 |

|

|

|

2,000 |

|

| |

|

|

|

|

| |

Total

current liabilities |

|

26,708 |

|

|

|

28,550 |

|

| |

|

|

|

|

| Long-term

debt |

|

|

|

| |

Principal

amount |

|

7,000 |

|

|

|

7,500 |

|

| |

Less:

unamortized discount and deferred offering costs |

|

(84 |

) |

|

|

(91 |

) |

| |

Long-term

debt, net of unamortized discount and deferred offering costs |

|

6,916 |

|

|

|

7,409 |

|

| |

Other

long-term liabilities |

|

2,090 |

|

|

|

2,169 |

|

| |

Total

liabilities |

|

35,714 |

|

|

|

38,128 |

|

| Commitments

and contingencies |

|

|

|

|

Stockholders' equity |

|

|

|

| |

Preferred

stock - par value $.001 per share, 50,000 shares authorized;

no shares issued or outstanding |

|

- |

|

|

|

- |

|

| |

Common

stock - par value $.001 per share, 250,000 shares authorized and

14,059 and 14,028 issued and outstanding as of September 30, 2016

and June 30, 2016, respectively |

|

14 |

|

|

|

14 |

|

| |

Additional paid-in capital |

|

120,830 |

|

|

|

120,150 |

|

| |

Accumulated deficit |

|

(106,896 |

) |

|

|

(108,076 |

) |

| |

Accumulated other comprehensive loss |

|

134 |

|

|

|

43 |

|

| |

Total

stockholders’ equity |

|

14,082 |

|

|

|

12,131 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

49,796 |

|

|

$ |

50,259 |

|

| |

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

| (unaudited) |

|

|

|

|

|

|

|

|

|

For the Three Months Ended September

30, |

|

|

|

|

2016 |

|

|

|

2015 |

|

| (In thousands, except

per share data) |

|

|

|

|

| Revenue, net |

|

$ |

54,894 |

|

|

$ |

45,352 |

|

| Cost of sales |

|

|

8,832 |

|

|

|

6,975 |

|

| Gross

profit |

|

|

46,062 |

|

|

|

38,377 |

|

| |

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

Commissions and incentives |

|

|

26,296 |

|

|

|

22,043 |

|

| Selling,

general and administrative |

|

|

17,780 |

|

|

|

13,663 |

|

| Total

operating expenses |

|

|

44,076 |

|

|

|

35,706 |

|

| Operating income |

|

|

1,986 |

|

|

|

2,671 |

|

| |

|

|

|

|

| Other expense: |

|

|

|

|

| Interest

expense |

|

|

(137 |

) |

|

|

(749 |

) |

| Other

expense, net |

|

|

(171 |

) |

|

|

(216 |

) |

| Total

other expense |

|

|

(308 |

) |

|

|

(965 |

) |

| Income before income

taxes |

|

|

1,678 |

|

|

|

1,706 |

|

| Income

tax expense |

|

|

(498 |

) |

|

|

(640 |

) |

| Net income |

|

$ |

1,180 |

|

|

$ |

1,066 |

|

| Net income per

share: |

|

|

|

|

|

Basic |

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

Diluted |

|

$ |

0.08 |

|

|

$ |

0.08 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

Basic |

|

|

13,820 |

|

|

|

13,709 |

|

|

Diluted |

|

|

14,466 |

|

|

|

13,830 |

|

| |

|

|

|

|

| Other

comprehensive income, net of tax: |

|

|

|

|

| Foreign

currency translation adjustment |

|

|

91 |

|

|

|

17 |

|

| Other comprehensive

income, net of tax: |

|

|

91 |

|

|

|

17 |

|

| Comprehensive

income |

|

$ |

1,271 |

|

|

$ |

1,083 |

|

| |

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Revenue by Region |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September

30, |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

| Americas |

|

$ |

40,135 |

|

73 |

% |

|

$ |

34,726 |

|

77 |

% |

|

| Asia/Pacific &

Europe |

|

|

14,759 |

|

27 |

% |

|

|

10,626 |

|

23 |

% |

|

|

Total |

|

$ |

54,894 |

|

100 |

% |

|

$ |

45,352 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Active Independent Distributors

(1) |

|

| |

|

(unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

September 30 |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

| Americas |

|

|

48,000 |

|

71 |

% |

|

|

44,000 |

|

69 |

% |

|

| Asia/Pacific &

Europe |

|

|

20,000 |

|

29 |

% |

|

|

20,000 |

|

31 |

% |

|

|

Total |

|

|

68,000 |

|

100 |

% |

|

|

64,000 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Active Preferred Customers(2) |

|

| |

|

(unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

September 30 |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

| Americas |

|

|

91,000 |

|

80 |

% |

|

|

93,000 |

|

82 |

% |

|

| Asia/Pacific &

Europe |

|

|

23,000 |

|

20 |

% |

|

|

21,000 |

|

18 |

% |

|

|

Total |

|

|

114,000 |

|

100 |

% |

|

|

114,000 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| (1)

Active Independent Distributors have purchased product in the prior

three months for retail or personal consumption. |

| (2)

Active Preferred Customers have purchased product in the prior

three months for personal consumption only. |

| |

|

|

|

|

|

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

EBITDA and Non-GAAP Adjusted EBITDA: (Unaudited) |

| |

|

| |

For the Three Months Ended September

30, |

| |

|

2016 |

|

|

2015 |

| (In thousands) |

|

|

|

| GAAP Net income |

$ |

1,180 |

|

$ |

1,066 |

| Interest Expense |

|

137 |

|

|

749 |

| Provision for income

taxes |

|

498 |

|

|

640 |

| Depreciation and

amortization |

|

412 |

|

|

531 |

| Non-GAAP EBITDA: |

|

2,227 |

|

|

2,986 |

| Adjustments: |

|

|

|

| Stock compensation

expense |

|

939 |

|

|

192 |

| Other expense, net |

|

171 |

|

|

216 |

| Other adjustments* |

|

1,011 |

|

|

1,079 |

| Total adjustments |

|

2,121 |

|

|

1,487 |

| Non-GAAP Adjusted

EBITDA |

$ |

4,348 |

|

$ |

4,473 |

| |

|

|

|

| *Other

adjustments for the three months ended September 30, 2016 include

approximately $1.0 million for costs associated with the audit

committee independent review. Other adjustments for the three

months ended September 30, 2015 include approximately $0.7 million

for executive severance expenses and $0.4 million for search firm

and hiring expenses associated with the search for executive

officers. |

| |

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

Net Income and Non-GAAP Adjusted EPS: (Unaudited) |

|

|

|

|

|

For the Three Months Ended September

30, |

|

|

|

2016 |

|

|

2015 |

| (In thousands) |

|

|

|

| GAAP Net income |

$ |

1,180 |

|

$ |

1,066 |

| Executive team

severance expenses (1) |

|

- |

|

|

423 |

| Executive team

recruiting and transition expenses(2) |

|

- |

|

|

251 |

| Audit committee

indpendent review expenses(3) |

|

711 |

|

|

- |

| Non-GAAP Net

Income: |

|

1,891 |

|

|

1,740 |

| |

|

|

|

| |

|

| |

For the Three Months Ended September

30, |

| |

|

2016 |

|

|

2015 |

| |

|

|

|

| Diluted earnings per

share, as reported |

$ |

0.08 |

|

$ |

0.08 |

| Executive team

severance expenses (1) |

|

- |

|

|

0.03 |

| Executive team

recruiting and transition expenses(2) |

|

- |

|

|

0.02 |

| Audit committee

indpendent review expenses(3) |

|

0.05 |

|

|

- |

| Diluted earnings per

share, as adjusted |

$ |

0.13 |

|

$ |

0.13 |

| |

|

|

|

| (1) Net of

$254,000 in tax expense for the three months ended September 30,

2015 |

| (2) Net of

$151,000 in tax expense for the three months ended September 30,

2015 |

| (3) Net of

$711,000 in tax expense for the three months ended September 30,

2016 |

| |

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| |

| |

|

|

|

|

| (In

thousands, except per share data) |

As of |

| ASSETS |

June 30, 2016 |

|

June 30, 2015 |

| |

Current assets |

|

|

|

| |

Cash and

cash equivalents |

$ |

7,883 |

|

|

$ |

13,905 |

|

| |

Accounts

receivable |

|

1,552 |

|

|

|

1,031 |

|

| |

Income

tax receivable |

|

- |

|

|

|

2,179 |

|

| |

Inventory, net |

|

25,116 |

|

|

|

9,248 |

|

| |

Current

deferred income tax asset |

|

2,776 |

|

|

|

1,117 |

|

| |

Prepaid

expenses and deposits |

|

5,082 |

|

|

|

2,995 |

|

| |

Total

current assets |

|

42,409 |

|

|

|

30,475 |

|

| |

|

|

|

|

| |

Property

and equipment, net |

|

3,456 |

|

|

|

5,759 |

|

| |

Intangible assets, net |

|

1,744 |

|

|

|

1,879 |

|

| |

Long-term

deferred income tax asset |

|

1,130 |

|

|

|

235 |

|

| |

Other

long-term assets |

|

1,520 |

|

|

|

1,433 |

|

| TOTAL

ASSETS |

$ |

50,259 |

|

|

$ |

39,781 |

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

| |

Current

liabilities |

|

|

|

| |

Accounts

payable |

$ |

8,891 |

|

|

$ |

2,614 |

|

| |

Commissions payable |

|

7,719 |

|

|

|

6,505 |

|

| |

Income

tax payable |

|

1,206 |

|

|

|

- |

|

| |

Other

accrued expenses |

|

8,734 |

|

|

|

5,600 |

|

| |

Current

portion of long-term debt |

|

2,000 |

|

|

|

11,141 |

|

| |

|

|

|

|

| |

Total

current liabilities |

|

28,550 |

|

|

|

25,860 |

|

| |

|

|

|

|

| Long-term

debt |

|

|

|

| |

Principal

amount |

|

7,500 |

|

|

|

10,484 |

|

| |

Less:

unamortized discount and deferred offering costs |

|

(91 |

) |

|

|

(1,951 |

) |

| |

Long-term

debt, net of unamortized discount and deferred offering costs |

|

7,409 |

|

|

|

8,533 |

|

| |

Other

long-term liabilities |

|

2,169 |

|

|

|

2,063 |

|

| |

Total

liabilities |

|

38,128 |

|

|

|

36,456 |

|

| Commitments

and contingencies |

|

|

|

|

Stockholders' equity |

|

|

|

| |

Preferred

stock - par value $.001 per share, 50,000 shares authorized;

no shares issued or outstanding |

|

- |

|

|

|

- |

|

| |

Common

stock - par value $.001 per share, 250,000 shares authorized and

14,028 and 13,958 issued and outstanding as of June 30, 2016 and

2015, respectively |

|

14 |

|

|

|

14 |

|

| |

Additional paid-in capital |

|

120,150 |

|

|

|

117,657 |

|

| |

Accumulated deficit |

|

(108,076 |

) |

|

|

(114,095 |

) |

| |

Accumulated other comprehensive income (loss) |

|

43 |

|

|

|

(251 |

) |

| |

Total

stockholders’ equity |

|

12,131 |

|

|

|

3,325 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

50,259 |

|

|

$ |

39,781 |

|

| |

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30,

(Unaudited) |

|

For the Twelve Months Ended June

30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| (In thousands, except

per share data) |

|

|

|

|

|

|

|

| Revenue, net |

$ |

53,033 |

|

|

$ |

45,301 |

|

|

$ |

206,540 |

|

|

$ |

190,336 |

|

| Cost of sales |

|

9,401 |

|

|

|

7,293 |

|

|

|

33,932 |

|

|

|

28,010 |

|

| Gross

profit |

|

43,632 |

|

|

|

38,008 |

|

|

|

172,608 |

|

|

|

162,326 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Commissions and incentives |

|

25,595 |

|

|

|

21,668 |

|

|

|

103,120 |

|

|

|

91,074 |

|

| Selling,

general and administrative |

|

13,957 |

|

|

|

14,782 |

|

|

|

56,074 |

|

|

|

57,353 |

|

| Total

operating expenses |

|

39,552 |

|

|

|

36,450 |

|

|

|

159,194 |

|

|

|

148,427 |

|

| Operating income |

|

4,080 |

|

|

|

1,558 |

|

|

|

13,414 |

|

|

|

13,899 |

|

| |

|

|

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

| Interest

expense |

|

(145 |

) |

|

|

(746 |

) |

|

|

(3,321 |

) |

|

|

(3,087 |

) |

| Other

expense, net |

|

(1,153 |

) |

|

|

(103 |

) |

|

|

(1,409 |

) |

|

|

(159 |

) |

| Total

other expense |

|

(1,298 |

) |

|

|

(849 |

) |

|

|

(4,730 |

) |

|

|

(3,246 |

) |

| Income before income

taxes |

|

2,782 |

|

|

|

709 |

|

|

|

8,684 |

|

|

|

10,653 |

|

| Income

tax expense |

|

(432 |

) |

|

|

(483 |

) |

|

|

(2,665 |

) |

|

|

(3,666 |

) |

| Net income |

$ |

2,350 |

|

|

$ |

226 |

|

|

$ |

6,019 |

|

|

$ |

6,987 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.17 |

|

|

$ |

0.02 |

|

|

$ |

0.44 |

|

|

$ |

0.50 |

|

|

Diluted |

$ |

0.16 |

|

|

$ |

0.02 |

|

|

$ |

0.41 |

|

|

$ |

0.49 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

13,758 |

|

|

|

13,687 |

|

|

|

13,730 |

|

|

|

13,899 |

|

|

Diluted |

|

14,640 |

|

|

|

13,786 |

|

|

|

14,531 |

|

|

|

14,150 |

|

| |

|

|

|

|

|

|

|

| Other

comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

| Foreign

currency translation adjustment |

|

167 |

|

|

|

(57 |

) |

|

|

294 |

|

|

|

(135 |

) |

| Other comprehensive

income (loss), net of tax: |

|

167 |

|

|

|

(57 |

) |

|

|

294 |

|

|

|

(135 |

) |

| Comprehensive

income |

$ |

2,517 |

|

|

$ |

169 |

|

|

$ |

6,313 |

|

|

$ |

6,852 |

|

| |

|

|

|

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Revenue by Region |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30,

(unaudited) |

|

For the Twelve Months Ended June

30, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

|

$ |

39,498 |

|

74 |

% |

|

$ |

33,723 |

|

74 |

% |

|

$ |

158,291 |

|

77 |

% |

|

$ |

138,118 |

|

73 |

% |

| Asia/Pacific &

Europe |

|

|

13,535 |

|

26 |

% |

|

|

11,578 |

|

26 |

% |

|

|

48,249 |

|

23 |

% |

|

|

52,218 |

|

27 |

% |

|

Total |

|

$ |

53,033 |

|

100 |

% |

|

$ |

45,301 |

|

100 |

% |

|

$ |

206,540 |

|

100 |

% |

|

$ |

190,336 |

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Active Independent Distributors

(1) |

|

|

|

|

|

|

|

|

| |

|

(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30 |

|

|

|

|

|

|

|

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

| Americas |

|

|

49,000 |

|

71 |

% |

|

|

44,000 |

|

68 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific &

Europe |

|

|

20,000 |

|

29 |

% |

|

|

21,000 |

|

32 |

% |

|

|

|

|

|

|

|

|

|

Total |

|

|

69,000 |

|

100 |

% |

|

|

65,000 |

|

100 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Active Preferred Customers(2) |

|

|

|

|

|

|

|

|

| |

|

(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30 |

|

|

|

|

|

|

|

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

| Americas |

|

|

95,000 |

|

81 |

% |

|

|

94,000 |

|

82 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific &

Europe |

|

|

22,000 |

|

19 |

% |

|

|

21,000 |

|

18 |

% |

|

|

|

|

|

|

|

|

|

Total |

|

|

117,000 |

|

100 |

% |

|

|

115,000 |

|

100 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Active Independent Distributors have purchased product in the prior

three months for retail or personal consumption. |

| (2)

Active Preferred Customers have purchased product in the prior

three months for personal consumption only. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

EBITDA and Non-GAAP Adjusted EBITDA: (Unaudited) |

|

|

|

|

|

|

|

For the Three Months Ended June

30, |

|

For the Twelve Months Ended June

30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| (In thousands) |

|

|

|

|

|

|

|

| GAAP Net income |

$ |

2,350 |

|

|

$ |

226 |

|

$ |

6,019 |

|

$ |

6,987 |

|

| Interest Expense |

|

145 |

|

|

|

746 |

|

|

3,321 |

|

|

3,087 |

|

| Provision for income

taxes |

|

432 |

|

|

|

483 |

|

|

2,665 |

|

|

3,666 |

|

| Depreciation and

amortization |

|

471 |

|

|

|

547 |

|

|

1,895 |

|

|

2,285 |

|

| Non-GAAP EBITDA: |

|

3,398 |

|

|

|

2,002 |

|

|

13,900 |

|

|

16,025 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Stock compensation

expense |

|

1,045 |

|

|

|

301 |

|

|

2,621 |

|

|

1,806 |

|

| Other expense, net |

|

1,153 |

|

|

|

103 |

|

|

1,409 |

|

|

159 |

|

| Other adjustments* |

|

(7 |

) |

|

|

729 |

|

|

1,720 |

|

|

(554 |

) |

| Total adjustments |

|

2,191 |

|

|

|

1,133 |

|

|

5,750 |

|

|

1,411 |

|

| Non-GAAP Adjusted

EBITDA |

$ |

5,589 |

|

|

$ |

3,135 |

|

$ |

19,650 |

|

$ |

17,436 |

|

| |

|

|

|

|

|

|

|

| *Other

adjustments for the twelve months ended June 30, 2016 include

approximately $0.7 million for executive severance expenses, $0.9

million for search firm and hiring expenses associated with the

search for executive officers, and $0.1 million for expenses

associated with the reverse stock split completed during October

2015. Other adjustments for the twelve months ended June 30,

2015 include a ($2.0) million reduction for a one-time pretax

benefit from settlement proceeds, $0.6 million in CEO severance

expenses and $0.9 million in search firm expenses. Other

adjustments for the three months ended June 30, 2016 include

approximately ($7,000) for net severance, search firm and hiring

expenses. Other adjustments for the three months ended June 30,

2015 include $0.7 million in search firm expenses. |

| |

|

|

|

|

|

|

|

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

Net Income and Non-GAAP Adjusted EPS: (Unaudited) |

|

|

|

|

|

|

|

For the Three Months Ended June

30, |

|

For the Twelve Months Ended June

30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| (In thousands) |

|

|

|

|

|

|

|

| GAAP Net income |

$ |

2,350 |

|

|

$ |

226 |

|

$ |

6,019 |

|

$ |

6,987 |

|

| Executive team

severance expenses (1) |

|

(31 |

) |

|

|

- |

|

|

438 |

|

|

371 |

|

| Executive team

recruiting and transition expenses(2) |

|

26 |

|

|

|

478 |

|

|

643 |

|

|

577 |

|

| Reverse split

administrative expenses(3) |

|

- |

|

|

|

- |

|

|

110 |

|

|

- |

|

| Write-off of deferred

debt transaction costs(4) |

|

- |

|

|

|

- |

|

|

1,070 |

|

|

- |

|

| Write-off of

capitalized software development costs(5) |

|

822 |

|

|

|

- |

|

|

822 |

|

|

| Insurance proceeds from

product recall(6) |

|

- |

|

|

|

- |

|

|

- |

|

|

(1,312 |

) |

| Non-GAAP Net

Income: |

|

3,167 |

|

|

|

704 |

|

|

9,102 |

|

|

6,623 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

| |

For the Three Months Ended June

30, |

|

For the Twelve Months Ended June

30, |

| |

|

2016 |

|

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

share, as reported |

$ |

0.16 |

|

|

$ |

0.02 |

|

$ |

0.41 |

|

$ |

0.49 |

|

| Executive team

severance expenses (1) |

|

- |

|

|

|

- |

|

|

0.03 |

|

|

0.03 |

|

| Executive team

recruiting and transition expenses(2) |

|

- |

|

|

|

0.03 |

|

|

0.04 |

|

|

0.04 |

|

| Reverse split

administrative expenses(3) |

|

- |

|

|

|

- |

|

|

0.01 |

|

|

- |

|

| Write-off of deferred

debt transaction costs(4) |

|

- |

|

|

|

- |

|

|

0.07 |

|

|

- |

|

| Write-off of

capitalized software development costs(5) |

|

0.06 |

|

|

|

- |

|

|

0.06 |

|

|

- |

|

| Insurance proceeds from

product recall(6) |

|

- |

|

|

|

- |

|

|

- |

|

|

(0.09 |

) |

| Diluted earnings per

share, as adjusted |

$ |

0.22 |

|

|

$ |

0.05 |

|

$ |

0.62 |

|

$ |

0.47 |

|

| |

|

|

|

|

|

|

|

| (1) Net of

($14,000) and $194,000 in tax expense (benefit) for the three and

twelve months ended June 30, 2016, and net of $194,000 in tax

expense for the twelve months ended June 30, 2015 |

| (2) Net of

$12,000 and $285,000 tax expense for the three and twelve months

ended June 30, 2016, respectively, and net of $251,000 and $303,000

in tax expense for the three and twelve months ended June 30,

2015 |

| (3) Net of

$49,000 tax expense for the twelve months ended June 30, 2016 |

| (4) Net of

$474,000 tax expense for the twelve months ended June 30, 2016 |

| (5) Net of

$364,000 tax expense for the three and twelve months ended June 30,

2015 |

| (6) Net of

$688,000 tax benefit for the twelve months ended June 30, 2015 |

| |

|

|

|

|

|

|

|

Investor Relations Contacts:

Cindy England

Director of Investor Relations

(801) 432-9036

cengland@lifevantage.com

-or-

Scott Van Winkle

Managing Director, ICR

(617) 956-6736

scott.vanwinkle@icrinc.com

Company Relations Contact:

John Genna

Vice President of Communications and Corporate Partnerships

(801) 432-9172

jgenna@lifevantage.com

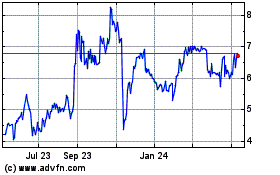

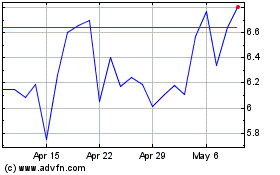

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024